OPEC+ Decision Looms As Big Oil Resists Production Increases

Table of Contents

Current State of the Oil Market

The global oil market is a complex interplay of supply, demand, and geopolitical factors. Understanding the current dynamics is crucial to predicting the outcome of the upcoming OPEC+ meeting.

Global Oil Demand and Supply

Global oil demand is recovering strongly from the pandemic slump, driven primarily by increased travel and economic activity in key regions like Asia. However, this resurgence in demand is colliding with existing supply constraints.

- Increased travel demand: Post-pandemic pent-up demand for air travel and road transportation is significantly boosting oil consumption.

- Economic recovery in key regions: Strong economic growth in many parts of the world is fueling industrial activity and energy consumption.

- Impact of sanctions on Russian oil: Sanctions imposed on Russia following its invasion of Ukraine have disrupted global oil supplies, creating a significant supply gap.

- OPEC+ adherence to production quotas: The adherence (or lack thereof) by OPEC+ members to their agreed-upon production quotas plays a critical role in shaping the overall supply picture.

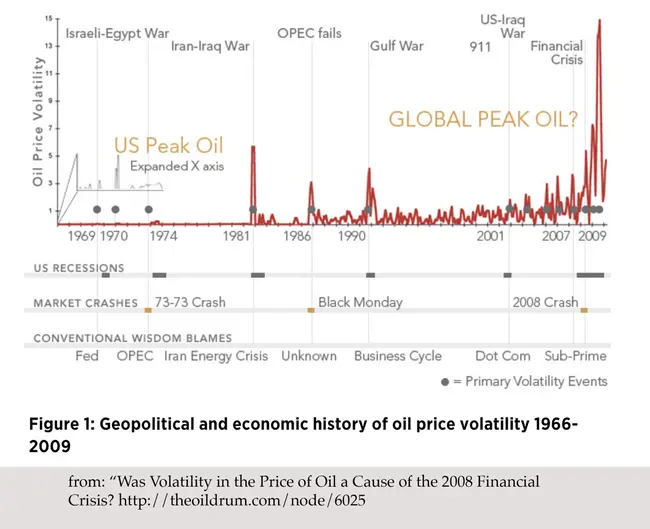

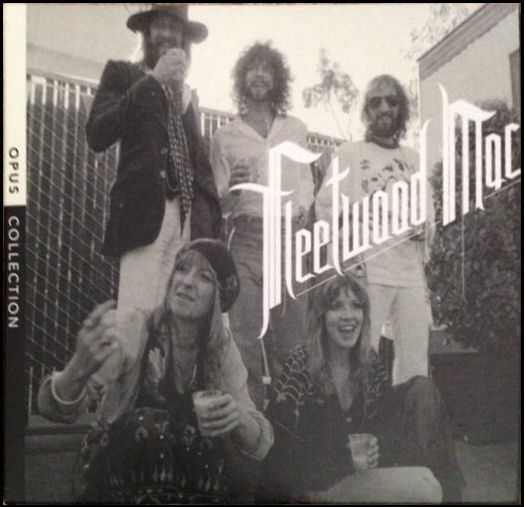

Price Volatility and its Drivers

Recent oil price fluctuations reflect a complex mix of factors. The uncertainty surrounding the war in Ukraine, inflationary pressures, and speculation in the futures market all contribute to price volatility.

- Inflationary pressures: Rising inflation globally increases the cost of production and transportation, impacting oil prices.

- The impact of the war in Ukraine: The ongoing conflict continues to create uncertainty and disruption in global oil markets.

- Inventory levels: Current inventory levels of crude oil and refined products significantly influence market sentiment and price movements.

- Futures market activity: Speculation and trading in oil futures contracts can amplify price fluctuations and contribute to volatility.

Big Oil's Resistance to Production Increases

Despite the apparent need for increased oil production, major oil companies are showing resistance. This resistance stems from a combination of financial incentives and long-term strategic considerations.

Profitability and Investor Pressure

High oil prices have significantly boosted the profitability of major oil companies. This profitability creates a disincentive to increase production, as doing so could lead to lower prices and reduced profits.

- High profit margins: Current oil prices are generating exceptionally high profit margins for major oil producers.

- Share buybacks: Many oil companies are using their profits to buy back their own shares, increasing shareholder value.

- Dividends: Increased profits are also being used to pay higher dividends to shareholders.

- Capital expenditure priorities: Companies are prioritizing investments in areas they deem more lucrative than expanding oil production capacity.

Investment in Renewables and Transition Concerns

The global shift towards renewable energy sources is forcing major oil companies to reassess their long-term strategies. Investment in renewable energy and carbon capture technologies is increasing, but this transition doesn't automatically translate into increased oil production in the short term.

- ESG (Environmental, Social, and Governance) investing: Growing investor pressure on ESG factors is influencing investment decisions away from fossil fuels.

- Renewable energy projects: Many oil majors are investing heavily in renewable energy projects like solar and wind power.

- Carbon capture technologies: Investments in carbon capture and storage technologies are seen as a way to mitigate the environmental impact of fossil fuels.

- Long-term investment strategies: Oil companies are balancing short-term profitability with long-term sustainability considerations, influencing their production decisions.

Potential Outcomes of the OPEC+ Meeting

The OPEC+ meeting could result in several scenarios, each with significant implications for the global oil market.

Scenario 1: Production Increase

An OPEC+ decision to increase oil production would likely lead to lower crude oil prices, easing inflationary pressures and potentially stabilizing the global energy supply chain.

- Impact on crude oil prices: A production increase would likely put downward pressure on crude oil prices.

- Effect on inflation: Lower oil prices would help to curb inflationary pressures globally.

- Potential easing of supply chain pressures: Increased supply could alleviate some of the strains on the global energy supply chain.

Scenario 2: Maintaining Current Production Levels

Maintaining current production levels could lead to continued price volatility, potential supply shortages, and negatively impact global economic growth.

- Continued price volatility: Uncertainty about future supply would likely persist, leading to continued price fluctuations.

- Potential for supply disruptions: Tight supply could lead to disruptions in energy markets, particularly in regions heavily reliant on oil imports.

- Impact on global economic growth: High oil prices can stifle economic growth by increasing the cost of transportation and production.

Scenario 3: Production Decrease

A production decrease, while less likely, could result in significant price spikes and exacerbate economic instability, potentially leading to a global recession.

- Severe price increases: A reduction in production would likely cause a sharp increase in oil prices.

- Potential for economic recession: High oil prices can trigger a recession by increasing production costs and reducing consumer spending.

- Market disruptions: Severe price spikes could lead to significant disruptions in global energy markets.

Conclusion

The OPEC+ decision on oil production has significant ramifications for the global economy and energy markets. Big oil's resistance to increasing production highlights the complex interplay between profitability, investor expectations, and the transition to renewable energy. The outcome of the meeting will directly influence crude oil prices, global inflation, and the stability of the energy supply chain. Understanding the factors at play is crucial for businesses and individuals alike. Stay informed about the latest developments surrounding the OPEC+ decision and its potential impact on oil prices and global energy security. Monitor future OPEC+ meetings closely to anticipate shifts in oil production and adjust your strategies accordingly.

Featured Posts

-

Final Destination 5 North American Box Office Projections Exceed Expectations

May 04, 2025

Final Destination 5 North American Box Office Projections Exceed Expectations

May 04, 2025 -

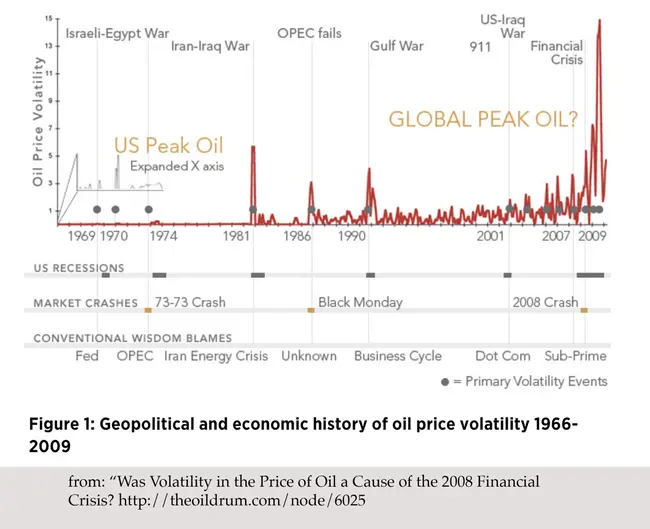

Aiguiser La Guillotine Prevenir Les Actes Insenses D Un Imbecile

May 04, 2025

Aiguiser La Guillotine Prevenir Les Actes Insenses D Un Imbecile

May 04, 2025 -

The Enduring Success Of Fleetwood Macs Multi Platinum Albums

May 04, 2025

The Enduring Success Of Fleetwood Macs Multi Platinum Albums

May 04, 2025 -

Kentucky Derby 2024 Final Preparations At Churchill Downs

May 04, 2025

Kentucky Derby 2024 Final Preparations At Churchill Downs

May 04, 2025 -

Disneys Cruella New Trailer Shows Emma Stones Growing Rivalry With Emma Thompson

May 04, 2025

Disneys Cruella New Trailer Shows Emma Stones Growing Rivalry With Emma Thompson

May 04, 2025