Palantir Stock Before May 5th: Is Now The Time To Buy? Wall Street's Verdict

Table of Contents

The question on many investors' minds is: is Palantir stock a worthwhile investment before May 5th? This article delves into recent Wall Street analyses and market trends to help you decide whether now is the opportune moment to buy PLTR stock. We’ll examine key factors influencing Palantir's price and offer insights to guide your investment strategy. Remember, this analysis is for informational purposes only and shouldn't be considered financial advice.

Palantir's Recent Performance and Financial Health

Q4 2023 Earnings and Revenue Growth

Palantir's Q4 2023 earnings report offered a mixed bag for investors. While the company exceeded revenue expectations, profitability remained a key area of focus. Let's break down the key figures:

- Revenue: [Insert actual Q4 2023 revenue figure]. This represents a [percentage]% increase compared to Q4 2022, showcasing continued growth.

- Earnings Per Share (EPS): [Insert actual Q4 2023 EPS figure]. This is [higher/lower] than analysts' expectations and [higher/lower] than the previous quarter.

- Profit Margin: [Insert actual Q4 2023 profit margin]. This indicates [improvement/decline] in profitability compared to the previous year.

- Analyst Reaction: Following the release, analysts at [mention specific firms, e.g., Goldman Sachs, Morgan Stanley] expressed [summarize overall sentiment - positive, negative, neutral] views on the results, citing [mention specific reasons given by analysts].

These figures suggest [positive or negative summary of the performance in relation to the Palantir stock price]. Further analysis is needed to understand the long-term implications for Palantir stock. Keywords: Palantir earnings, Q4 2023, revenue growth, earnings per share (EPS), profit margin.

Key Partnerships and Government Contracts

A significant portion of Palantir's revenue comes from government contracts and strategic partnerships. This reliance creates both opportunities and risks.

- Government Contracts: Palantir continues to secure substantial contracts with various government agencies, particularly in defense and intelligence. Recent examples include [mention specific examples if available]. These contracts provide a steady revenue stream, but their renewal is subject to budget allocations and political shifts.

- Commercial Partnerships: Palantir is expanding its reach in the commercial sector, partnering with companies in various industries to provide data analytics and AI-powered solutions. Successful partnerships with [mention examples if available] are driving revenue diversification.

- Future Growth Potential: The increasing demand for sophisticated data analytics and AI solutions across both government and commercial sectors presents significant growth potential for Palantir. Future contract wins and successful partnerships could positively impact the PLTR stock price.

Keywords: Government contracts, commercial partnerships, data analytics, AI, defense contracts.

Market Sentiment and Analyst Predictions

Wall Street Ratings and Price Targets

Wall Street analysts offer a range of opinions regarding Palantir's stock prospects.

- Price Targets: Analyst price targets for PLTR stock currently range from [low price target] to [high price target], with an average price target of [average price target].

- Ratings: [Mention the number of analysts with buy, hold, and sell ratings], indicating a [overall sentiment, e.g., cautiously optimistic, bearish, bullish] outlook on the stock.

- Factors Influencing Opinions: Analysts' differing opinions are influenced by factors such as the company's revenue growth, profitability, competitive landscape, and the overall macroeconomic climate.

Keywords: Analyst ratings, price target, buy rating, hold rating, sell rating, stock forecast.

Macroeconomic Factors and Market Volatility

The broader economic environment significantly impacts Palantir's stock performance, as it does with other tech stocks.

- Interest Rate Hikes: Rising interest rates can negatively affect technology stocks, particularly those with high valuations and future growth expectations.

- Inflation: High inflation can erode profit margins and reduce consumer spending, potentially impacting Palantir's commercial partnerships.

- Recessionary Fears: Concerns about a potential recession can lead to increased market volatility and decreased investor confidence, putting downward pressure on Palantir's stock price.

Keywords: Macroeconomic factors, inflation, interest rates, recession, market volatility, tech stocks.

Risks and Potential Downsides of Investing in Palantir

Competition in the Data Analytics Market

Palantir operates in a competitive data analytics market with established players and emerging startups.

- Key Competitors: Palantir faces competition from companies such as [list key competitors, e.g., AWS, Microsoft, Google].

- Competitive Advantages: Palantir's competitive advantages include its strong government relationships, its specialized software platforms, and its focus on complex data analysis. However, these advantages might not be sufficient in the face of increasing competition.

- Market Share: Maintaining and expanding market share is crucial for Palantir's continued growth. The competitive landscape presents a significant risk to their future performance.

Keywords: Data analytics competition, competitors, market share, competitive advantage.

Dependence on Government Contracts

Palantir's significant reliance on government contracts exposes it to various risks.

- Government Spending: Changes in government spending priorities or budget cuts could significantly impact Palantir's revenue.

- Geopolitical Factors: Geopolitical instability or shifts in international relations can affect the demand for Palantir's services and potentially delay or cancel contracts.

Keywords: Government contract risk, geopolitical risk, budget cuts.

Conclusion

Determining whether to buy Palantir stock before May 5th requires careful consideration of its recent performance, future growth prospects, and the inherent risks involved. While Palantir demonstrates consistent revenue growth and holds a strong position in the data analytics market, its dependence on government contracts and the competitive landscape present significant challenges. The macroeconomic environment also plays a crucial role. Investors should carefully analyze Wall Street's predictions, assess the risks, and conduct thorough due diligence before making any investment decision.

Ultimately, the decision of whether to buy Palantir stock before May 5th rests with you. Conduct your own thorough due diligence and consider seeking professional financial advice before investing in Palantir or any other security. Carefully weigh the potential risks and rewards before making any investment decisions related to PLTR stock.

Featured Posts

-

Navigating The Elizabeth Line A Wheelchair Users Guide To Accessibility

May 09, 2025

Navigating The Elizabeth Line A Wheelchair Users Guide To Accessibility

May 09, 2025 -

Don De Cheveux A Dijon Pour Une Bonne Cause

May 09, 2025

Don De Cheveux A Dijon Pour Une Bonne Cause

May 09, 2025 -

1078 2025

May 09, 2025

1078 2025

May 09, 2025 -

Review Of Wynne And Joanna All At Sea

May 09, 2025

Review Of Wynne And Joanna All At Sea

May 09, 2025 -

The Reform Party Delivering On Its Promises An Analysis Of Farages Leadership

May 09, 2025

The Reform Party Delivering On Its Promises An Analysis Of Farages Leadership

May 09, 2025

Latest Posts

-

A Loss For The Community The Passing Of Americas First Nonbinary Individual

May 10, 2025

A Loss For The Community The Passing Of Americas First Nonbinary Individual

May 10, 2025 -

The Death Of Americas Pioneer Nonbinary Individual A Tragedy

May 10, 2025

The Death Of Americas Pioneer Nonbinary Individual A Tragedy

May 10, 2025 -

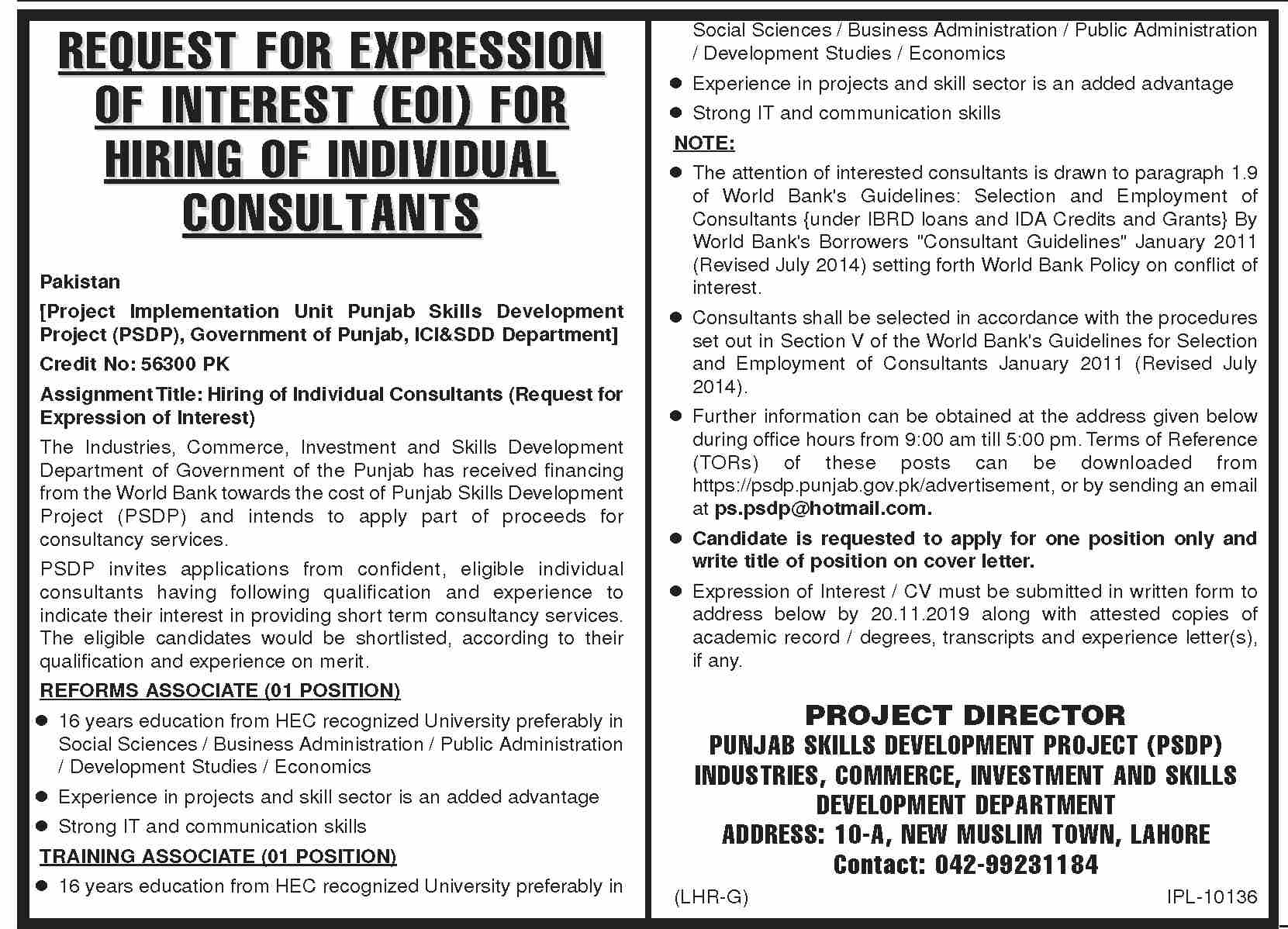

Skill Development Program For Transgender People In Punjab

May 10, 2025

Skill Development Program For Transgender People In Punjab

May 10, 2025 -

Tragic Fate Of Americas First Nonbinary Person

May 10, 2025

Tragic Fate Of Americas First Nonbinary Person

May 10, 2025 -

Lynk Lee Nhan Sac Rang Ro Tinh Yeu Hanh Phuc Sau Chuyen Gioi

May 10, 2025

Lynk Lee Nhan Sac Rang Ro Tinh Yeu Hanh Phuc Sau Chuyen Gioi

May 10, 2025