Nvidia's Geopolitical Risks: Beyond The China Factor

Table of Contents

The China Factor: Beyond Sales and Manufacturing

Nvidia's relationship with China is undeniably complex and crucial. The country represents a significant market for Nvidia's products and plays a role in its manufacturing processes. However, this dependence introduces considerable geopolitical risks.

Dependency on Chinese Market and Manufacturing

Nvidia's reliance on the Chinese market for both sales and manufacturing presents several potential disruptions:

- Trade Wars and Sanctions: Escalating trade tensions between the US and China could lead to tariffs or sanctions, impacting Nvidia's sales and profitability in the Chinese market.

- Intellectual Property Theft: The risk of intellectual property theft in China is a constant concern for tech companies like Nvidia, potentially impacting its competitive advantage and long-term growth.

- Supply Chain Vulnerabilities: Disruptions to the supply chain within China, due to factors like political instability or natural disasters, could severely impact Nvidia's production and delivery timelines.

While precise figures fluctuate, it's estimated that China contributes a substantial portion (though precise percentage varies yearly and is not publicly released by Nvidia with complete accuracy) to Nvidia's overall revenue, illustrating the significance of this market. Similarly, a portion of Nvidia's manufacturing processes relies on Chinese facilities, further highlighting the inherent vulnerability.

Geopolitical Tensions in the Taiwan Strait

The escalating tensions between China and Taiwan present a critical risk to Nvidia's supply chain. Taiwan is home to Taiwan Semiconductor Manufacturing Company (TSMC), the world's leading semiconductor foundry, which plays a vital role in producing Nvidia's chips.

- Impact on Chip Production: Any conflict in the Taiwan Strait could disrupt TSMC's operations, directly impacting Nvidia's ability to manufacture its crucial products.

- Logistics and Investment: The uncertainty surrounding the situation could deter investment and severely impact logistics, affecting the timely delivery of Nvidia's products globally.

TSMC holds a dominant market share in advanced semiconductor manufacturing, and Nvidia’s heavy reliance on TSMC makes it particularly susceptible to disruptions originating from this geopolitical hotspot.

US-China Tech Cold War and Export Controls

The ongoing US-China tech cold war and the implementation of export controls on advanced chip technology create another significant layer of geopolitical risk for Nvidia.

Impact of US Export Controls

US restrictions on the export of advanced chip technology to China directly impact Nvidia's ability to sell its most sophisticated products in this crucial market.

- Limitations on Sales: Export controls restrict Nvidia's sales of high-performance GPUs to Chinese customers, resulting in significant revenue losses.

- Impact on Future Technological Advancements: These restrictions could also hinder Nvidia's ability to conduct research and development collaborations with Chinese partners, potentially impacting future technological advancements.

The financial impact of these export controls is substantial, with projections indicating millions, if not billions, in potential lost revenue.

Navigating the Regulatory Landscape

Complying with the ever-evolving regulations from both the US and China presents significant challenges for Nvidia.

- Compliance Costs: Maintaining compliance requires substantial investments in legal and regulatory expertise, adding to the company's operational costs.

- Potential for Legal Disputes: Navigating these complex regulations increases the potential for legal disputes and fines.

- Risks of Non-Compliance: Failure to comply with regulations in either country could lead to severe penalties and reputational damage.

Other Geopolitical Risks Beyond China

Nvidia's geopolitical risks are not confined to its relationship with China. Other factors contribute to a complex and volatile global landscape.

Regional Instability and Supply Chain Disruptions

Regional conflicts or instability in various parts of the world can disrupt Nvidia's global supply chain.

- Specific Examples: Conflicts in Eastern Europe or the Middle East could affect the availability of raw materials or disrupt transportation routes, impacting production and delivery.

- Diversification Strategies: Nvidia is actively pursuing supply chain diversification strategies to mitigate these risks, but complete elimination is unlikely.

Competition and Intellectual Property

The competitive landscape in the semiconductor industry is fiercely competitive, with companies like AMD posing a significant challenge. Protecting intellectual property is also a crucial concern.

- Competition from AMD and Others: Intense competition necessitates continuous innovation, increasing pressure to maintain a technological edge.

- Risks of IP Theft: Protecting Nvidia's valuable intellectual property from theft or unauthorized use across different jurisdictions is a constant concern.

- Patents and Legal Battles: The pursuit and defense of patents, along with potential legal battles, are inevitable aspects of operating in this competitive landscape.

Conclusion: Mitigating Nvidia's Geopolitical Risks

Nvidia faces a complex web of geopolitical risks that significantly impact its long-term success. These risks extend far beyond the China factor, encompassing US-China relations, regional instability, and intense global competition. Understanding and proactively managing these multifaceted challenges is crucial for Nvidia's continued growth and stability. Further research into Nvidia's geopolitical strategy, the broader implications of global tech competition, and the future of semiconductor manufacturing in a volatile geopolitical climate is essential for investors, analysts, and anyone interested in the future of this critical technology sector. Ignoring these Nvidia geopolitical risks could have significant consequences.

Featured Posts

-

Double Strike Cripples Hollywood Writers And Actors Demand Fair Treatment

Apr 30, 2025

Double Strike Cripples Hollywood Writers And Actors Demand Fair Treatment

Apr 30, 2025 -

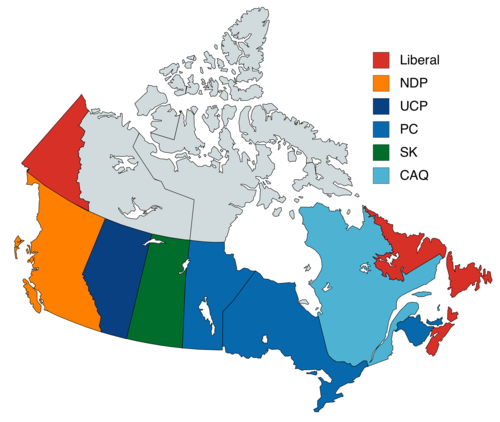

Analysis Poilievres Loss And Its Impact On The Canadian Political Landscape

Apr 30, 2025

Analysis Poilievres Loss And Its Impact On The Canadian Political Landscape

Apr 30, 2025 -

Neal Pionk News Highlights And His Impact On The Team

Apr 30, 2025

Neal Pionk News Highlights And His Impact On The Team

Apr 30, 2025 -

The Big Deal Whats New On 2025 Cruise Ships

Apr 30, 2025

The Big Deal Whats New On 2025 Cruise Ships

Apr 30, 2025 -

Trumps Election Claim Does Canada Need The Us More

Apr 30, 2025

Trumps Election Claim Does Canada Need The Us More

Apr 30, 2025