Palantir Stock: Buy Or Sell? Evaluating The Current Market Conditions

Table of Contents

Palantir's Business Model and Growth Prospects

Palantir's success hinges on its unique business model and future growth prospects. Understanding these factors is key to assessing the value of Palantir stock.

Government Contracts and Revenue Streams

Government contracts form a substantial portion of Palantir's revenue. The future growth of Palantir stock is significantly tied to the continued expansion of these contracts.

- Examples of key government contracts: Palantir has secured substantial contracts with various government agencies, including the US intelligence community and numerous defense departments worldwide. These contracts are often multi-year and high-value, providing a stable revenue stream.

- Projected growth in government spending on data analytics: Government spending on data analytics and AI is projected to increase significantly in the coming years, presenting a substantial opportunity for Palantir's growth.

- Risks associated with government contract reliance: Over-reliance on government contracts exposes Palantir to the risk of budget cuts, changing political priorities, and potential delays in contract renewals. Diversification into the commercial sector is crucial to mitigate this risk.

Commercial Sector Expansion

While government contracts are crucial, Palantir's expansion into the commercial sector is a key indicator of its long-term growth potential. Success in this sector will significantly impact the future trajectory of Palantir stock.

- Key commercial clients: Palantir is increasingly attracting major clients in various industries, including finance, healthcare, and manufacturing. These clients utilize Palantir's platforms for data integration, analysis, and operational improvements.

- Market share compared to competitors: Palantir faces stiff competition from established players in the big data and AI market. Its ability to gain market share will be a critical factor in determining the future price of Palantir stock.

- Success rates in acquiring new commercial clients: Palantir's success in attracting and retaining commercial clients demonstrates its ability to adapt its technology and services to a wider range of industries and business needs. This is a key area to watch.

- Potential for future growth: The commercial sector offers significant potential for Palantir's growth, providing a broader revenue base and reducing dependence on government contracts.

Technological Innovation and Competitive Advantage

Palantir's technological innovation is central to its competitive advantage. Its proprietary platforms, Foundry and Gotham, provide unique capabilities for data integration and analysis.

- Key technologies (e.g., Foundry, Gotham): These platforms allow organizations to integrate data from disparate sources, perform complex analyses, and make data-driven decisions. Their user-friendliness and security features are significant competitive advantages.

- Patent portfolio strength: A strong patent portfolio protects Palantir's intellectual property and reinforces its competitive position in the market.

- Competitive advantages over rivals (e.g., data integration capabilities, security features): Palantir’s ability to integrate vast quantities of data from various sources, along with its robust security features, differentiates it from competitors and is a key driver of Palantir stock value.

Financial Performance and Valuation

Analyzing Palantir's financial performance and valuation is essential for understanding its investment potential.

Recent Financial Results

A close look at Palantir's recent financial statements reveals insights into its financial health and growth trajectory.

- Key financial metrics (revenue growth, profitability, operating margins): Consistent revenue growth, improving profitability, and expanding operating margins are positive signs for Palantir stock.

- Comparison to analyst estimates: Comparing actual financial results to analyst estimates provides valuable insights into market expectations and the potential for future price movements of Palantir stock.

- Impact of macroeconomic factors: Macroeconomic factors, such as inflation and interest rates, can significantly impact Palantir's financial performance and, consequently, its stock price.

Valuation Metrics

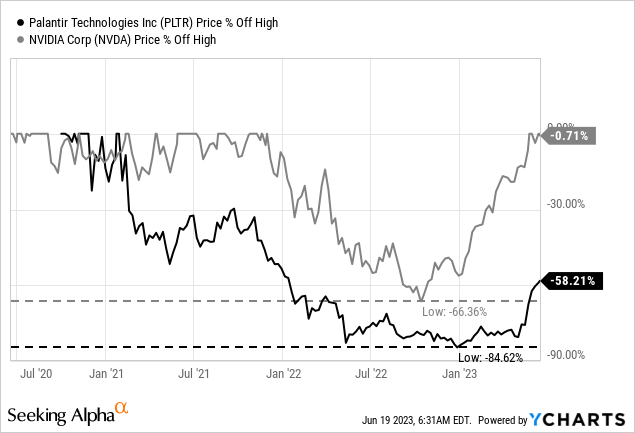

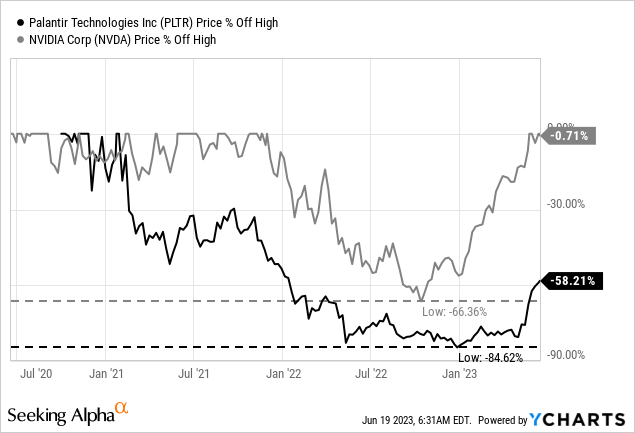

Evaluating Palantir's valuation against various metrics helps determine whether the stock is currently overvalued or undervalued.

- Key valuation metrics: Metrics such as the Price-to-Earnings (P/E) ratio, Price-to-Sales (P/S) ratio, and others provide context for Palantir's valuation relative to its peers and historical performance.

- Comparison to competitors' valuations: Comparing Palantir's valuation to that of its competitors in the big data and AI market helps determine its relative attractiveness as an investment.

- Discussion on whether the stock is overvalued or undervalued: Based on the valuation metrics and comparison to competitors, investors can form an opinion on the current valuation of Palantir stock.

Debt and Cash Position

Palantir's debt levels and cash reserves are crucial indicators of its financial stability and future growth potential.

- Total debt: A manageable level of debt indicates financial stability and the capacity for further investments.

- Cash on hand: Significant cash reserves provide financial flexibility and the ability to pursue growth opportunities.

- Debt-to-equity ratio: A healthy debt-to-equity ratio indicates a sound financial position.

- Impact on future growth potential: A strong financial position, characterized by low debt and substantial cash reserves, enables Palantir to invest in research and development, expansion, and acquisitions, thus impacting the future growth potential of Palantir stock.

Market Sentiment and Analyst Opinions

Understanding market sentiment and analyst opinions is crucial for assessing the potential for future price movements of Palantir stock.

Investor Sentiment

The overall sentiment towards Palantir stock reflects investor confidence and expectations.

- Summary of analyst ratings (buy, hold, sell): Analyzing analyst ratings helps gauge the consensus view on the future prospects of Palantir stock.

- Recent news affecting stock price: Significant news events, such as contract wins or losses, technological advancements, or macroeconomic shifts, can greatly affect investor sentiment and Palantir's stock price.

- Social media sentiment analysis: Monitoring social media sentiment can provide valuable insights into the overall perception of Palantir stock among investors.

Macroeconomic Factors

Broader macroeconomic factors can significantly impact Palantir's stock price.

- Impact of interest rate hikes: Rising interest rates can affect investor appetite for riskier assets, potentially impacting Palantir's stock price.

- Inflation's effect on government spending: Inflation can lead to adjustments in government spending priorities, impacting the demand for Palantir's services.

- Impact of potential recession: Economic downturns can reduce demand for data analytics services, impacting Palantir's revenue and stock price.

Palantir Stock: A Final Verdict and Call to Action

Analyzing Palantir stock requires considering its strong government contracts, growth potential in the commercial sector, and technological innovation. While its dependence on government contracts presents a risk, its expansion into the commercial market and ongoing technological advancements offer significant upside. The current valuation warrants careful consideration, and macroeconomic factors must be factored into any investment decision.

Recommendation: Given the potential for growth in both the government and commercial sectors and its technological leadership, we suggest a hold on Palantir stock. However, it is crucial to monitor its financial performance, market sentiment, and the evolving macroeconomic landscape.

Call to Action: Conduct your own due diligence before investing in Palantir stock. Consider your individual risk tolerance and investment goals when making investment decisions. Make an informed decision about your Palantir stock investment today!

Featured Posts

-

Inquiry Into Nottingham Attacks Retired Judge Takes The Lead

May 10, 2025

Inquiry Into Nottingham Attacks Retired Judge Takes The Lead

May 10, 2025 -

Jeanine Pirro And Aoc Clashes A Fact Check Analysis

May 10, 2025

Jeanine Pirro And Aoc Clashes A Fact Check Analysis

May 10, 2025 -

Kultov Roman Na Stivn King Netflix Gotvi Rimeyk

May 10, 2025

Kultov Roman Na Stivn King Netflix Gotvi Rimeyk

May 10, 2025 -

Jogsertes Transznemu No Letartoztatasa Floridaban Noi Mosdo Miatt

May 10, 2025

Jogsertes Transznemu No Letartoztatasa Floridaban Noi Mosdo Miatt

May 10, 2025 -

Blue Origins Rocket Launch Cancelled Vehicle Subsystem Problem

May 10, 2025

Blue Origins Rocket Launch Cancelled Vehicle Subsystem Problem

May 10, 2025