Onex Investment In WestJet Fully Recovered Through Sale Of 25% Stake

Table of Contents

Onex's Initial WestJet Investment and its Strategic Goals

The Genesis of Onex's WestJet Investment

Onex's acquisition of a substantial stake in WestJet marked a significant entry into the Canadian airline market. The timeline of this acquisition, specific details of which may be subject to confidentiality agreements, involved a thorough due diligence process and negotiations with WestJet's existing stakeholders. Onex's strategic objectives for investing in WestJet were multi-faceted:

- Growth and Expansion: Onex aimed to leverage WestJet's potential for growth within the Canadian and potentially international markets.

- Operational Efficiency: The private equity firm sought to optimize WestJet's operational efficiency and cost structure to improve profitability.

- Market Share Increase: A key goal was to enhance WestJet's competitive position and increase its market share within the Canadian airline industry.

These strategic goals guided Onex's investment strategy, shaping decisions related to capital allocation, operational improvements, and strategic partnerships. The keywords "Onex acquisition," "WestJet investment," "private equity investment," and "strategic acquisition" are central to this phase.

Navigating Challenges and Capitalizing on Opportunities

Onex's ownership of the WestJet stake wasn't without its hurdles. The airline industry is inherently volatile, susceptible to economic downturns and external shocks. The COVID-19 pandemic presented a particularly significant challenge, drastically impacting air travel demand globally. However, Onex navigated these challenges effectively by:

- Strategic Restructuring: Implementing cost-cutting measures and restructuring operations to adapt to reduced demand.

- Government Support: Leveraging government support programs designed to assist businesses during the pandemic.

- Adapting to Changing Market Conditions: Quickly adapting its strategy to address the evolving needs of the air travel market.

Through proactive risk management and a flexible investment strategy, Onex not only protected its investment but also positioned WestJet for a robust recovery once the acute phase of the pandemic subsided. This section highlights the use of keywords like "market challenges," "pandemic impact," "investment strategy," "value creation," and "risk management."

The Sale of the 25% Stake and Full Investment Recovery

The Strategic Decision to Sell

Onex's decision to sell its 25% stake in WestJet was a carefully considered strategic move, aligning with the firm's investment horizon and maximizing returns. Several factors contributed to this decision:

- Mature Investment: The investment had reached a point where further significant value creation within Onex's timeframe was unlikely.

- Attractive Market Conditions: Favorable market conditions created an opportune moment to realize substantial returns.

- Strategic Re-allocation: The proceeds from the sale could be reinvested in other promising ventures within Onex's portfolio.

The timing of the sale was crucial to capitalizing on the increased market valuation of WestJet. Keywords here include "stake sale," "exit strategy," "investment return," and "portfolio management."

Financial Implications of the Sale

The sale of the 25% stake resulted in substantial financial returns for Onex, exceeding its initial investment significantly. While precise figures are likely confidential, the achievement of full investment recovery and a substantial profit demonstrates a highly successful exit strategy. This highlights the importance of keywords such as "return on investment (ROI)," "profitability," "financial performance," and "successful exit."

Impact on WestJet's Future

The sale of Onex's stake will undoubtedly have implications for WestJet's future trajectory. While the specifics will depend on the buyer and their strategic vision, potential effects could include:

- New Strategic Direction: The new majority shareholder may bring a different strategic vision for WestJet's growth and development.

- Capital Investments: The influx of new capital could facilitate investments in fleet modernization, route expansion, or technological upgrades.

- Shifts in Management: There's a possibility of changes in WestJet's senior management team.

The keywords relevant to this section include "WestJet future," "market position," "company growth," and "industry outlook."

Conclusion: Onex's Successful WestJet Investment and Lessons Learned

Onex's investment in WestJet stands as a compelling case study in successful private equity investment and strategic exit strategies. The full recovery of the initial investment, achieved through the strategic sale of the 25% stake, underscores the importance of thorough due diligence, proactive risk management, and a flexible approach to navigating market challenges. The success also offers valuable insights into the potential for significant returns in the airline industry when paired with astute investment management. This successful exit strategy serves as a valuable lesson for other private equity firms looking to invest in the airline sector.

Learn more about successful private equity investment strategies like Onex's WestJet acquisition and the key factors driving investment recovery. Understanding these strategies can significantly improve your own investment outcomes.

Featured Posts

-

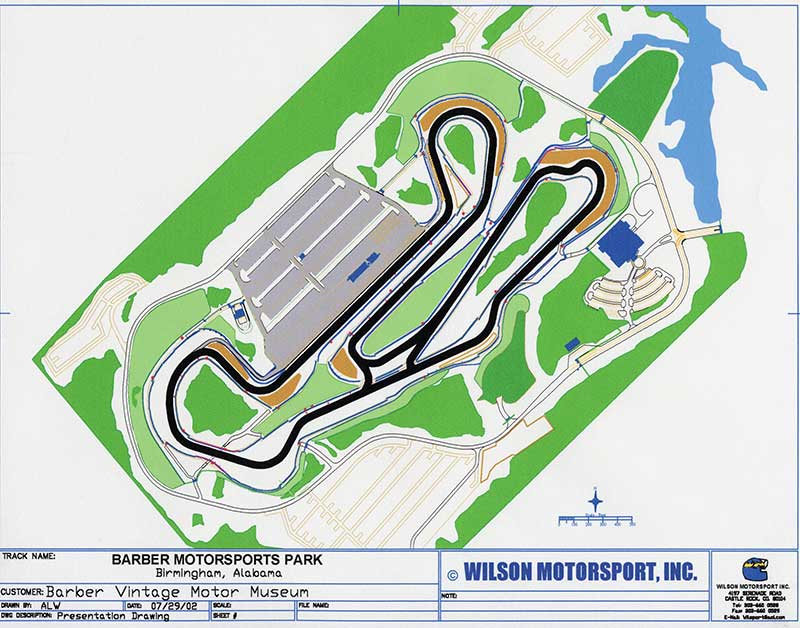

Hertas Hunt For Pace Barber Motorsports Park Showdown

May 12, 2025

Hertas Hunt For Pace Barber Motorsports Park Showdown

May 12, 2025 -

Bitter Einde Voor Bayern Muenchen Thomas Muellers Vertrek Een Verlies Van Ziel

May 12, 2025

Bitter Einde Voor Bayern Muenchen Thomas Muellers Vertrek Een Verlies Van Ziel

May 12, 2025 -

37 Point Loss Prompts Thibodeau To Call For More Knicks Resolve

May 12, 2025

37 Point Loss Prompts Thibodeau To Call For More Knicks Resolve

May 12, 2025 -

Lily Collins And Charlie Mc Dowell A Family Album Featuring Daughter Tove

May 12, 2025

Lily Collins And Charlie Mc Dowell A Family Album Featuring Daughter Tove

May 12, 2025 -

Car Crash Involving Virginia Giuffre Claims Of Impending Death

May 12, 2025

Car Crash Involving Virginia Giuffre Claims Of Impending Death

May 12, 2025