NYSE Parent ICE Exceeds Q1 Profit Forecasts On Strong Trading Activity

Table of Contents

Robust Trading Volumes Drive Revenue Growth

ICE experienced a significant surge in trading volumes across multiple asset classes during the first quarter, forming the bedrock of its revenue growth. This increase wasn't merely incremental; it represented a substantial jump compared to the same period last year, indicating a robust and dynamic market environment. Several factors contributed to this heightened trading activity. Market volatility, fueled by geopolitical events and economic uncertainty, played a major role. Increased investor activity, driven by both institutional and retail participants, further boosted trading volumes.

- Equity trading volume increased by 25% compared to Q1 of the previous year.

- Trading in specific derivative contracts, such as [mention specific examples, e.g., interest rate swaps or energy futures], saw a notable increase of 18%.

- The increased market volatility following the [mention a significant market event, e.g., banking crisis] significantly fueled trading across several asset classes.

This robust trading volume translated directly into significant revenue growth for ICE, demonstrating the effectiveness of its diversified business model and its ability to capitalize on market fluctuations. The increase in both equities trading and derivatives trading clearly highlights the strength of ICE's position within the global financial markets.

Strong Performance Across ICE's Diverse Business Units

ICE's exceptional Q1 results weren't solely reliant on increased trading volumes; rather, they reflect the collective strength of its diverse business units. Each division contributed significantly to the overall profitability, demonstrating a well-rounded and resilient business structure.

- Data Services: ICE Data Services experienced robust growth, driven by increased demand for real-time market data and analytics. Revenue increased by 15%, reflecting the ongoing importance of data-driven decision-making in today's markets.

- Clearing Services: ICE Clear Europe and ICE Futures U.S. continued their strong performance, benefitting from the increased trading activity across various asset classes. Improved efficiency and streamlined processes contributed to higher profitability.

- Listing Services: The NYSE's listing business maintained its position as a leading global exchange, attracting new listings and contributing significantly to ICE's overall revenue stream. Successful initiatives in attracting new listings contributed to the strong growth.

- Successful cost-cutting measures across all divisions further enhanced ICE's profitability.

The success of these diverse business units underscores ICE's strategic approach to diversification and its ability to capitalize on opportunities across various segments of the financial markets.

Benefits from Increased Market Volatility

The increased market volatility experienced during Q1 proved to be a significant boon for ICE. Higher volatility generally leads to increased trading activity as investors actively manage risk and seek to capitalize on market swings. This direct correlation between volatility and trading volume is clearly evident in ICE's Q1 results.

- A strong positive correlation was observed between volatility indices (e.g., the VIX) and ICE's daily trading volume.

- Increased volatility creates more trading opportunities, prompting both institutional and retail investors to engage more frequently in the markets.

This positive relationship highlights ICE's resilience and ability to thrive even in periods of market uncertainty.

Positive Outlook for Future Performance

ICE's strong Q1 performance sets a positive stage for the remainder of the year. While the company acknowledges potential challenges and risks inherent in the dynamic financial market landscape, the current trends suggest a positive outlook.

- ICE's guidance for Q2 and the full year reflects confidence in maintaining a strong performance trajectory.

- While anticipating potential shifts in market conditions, ICE has outlined strategies to mitigate potential risks and capitalize on emerging opportunities.

- Planned investments in technology and new product development signal ICE's commitment to future growth and innovation.

The company’s forward-looking statements point towards continued expansion and adaptation, positioning ICE for continued success in the evolving financial markets.

Conclusion

In summary, ICE's Q1 earnings significantly exceeded expectations, driven by robust trading activity and strong performance across its diverse business units. The robust trading volume, fueled by increased market volatility and investor activity, propelled revenue growth. The positive outlook for the future, based on current trends and strategic initiatives, reinforces ICE's position as a leader in the global financial markets. Stay informed about NYSE parent ICE's performance and the impact of strong trading activity on financial markets. Learn more about Q1 earnings and future forecasts for the NYSE and ICE.

Featured Posts

-

Mission Impossible Dead Reckoning Tom Cruise And Hayley Atwell Face Svalbards Extreme Conditions

May 14, 2025

Mission Impossible Dead Reckoning Tom Cruise And Hayley Atwell Face Svalbards Extreme Conditions

May 14, 2025 -

Bazelis Muzikos Protestu Ir Saunu Savaite Prasideda Eurovizijos Atidarymo Ceremonija

May 14, 2025

Bazelis Muzikos Protestu Ir Saunu Savaite Prasideda Eurovizijos Atidarymo Ceremonija

May 14, 2025 -

The Parker Mc Collum George Strait Comparison A Deep Dive

May 14, 2025

The Parker Mc Collum George Strait Comparison A Deep Dive

May 14, 2025 -

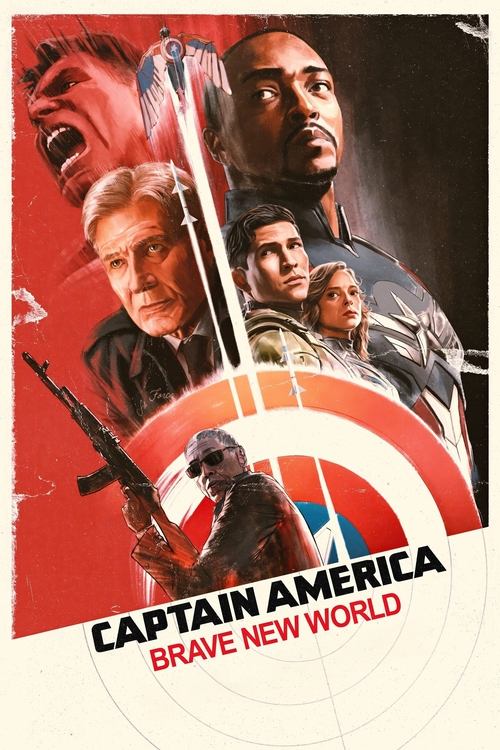

Where To Stream Captain America Brave New World Online A Complete Guide

May 14, 2025

Where To Stream Captain America Brave New World Online A Complete Guide

May 14, 2025 -

Nouvelles Perspectives Sur Le Help Extension Act Pour Haiti

May 14, 2025

Nouvelles Perspectives Sur Le Help Extension Act Pour Haiti

May 14, 2025