Palantir Stock: 30% Down - A Detailed Investment Analysis.

Table of Contents

Understanding Palantir's Business Model and Recent Performance

Palantir operates primarily through two platforms: Gotham, catering to government clients, and Foundry, targeting commercial enterprises. These platforms provide advanced data analytics and integration capabilities, helping organizations make better decisions through data-driven insights. Palantir's target markets include government agencies (defense, intelligence, etc.) and large commercial organizations across various sectors.

Recent financial performance has shown a mixed bag. While revenue growth has been positive, profitability remains a challenge. Let's examine some key figures:

- Q2 2024 Revenue: (Insert Actual Data Here - Source needed)

- Q2 2024 Net Income/Loss: (Insert Actual Data Here - Source needed)

- Year-over-Year Revenue Growth: (Insert Actual Data Here - Source needed)

- Operating Margin: (Insert Actual Data Here - Source needed)

Compared to previous quarters and years, (insert comparative analysis here – e.g., "revenue growth has slowed compared to Q1 2024, potentially contributing to investor concern").

Strengths: Palantir boasts a strong technology platform, a significant government client base, and a growing commercial presence. Its advanced data analytics capabilities are highly sought after.

Weaknesses: The company’s reliance on government contracts introduces volatility, and profitability remains a key challenge. Competition in the data analytics market is also intense. Recent news and press releases (cite specific examples and sources) have also influenced investor sentiment.

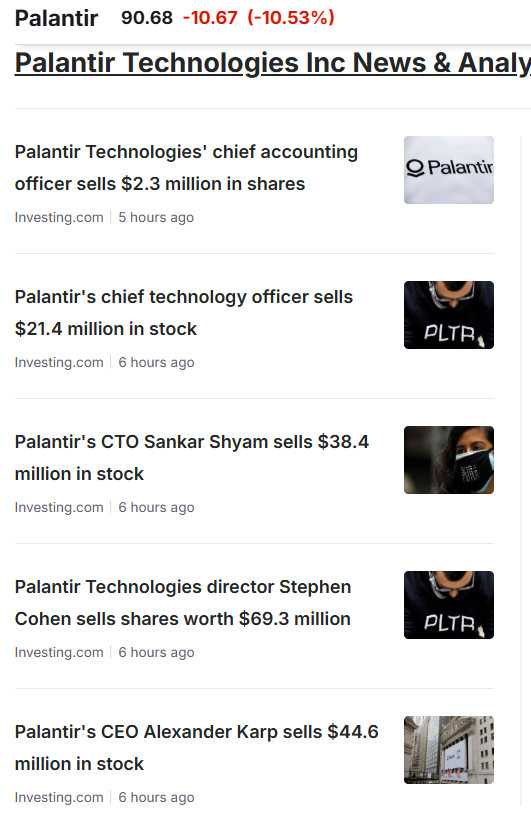

Analyzing the 30% Stock Drop: Key Contributing Factors

The recent 30% drop in Palantir stock price can be attributed to a confluence of macroeconomic and company-specific factors.

Macroeconomic Factors

- Rising Interest Rates: Higher interest rates increase borrowing costs, impacting business investment and potentially slowing down Palantir's growth.

- Inflationary Pressures: Inflation erodes purchasing power and can reduce demand for Palantir's services.

- Recession Fears: Concerns about a potential recession often lead to investors fleeing riskier assets, like Palantir stock, which is considered a growth stock with higher volatility.

Company-Specific Factors

Several company-specific events likely contributed to the stock price decline.

-

Disappointing Earnings Reports: (Mention specific reports and their shortcomings – cite sources)

-

Increased Competition: Growing competition in the data analytics space from established players and startups puts pressure on Palantir's market share.

-

Negative News and Press: (Cite any negative press, lawsuits, regulatory challenges, or management changes – with sources)

-

Short Interest: High short interest indicates that a significant number of investors are betting against the stock, potentially exacerbating price declines. (Include data if available and source).

Sentiment and Investor Confidence

Investor sentiment towards Palantir has shifted negatively in recent weeks, likely driven by the factors outlined above. Analyst ratings may have also played a role. Negative media coverage can further dampen investor confidence.

Evaluating the Investment Risks and Potential Rewards

Investing in Palantir stock carries significant risks:

- High Volatility: PLTR is known for its volatile stock price, making it a risky investment for risk-averse investors.

- Government Contract Dependence: A significant portion of Palantir's revenue comes from government contracts, which can be subject to budget cuts or changes in government priorities.

- Intense Competition: The data analytics market is highly competitive, with established players and new entrants vying for market share.

However, there's also potential for substantial rewards:

- Market Expansion: The market for data analytics is vast and growing rapidly, presenting significant opportunities for Palantir to expand its customer base.

- Technological Innovation: Palantir continues to invest in research and development, enhancing its platform and expanding its capabilities.

- Government Spending: Increased government spending on defense and intelligence could benefit Palantir.

Alternative investment options in the data analytics sector include established companies like (mention competitors) which offer lower volatility but potentially lower growth potential. Palantir’s long-term potential hinges on its ability to maintain technological leadership, expand its commercial market share, and consistently deliver strong financial results.

Palantir Stock Valuation and Future Price Predictions (with cautionary note)

Analyzing Palantir's valuation using metrics like P/E ratio and PEG ratio compared to competitors reveals (insert comparative analysis). Different valuation models (mention examples, like DCF) yield varying price targets, but these are highly sensitive to assumptions about future growth and profitability.

Disclaimer: It is crucial to remember that predicting stock prices is inherently speculative. Investing in the stock market involves significant risk, and past performance is not indicative of future results. Any price predictions should be treated with extreme caution.

Conclusion

The 30% drop in Palantir stock reflects a confluence of macroeconomic headwinds and company-specific challenges. While the risks associated with investing in Palantir stock are substantial – high volatility, reliance on government contracts, and intense competition – the potential for long-term growth remains. The current downturn might present an opportunity for long-term investors with a high risk tolerance.

However, before making any investment decisions regarding Palantir stock, conduct your own thorough due diligence, carefully assess your risk tolerance, and consider seeking advice from a qualified financial advisor. Remember to diversify your portfolio to mitigate risk. Don't put all your eggs in one basket, especially when dealing with volatile stocks like Palantir stock.

Featured Posts

-

Harry Styles On That Awful Snl Impression His Honest Reaction

May 09, 2025

Harry Styles On That Awful Snl Impression His Honest Reaction

May 09, 2025 -

Expensive Babysitter Costs Lead To Even Higher Daycare Fees One Mans Dilemma

May 09, 2025

Expensive Babysitter Costs Lead To Even Higher Daycare Fees One Mans Dilemma

May 09, 2025 -

Pam Bondi And The Killing Of American Citizens Examining The Controversy

May 09, 2025

Pam Bondi And The Killing Of American Citizens Examining The Controversy

May 09, 2025 -

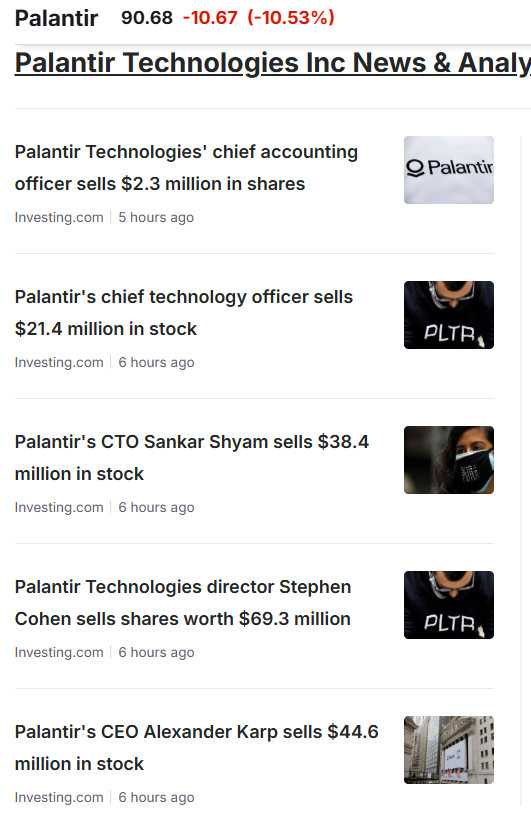

Wireless Mesh Networks Market Size And Growth Projections 9 8 Cagr

May 09, 2025

Wireless Mesh Networks Market Size And Growth Projections 9 8 Cagr

May 09, 2025 -

Asias Premier Bitcoin Event Bitcoin Seoul 2025

May 09, 2025

Asias Premier Bitcoin Event Bitcoin Seoul 2025

May 09, 2025

Latest Posts

-

Oilers Projected To Win Analyzing Edmonton Kings Playoff Series Odds

May 10, 2025

Oilers Projected To Win Analyzing Edmonton Kings Playoff Series Odds

May 10, 2025 -

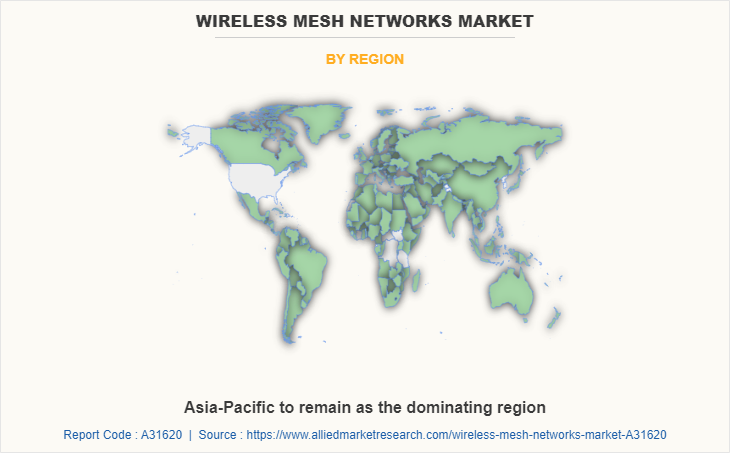

Edmonton Federal Electoral Boundaries Understanding The Impact On Voters

May 10, 2025

Edmonton Federal Electoral Boundaries Understanding The Impact On Voters

May 10, 2025 -

Edmonton Oilers Vs Los Angeles Kings Series Betting Odds And Predictions

May 10, 2025

Edmonton Oilers Vs Los Angeles Kings Series Betting Odds And Predictions

May 10, 2025 -

Greater Edmonton Federal Riding Changes What Voters Need To Know

May 10, 2025

Greater Edmonton Federal Riding Changes What Voters Need To Know

May 10, 2025 -

Edmonton Oilers Favored Betting Odds For Kings Series End

May 10, 2025

Edmonton Oilers Favored Betting Odds For Kings Series End

May 10, 2025