One Wall Street Analyst Sees Apple Reaching $254: Should You Buy?

Table of Contents

The Analyst's Rationale Behind the $254 Apple Stock Price Prediction

The prediction of Apple reaching $254 originates from [Analyst Name], a respected analyst at [Analyst Firm]. Their bullish outlook stems from a confluence of factors pointing towards significant growth for the tech giant.

- Robust iPhone Sales: [Analyst Name] highlights consistently strong iPhone sales, even in a potentially softening smartphone market, driven by [mention specific factors like new models, strong demand in specific markets, etc.].

- Exponential Services Revenue Growth: The analyst emphasizes the impressive and accelerating growth of Apple's services sector, encompassing App Store revenue, Apple Music subscriptions, iCloud storage, and other offerings. This recurring revenue stream provides a crucial foundation for future growth.

- Innovative Product Pipeline: Anticipation for upcoming product launches, including potential advancements in [mention product categories like AR/VR, electric vehicles, etc.], is a key component of the prediction. These innovations are expected to capture significant market share and boost revenue further.

- Strong Financial Metrics: The analyst likely cited specific financial metrics like impressive profit margins, strong cash flow, and a growing user base as supporting evidence for their prediction. [If available, insert specific numbers and context from the analyst's report].

You can find the original source of this prediction here: [Insert Link to Analyst Report if available].

Apple's Current Financial Performance and Future Outlook

Apple's recent financial reports paint a largely positive picture. While challenges exist, the company demonstrates significant strengths:

- Consistent Revenue Growth: Apple has consistently shown year-over-year revenue growth, although the rate of growth may fluctuate from quarter to quarter.

- High Profit Margins: Apple maintains exceptionally high profit margins compared to competitors, reflecting its premium brand positioning and effective cost management.

- Dominant Market Share: Apple holds a leading market share in smartphones, tablets, and wearables, solidifying its position as a major player in the tech industry.

- Competitive Landscape: While facing competition from established players like Samsung and Google, as well as emerging rivals, Apple continues to innovate and adapt, maintaining its competitive edge.

- Future Product Plans: Apple's ongoing investments in research and development suggest a strong pipeline of future products and services that have the potential to drive growth in the years to come.

Risks and Potential Downsides of Investing in Apple at Current Prices

Despite the optimistic forecast of Apple reaching $254, it's crucial to acknowledge potential downsides:

- Market Volatility: The stock market is inherently volatile. Economic downturns, geopolitical instability, or unexpected market shifts could negatively impact Apple's stock price.

- Intense Competition: The tech landscape is fiercely competitive. New entrants and existing rivals could disrupt Apple's market share or impact its profitability.

- Supply Chain Disruptions: Global supply chain issues, unforeseen natural disasters, or other unforeseen events could affect Apple's production and sales.

- Overvaluation Concerns: Some analysts believe Apple's current valuation is already high, raising concerns about the potential for a price correction.

Comparing the $254 Prediction to Other Analyst Forecasts and Current Market Sentiment

While [Analyst Name]'s prediction of Apple reaching $254 is bold, it's crucial to consider other perspectives. The average analyst price target for Apple stock currently sits around [Insert Average Price Target]. This indicates a range of opinions, from more conservative to extremely bullish projections.

- Range of Analyst Price Targets: Analyst predictions vary significantly, underscoring the inherent uncertainty in stock market forecasting.

- Current Market Sentiment: Investor sentiment towards Apple currently leans [Insert Bullish/Bearish/Neutral Sentiment and supporting evidence]. Recent news about [mention relevant news, e.g., new product launches, regulatory challenges, etc.] has influenced this sentiment.

Technical Analysis of Apple Stock Chart (Optional)

[If including technical analysis, provide a concise summary of relevant technical indicators, such as moving averages, support/resistance levels, etc. Keep it simple and avoid overly technical jargon].

Conclusion: Should You Buy Apple Stock Based on the $254 Prediction?

The possibility of Apple reaching $254 is certainly exciting, but investing in any stock involves risk. While the analyst's rationale presents a compelling case for future growth, factors such as market volatility, competition, and the potential for overvaluation need careful consideration. The prediction of Apple reaching $254 is just one perspective; comparing it with other analyst forecasts and understanding the broader market sentiment is vital.

Ultimately, the decision of whether to buy Apple stock, considering the possibility of it reaching $254, rests with you. Conduct your own due diligence and consult with a financial advisor before making any investment choices.

Featured Posts

-

A Relaxing Escape To The Country Benefits Of Rural Living

May 24, 2025

A Relaxing Escape To The Country Benefits Of Rural Living

May 24, 2025 -

Relx Succes Ai Strategie Overtreft Economische Verwachtingen

May 24, 2025

Relx Succes Ai Strategie Overtreft Economische Verwachtingen

May 24, 2025 -

Analyzing The Impact Of Trumps Cuts On Museum Programming And Accessibility

May 24, 2025

Analyzing The Impact Of Trumps Cuts On Museum Programming And Accessibility

May 24, 2025 -

Bitcoin Price Surge Positive Us Regulation Outlook Drives Record

May 24, 2025

Bitcoin Price Surge Positive Us Regulation Outlook Drives Record

May 24, 2025 -

Avrupa Borsalari Ecb Faiz Kararindan Sonra Nasil Etkilendi

May 24, 2025

Avrupa Borsalari Ecb Faiz Kararindan Sonra Nasil Etkilendi

May 24, 2025

Latest Posts

-

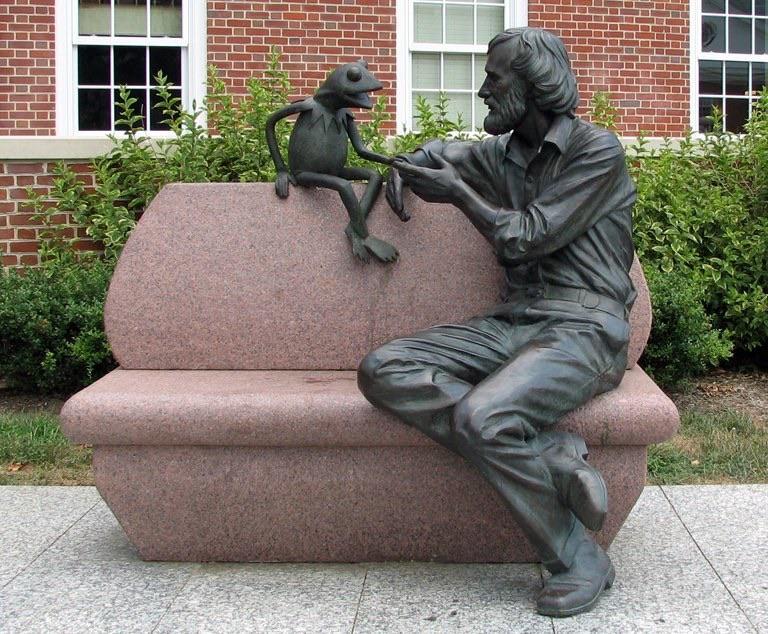

Confirmed Kermit The Frog To Address University Of Maryland Graduates In 2025

May 24, 2025

Confirmed Kermit The Frog To Address University Of Maryland Graduates In 2025

May 24, 2025 -

University Of Maryland Chooses Kermit The Frog For 2025 Commencement Speaker

May 24, 2025

University Of Maryland Chooses Kermit The Frog For 2025 Commencement Speaker

May 24, 2025 -

Billie Jean King Cup Kazakhstan Defeats Australia In Qualifier

May 24, 2025

Billie Jean King Cup Kazakhstan Defeats Australia In Qualifier

May 24, 2025 -

Kazakhstan Upsets Australia In Billie Jean King Cup Qualifier

May 24, 2025

Kazakhstan Upsets Australia In Billie Jean King Cup Qualifier

May 24, 2025 -

Gaubas Stuns Shapovalov In Italian Open Upset

May 24, 2025

Gaubas Stuns Shapovalov In Italian Open Upset

May 24, 2025