Omada Health's US IPO: A Look At The Andreessen Horowitz Investment

Table of Contents

Andreessen Horowitz's Investment in Omada Health

The Size and Significance of the Investment

While precise figures regarding a16z's investment in Omada Health may not be publicly available until after the IPO, its involvement has been significant throughout Omada Health's funding rounds. The investment likely represents a substantial portion of Omada Health's total funding, signifying a strong vote of confidence in the company's potential.

- Funding Stage: a16z's involvement likely spanned multiple funding rounds, possibly including Series B and beyond. The exact stages and amounts will need to be disclosed in the IPO filing.

- Valuation: The valuation of Omada Health at the time of a16z's investments would be a crucial factor in determining the significance of their contributions. High valuations indicate strong market confidence and significant growth potential.

- Investment Type: Determining whether a16z led specific funding rounds or participated as part of a larger syndicate provides valuable insights into the competitive landscape and the level of confidence other investors had in Omada Health.

Andreessen Horowitz's Investment Thesis

Andreessen Horowitz's investment in Omada Health aligns perfectly with its focus on disruptive technologies in the healthcare space. Their investment thesis likely centered around several key factors:

- Innovative Approach to Chronic Disease Management: Omada Health's technology-driven approach to managing chronic conditions, such as diabetes and hypertension, offers a scalable and potentially more cost-effective solution compared to traditional methods.

- Booming Telehealth Market: The rapidly growing market for telehealth services presents a significant opportunity for Omada Health. a16z likely recognized the long-term growth potential of this sector.

- Scalability and Profitability: Omada Health's platform’s ability to serve a large number of patients remotely creates significant potential for scalability and profitability. This aligns with a16z's focus on high-growth companies.

- Portfolio Synergy: The investment likely aligns strategically with other investments in a16z's portfolio, creating potential synergies and cross-promotion opportunities.

A16z's Influence on Omada Health's Strategy and Growth

Andreessen Horowitz's influence on Omada Health extends beyond mere financial investment. Their expertise and extensive network have likely played a significant role in shaping Omada Health's trajectory:

- Board Representation: A16z may hold board seats, providing strategic guidance and oversight to Omada Health's management team.

- Strategic Partnerships: a16z's connections within the healthcare industry could have facilitated crucial partnerships for Omada Health, accelerating market penetration and expansion.

- Network Access: Access to a16z's vast network of contacts and resources can open doors to new opportunities, including potential acquisitions or collaborations.

Omada Health's Business Model and IPO Prospects

Omada Health's Chronic Disease Management Platform

Omada Health's core offering is a digital platform designed to help individuals manage chronic conditions. Its user-friendly interface and comprehensive approach differentiates it in the competitive telehealth space.

- Remote Patient Monitoring: The platform utilizes wearable devices and other technologies to track patient progress remotely.

- Digital Coaching: Patients receive personalized support from certified health coaches, offering guidance and motivation.

- Medication Adherence Support: Tools within the platform assist patients in managing their medication schedules and adherence.

- Targeted Conditions: Omada Health primarily focuses on conditions like diabetes, hypertension, and prediabetes, addressing a large and growing market.

Market Analysis and Competitive Landscape

The market for telehealth solutions in chronic disease management is experiencing rapid expansion. Omada Health faces competition from other established telehealth companies and emerging startups.

- Market Size and Growth: The market is projected to experience substantial growth in the coming years, driven by increasing demand and technological advancements.

- Competitive Landscape: Identifying key competitors, their strengths and weaknesses, and Omada Health's market share provides a crucial perspective on its competitive position.

- Growth Projections: Analyzing future growth projections for the telehealth market helps determine the overall potential of Omada Health's business.

Factors Influencing Omada Health's IPO Valuation

Omada Health's IPO valuation will depend on several factors, including its financial performance, market conditions, and competitive landscape:

- Key Financial Metrics: Revenue growth, profitability, and user acquisition metrics are critical indicators of the company's financial health.

- Risk Factors: Potential risks associated with the IPO, such as regulatory changes, competition, and market volatility, will need careful consideration.

- Market Sentiment: Overall market sentiment towards telehealth companies and the broader tech sector will significantly impact investor interest.

The Impact of the IPO on the Telehealth Industry

Implications for Future Investment in Telehealth

Omada Health's IPO success could have a significant ripple effect on the telehealth industry:

- Increased Funding Rounds: A successful IPO may attract further investment into telehealth startups, fueling innovation and growth.

- Institutional Investor Interest: Positive results could lead to increased interest from institutional investors, providing significant capital for expansion.

Increased Adoption of Telehealth Services

The Omada Health IPO could also significantly increase awareness and adoption of telehealth services:

- Consumer Trust: A successful IPO can boost consumer trust in telehealth platforms, encouraging greater adoption.

- Healthcare Delivery Models: The success of Omada Health’s model could influence how healthcare providers deliver services, promoting broader acceptance of telehealth.

Conclusion

Omada Health's IPO, significantly supported by Andreessen Horowitz's investment, marks a pivotal moment for the telehealth industry. The success of this offering will not only determine Omada Health's future but also influence the trajectory of investment and adoption in the broader telehealth market. Understanding the details of a16z's involvement, Omada Health's business model, and the overall market landscape is crucial for investors and stakeholders alike. Stay informed about future developments in the Omada Health IPO and the evolving telehealth landscape. Monitor the Omada Health IPO closely to gauge the future of this transformative technology in healthcare.

Featured Posts

-

Stallone And Partons Failed Musical A Box Office Bomb

May 11, 2025

Stallone And Partons Failed Musical A Box Office Bomb

May 11, 2025 -

New York Knicks Thibodeau Demands More Resolve After Crushing Defeat

May 11, 2025

New York Knicks Thibodeau Demands More Resolve After Crushing Defeat

May 11, 2025 -

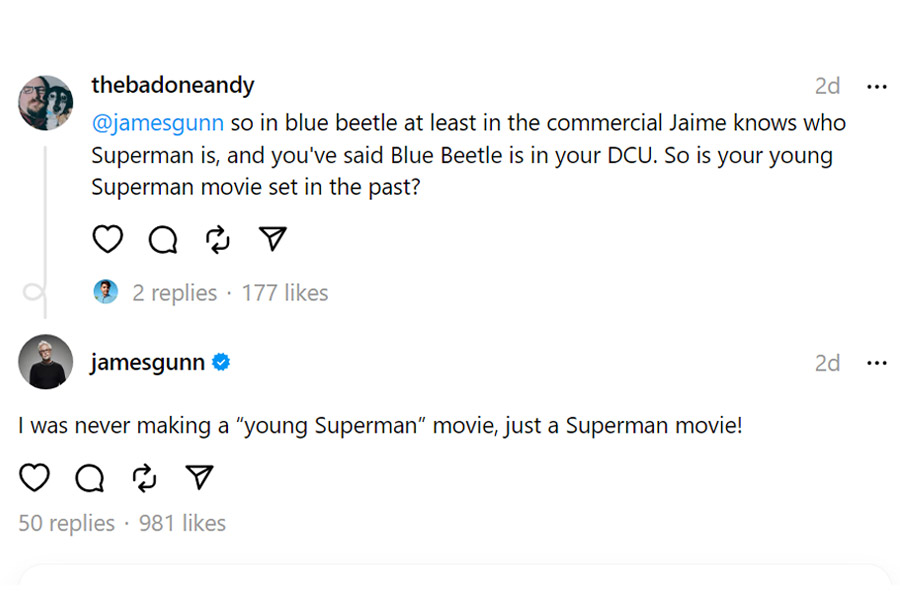

Henry Cavills Superman Recasting James Gunns Account Of Past Mismanagement

May 11, 2025

Henry Cavills Superman Recasting James Gunns Account Of Past Mismanagement

May 11, 2025 -

Thomas Muellers Farewell His Most Frequent Playing Partners At Bayern Munich

May 11, 2025

Thomas Muellers Farewell His Most Frequent Playing Partners At Bayern Munich

May 11, 2025 -

Cineplex Q1 Loss Attendance Drop Impacts Revenue

May 11, 2025

Cineplex Q1 Loss Attendance Drop Impacts Revenue

May 11, 2025