Omada Health: Andreessen Horowitz-Backed Company Files For US IPO

Table of Contents

Omada Health's Business Model and Target Market

Omada Health's core mission is to improve the lives of people living with chronic conditions through its innovative digital health programs. They focus primarily on conditions like diabetes and hypertension, offering comprehensive, evidence-based interventions delivered entirely through a digital-first approach. This approach leverages telehealth, remote patient monitoring (RPM), and personalized coaching to empower individuals to take control of their health.

Omada Health's programs combine several key elements:

- Comprehensive curriculum: Structured educational materials covering diet, exercise, medication management, and stress reduction techniques.

- Personalized coaching: Certified health coaches provide support, guidance, and motivation throughout the program.

- Digital tools and technology: A user-friendly mobile app integrates wearable device data and facilitates communication with healthcare professionals.

Their target market is multifaceted:

- Patients: Individuals diagnosed with or at risk of developing chronic conditions.

- Employers: Companies seeking to improve employee health and reduce healthcare costs.

- Health plans: Insurance providers looking to enhance member engagement and improve health outcomes.

Specific programs include the highly successful Omada Diabetes Prevention Program, which has demonstrated significant improvements in participants' health metrics. The company's success is further demonstrated by key metrics like high user engagement rates and demonstrable market penetration within specific employer and health plan segments. Key technologies used include a sophisticated mobile app, seamless integration with various wearable devices, and robust data analytics capabilities.

Andreessen Horowitz's Role and Investment

Andreessen Horowitz (a16z), a prominent venture capital firm, has played a crucial role in Omada Health's journey. Their significant investment underscores their belief in Omada Health's potential and the future of digital therapeutics. This backing not only provided essential capital for growth but also lent significant credibility, bolstering investor confidence ahead of the Omada Health initial public offering.

A16z's involvement offers several strategic advantages:

- Access to a vast network: A16z's extensive network within the healthcare industry can facilitate partnerships and market expansion.

- Industry expertise: Their deep understanding of the digital health landscape provides valuable guidance and support.

- Strong brand recognition: Association with a leading VC firm enhances Omada Health's reputation and attracts potential investors.

Specific funding rounds and amounts are publicly available through SEC filings and press releases. A review of A16z's portfolio reveals a strong focus on innovative companies in the digital health sector, further solidifying their commitment to this rapidly evolving market.

Omada Health's Financial Performance and Growth Prospects

Omada Health's recent filings reveal impressive financial performance, marked by strong year-over-year revenue growth and increasing market share. While profitability might not yet be fully realized, the company's growth trajectory is promising. Their expansion plans focus on broadening their program offerings, expanding into new therapeutic areas, and penetrating new markets both domestically and internationally.

Key financial highlights (sourced from official filings):

- [Insert Year-over-Year Revenue Growth Percentage]

- [Insert Customer Acquisition Cost and Retention Rate Data]

- [Insert Market Size Projections for Digital Health Market]

The market opportunity for digital chronic disease management is substantial, driven by factors such as an aging population, rising healthcare costs, and increased demand for convenient, personalized care. Omada Health is well-positioned to capitalize on this growth, given its proven technology and strong market position.

Risks and Challenges Facing Omada Health's IPO

Despite the considerable potential, the Omada Health IPO also presents certain risks and challenges:

- Competition: The digital health space is becoming increasingly competitive, with new entrants constantly emerging.

- Regulatory hurdles: Compliance with HIPAA and other regulations related to telehealth and data privacy is crucial and requires significant ongoing investment.

- Market volatility: The overall market environment can significantly impact the success of any IPO.

- Scaling challenges: Maintaining profitability while scaling operations can be a significant hurdle.

Potential financial risks associated with the Omada Health initial public offering include dilution of existing shareholder equity and potential market downturn impacting the initial valuation.

Conclusion: Investing in the Future of Digital Health with the Omada Health IPO

The Omada Health IPO represents a significant opportunity for investors interested in the rapidly growing digital health market. While risks exist, Omada Health's innovative business model, strong financial performance, and the backing of a leading venture capital firm like Andreessen Horowitz position it favorably for future success. The company’s digital-first approach to chronic disease management addresses a significant unmet need, and its expansion plans suggest a robust growth trajectory. Understanding the nuances of the Omada Health initial public offering, including both its potential and its challenges, is crucial for making informed investment decisions. Stay informed about the Omada Health IPO and learn more about the Omada Health initial public offering to assess its alignment with your investment strategy. Follow the progress of the Omada Health IPO to stay updated on this exciting development in the digital health sector.

Featured Posts

-

Graham Rahal And The Porsche 911 Gt 3 Rs 4 0 Unrivaled Performance

May 11, 2025

Graham Rahal And The Porsche 911 Gt 3 Rs 4 0 Unrivaled Performance

May 11, 2025 -

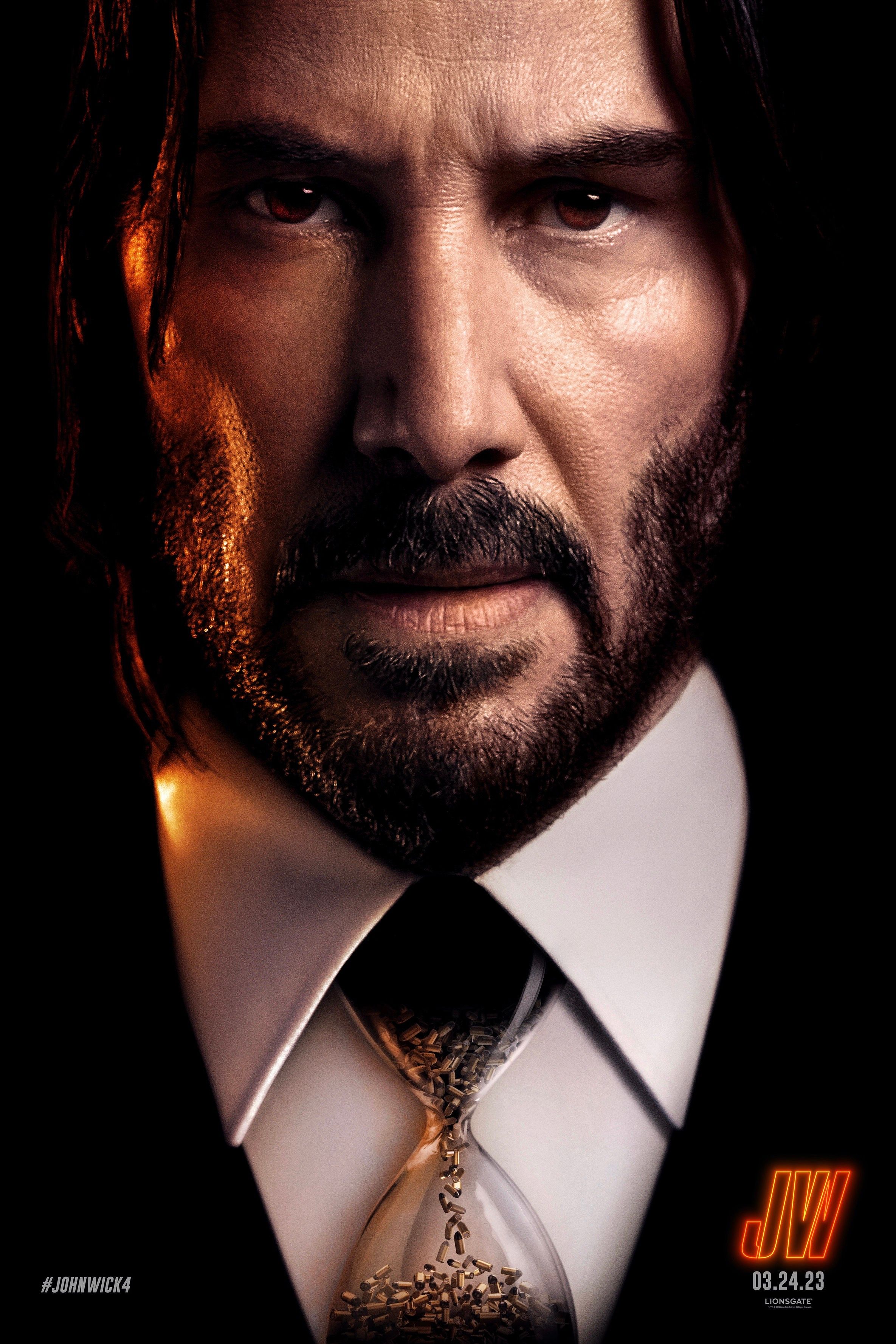

John Wick 5 Update Thrilling Developments Release Date A Mystery

May 11, 2025

John Wick 5 Update Thrilling Developments Release Date A Mystery

May 11, 2025 -

Confirmed Crazy Rich Asians Series Coming Soon Directed By Jon M Chu

May 11, 2025

Confirmed Crazy Rich Asians Series Coming Soon Directed By Jon M Chu

May 11, 2025 -

Jessica Simpson Opens Up About Marital Struggles My Heart Gets Tossed Around

May 11, 2025

Jessica Simpson Opens Up About Marital Struggles My Heart Gets Tossed Around

May 11, 2025 -

John Wick 5 Confirmed Lionsgate Announces Future Of Keanu Reeves Hitman

May 11, 2025

John Wick 5 Confirmed Lionsgate Announces Future Of Keanu Reeves Hitman

May 11, 2025