Ozempic And The Weight-Loss Market: Novo Nordisk's Stumbling Blocks

Table of Contents

Increased Competition and the Rise of Biosimilars

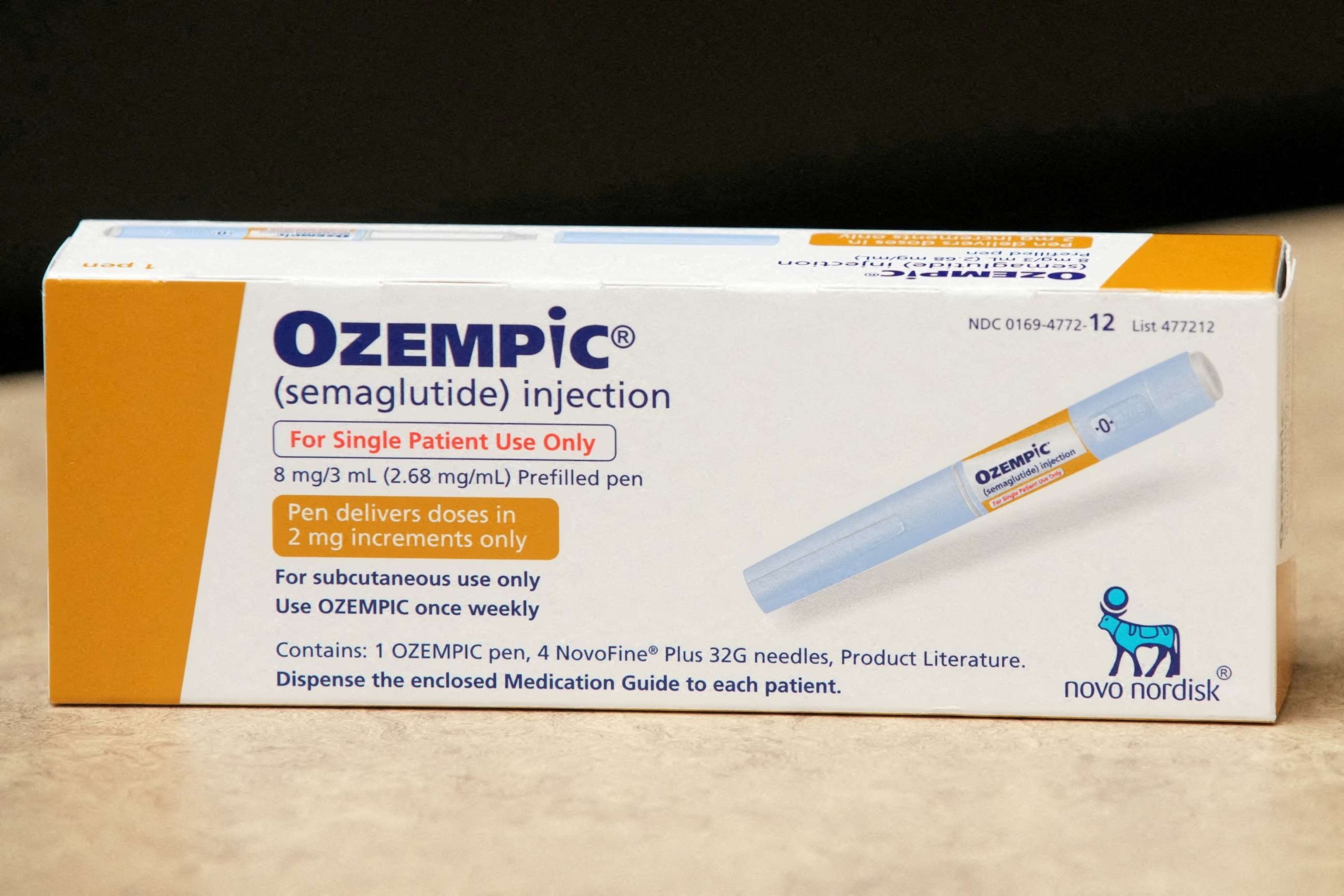

The Ozempic weight loss market is becoming increasingly crowded. Several competitors are vying for market share, posing a significant threat to Novo Nordisk's leading position. This intensified competition comes from both established players and the emerging threat of biosimilars.

-

Competitor Drugs: Drugs like Wegovy (semaglutide), also from Novo Nordisk, and Mounjaro (tirzepatide) from Eli Lilly, are strong competitors, offering similar mechanisms of action and often comparable efficacy. These drugs directly challenge Ozempic's market share, especially given their marketing strategies and potential for broader patient access.

-

Biosimilar Threat: The looming threat of biosimilars is perhaps the most significant challenge. Once biosimilars gain approval, they can significantly undercut Ozempic's pricing, impacting Novo Nordisk's profit margins. The development and launch timelines of these biosimilars will be critical in determining the long-term impact on the Ozempic weight loss market.

-

Generic Competition: The eventual entry of generic versions of semaglutide (the active ingredient in Ozempic and Wegovy) will further intensify price competition and erode Novo Nordisk’s market share. This will force a re-evaluation of pricing strategies and potentially affect the overall profitability of the product line.

-

Market Share Projections: Analysts predict [insert data/statistic, e.g., a 15% reduction in Ozempic’s market share within the next 3 years due to increased competition]. This highlights the urgent need for Novo Nordisk to adapt its strategies.

Supply Chain Issues and Accessibility

Maintaining sufficient Ozempic supply to meet the overwhelming demand has proven to be a major challenge for Novo Nordisk. This has resulted in significant stock shortages and limited accessibility for patients who rely on this medication.

-

Manufacturing Capacity: Novo Nordisk's manufacturing capacity has struggled to keep pace with the unexpectedly high demand for Ozempic, resulting in production bottlenecks and delays.

-

Raw Material Shortages: Securing a consistent supply of raw materials needed for Ozempic production presents an ongoing challenge, further exacerbating supply chain issues.

-

Distribution Network Efficiency: Optimizing the distribution network to ensure efficient and timely delivery of Ozempic to pharmacies and healthcare providers is crucial, yet remains a point of concern. Improving logistics and expanding distribution channels are necessary to improve accessibility.

-

Patient Access: Limited accessibility directly affects patients' ability to obtain and continue treatment, impacting their health outcomes and potentially driving them toward alternative weight-loss solutions.

Ethical Concerns and Public Perception

The widespread use of Ozempic, particularly its off-label prescription for weight loss, has raised ethical concerns and sparked public debate.

-

Celebrity Endorsements and Influence: The use of Ozempic by celebrities and influencers has fueled both demand and controversy. This has created a perception, both positive and negative, which is impacting the public’s view of the drug and its appropriateness.

-

Negative Media Coverage: Negative press surrounding Ozempic's use and side effects has impacted public perception, leading to heightened scrutiny and potential concerns regarding safety and efficacy.

-

Regulatory Scrutiny: The increased use and associated controversy have attracted greater regulatory scrutiny, potentially leading to stricter guidelines and restrictions on prescribing practices.

-

Equity and Affordability: Concerns have been raised regarding equity of access due to high costs, creating disparities in who can afford this treatment. This highlights ethical issues around access and the affordability of Ozempic for all patients who may benefit.

Pricing Strategies and Market Sustainability

Novo Nordisk’s pricing strategies will be vital in determining the long-term sustainability of Ozempic in the competitive weight-loss market.

-

Impact on Patient Access: High prices limit patient access, potentially driving them towards cheaper alternatives or delaying treatment.

-

Competitor Pricing: Competitors are adopting various pricing strategies, putting pressure on Novo Nordisk to remain competitive while ensuring profitability.

-

Strategies for Maintaining Profitability: Balancing profitability with accessibility requires strategic pricing adjustments, potentially involving tiered pricing or patient assistance programs.

-

Insurance Coverage and Reimbursement: The role of insurance coverage and reimbursement policies is critical, as these factors significantly impact patient affordability and access to Ozempic.

Conclusion

Novo Nordisk faces several significant challenges in maintaining its leadership in the Ozempic weight loss market. Increased competition, supply chain vulnerabilities, ethical concerns, and pricing strategies all play crucial roles. Addressing these issues proactively is paramount for ensuring the long-term success of Ozempic. Understanding the complexities of the Ozempic weight loss market is crucial for investors, healthcare professionals, and patients alike. Further research into the competitive landscape and the evolving regulatory environment is essential to navigate this dynamic sector of the pharmaceutical industry.

Featured Posts

-

Understanding Primera Natural Bladder Control Solutions For Women

May 30, 2025

Understanding Primera Natural Bladder Control Solutions For Women

May 30, 2025 -

Del Toro Extends Giro D Italia Lead Stage 17 Victory Australian Withdrawals

May 30, 2025

Del Toro Extends Giro D Italia Lead Stage 17 Victory Australian Withdrawals

May 30, 2025 -

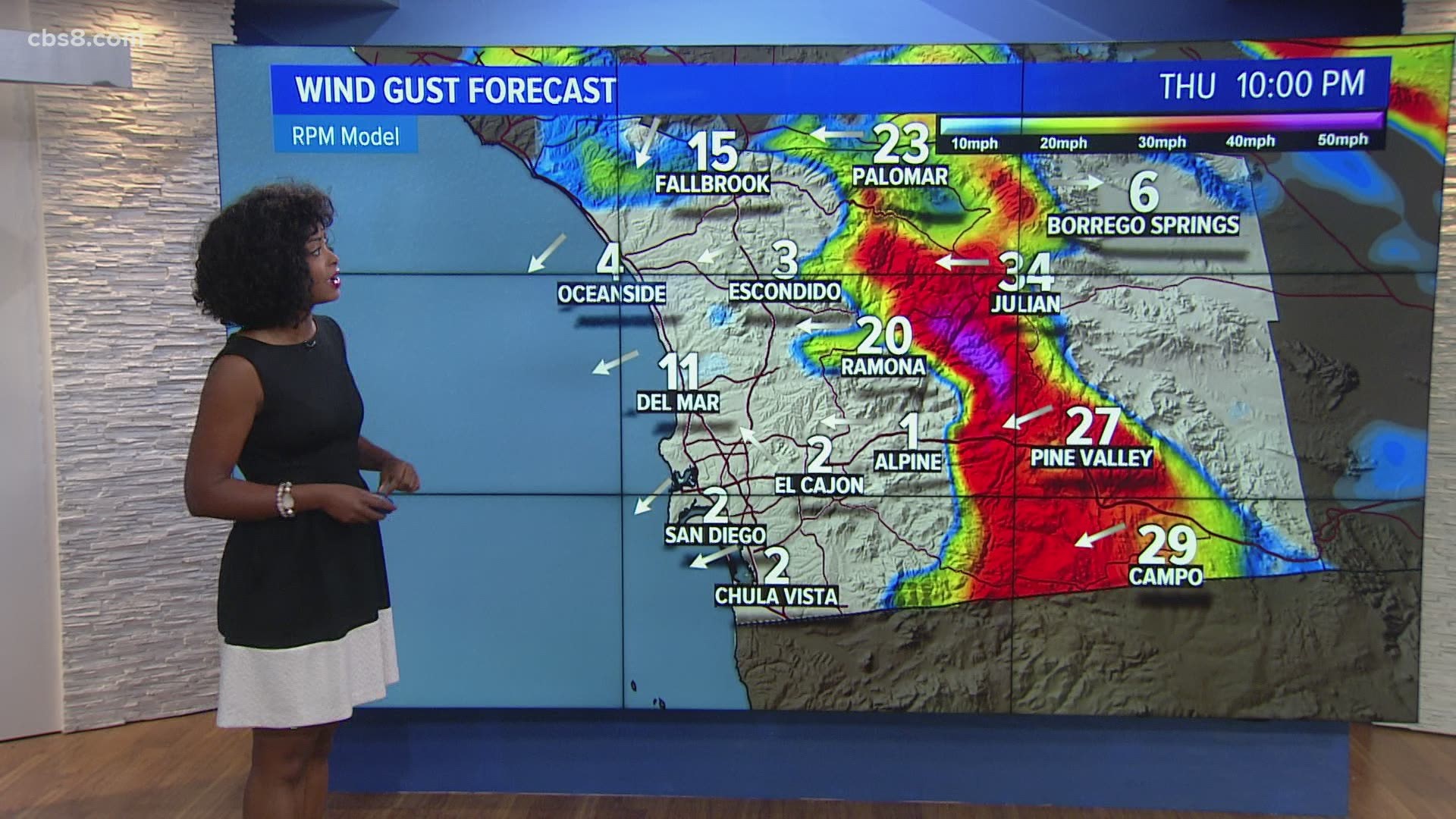

San Diego County Weather Fog Cooler Temperatures And Possible Showers

May 30, 2025

San Diego County Weather Fog Cooler Temperatures And Possible Showers

May 30, 2025 -

Carneys Military Spending Plan A 64 Billion Economic Stimulus Cibc

May 30, 2025

Carneys Military Spending Plan A 64 Billion Economic Stimulus Cibc

May 30, 2025 -

Jw 24 Alshykh Fysl Alhmwd Ybeth Brsalt Thnyt Llardn Bmnasbt Eyd Alastqlal

May 30, 2025

Jw 24 Alshykh Fysl Alhmwd Ybeth Brsalt Thnyt Llardn Bmnasbt Eyd Alastqlal

May 30, 2025