Palantir Stock: Buy, Sell, Or Hold? A Detailed Market Analysis

Table of Contents

Palantir's Business Model and Revenue Streams

Palantir Technologies operates on a unique business model, generating revenue from two primary sectors: government contracts and commercial clients. Understanding these revenue streams is crucial for assessing the long-term viability of PLTR stock.

Palantir Government Contracts

Government contracts represent a historically dominant revenue source for Palantir. The stability and future growth of this sector are paramount to the company's success.

- Breakdown of Government Revenue: Palantir's government contracts span various sectors, including defense, intelligence, and law enforcement, providing diversification but also making them susceptible to changes in government spending priorities. A detailed breakdown of revenue by sector is essential for a complete analysis.

- Contract Renewal Rates: Analyzing the success rate of contract renewals provides insights into customer satisfaction and the long-term sustainability of this revenue stream. High renewal rates indicate strong client relationships and a less volatile revenue outlook.

- Geographic Diversification: The extent to which Palantir's government contracts are spread across different geographical regions also impacts its risk profile. Greater diversification reduces dependence on any single government or region.

- Keyword Integration: Analyzing data on Palantir government contracts, PLTR government revenue, and Palantir defense contracts is essential for a comprehensive understanding of this key revenue driver.

Palantir Commercial Sector Growth

While government contracts have been the cornerstone of Palantir's business, the company is increasingly focusing on expanding its commercial client base. This presents both significant opportunities and substantial challenges.

- Key Commercial Clients: Identifying and analyzing Palantir's major commercial clients reveals the strength and diversity of its commercial portfolio. Securing large, reputable clients signals market acceptance and credibility.

- Growth Rate in Commercial Revenue: Tracking the growth rate of commercial revenue provides critical data on the success of Palantir's expansion into the commercial sector. Sustained high growth indicates a strong market position and potential for future expansion.

- Challenges in Competing with Established Players: Palantir faces stiff competition from established players in the commercial data analytics market. Understanding these competitive pressures is vital for accurately assessing the potential for future growth in this sector.

- Keyword Integration: Understanding Palantir commercial clients, PLTR commercial growth, and Palantir commercial revenue is key to evaluating this increasingly important aspect of their business model.

Palantir Foundry Platform

Palantir Foundry, the company's flagship data integration and analytics platform, is a key driver of both government and commercial revenue. Its adoption rate and market potential are critical factors in determining the future value of PLTR stock.

- Key Features and Benefits: Understanding the unique features and benefits of Palantir Foundry compared to competitors is vital for determining its competitive advantages.

- Competitive Advantages: Palantir's emphasis on data security, ease of use, and powerful analytical capabilities offers potential competitive advantages over rival platforms.

- Market Penetration: Tracking the growth in the number of clients using Palantir Foundry and the expansion into new market segments offers valuable insights into its market penetration and future growth potential.

- Keyword Integration: Analyzing keywords such as Palantir Foundry, PLTR Foundry platform, and Palantir data analytics provides crucial information for evaluating the platform's impact on the company's overall success.

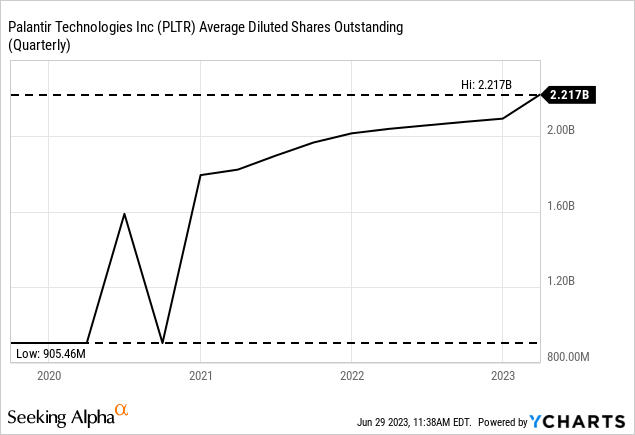

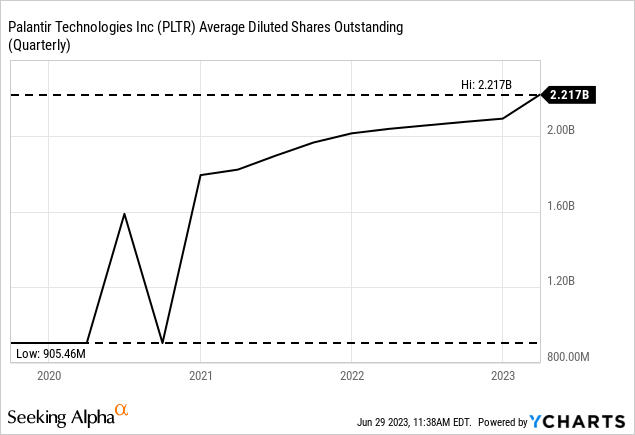

Financial Performance and Valuation

Analyzing Palantir's financial performance and valuation is crucial for determining whether PLTR stock is currently undervalued or overvalued.

Revenue Growth and Profitability

Examining Palantir's historical financial performance and projected growth offers insights into its financial health and sustainability.

- Revenue Growth Rate: A consistent high revenue growth rate indicates strong demand for Palantir's products and services.

- Profitability Margins: Analyzing profitability margins (gross margin, operating margin, net margin) helps determine the efficiency of Palantir's operations and its ability to generate profits.

- Cash Flow Analysis: Analyzing cash flow from operations reveals the company's ability to generate cash and its financial stability.

- Keyword Integration: Understanding Palantir financial performance, PLTR revenue growth, and Palantir profitability are critical aspects of any investment analysis.

Stock Valuation Metrics

Various valuation metrics can be used to assess whether Palantir's stock is currently fairly valued, undervalued, or overvalued.

- P/E Ratio: Comparing Palantir's price-to-earnings ratio to those of its competitors provides insights into its relative valuation.

- Price-to-Sales Ratio: The price-to-sales ratio provides another perspective on valuation, especially useful for companies that are not yet profitable.

- Comparison with Industry Peers: Comparing Palantir's valuation metrics to those of its competitors within the data analytics industry provides a benchmark for assessing its relative valuation.

- Potential Undervaluation or Overvaluation: Based on the analysis of these metrics, a determination can be made regarding whether Palantir's stock is currently undervalued or overvalued.

- Keyword Integration: Tracking PLTR stock valuation, Palantir PE ratio, and Palantir stock price is vital for assessing the investment opportunity.

Competitive Landscape and Risks

Understanding Palantir's competitive landscape and associated risks is critical for a comprehensive investment analysis.

Key Competitors

Palantir faces competition from various players in both the government and commercial sectors.

- Strengths and Weaknesses of Competitors: Identifying the strengths and weaknesses of Palantir's key competitors allows for a comparative analysis of market positioning.

- Market Share Analysis: Assessing Palantir's market share provides insights into its competitive strength and potential for future growth.

- Keyword Integration: Researching Palantir competitors, PLTR competition, and Palantir market share gives a better understanding of its competitive positioning.

Potential Risks

Several potential risks could impact Palantir's future performance.

- Dependence on Government Contracts: Palantir's historical reliance on government contracts creates a degree of vulnerability to changes in government spending and priorities.

- Competition: Intense competition from established players in the data analytics market poses a significant challenge to Palantir's growth.

- Technological Disruption: Rapid technological advancements could render Palantir's technology obsolete, impacting its competitiveness.

- Macroeconomic Factors: Economic downturns or geopolitical instability could negatively affect government spending and commercial demand for Palantir's products and services.

- Keyword Integration: Analyzing Palantir risks, PLTR risk factors, and Palantir investment risks is crucial for evaluating the investment’s overall prospects.

Conclusion

This analysis of Palantir Technologies reveals a company with significant growth potential but also substantial risks. While Palantir's innovative data analytics platform and strong government contracts provide a solid foundation, its dependence on government contracts and the competitive commercial landscape present challenges. The financial performance, valuation, and competitive landscape must be carefully considered. Based on this analysis, investors should conduct thorough due diligence before making any investment decisions in PLTR stock. Remember to always consult with a financial advisor before making investment decisions. This analysis should not be considered financial advice. Are you ready to make an informed decision on your Palantir investment? Learn more about Palantir stock and its future.

Featured Posts

-

West Bengal Madhyamik Result 2025 Merit List And Analysis

May 10, 2025

West Bengal Madhyamik Result 2025 Merit List And Analysis

May 10, 2025 -

Elon Musks Wealth A Study Of Us Economic Influence On Teslas Success

May 10, 2025

Elon Musks Wealth A Study Of Us Economic Influence On Teslas Success

May 10, 2025 -

Data Breach Nhs Staff Accused Of Illegally Obtaining Records Of Nottingham Stabbing Victim

May 10, 2025

Data Breach Nhs Staff Accused Of Illegally Obtaining Records Of Nottingham Stabbing Victim

May 10, 2025 -

Increased Advocacy For Transgender Equality Recent Coverage In The Bangkok Post

May 10, 2025

Increased Advocacy For Transgender Equality Recent Coverage In The Bangkok Post

May 10, 2025 -

Oilers Vs Kings Expert Prediction For Game 1 Of The Nhl Playoffs

May 10, 2025

Oilers Vs Kings Expert Prediction For Game 1 Of The Nhl Playoffs

May 10, 2025