Norwegian Cruise Line (NCLH) Stock Jumps On Positive Earnings Report

Table of Contents

Strong Revenue Growth Fuels NCLH Stock Surge

The primary driver behind the NCLH stock price increase was the company's robust revenue growth. This surge can be attributed to two key areas: increased bookings and higher average prices.

Increased Bookings and Higher Average Prices

NCLH reported a significant increase in bookings compared to the same period last year and even pre-pandemic levels. Specifically, bookings were up by [Insert Percentage]% compared to [Specify Time Period, e.g., Q2 2022] and [Insert Percentage]% compared to the same period in 2019. This strong demand reflects a rebound in consumer confidence and pent-up demand for leisure travel, particularly cruises.

- Increased Demand: The post-pandemic travel boom fueled a significant rise in demand for cruises.

- Premium Offerings: NCLH’s introduction of new premium offerings and enhanced onboard experiences contributed to higher average ticket prices. These offerings, including upgraded suites and exclusive dining options, attract customers willing to pay more for a luxury experience.

- Strategic Pricing: The company effectively implemented dynamic pricing strategies, adjusting prices based on demand to maximize revenue.

The average revenue per passenger (ARP) also saw a substantial increase, reflecting the success of these strategies. The ARP rose by [Insert Percentage]%, further boosting NCLH's overall revenue. This demonstrates the effectiveness of their pricing strategies and the strength of demand within the cruise market. Keywords: NCLH bookings, average revenue per passenger, cruise pricing, demand for cruises.

Improved Occupancy Rates and Yield Management

Beyond increased bookings, NCLH's success is also attributable to improved occupancy rates and skillful yield management. Occupancy rates on NCLH ships reached [Insert Percentage]%, significantly higher than the same period last year. This reflects the company's successful marketing campaigns and strong demand. Furthermore, NCLH implemented sophisticated yield management techniques, optimizing pricing and capacity to maximize revenue per available cabin (RevPAC).

- Dynamic Pricing: Real-time adjustments to pricing based on demand.

- Capacity Control: Strategic management of available berths to maximize profitability.

- Targeted Promotions: Focused marketing initiatives to attract specific customer segments.

The combination of high occupancy and effective yield management contributed significantly to NCLH's revenue growth, exceeding analysts’ expectations and positively impacting the NCLH stock price. Keywords: NCLH occupancy, yield management, cruise ship capacity, revenue per available cabin.

Positive Outlook for the Future of NCLH

The strong earnings report wasn't just about past performance; it also painted a positive picture of NCLH's future.

Expansion Plans and New Ship Deployments

NCLH continues its strategic fleet expansion, with plans to add [Number] new ships to its fleet in the coming years. These new vessels will increase capacity, introduce innovative features, and expand into new markets. The addition of [Mention Ship Names or Types] will boost revenue and cater to evolving customer preferences. Furthermore, NCLH is exploring new itineraries and expanding into untapped markets, diversifying its revenue streams and reducing reliance on established routes.

- New Itineraries: Exploration of less-traveled destinations.

- Strategic Partnerships: Collaborations with other travel companies to broaden reach.

- Market Expansion: Targeting new geographical regions.

Keywords: NCLH fleet expansion, new cruise ships, cruise itineraries, NCLH growth strategy.

Operational Efficiency and Cost-Cutting Measures

NCLH is actively focusing on operational efficiency and cost-cutting measures, enhancing profitability. These include initiatives such as fuel efficiency programs and streamlining operational processes. By optimizing fuel consumption and reducing unnecessary expenses, NCLH is improving its margins and bolstering its bottom line. This focus on operational efficiency is crucial for long-term sustainability and profitability in the competitive cruise industry.

- Fuel Efficiency: Investing in technologies and strategies to minimize fuel consumption.

- Streamlined Operations: Improving operational processes to reduce waste and increase productivity.

- Cost Optimization: Negotiating better deals with suppliers and vendors.

Keywords: NCLH operational efficiency, cost reduction, profitability, cruise line expenses.

Market Reaction and Analyst Sentiment

The strong earnings report triggered a positive market reaction, reflected in the NCLH stock price and trading volume.

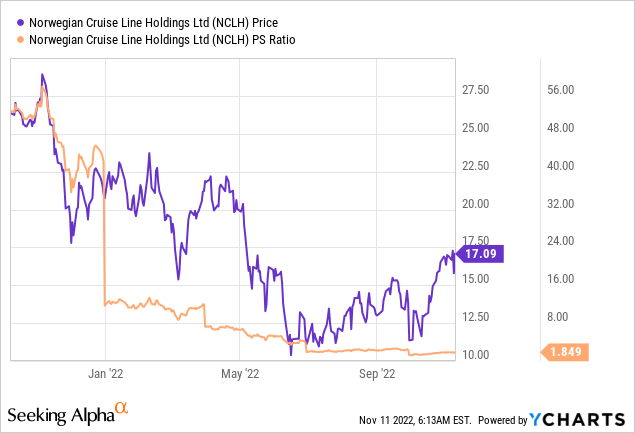

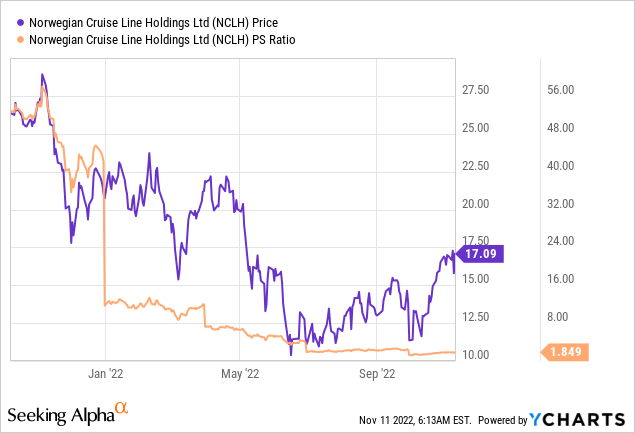

Stock Price Performance and Trading Volume

Following the release of the earnings report, the NCLH stock price saw a [Insert Percentage]% increase, with trading volume significantly exceeding average daily levels. This high trading volume indicates strong investor interest and confidence in the company's future performance. The market reacted positively to the exceeding expectations, which has solidified its position.

Keywords: NCLH stock performance, trading volume, stock market reaction.

Analyst Upgrades and Price Target Revisions

Several analysts upgraded their ratings on NCLH stock, citing the strong earnings report and positive outlook for the cruise industry. Price targets were also revised upwards, reflecting increased confidence in the company's future performance. The overall analyst sentiment toward NCLH remains positive, suggesting further potential upside for the stock price.

Keywords: analyst ratings, price target, NCLH stock forecast, investment outlook.

Conclusion: Investing in the Resurgence of NCLH

The strong earnings report and subsequent surge in NCLH stock price clearly demonstrate the company's recovery and robust growth trajectory. Increased bookings, improved occupancy rates, successful yield management, and a focus on operational efficiency all point to a positive outlook for NCLH. The company's expansion plans further strengthen its position for continued growth. Considering the positive market reaction, analyst upgrades, and the company's strategic initiatives, NCLH represents a compelling investment opportunity for those interested in the resurgence of the cruise industry. Further research into NCLH stock analysis and future prospects is recommended, but remember that all investments carry inherent risk. Consider consulting a financial advisor before making any investment decisions.

Featured Posts

-

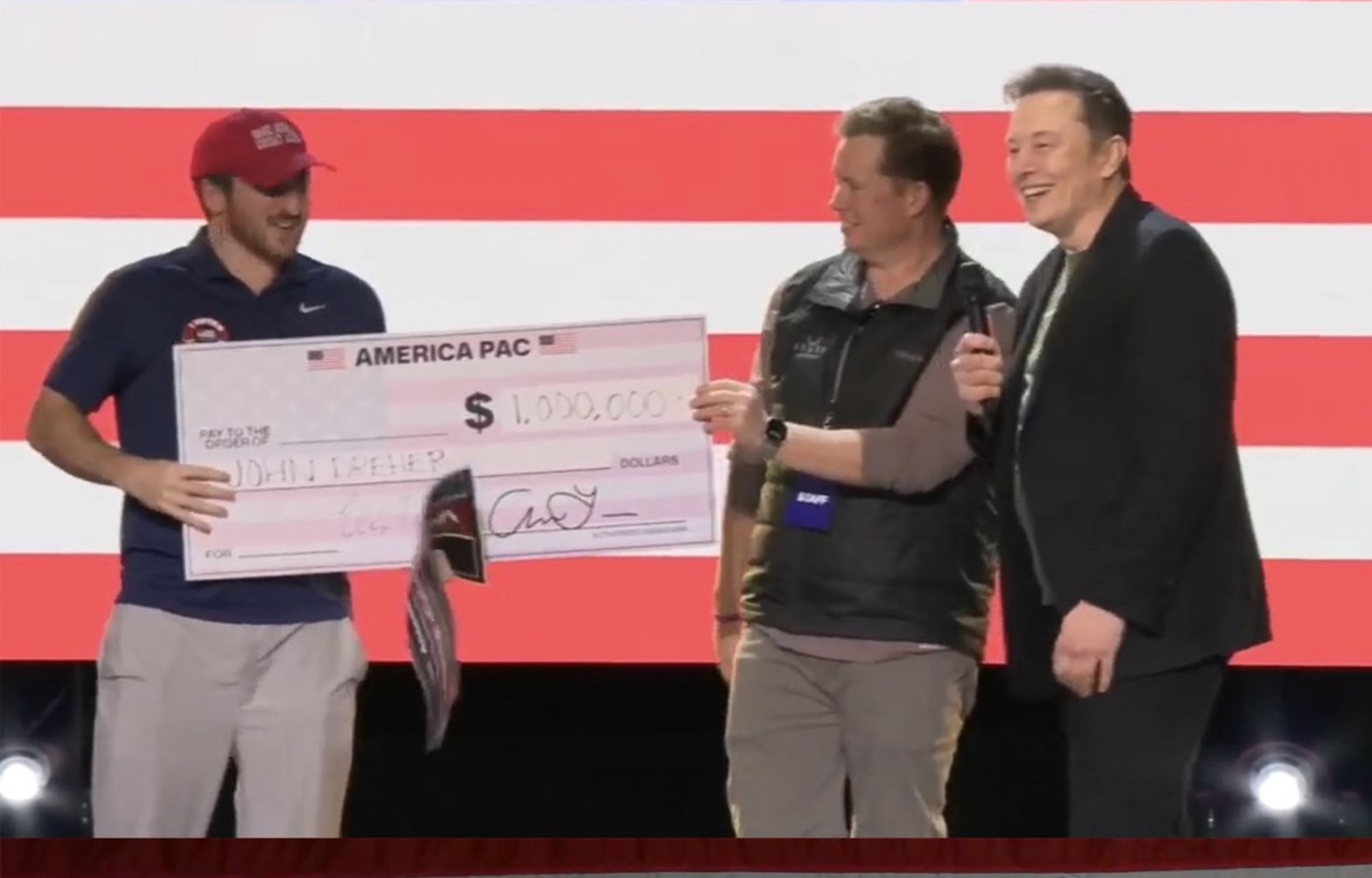

Michael Sheens Philanthropy A 1 Million Giveaway Explained

May 01, 2025

Michael Sheens Philanthropy A 1 Million Giveaway Explained

May 01, 2025 -

Irishman Creates Eurovision History With Armenian Entry

May 01, 2025

Irishman Creates Eurovision History With Armenian Entry

May 01, 2025 -

Program Tabung Baitulmal Sarawak Bantu 125 Anak Asnaf Sibu Kembali Ke Sekolah 2025

May 01, 2025

Program Tabung Baitulmal Sarawak Bantu 125 Anak Asnaf Sibu Kembali Ke Sekolah 2025

May 01, 2025 -

Inside Michael Sheens Life From Famous Relationships To Fortune And Farewell To Hollywood

May 01, 2025

Inside Michael Sheens Life From Famous Relationships To Fortune And Farewell To Hollywood

May 01, 2025 -

Fan Favourites Shocking Coronation Street Exit What We Know

May 01, 2025

Fan Favourites Shocking Coronation Street Exit What We Know

May 01, 2025