One-Year Ban: Saudi Wealth Fund Restricts PwC's Advisory Work

Table of Contents

Reasons Behind the Saudi Wealth Fund's Decision

The PIF's decision to ban PwC from providing advisory services for a year is a serious matter with potentially complex underlying reasons. While the PIF hasn't publicly disclosed all the specifics, several factors likely contributed to this drastic action.

Allegations of Conflicts of Interest

Reports suggest that allegations of conflicts of interest played a significant role in the PIF's decision. These allegations, if substantiated, could seriously undermine the trust and confidence placed in PwC by the PIF.

- Specific Allegations: [Insert specific allegations here, if available from reliable sources, citing those sources. For example: "Reports from [Source A] and [Source B] allege PwC's simultaneous engagement with both the PIF and a competing investment firm led to potential bias in advisory recommendations."]

- Investigations: [Mention any ongoing or completed investigations into these allegations. For example: "The Saudi Arabian authorities have launched an investigation into these claims, the results of which are pending."]

- Credible News Sources: [Include hyperlinks to reputable news articles detailing the allegations and investigations. Example: "[Link to News Article 1] and [Link to News Article 2] provide further details on these allegations."]

Failure to Meet Regulatory Standards

Another potential factor contributing to the ban is PwC's possible failure to adhere to Saudi Arabian regulatory requirements concerning financial reporting and auditing standards. Stringent regulations govern the financial sector in Saudi Arabia, and any non-compliance can have severe repercussions.

- Potential Breaches: [List potential regulatory breaches, citing sources where applicable. For example: "Reports indicate possible breaches related to [Specific Regulation 1] and [Specific Regulation 2], leading to concerns about the accuracy and reliability of PwC's work."]

- Penalties: [Specify if any penalties were imposed beyond the ban. For example: "In addition to the ban, PwC may face [Specific Penalty, e.g., a fine]. "]

- Implications for Other Firms: This incident serves as a stark warning to other consulting and auditing firms operating in Saudi Arabia, emphasizing the importance of strict adherence to local regulations.

Impact on PIF's Investment Strategy

The PwC ban will undoubtedly impact the PIF's investment strategy, potentially causing delays and disruptions to ongoing projects. The PIF's reliance on external advisors for its vast investment portfolio necessitates finding alternative solutions.

- Project Delays: The ban could lead to delays in crucial investment decisions, portfolio restructuring, and the implementation of new strategies.

- Alternative Advisory Services: The PIF will need to quickly identify and engage alternative advisory firms to fill the gap left by PwC. This process could take time and resources.

- Future Investments: The disruption could affect the PIF's future investment plans, impacting its overall investment strategy and potentially altering its risk appetite.

Implications of the One-Year Ban on PwC

The one-year ban imposed on PwC carries significant consequences for the firm, impacting its financial stability and global reputation.

Financial Losses and Revenue Impact

The loss of the PIF's business represents a substantial blow to PwC's revenue streams.

- Estimated Revenue Loss: [Attempt to estimate the potential revenue loss based on available information about previous PwC engagements with the PIF.]

- Long-Term Repercussions: The loss of such a significant client could have long-term financial repercussions for PwC, impacting its profitability and growth.

- Stock Market Reaction: [Note any observed reactions in PwC's stock price or market capitalization following the announcement of the ban.]

Reputational Damage and Loss of Trust

The ban severely damages PwC's reputation and erodes the trust placed in the firm, not only within Saudi Arabia but globally.

- Impact on Client Relationships: The ban could affect PwC's relationships with other clients, particularly those in the Middle East and those who value a strong reputation for regulatory compliance.

- Global Brand Image: The incident could tarnish PwC's global brand image, raising questions about its commitment to ethical conduct and regulatory adherence.

- Employee Morale and Recruitment: The negative publicity could also affect employee morale and potentially impact the firm's ability to attract and retain top talent.

Responses from PwC and the PIF

[Include summaries of official statements released by PwC and the PIF regarding the ban. Provide hyperlinks to these statements whenever possible.]

Wider Implications for the Consulting Industry

The Saudi Wealth Fund PwC Ban has significant implications for the global consulting industry, particularly firms operating in the Middle East.

Increased Scrutiny of Consulting Firms

The incident serves as a cautionary tale, leading to increased regulatory scrutiny for consulting firms worldwide.

- Stricter Regulations: We can anticipate stricter regulations and more stringent oversight of consulting firms operating in Saudi Arabia and potentially other regions.

- Operational Changes: Consulting firms will likely need to adapt their operational procedures to ensure complete compliance with evolving regulations.

- International Business Practices: The incident highlights the importance of adhering to local laws and regulations when conducting international business.

Shifting Landscape of the Saudi Arabian Market

The ban could significantly reshape the Saudi Arabian business landscape and create opportunities for competing firms.

- Opportunities for Competitors: The ban presents opportunities for other consulting firms to secure business with the PIF and other Saudi Arabian entities.

- Impact on Foreign Investment: The incident could impact foreign investment in Saudi Arabia, depending on how the situation is resolved and the perceived risk to foreign firms.

- Future Regulatory Frameworks: We can expect future regulatory frameworks in Saudi Arabia to be more stringent and focused on preventing similar conflicts of interest or regulatory breaches.

Conclusion

The Saudi Wealth Fund PwC Ban is a watershed moment for the global consulting industry. The reasons behind the ban – encompassing potential conflicts of interest and regulatory breaches – underscore the growing importance of ethical conduct and regulatory compliance. This situation's implications are far-reaching, impacting not only PwC but also the broader consulting sector and the investment landscape within Saudi Arabia. Understanding the intricacies of this "Saudi Wealth Fund PwC Ban" is crucial for firms operating in this dynamic market. Staying abreast of future developments in this case and similar instances is critical for risk mitigation and ensuring compliance with evolving regulatory standards. Proactive measures to maintain ethical conduct and strict adherence to all relevant regulations are essential for all firms seeking to successfully navigate this complex environment.

Featured Posts

-

Nyt Spelling Bee Answers For February 12 2025

Apr 29, 2025

Nyt Spelling Bee Answers For February 12 2025

Apr 29, 2025 -

Where To Watch Lionel Messis Inter Miami Mls Games Live Stream Schedule And Betting Odds

Apr 29, 2025

Where To Watch Lionel Messis Inter Miami Mls Games Live Stream Schedule And Betting Odds

Apr 29, 2025 -

Uguaglianza Sul Lavoro Quanto Siamo Davvero Vicini Alla Parita

Apr 29, 2025

Uguaglianza Sul Lavoro Quanto Siamo Davvero Vicini Alla Parita

Apr 29, 2025 -

Cleveland Indians Fan Removed After Targeting Jarren Duran Following Suicide Revelation

Apr 29, 2025

Cleveland Indians Fan Removed After Targeting Jarren Duran Following Suicide Revelation

Apr 29, 2025 -

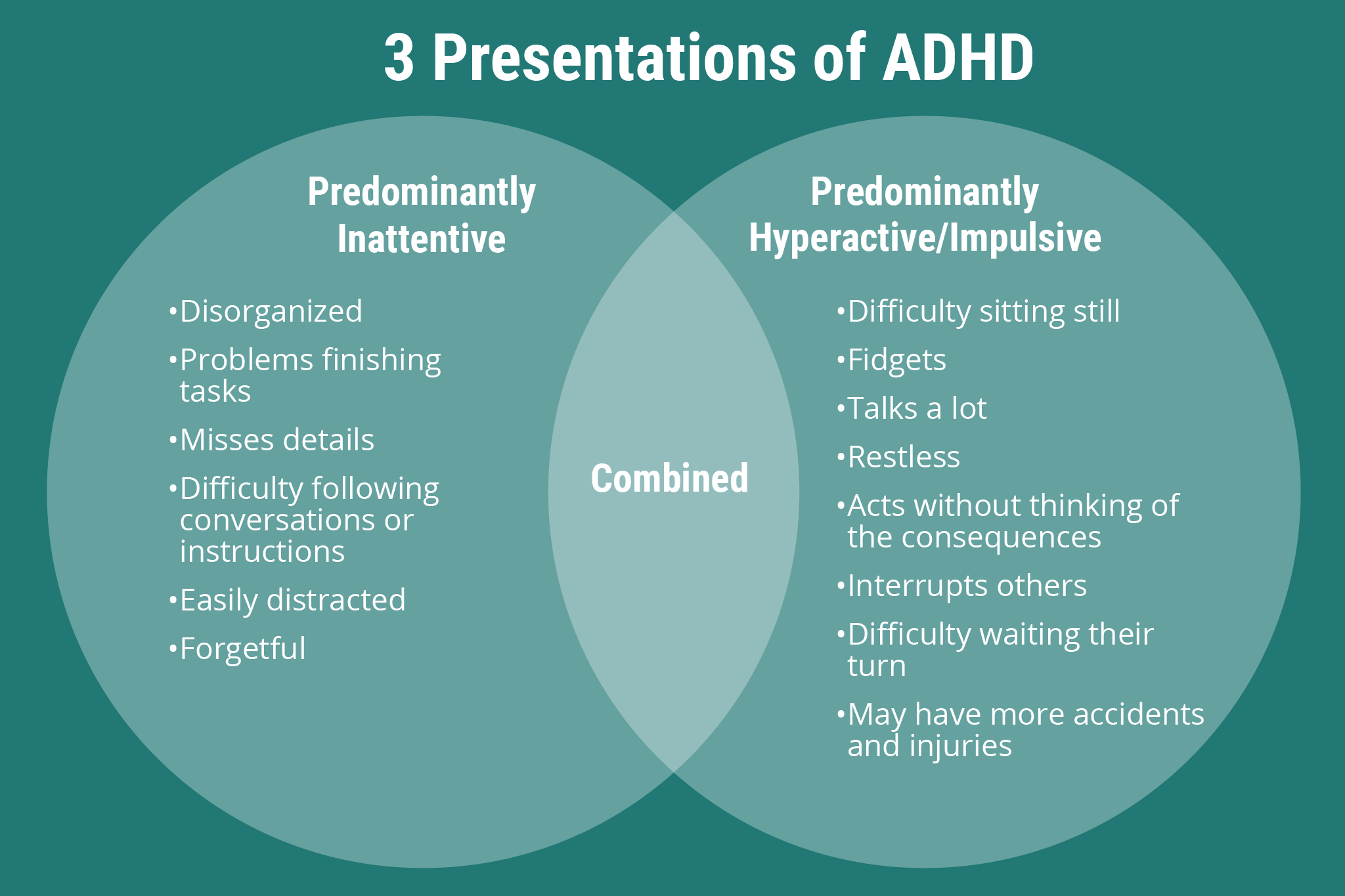

Coping With Adhd The Importance Of Community And Group Support

Apr 29, 2025

Coping With Adhd The Importance Of Community And Group Support

Apr 29, 2025

Latest Posts

-

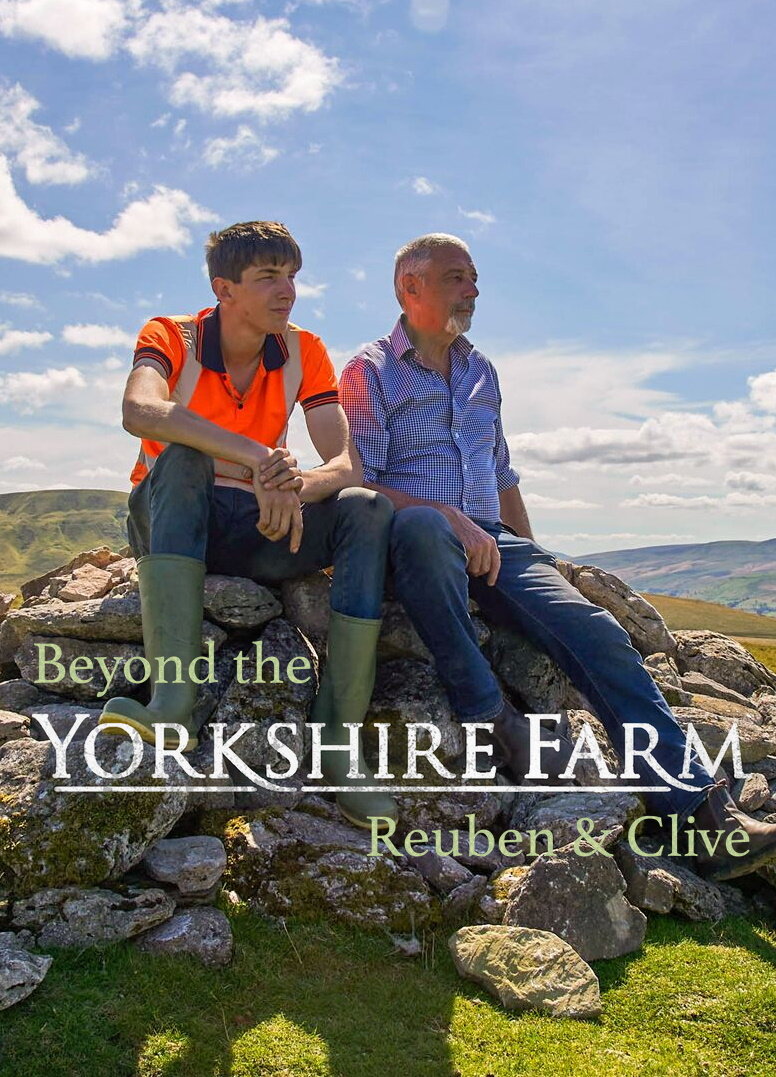

Our Yorkshire Farm Amanda Owens Emotional Farewell

Apr 30, 2025

Our Yorkshire Farm Amanda Owens Emotional Farewell

Apr 30, 2025 -

The Challenges Of Growing Up On Our Yorkshire Farm Reuben Owens Perspective

Apr 30, 2025

The Challenges Of Growing Up On Our Yorkshire Farm Reuben Owens Perspective

Apr 30, 2025 -

Our Yorkshire Farm Reuben Owen Opens Up About His Childhood Struggles

Apr 30, 2025

Our Yorkshire Farm Reuben Owen Opens Up About His Childhood Struggles

Apr 30, 2025 -

Our Yorkshire Farm Channel 4 Announcement Sparks Further Complaints Against Amanda Owen

Apr 30, 2025

Our Yorkshire Farm Channel 4 Announcement Sparks Further Complaints Against Amanda Owen

Apr 30, 2025 -

Amanda Owen Raising 9 Children On Our Farm Next Door

Apr 30, 2025

Amanda Owen Raising 9 Children On Our Farm Next Door

Apr 30, 2025