Palantir Stock: Buy, Sell, Or Hold After The 30% Fall?

Table of Contents

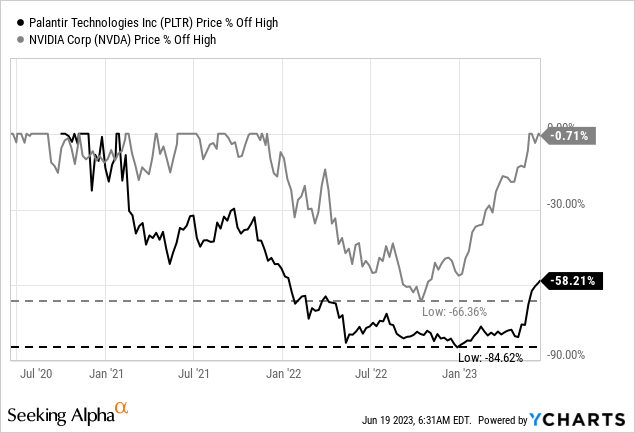

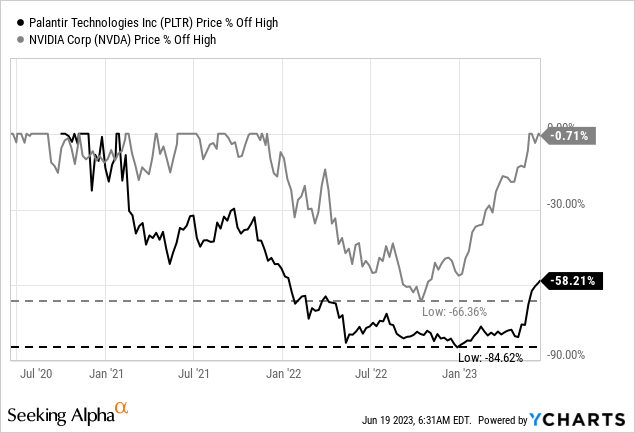

Analyzing Palantir's Recent Performance and the 30% Drop

The recent 30% decline in Palantir stock price is a multifaceted issue stemming from a confluence of factors.

-

Market Sentiment: The broader tech sector has seen significant corrections recently, impacting even strong performers like Palantir. Investor sentiment towards high-growth, often unprofitable, tech companies has shifted, leading to widespread sell-offs.

-

Specific Negative News: While Palantir has reported strong revenue growth in some areas, specific announcements, such as slower-than-expected contract wins or less-than-stellar earnings reports, can significantly impact the Palantir share price. Investors closely scrutinize these announcements, leading to market reactions. Analyzing these news releases alongside other market factors is crucial for understanding the price fluctuations.

-

Economic Conditions: The overall macroeconomic environment plays a crucial role. Rising interest rates, inflation concerns, and potential recessionary fears can impact investor confidence and lead to a flight to safety, negatively affecting even fundamentally sound companies like Palantir.

Analyzing Palantir's financial health requires a closer look at key metrics:

-

Revenue Growth: Palantir has demonstrated significant revenue growth, particularly in its government and commercial sectors. However, the rate of growth needs to be analyzed against projections and compared to competitors to gauge its true performance.

-

Profitability: While profitability is a key factor in determining stock valuation, Palantir's profitability metrics should be examined within the context of its high-growth phase and compared with industry peers. Analyzing the path to consistent profitability is key for making a sound Palantir investment decision.

-

Key Financial Ratios: Investors should carefully study Palantir's P/E ratio, PEG ratio, and other relevant financial ratios to assess its valuation compared to its growth prospects and similar companies.

Evaluating Palantir's Long-Term Growth Potential

Palantir's core business lies in its powerful data analytics platform, Gotham and Foundry, serving both government and commercial clients. Its long-term prospects depend on several key factors:

-

Government and Commercial Contracts: Palantir’s success hinges on securing and retaining lucrative contracts with government agencies and large commercial enterprises. The pipeline of future contracts is a crucial indicator of its potential.

-

Data Analytics Platform: The company's proprietary platform provides powerful data integration and analysis capabilities, offering a competitive edge. Continued innovation and development of this platform are crucial for maintaining this advantage.

-

Partnerships and Strategic Initiatives: Strategic alliances and acquisitions can significantly enhance Palantir's capabilities and market reach, boosting future growth.

Analyzing the competitive landscape is equally critical:

-

Major Competitors: Palantir faces stiff competition from other established players and emerging tech companies in the data analytics sector. Understanding the strengths and weaknesses of its competitors is essential for assessing its market position.

-

Competitive Advantages: Palantir’s proprietary technology, strong government relationships, and focus on complex data challenges provide some competitive advantages. However, the ever-evolving landscape requires continuous innovation to maintain its edge.

Assessing the Risks Associated with Investing in Palantir Stock

Investing in Palantir stock carries inherent risks:

-

Stock Price Volatility: Palantir's stock price has historically shown significant volatility, meaning its value can fluctuate considerably in short periods.

-

Dependence on Government Contracts: A substantial portion of Palantir's revenue comes from government contracts. Changes in government policy or budget cuts could negatively impact the company's performance.

-

Competition: The intense competition in the data analytics market necessitates ongoing innovation and adaptation to stay ahead.

-

Potential for Future Losses: While Palantir demonstrates significant growth potential, there's always a risk of future financial losses, as is true with any investment.

Strategies to mitigate these risks include:

-

Diversification: Don't put all your eggs in one basket. Diversify your investment portfolio to reduce the impact of any single investment's underperformance.

-

Long-Term Investment Horizon: Consider Palantir a long-term investment rather than a short-term trading opportunity. This approach helps weather short-term market fluctuations.

-

Regular Monitoring: Regularly monitor Palantir's performance, paying close attention to financial reports and news affecting the company. Adjust your investment strategy accordingly.

Considering Alternative Investment Strategies

Beyond simply buying, selling, or holding, consider alternative approaches:

-

Buying on Dips: The recent price drop might present a buying opportunity for long-term investors. However, thorough due diligence is essential before making this decision.

-

Dollar-Cost Averaging: Invest a fixed amount of money at regular intervals, regardless of the stock price. This strategy reduces the risk of investing a lump sum at a market peak.

-

Stop-Loss Orders: Set stop-loss orders to limit potential losses if the stock price falls below a predetermined level.

Thorough due diligence is crucial before making any investment decision. Consult financial statements, analyst reports, and consider seeking professional financial advice.

Conclusion: Making Informed Decisions About Your Palantir Stock

Investing in Palantir stock presents both opportunities and risks. While the company shows significant growth potential in the data analytics field, its share price volatility, dependence on government contracts, and competitive landscape require careful consideration. Remember to conduct thorough due diligence, analyze Palantir's financial reports and key performance indicators, and factor in the broader economic conditions and market sentiment before making any decisions about your Palantir stock, Palantir share price, or broader Palantir investment. The recent 30% fall presents both risk and potential reward. Carefully weigh these factors and potentially seek professional financial advice before deciding whether to buy, sell, or hold Palantir. Make an informed decision about your Palantir stock investment by considering the factors discussed in this article. Remember to conduct thorough due diligence and consult a financial advisor before making any investment choices regarding Palantir stock or other related securities.

Featured Posts

-

Stock Market Today Sensex Up 200 Nifty Above 18 600 Ultra Tech Dips

May 09, 2025

Stock Market Today Sensex Up 200 Nifty Above 18 600 Ultra Tech Dips

May 09, 2025 -

Colapintos Move From Williams To Alpine A Full Explanation

May 09, 2025

Colapintos Move From Williams To Alpine A Full Explanation

May 09, 2025 -

Will Apples Ai Strategy Lead Or Lag

May 09, 2025

Will Apples Ai Strategy Lead Or Lag

May 09, 2025 -

Arsenal Ps Zh Barselona Inter Polufinaly Ligi Chempionov 2024 2025 Prognoz I Analiz

May 09, 2025

Arsenal Ps Zh Barselona Inter Polufinaly Ligi Chempionov 2024 2025 Prognoz I Analiz

May 09, 2025 -

Federal Reserve Rate Pause Expected Economic Data Drives Decision

May 09, 2025

Federal Reserve Rate Pause Expected Economic Data Drives Decision

May 09, 2025

Latest Posts

-

News From The Bangkok Post The Push For Better Transgender Rights

May 10, 2025

News From The Bangkok Post The Push For Better Transgender Rights

May 10, 2025 -

The Bangkok Post And The Ongoing Struggle For Transgender Equality

May 10, 2025

The Bangkok Post And The Ongoing Struggle For Transgender Equality

May 10, 2025 -

The Impact Of Trumps Executive Orders On The Transgender Community A Call For Stories

May 10, 2025

The Impact Of Trumps Executive Orders On The Transgender Community A Call For Stories

May 10, 2025 -

Examining Transgender Equality Issues Highlighted By The Bangkok Post

May 10, 2025

Examining Transgender Equality Issues Highlighted By The Bangkok Post

May 10, 2025 -

The Bangkok Post And The Fight For Transgender Equality In Thailand

May 10, 2025

The Bangkok Post And The Fight For Transgender Equality In Thailand

May 10, 2025