Palantir Stock Before May 5th: Is It A Buy? Wall Street's Verdict

Table of Contents

Palantir's Recent Performance and Key Financials

Analyzing Palantir's recent performance is crucial for assessing its current valuation and future potential. Recent quarterly earnings reports have shown [mention specific data, e.g., fluctuating revenue growth, changes in profitability]. Examining key financial metrics provides a clearer picture.

- Revenue Growth: Palantir's revenue growth rate has [increased/decreased] compared to the previous quarter and [compared to] industry averages, indicating [positive/negative] momentum.

- Profitability Margins: Profitability margins have [improved/worsened], reflecting [reasons for the change, e.g., increased operating efficiency, higher R&D costs].

- Debt Levels and Cash Reserves: Palantir's debt levels are [high/low/stable], and its cash reserves stand at [amount], providing [level of] financial flexibility.

- Key Performance Indicators (KPIs): Key performance indicators such as [mention specific KPIs and their trends, e.g., customer acquisition costs, average revenue per user] reveal valuable insights into Palantir's operational efficiency and market penetration.

Factors Influencing Palantir Stock Price Before May 5th

Several factors will significantly influence investor sentiment towards Palantir stock before May 5th. These factors extend beyond the company's internal performance and encompass broader macroeconomic and geopolitical forces.

- Upcoming Events: The anticipated [earnings report/product launch/partnership announcement] on or around May 5th will undoubtedly shape investor perceptions. Analysts' forecasts currently suggest [summarize analyst expectations].

- Macroeconomic Factors: Rising interest rates and persistent inflation are impacting the tech sector broadly, potentially affecting Palantir's valuation. Investors are sensitive to these macroeconomic headwinds and their influence on tech stock prices.

- Geopolitical Events: Geopolitical instability can significantly influence government contracts, a considerable portion of Palantir's revenue. Any shifts in the global political landscape could impact investor confidence.

- Government Spending: Government spending on defense and intelligence, key markets for Palantir, can create opportunities or challenges depending on budget allocations and policy changes.

Wall Street's Opinion: Analyst Ratings and Price Targets

Wall Street analysts hold diverse opinions on Palantir's future. The range of price targets and buy/sell recommendations reflects this divergence.

- Average Price Target: The average price target from prominent analysts is currently [amount], with a standard deviation of [amount], indicating a [high/low/moderate] level of uncertainty.

- Analyst Recommendations: The consensus among analysts is [summarize the overall sentiment, e.g., cautiously optimistic, bearish, bullish]. The breakdown is roughly [percentage]% Buy, [percentage]% Hold, and [percentage]% Sell.

- Rationale Behind Differing Opinions: Analysts' differing opinions stem from varying assessments of [mention factors contributing to differences, e.g., revenue growth potential, competition, regulatory risks].

- Competitor Valuations: Comparing Palantir's valuation multiples (e.g., Price-to-Sales ratio) to its competitors provides further context for assessing its attractiveness as an investment.

Risks and Opportunities for Palantir Investors

Investing in Palantir, like any other stock, entails both risks and opportunities.

- Competitive Landscape: Palantir faces competition from established players and emerging startups in the data analytics and AI space. A thorough competitive analysis is essential.

- Regulatory Hurdles: Navigating regulatory landscapes in various countries poses potential challenges for Palantir's operations and growth.

- Opportunities in Emerging Technologies: Palantir's strategic initiatives in areas like AI and cloud computing present significant growth opportunities.

- Long-Term Growth Potential: The long-term growth potential of Palantir depends on its ability to successfully adapt to technological advancements, expand into new markets, and maintain a competitive edge.

Conclusion: Making Informed Decisions on Palantir Stock Before May 5th

Analyzing Palantir's financial performance, upcoming events, analyst sentiment, and inherent risks and opportunities provides a comprehensive picture. However, uncertainty remains regarding Palantir stock's trajectory before May 5th. While potential risks exist, the opportunities for substantial returns are also present. Before making any investment decisions regarding Palantir stock before May 5th, conduct thorough due diligence, consider your personal investment goals and risk tolerance, and further research Palantir's financials and broader market conditions. Remember, this analysis is for informational purposes only and does not constitute financial advice.

Featured Posts

-

Jayson Tatum Ankle Injury Updates On Celtics Forwards Condition

May 09, 2025

Jayson Tatum Ankle Injury Updates On Celtics Forwards Condition

May 09, 2025 -

Cheveux Faire Un Don A Dijon

May 09, 2025

Cheveux Faire Un Don A Dijon

May 09, 2025 -

X Blocks Jailed Turkish Mayors Social Media Opposition Backlash

May 09, 2025

X Blocks Jailed Turkish Mayors Social Media Opposition Backlash

May 09, 2025 -

Frances Europe Minister Promotes Shared Nuclear Shield

May 09, 2025

Frances Europe Minister Promotes Shared Nuclear Shield

May 09, 2025 -

Tomas Hertls Dominant Performance Golden Knights Beat Red Wings

May 09, 2025

Tomas Hertls Dominant Performance Golden Knights Beat Red Wings

May 09, 2025

Latest Posts

-

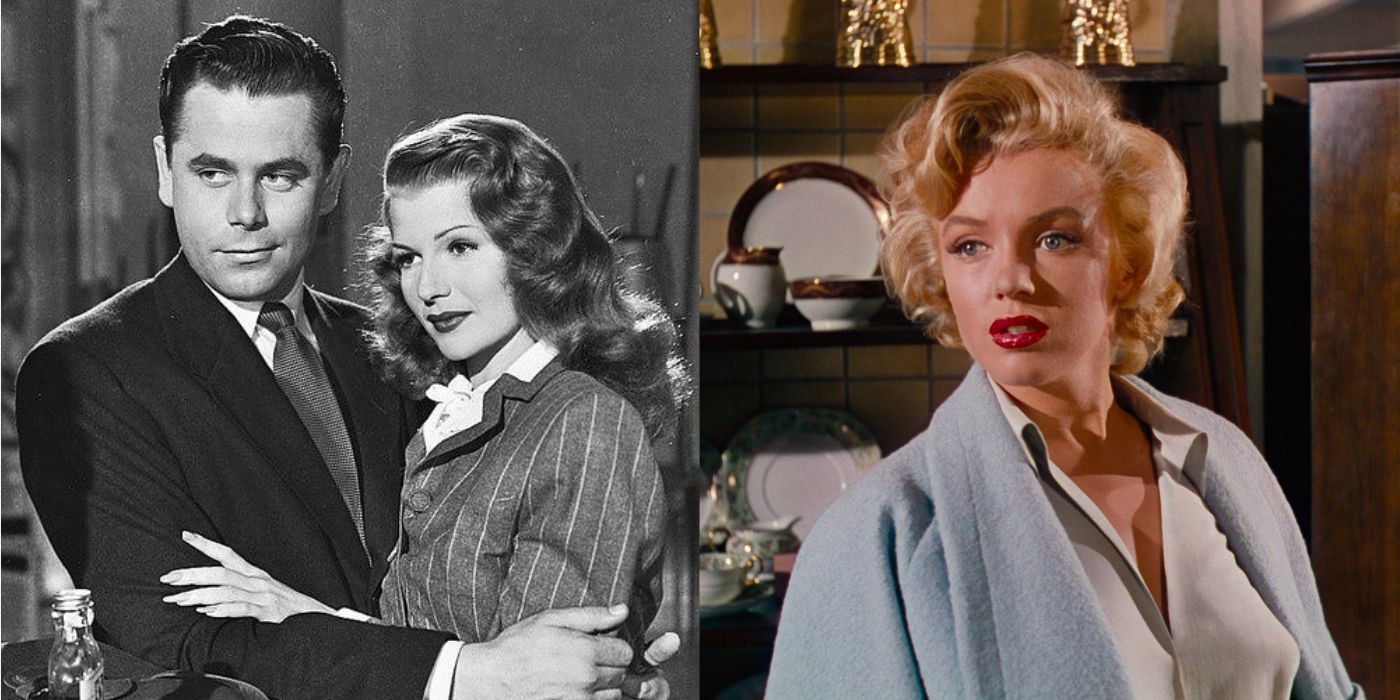

The 10 Best Film Noir Movies A Comprehensive List

May 09, 2025

The 10 Best Film Noir Movies A Comprehensive List

May 09, 2025 -

Top 10 Film Noir Films A Critics Picks

May 09, 2025

Top 10 Film Noir Films A Critics Picks

May 09, 2025 -

10 Essential Film Noir Movies You Need To See

May 09, 2025

10 Essential Film Noir Movies You Need To See

May 09, 2025 -

10 Film Noir Movies Guaranteed To Captivate

May 09, 2025

10 Film Noir Movies Guaranteed To Captivate

May 09, 2025 -

Man Dies In Racist Stabbing Unprovoked Attack By Woman

May 09, 2025

Man Dies In Racist Stabbing Unprovoked Attack By Woman

May 09, 2025