Omada Health's US IPO Filing: What Andreessen Horowitz's Backing Means

Table of Contents

Andreessen Horowitz's Influence and Omada Health's Growth

Andreessen Horowitz boasts a stellar reputation in the tech and healthcare investment world, known for its shrewd investments and ability to nurture high-growth companies. Their portfolio includes numerous successful digital health ventures, showcasing their expertise in identifying and supporting innovative solutions within the healthcare sector. a16z's involvement significantly boosted Omada Health's credibility, attracting further investment and accelerating its growth trajectory. This backing provided several key advantages:

- Increased investor confidence: a16z's endorsement significantly increased investor confidence in Omada Health's business model and future prospects.

- Access to a vast network: a16z provided access to its extensive network of industry experts, potential partners, and strategic advisors.

- Facilitated strategic partnerships: a16z's connections likely facilitated crucial partnerships and collaborations, expanding Omada Health's reach and capabilities.

- Improved IPO success: a16z's proven track record in guiding companies through successful IPOs significantly enhanced Omada Health's chances of a positive market debut.

Omada Health's Business Model and Market Opportunity

Omada Health's core offering revolves around digital therapeutics—specifically, providing evidence-based, clinically-proven programs to help individuals manage chronic conditions like diabetes and hypertension. Its target market is vast, encompassing millions of individuals struggling with these prevalent diseases. The demand for telehealth and digital health solutions is experiencing exponential growth, driven by factors such as rising healthcare costs, improved patient access, and a greater emphasis on preventative care. Omada Health's model offers several key advantages:

- Scalability and cost reduction: The digital model allows for significant scalability, potentially reducing overall healthcare costs compared to traditional, in-person care.

- Enhanced patient engagement: Digital platforms facilitate improved patient engagement and adherence to treatment plans, leading to better outcomes.

- Competitive advantage: Omada Health's technology offers a competitive edge compared to traditional healthcare models, providing a more convenient and accessible solution.

- Addressing a significant market need: The company directly addresses the considerable market need for effective and affordable chronic disease management.

Valuation and Potential IPO Outcomes

The projected valuation of Omada Health during its IPO is eagerly anticipated by investors. Factors influencing this valuation include its revenue growth, the substantial size of the target market, and the overall performance of the digital health sector. While the potential for significant returns is high, several risks are associated with any IPO:

- Investor demand: The level of investor interest and demand for Omada Health shares will significantly impact the IPO pricing.

- Return on investment: The IPO's success will determine the return on investment for early investors, including a16z.

- Market conditions: Prevailing market conditions at the time of the IPO will play a crucial role in its pricing and overall success.

- Future growth trajectory: The IPO's performance will set the stage for Omada Health's future growth and trajectory.

The Role of a16z in Shaping Omada Health's IPO Strategy

Andreessen Horowitz's influence extends beyond simply providing funding. a16z likely played a pivotal role in shaping Omada Health's IPO strategy, offering valuable expertise and guidance throughout the process:

- IPO preparation and planning: a16z likely provided strategic advice on all aspects of IPO preparation and planning.

- Investor networking: Their extensive network facilitated connections with potential investors and strategic partners.

- Long-term growth strategy: a16z likely guided Omada Health in developing a robust long-term growth strategy post-IPO.

Conclusion

The Omada Health IPO, backed by the influential Andreessen Horowitz, signifies a landmark event for the digital health industry. The company's innovative approach to chronic disease management, combined with a16z's expertise and support, positions Omada Health for considerable growth and success. The outcome of this Omada Health IPO will serve as a key indicator of the future of digital therapeutics and the continued investment in this rapidly expanding sector of healthcare. Stay informed and learn more about the Omada Health IPO and its implications for the future of digital health.

Featured Posts

-

How Trumps Actions Reshaped Greenlands Relationship With Denmark

May 10, 2025

How Trumps Actions Reshaped Greenlands Relationship With Denmark

May 10, 2025 -

Britannian Kruununperimysjaerjestys Kuka Seuraa Kuningas Charlesia

May 10, 2025

Britannian Kruununperimysjaerjestys Kuka Seuraa Kuningas Charlesia

May 10, 2025 -

Understanding Trumps Transgender Military Ban Separating Fact From Fiction

May 10, 2025

Understanding Trumps Transgender Military Ban Separating Fact From Fiction

May 10, 2025 -

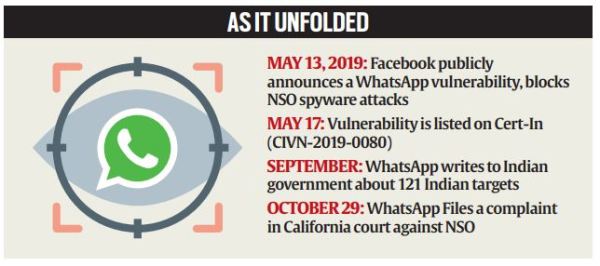

Meta Faces 168 Million Verdict In Whats App Spyware Case Analysis And Outlook

May 10, 2025

Meta Faces 168 Million Verdict In Whats App Spyware Case Analysis And Outlook

May 10, 2025 -

Attorney General Uses Fake Fentanyl To Illustrate Opioid Crisis Severity

May 10, 2025

Attorney General Uses Fake Fentanyl To Illustrate Opioid Crisis Severity

May 10, 2025