Nvidia's Exposure: Assessing Risks Beyond The China Trade War

Table of Contents

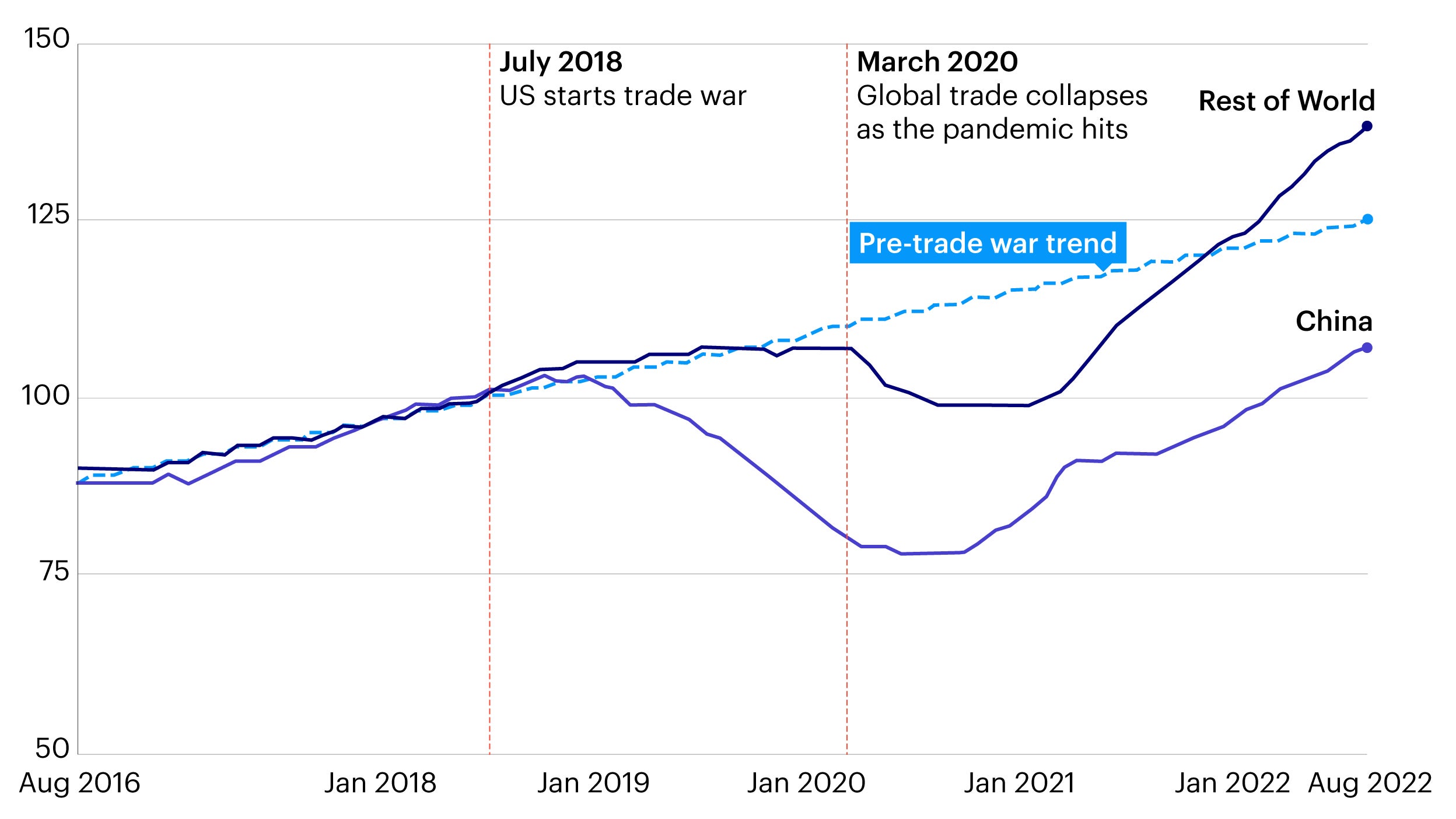

Geopolitical Risks Beyond the US-China Trade War

The international landscape presents a complex web of challenges for Nvidia. While the US-China trade war has been a significant focus, broader geopolitical tensions pose equally significant threats. Increased scrutiny of technology exports to various countries, potential future trade wars or sanctions impacting key markets, and the risk of intellectual property theft and security breaches all contribute to Nvidia's geopolitical risk profile. These risks are not limited to the US and China; they extend to various regions and nations.

- Increased scrutiny of technology exports: Governments worldwide are increasingly scrutinizing the export of advanced technologies, particularly those with military or dual-use applications. This could lead to restrictions on Nvidia's ability to export its products to certain countries.

- Potential for future trade wars or sanctions: The current geopolitical climate suggests the potential for future trade disputes and sanctions, potentially impacting Nvidia's access to key markets or its ability to source materials.

- Risk of intellectual property theft and security breaches: Protecting Nvidia's intellectual property from theft and its systems from cyberattacks is crucial. Breaches could have severe financial and reputational consequences.

- Impact of sanctions on Nvidia's ability to source materials and manufacture its products: Sanctions imposed on specific countries or entities could disrupt Nvidia's supply chain, impacting its production capabilities.

Supply Chain Vulnerabilities and Diversification Efforts

Nvidia's supply chain, like that of many semiconductor companies, is concentrated geographically. A heavy reliance on Taiwanese foundries for chip manufacturing creates vulnerabilities to natural disasters, geopolitical instability in the region, and potential disruptions to the global supply chain. While Nvidia is actively working on diversification strategies, the effectiveness of these efforts remains a key concern for assessing Nvidia exposure.

- Heavy reliance on Taiwanese foundries: Taiwan's dominance in semiconductor manufacturing exposes Nvidia to significant risk. Any disruption to Taiwanese manufacturing capacity could severely impact Nvidia's production.

- Vulnerability to natural disasters or geopolitical instability in key manufacturing regions: Natural disasters such as earthquakes or typhoons, as well as geopolitical instability, could severely impact production capacity.

- Analysis of Nvidia's progress in diversifying its manufacturing base: Nvidia is actively investing in diversifying its manufacturing base, but this is a long-term process with inherent challenges.

- Evaluation of the effectiveness of diversification strategies in mitigating risks: The success of Nvidia's diversification efforts in reducing its reliance on specific regions will be a key factor in determining its future resilience.

Market Dependence and Demand Fluctuations

Nvidia's revenue is generated across various market segments: gaming, data centers, AI, and automotive. While the AI market offers substantial growth potential, over-reliance on any single segment exposes Nvidia to significant risks associated with demand volatility and market saturation.

- Analysis of market share across key segments: Nvidia’s market share varies significantly across segments. Understanding the dynamics of each segment is vital.

- Discussion of the cyclical nature of the gaming market and its impact on Nvidia's revenue: The gaming market is subject to cyclical trends that can significantly impact Nvidia's revenue.

- Assessment of the growth potential of the AI market and its effect on Nvidia's long-term prospects: The rapid growth of the AI market presents significant opportunities for Nvidia, but competition is intensifying.

- Exploration of strategies to mitigate risk associated with market concentration: Diversifying its product portfolio and expanding into new markets can help mitigate this risk.

The Impact of Competition

The semiconductor industry is highly competitive. AMD and Intel are key competitors to Nvidia, constantly striving to improve their own products and gain market share. Technological innovation is crucial for Nvidia to maintain its leading position and mitigate the risk of competitive disruption. Nvidia's ability to innovate and adapt to changing technological landscapes will greatly impact its long-term success.

Conclusion

Nvidia's success is intricately tied to global stability and the resilience of its supply chain. While the company has taken steps to address risks related to the US-China trade war and other geopolitical factors, considerable vulnerabilities remain. Understanding these Nvidia exposure risks is critical for investors and industry analysts alike. To stay informed about the evolving landscape and the company’s strategic responses, continue to monitor geopolitical developments and the company's strategic responses. Further research into Nvidia's supply chain diversification and its competitive position is recommended for a comprehensive understanding of its future prospects. Careful analysis of Nvidia exposure is vital for informed decision-making.

Featured Posts

-

Youth Protests Pressure Spds German Coalition Efforts

May 01, 2025

Youth Protests Pressure Spds German Coalition Efforts

May 01, 2025 -

The Sec And Xrp Navigating Uncertainty In The Crypto Market

May 01, 2025

The Sec And Xrp Navigating Uncertainty In The Crypto Market

May 01, 2025 -

Targets Controversial Dei Decision Analysis Of The Consumer Response And Sales Decline

May 01, 2025

Targets Controversial Dei Decision Analysis Of The Consumer Response And Sales Decline

May 01, 2025 -

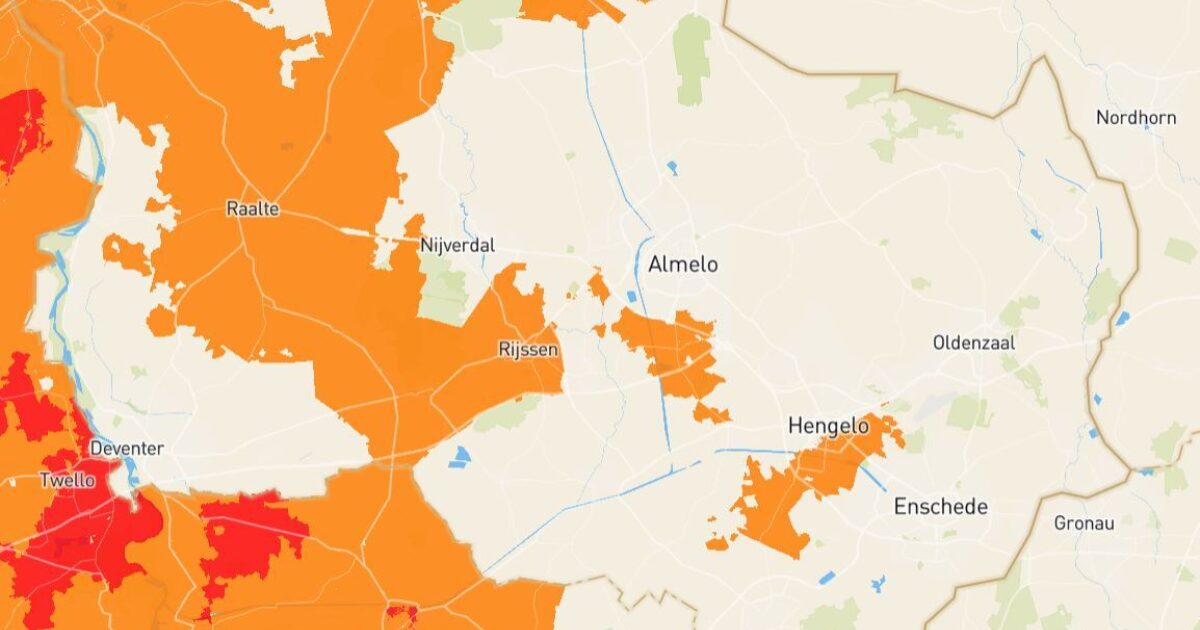

1000 Limburgse Ondernemers Wachten Op Energieaansluiting Van Enexis

May 01, 2025

1000 Limburgse Ondernemers Wachten Op Energieaansluiting Van Enexis

May 01, 2025 -

Celtics Mettle Tested During Star Studded Homestand

May 01, 2025

Celtics Mettle Tested During Star Studded Homestand

May 01, 2025