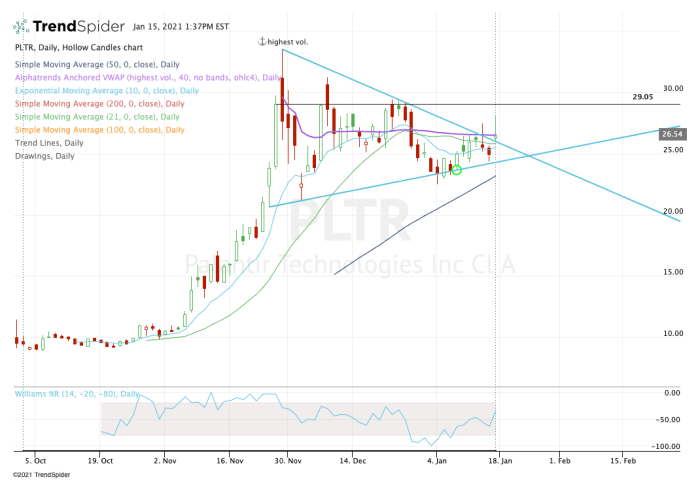

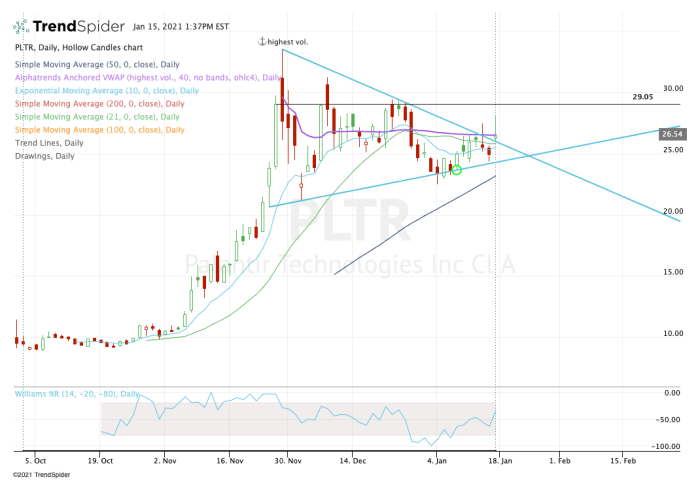

Palantir Stock Down 30%: Is It A Buying Opportunity?

Table of Contents

Analyzing the 30% Drop in Palantir Stock

Understanding the Underlying Reasons

Several factors have contributed to the recent downturn in Palantir stock. Understanding these underlying reasons is crucial before considering any investment decisions.

-

Overall Market Downturn: The broader tech stock downturn has significantly impacted Palantir, as investors become more risk-averse in times of economic uncertainty. This general market volatility affects even strong performers like Palantir.

-

Missed Earnings Expectations: Palantir's recent earnings reports may have fallen short of analyst expectations, leading to a sell-off by investors who were anticipating stronger growth. This highlights the importance of carefully analyzing Palantir earnings reports and comparing them to projections.

-

Concerns About Future Growth: Some investors express concerns about Palantir's ability to maintain its high growth trajectory, particularly in the face of increasing competition in the data analytics market. This is a valid concern that requires careful consideration of Palantir's competitive landscape.

-

Increased Competition: The data analytics market is becoming increasingly competitive, with established players and new entrants vying for market share. This competitive pressure could impact Palantir's future profitability and revenue growth.

Evaluating Palantir's Long-Term Prospects

Despite the recent setbacks, Palantir possesses several strengths that suggest significant long-term growth potential.

-

Strong Government Partnerships: Palantir enjoys strong relationships with various government agencies, providing crucial data analytics solutions for national security and intelligence purposes. These Palantir government contracts ensure a steady stream of revenue.

-

Innovative Data Analytics Technology: Palantir's proprietary data analytics platform is considered cutting-edge, offering capabilities that are highly sought after in both the public and private sectors. This technological advantage is a key differentiator in the competitive landscape.

-

Potential for Expansion into New Markets: Palantir has significant potential for expansion into new markets, both domestically and internationally. Exploring new sectors and geographic regions could unlock substantial growth opportunities for Palantir. Further expansion into the private sector is also a key element of Palantir's growth strategy. This includes leveraging AI capabilities within their platform.

Assessing the Risk vs. Reward

Risks Associated with Investing in Palantir

Investing in Palantir stock, like any investment, carries inherent risks:

-

Volatility: Palantir stock is known for its volatility, meaning its price can fluctuate significantly in short periods. This high degree of volatility is a significant risk factor for investors with lower risk tolerance.

-

Dependence on Specific Clients or Government Contracts: Palantir's revenue is somewhat concentrated among specific clients, particularly government agencies. A loss of major contracts could severely impact the company's financial performance.

-

Competition from Established Players: The competitive landscape is intense, with established players and new entrants constantly innovating and vying for market share. This competitive pressure adds further risk to Palantir's future performance.

Potential for High Returns

Despite the risks, the potential for high returns on Palantir stock remains significant:

-

Palantir Return on Investment: If Palantir successfully executes its growth strategy and leverages its technological advantages, investors could see substantial returns on their investment. Long-term growth is a key driver of potential returns.

-

Stock Market Gains: If the broader market recovers, Palantir's stock price is likely to rebound, potentially offering significant gains for investors who bought during the dip.

-

High-Growth Potential: Palantir operates in a high-growth market segment, offering significant potential for future expansion and profitability. This high-growth potential justifies a closer look for investors with higher risk tolerance.

Conclusion

The 30% drop in Palantir stock presents a complex situation. While the reasons for the decline are understandable – market volatility, concerns about future growth, and increased competition – Palantir's strong technological foundation, government partnerships, and potential for expansion into new markets offer a compelling counterargument. The decision of whether or not to invest in Palantir stock at this price point requires a thorough assessment of your personal risk tolerance and a deep dive into the company's financials and future prospects. Assess your risk tolerance before investing in Palantir stock. Learn more about Palantir's financial performance and consider Palantir stock as part of a diversified portfolio. Don't hesitate to conduct thorough due diligence before making any investment decisions concerning Palantir stock.

Featured Posts

-

Rytsarstvo Dlya Stivena Fraya Zasluzhennoe Priznanie

May 09, 2025

Rytsarstvo Dlya Stivena Fraya Zasluzhennoe Priznanie

May 09, 2025 -

1078 R5

May 09, 2025

1078 R5

May 09, 2025 -

Psg Brise La Serie De Dijon En Arkema Premiere Ligue

May 09, 2025

Psg Brise La Serie De Dijon En Arkema Premiere Ligue

May 09, 2025 -

U S China Trade Talks De Escalation Efforts This Week

May 09, 2025

U S China Trade Talks De Escalation Efforts This Week

May 09, 2025 -

Sensex 600 Nifty

May 09, 2025

Sensex 600 Nifty

May 09, 2025

Latest Posts

-

Ashhr Njwm Krt Alqdm Almdkhnyn Hqayq Sadmt

May 09, 2025

Ashhr Njwm Krt Alqdm Almdkhnyn Hqayq Sadmt

May 09, 2025 -

Luis Enriques Psg Transformation How They Secured The Ligue 1 Victory

May 09, 2025

Luis Enriques Psg Transformation How They Secured The Ligue 1 Victory

May 09, 2025 -

West Hams Financial Future Addressing A Potential 25m Deficit

May 09, 2025

West Hams Financial Future Addressing A Potential 25m Deficit

May 09, 2025 -

25m Funding Needed Analysing West Hams Financial Situation

May 09, 2025

25m Funding Needed Analysing West Hams Financial Situation

May 09, 2025 -

Ma Aldhy Qdmh Fyraty Me Alerby Bed Andmamh Mn Alahly Almsry

May 09, 2025

Ma Aldhy Qdmh Fyraty Me Alerby Bed Andmamh Mn Alahly Almsry

May 09, 2025