Palantir Stock: A Current Market Assessment And Investment Recommendation

Table of Contents

Palantir's Current Financial Performance and Growth Prospects

Understanding Palantir's financial health is paramount when considering an investment in Palantir stock. Recent quarterly and annual reports reveal a mixed picture. While revenue has shown consistent growth, profitability remains elusive for the company. Analyzing key metrics is critical to gauging future potential.

- Revenue Growth Rate: Palantir has demonstrated consistent year-over-year revenue growth, though the quarter-over-quarter growth rate can fluctuate. Investors should carefully examine these trends to identify patterns and predict future performance.

- Profitability (Net Income, EBITDA): Palantir is currently not profitable on a net income basis, but EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) provides a more comprehensive view of its operational performance. Monitoring EBITDA margins is crucial to assess the company's progress towards profitability.

- Key Contracts Won or Lost: Large government contracts significantly impact Palantir's revenue. Tracking contract wins and losses is essential to understanding the short-term and long-term revenue trajectory.

- Expansion into New Markets (Commercial Sector): Palantir's expansion into the commercial sector is a key factor in its long-term growth prospects. Success in this area could significantly diversify its revenue streams and reduce reliance on government contracts.

- Cost-Cutting Measures and Efficiency Improvements: Palantir's focus on cost-cutting and operational efficiency will influence its path to profitability. Investors should scrutinize the company's efforts in this area.

The company's future growth projections are influenced by factors such as securing new contracts, successful commercial expansion, and the overall market demand for big data analytics solutions. Analyzing these factors is crucial for predicting future stock performance.

Market Analysis and Competitive Landscape for Palantir

The big data analytics market is highly competitive, with key players such as Databricks and Snowflake vying for market share. Palantir’s competitive advantages lie in its proprietary technology and its strong foothold in the government sector. However, it faces challenges from agile competitors with potentially broader market appeal.

- Key Competitors and Their Market Share: A thorough understanding of the competitive landscape, including market share analysis of key competitors, is vital.

- Palantir's Competitive Advantages: Palantir's specialized technology and extensive experience working with government agencies provide a significant competitive advantage.

- Market Size and Growth Projections: The overall market for big data analytics is experiencing significant growth, presenting opportunities for Palantir.

- Impact of Macroeconomic Factors on Palantir's Stock Price: Macroeconomic factors, such as interest rates, inflation, and recessionary fears, significantly influence investor sentiment and, consequently, Palantir's stock price.

Analyzing these factors provides a comprehensive understanding of the market dynamics and their potential impact on Palantir's stock performance.

Valuation and Investment Risks Associated with Palantir Stock

Assessing Palantir's valuation is crucial before making an investment decision. Various metrics, including the P/E ratio (price-to-earnings ratio) and price-to-sales ratio, should be compared to industry peers to determine if Palantir is overvalued or undervalued.

- Key Valuation Metrics and Comparison to Peers: A comparative analysis using relevant metrics provides insights into Palantir's valuation relative to its competitors.

- Major Risks and Mitigating Factors: Investing in Palantir stock carries inherent risks. Dependence on government contracts, high valuation, and intense competition are key risks that need careful consideration.

- Potential Return on Investment Scenarios (Bull Case, Bear Case, Base Case): Developing different scenarios for potential ROI helps assess the range of possible outcomes.

- Consideration of Different Investment Horizons (Short-Term, Long-Term): The investment horizon significantly impacts risk tolerance and expected return.

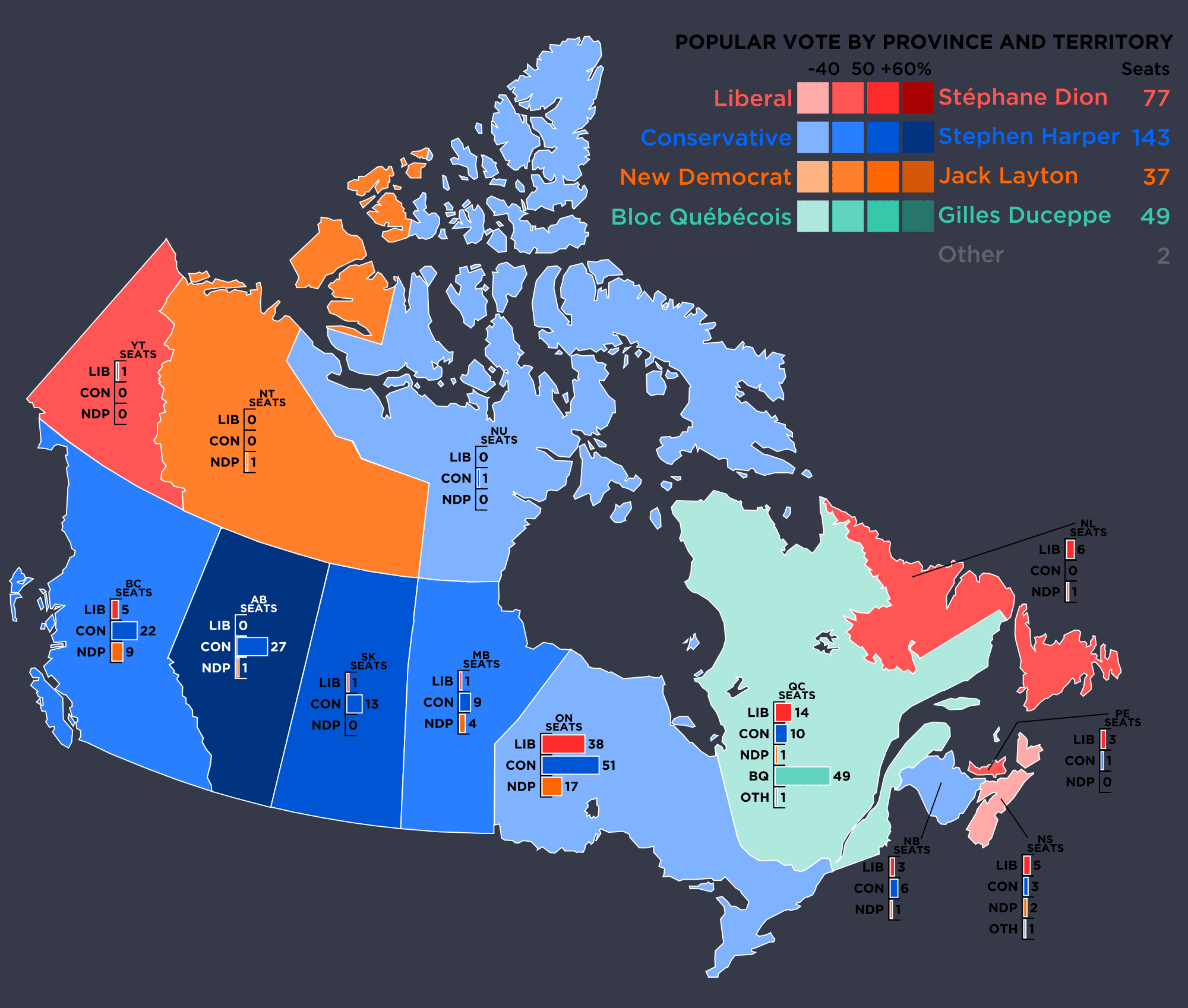

Technical Analysis of Palantir Stock Chart

[Insert relevant chart image here showing Palantir's stock price over a period of time, ideally 6 months to 1 year.]

A brief look at the Palantir stock chart can reveal important insights. Analyzing key support and resistance levels, as well as moving averages, can help understand short-term price trends.

- Key Support and Resistance Levels: Identifying these levels provides clues about potential price reversals.

- Relevant Moving Averages: Moving averages can indicate the overall trend and potential momentum shifts.

- Recent Price Trends and Momentum: Observing recent trends offers a glimpse into the immediate future price direction.

Conclusion: Investment Recommendation on Palantir Stock

In summary, Palantir presents a compelling investment case with substantial growth potential, but it also carries considerable risk. While revenue growth is encouraging, the company's path to profitability needs close monitoring. The competitive landscape and macroeconomic conditions will continue to influence Palantir stock price.

Based on our analysis, the recommendation is to hold Palantir stock for now. This is a cautious approach, given the existing risks and the need for further demonstration of sustained profitability. However, the long-term potential in the big data analytics market remains significant.

Before making any investment decisions regarding Palantir stock, it is crucial to conduct thorough due diligence, considering your individual risk tolerance and investment goals. Investing in Palantir requires a long-term perspective and a careful assessment of the company’s progress towards sustainable profitability. Further research into Palantir stock price trends and Palantir investment strategy is strongly advised.

Featured Posts

-

Extension Viticole A Dijon 2500 M Aux Valendons

May 09, 2025

Extension Viticole A Dijon 2500 M Aux Valendons

May 09, 2025 -

Buy Palantir Stock Before May 5th Weighing Wall Streets Near Unanimous Opinion

May 09, 2025

Buy Palantir Stock Before May 5th Weighing Wall Streets Near Unanimous Opinion

May 09, 2025 -

Manchesters Stunning Castle To Host Major Music Festival With Olly Murs

May 09, 2025

Manchesters Stunning Castle To Host Major Music Festival With Olly Murs

May 09, 2025 -

Alaskan Protests Against Doge And Trump Administration A Deep Dive

May 09, 2025

Alaskan Protests Against Doge And Trump Administration A Deep Dive

May 09, 2025 -

Violences Conjugales A Dijon Le Boxeur Bilel Latreche Devant La Justice

May 09, 2025

Violences Conjugales A Dijon Le Boxeur Bilel Latreche Devant La Justice

May 09, 2025

Latest Posts

-

Understanding Your Nl Federal Election Candidates

May 09, 2025

Understanding Your Nl Federal Election Candidates

May 09, 2025 -

2024 Nl Federal Election Candidate Information And Resources

May 09, 2025

2024 Nl Federal Election Candidate Information And Resources

May 09, 2025 -

Your Nl Federal Election Candidates Profiles And Platforms

May 09, 2025

Your Nl Federal Election Candidates Profiles And Platforms

May 09, 2025 -

Living Legends Of Aviation Awards Ceremony Recognizes Firefighters And Other Public Servants

May 09, 2025

Living Legends Of Aviation Awards Ceremony Recognizes Firefighters And Other Public Servants

May 09, 2025 -

Nl Federal Election Get To Know Your Candidates

May 09, 2025

Nl Federal Election Get To Know Your Candidates

May 09, 2025