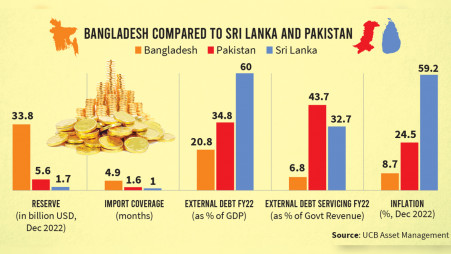

Pakistan, Sri Lanka, Bangladesh Pledge Closer Capital Market Ties

Table of Contents

Enhanced Investment Opportunities

This initiative promises to unlock significant investment opportunities across Pakistan, Sri Lanka, and Bangladesh. The core aim is to create a more integrated and efficient financial landscape in the region.

Increased Cross-border Investments

This pledge aims to streamline regulations and significantly reduce barriers to cross-border investments. This will allow investors from each country easier access to the vibrant capital markets of their neighbours.

- Reduced bureaucratic hurdles for foreign investment: Simplifying the investment process will attract greater foreign capital.

- Harmonization of regulatory frameworks: Creating a more consistent regulatory environment across the three nations will reduce uncertainty and encourage investment.

- Promotion of joint ventures and cross-border listings: Facilitating joint ventures and cross-border listings will increase market depth and liquidity.

- Increased transparency and investor protection mechanisms: Strengthening investor protection will boost confidence and attract more foreign investment.

Diversification of Investment Portfolios

Closer ties will allow investors to diversify their portfolios, mitigating risk and potentially enhancing returns. Access to a wider range of investment opportunities across the three nations is a key benefit.

- Access to previously untapped markets: Investors gain exposure to new markets and sectors with unique growth potential.

- Reduced reliance on domestic markets: Diversification lessens vulnerability to economic shocks specific to a single country.

- Opportunities for higher returns through diversification: Spreading investments across multiple markets can lead to improved overall portfolio performance.

- Exposure to different economic sectors and growth potential: Access to varied economic sectors provides opportunities for strategic investment and higher returns.

Boosting Economic Growth and Development

The increased flow of capital resulting from closer capital market ties is expected to have a significant positive impact on the economic landscape of all three nations.

Stimulating Economic Activity

The enhanced investment climate will stimulate economic activity, creating jobs and boosting overall economic growth across Pakistan, Sri Lanka, and Bangladesh.

- Increased Foreign Direct Investment (FDI): A key driver of economic growth and development.

- Development of new industries and businesses: Increased investment will fuel the creation of new businesses and industries, fostering innovation and competition.

- Job creation and poverty reduction: Economic growth translates into job creation, which will contribute to poverty reduction and improved living standards.

- Enhanced regional economic competitiveness: A more integrated regional economy will be better positioned to compete on the global stage.

Promoting Regional Stability

Strengthened economic ties can contribute to greater political stability and cooperation amongst Pakistan, Sri Lanka, and Bangladesh.

- Improved diplomatic relations: Economic cooperation can pave the way for stronger diplomatic relations and regional harmony.

- Reduced economic disparities: Closer integration can help reduce economic disparities within the region.

- Enhanced regional cooperation on other fronts: Success in capital market integration could serve as a model for cooperation in other areas.

- Greater stability for investors: A more stable and integrated region will attract more long-term investment.

Challenges and Opportunities

While the potential benefits are substantial, realizing the full potential of closer capital market ties requires addressing several challenges.

Regulatory Harmonization

Harmonizing the differing regulatory frameworks of the three countries' capital markets is a significant hurdle. Standardization of regulations and procedures is crucial for seamless cross-border investment.

Infrastructure Development

Adequate infrastructure, particularly digital connectivity and efficient payment systems, is essential for the smooth functioning of an integrated capital market. Improving digital infrastructure and payment systems is critical for efficient transactions.

Political Will and Commitment

Sustained political will and commitment from all three governments are paramount to overcome challenges and ensure the long-term success of this initiative. A consistent and supportive policy environment is vital.

Conclusion

The pledge by Pakistan, Sri Lanka, and Bangladesh to foster closer capital market ties represents a significant step toward greater regional economic integration in South Asia. This initiative holds immense potential for boosting economic growth, enhancing investment opportunities, and fostering regional stability. However, success hinges on overcoming challenges related to regulatory harmonization, infrastructure development, and sustained political commitment. The future of South Asian economic cooperation may well depend on the effective implementation of this crucial pledge to strengthen capital market ties. To gain a deeper understanding of this pivotal development and its potential impact, further research into the specifics of Pakistan, Sri Lanka, and Bangladesh's capital market integration is strongly recommended.

Featured Posts

-

K Trade And Jazz Cash Revolutionizing Stock Market Access

May 09, 2025

K Trade And Jazz Cash Revolutionizing Stock Market Access

May 09, 2025 -

Stephen King Weighs In Stranger Things Vs It

May 09, 2025

Stephen King Weighs In Stranger Things Vs It

May 09, 2025 -

King Pro Maska Ta Trampa Zrada Chi Politichna Zayava

May 09, 2025

King Pro Maska Ta Trampa Zrada Chi Politichna Zayava

May 09, 2025 -

Preview And Prediction Bayern Munichs Clash Against Eintracht Frankfurt

May 09, 2025

Preview And Prediction Bayern Munichs Clash Against Eintracht Frankfurt

May 09, 2025 -

Franco Colapinto To Replace Jack Doohan In Imola Analyzing The Speculation

May 09, 2025

Franco Colapinto To Replace Jack Doohan In Imola Analyzing The Speculation

May 09, 2025

Latest Posts

-

Mezhdunarodnaya Izolyatsiya Zelenskogo On Odin Na 9 Maya

May 09, 2025

Mezhdunarodnaya Izolyatsiya Zelenskogo On Odin Na 9 Maya

May 09, 2025 -

Pakistan Awaits Imf Decision On Crucial 1 3 Billion Loan Amidst Regional Tensions

May 09, 2025

Pakistan Awaits Imf Decision On Crucial 1 3 Billion Loan Amidst Regional Tensions

May 09, 2025 -

9 Maya Vladimir Zelenskiy Ostalsya Bez Podderzhki

May 09, 2025

9 Maya Vladimir Zelenskiy Ostalsya Bez Podderzhki

May 09, 2025 -

Dogovor Makrona I Tuska Novaya Glava Vo Franko Polskikh Otnosheniyakh

May 09, 2025

Dogovor Makrona I Tuska Novaya Glava Vo Franko Polskikh Otnosheniyakh

May 09, 2025 -

Oboronnoe Soglashenie Makron Tusk 9 Maya Analiz I Prognozy

May 09, 2025

Oboronnoe Soglashenie Makron Tusk 9 Maya Analiz I Prognozy

May 09, 2025