Palantir Stock: Buy, Sell, Or Hold? A Detailed Investment Guide

Table of Contents

Understanding Palantir Technologies and its Business Model

Palantir Technologies is a prominent player in the big data analytics market, providing software platforms to government and commercial clients for data integration, analysis, and visualization. Its core business revolves around making sense of massive datasets, enabling clients to make better-informed decisions. The company operates two primary platforms:

-

Gotham: This platform is primarily used by government agencies for national security, defense, and intelligence applications. These government contracts represent a significant portion of Palantir's revenue and provide a stable, albeit sometimes politically sensitive, revenue stream.

-

Foundry: This platform caters to the commercial sector, offering data analytics solutions across various industries, including finance, healthcare, and manufacturing. The commercial sector presents significant growth potential for Palantir, as more businesses recognize the value of sophisticated data analysis for operational efficiency and strategic decision-making.

Key aspects of Palantir's business model:

- Government contracts: These high-value contracts ensure a steady revenue flow, but they can also be subject to political and budgetary changes, creating inherent risk.

- Commercial sector growth: The commercial market offers substantial growth potential, but competition is fierce, and success depends on Palantir's ability to adapt and innovate.

- Unique selling propositions (USPs): Palantir's strength lies in its ability to handle extremely complex and sensitive data, its user-friendly interface, and its strong focus on data security.

- AI and machine learning: Palantir is heavily invested in integrating artificial intelligence and machine learning into its platforms, enhancing their analytical capabilities and creating a competitive advantage.

Analyzing Palantir Stock Performance and Financial Health

Palantir's stock price has experienced significant volatility since its initial public offering (IPO). Analyzing its historical performance requires considering various financial metrics. While revenue growth has been impressive, profitability has been a challenge, a common issue for many rapidly growing technology companies.

Key Financial Metrics:

- Revenue Growth: Examine year-over-year revenue growth rates to assess the company's overall trajectory. Reliable sources like Palantir's financial reports (available on the SEC's EDGAR database) and reputable financial news outlets should be consulted.

- Profitability: Assess Palantir's profitability (or lack thereof) by analyzing metrics like net income, operating margins, and earnings per share (EPS). Negative net income in earlier years is not uncommon for growth companies, but long-term profitability is crucial.

- Debt levels: Evaluate Palantir's debt-to-equity ratio and overall debt burden to understand its financial risk profile. High debt levels could indicate financial instability.

- Cash flow: Analyze Palantir's cash flow from operations to determine its ability to generate cash and fund future growth. Positive operating cash flow is a positive indicator of financial health.

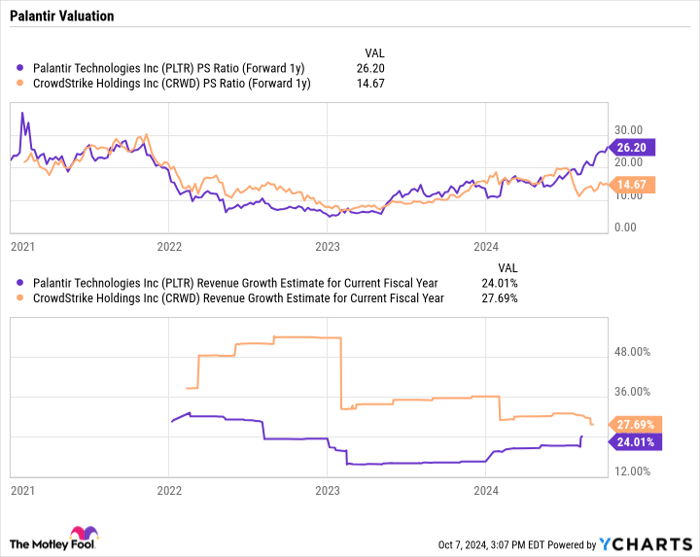

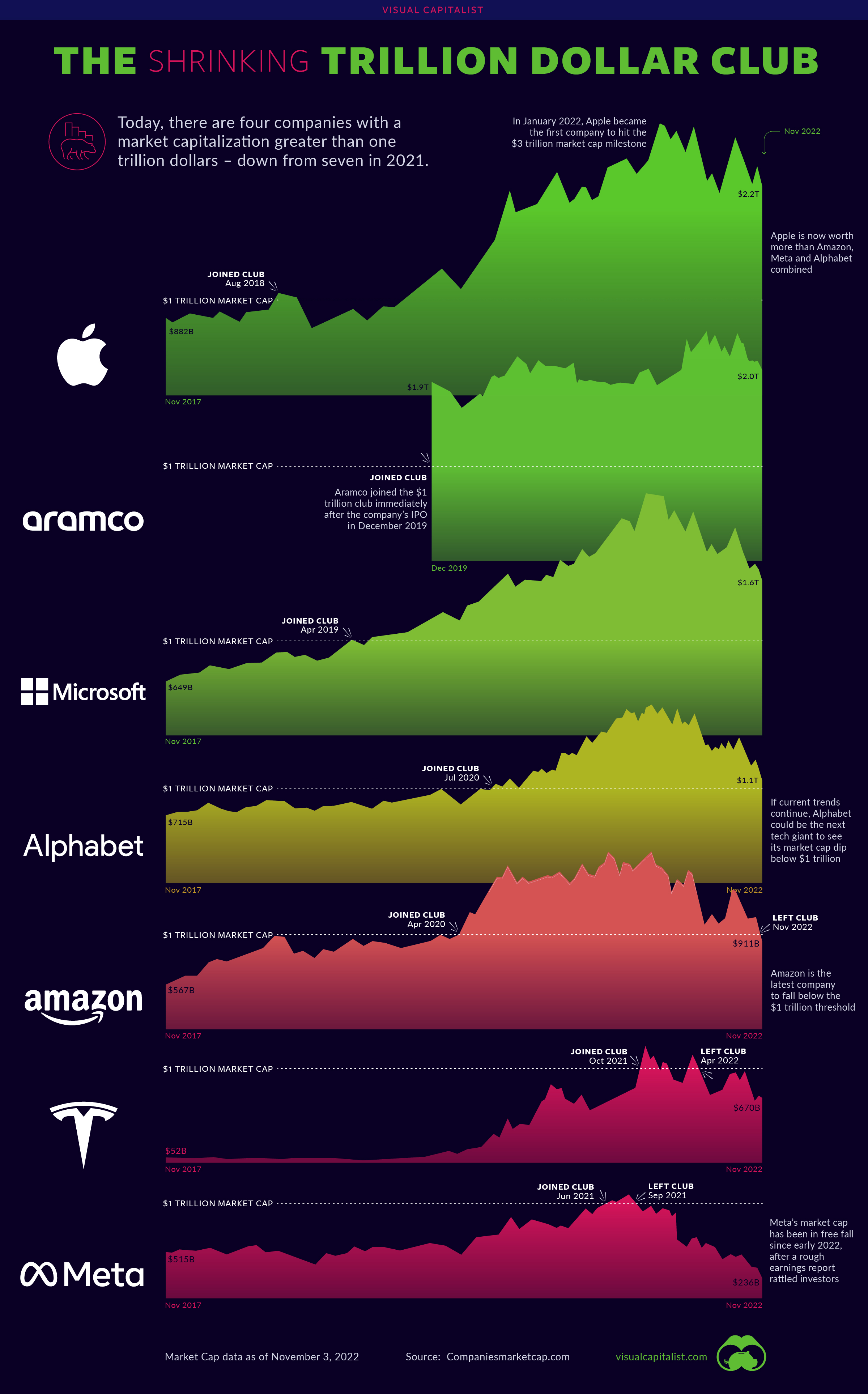

- Valuation: Compare Palantir's market capitalization to its revenue, earnings, and assets to determine whether it is overvalued or undervalued relative to its peers. Various valuation metrics, such as the Price-to-Sales (P/S) ratio, can be used.

Comparative Analysis: Compare Palantir's financial performance to its competitors in the big data analytics space, such as Databricks (though not publicly traded) and Snowflake, to gain a better understanding of its relative strengths and weaknesses. Keep an eye out for upcoming earnings reports and investor announcements for potential catalysts.

Evaluating the Risks and Rewards of Investing in Palantir Stock

Investing in Palantir stock carries both significant risks and potential rewards. A thorough evaluation is essential.

Potential Risks:

- Competition: The big data analytics market is competitive, with established players and emerging startups vying for market share.

- Government contract dependence: Over-reliance on government contracts exposes Palantir to political and budgetary risks.

- High valuation: Palantir's stock valuation might be considered high relative to its current profitability, making it susceptible to market corrections.

- Technological disruption: New technologies could render Palantir's current offerings obsolete.

Potential Rewards:

- Growth in the big data market: The big data market is expected to grow significantly in the coming years, offering ample opportunities for Palantir to expand its business.

- Expansion into new sectors: Palantir's ability to penetrate new sectors and diversify its client base could drive substantial growth.

- Technological advancements: Continued investment in AI and machine learning could provide a significant competitive advantage.

- Long-term growth prospects: Despite short-term challenges, Palantir's long-term growth potential in a rapidly expanding market is undeniable.

Macroeconomic factors: Changes in interest rates, inflation, and overall economic conditions can all influence Palantir's stock price, creating further volatility.

Considering Alternative Investment Strategies

While Palantir offers intriguing possibilities, it's crucial to consider alternative investments within the big data analytics sector.

- Other publicly traded companies: Explore other publicly traded companies in the big data space, such as Snowflake or Datadog, to diversify your portfolio and potentially reduce risk.

- Diversification: Diversifying your investment portfolio across various sectors can help mitigate risk associated with any single stock, including Palantir stock.

- Risk-averse strategies: For risk-averse investors, index funds or ETFs that track the technology sector might be more suitable alternatives.

Conclusion

Investing in Palantir stock presents a complex decision. While the company boasts impressive technology and a growing market, its high valuation, dependence on government contracts, and intense competition present considerable risks. This guide highlights the critical factors to consider when evaluating Palantir stock. Remember, thorough due diligence is crucial. Consult financial statements, industry analysis, and seek professional advice before committing your capital.

Ultimately, the decision of whether to buy, sell, or hold Palantir stock is a personal one based on your individual risk tolerance and investment goals. Use this guide to inform your own research and make a well-informed decision about your Palantir stock investment strategy. Remember to consult with a financial advisor before making any significant investment choices.

Featured Posts

-

Uk Government Tightens Visa Rules Impact On Work And Student Visas

May 09, 2025

Uk Government Tightens Visa Rules Impact On Work And Student Visas

May 09, 2025 -

The Palantir Nato Deal A Predictive Ai Revolution For Government

May 09, 2025

The Palantir Nato Deal A Predictive Ai Revolution For Government

May 09, 2025 -

Melanie Griffith And Siblings Support Dakota Johnson At Materialist Premiere

May 09, 2025

Melanie Griffith And Siblings Support Dakota Johnson At Materialist Premiere

May 09, 2025 -

Nyt Strands Game 374 Hints And Solutions For March 12

May 09, 2025

Nyt Strands Game 374 Hints And Solutions For March 12

May 09, 2025 -

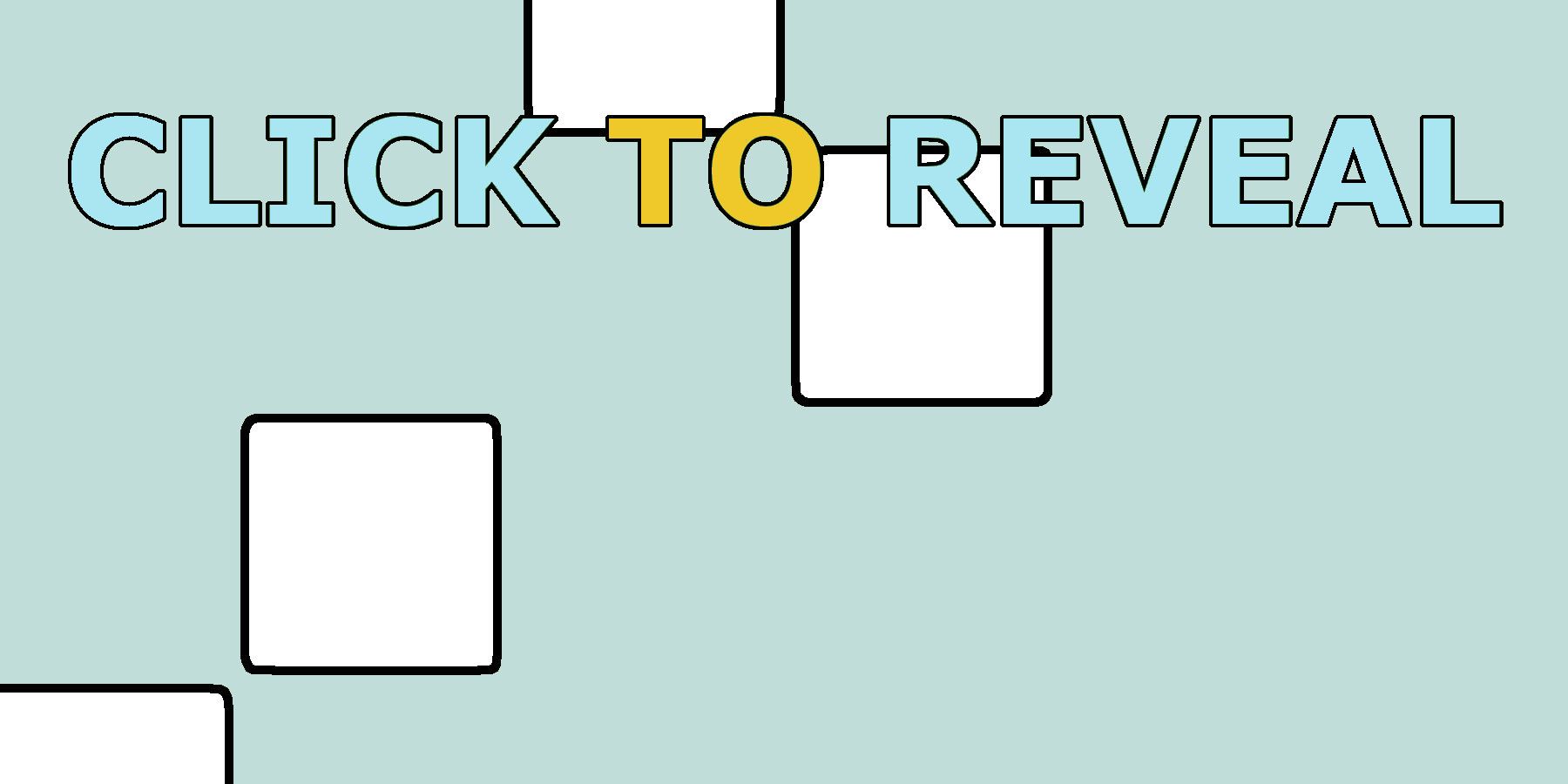

Palantirs Potential Can It Achieve A Trillion Dollar Market Cap By The End Of The Decade

May 09, 2025

Palantirs Potential Can It Achieve A Trillion Dollar Market Cap By The End Of The Decade

May 09, 2025

Latest Posts

-

His Journey Rejected By Wolves Now Europes Best

May 09, 2025

His Journey Rejected By Wolves Now Europes Best

May 09, 2025 -

Samuel Dickson Contributions To Canadian Industry And Forestry

May 09, 2025

Samuel Dickson Contributions To Canadian Industry And Forestry

May 09, 2025 -

The Unlikely Rise From Wolves Rejection To European Success

May 09, 2025

The Unlikely Rise From Wolves Rejection To European Success

May 09, 2025 -

Overlooked By Wolves Now The Heart Of Europes Best

May 09, 2025

Overlooked By Wolves Now The Heart Of Europes Best

May 09, 2025 -

St Albert Dinner Theatre A Fast Flying Farcical Comedy

May 09, 2025

St Albert Dinner Theatre A Fast Flying Farcical Comedy

May 09, 2025