Palantir Stock: Investment Outlook Before May 5th Earnings

Table of Contents

Recent Performance & Key Metrics

Understanding Palantir's recent performance is crucial for assessing its future potential. We'll examine key metrics like revenue growth and profitability, as well as customer acquisition and retention.

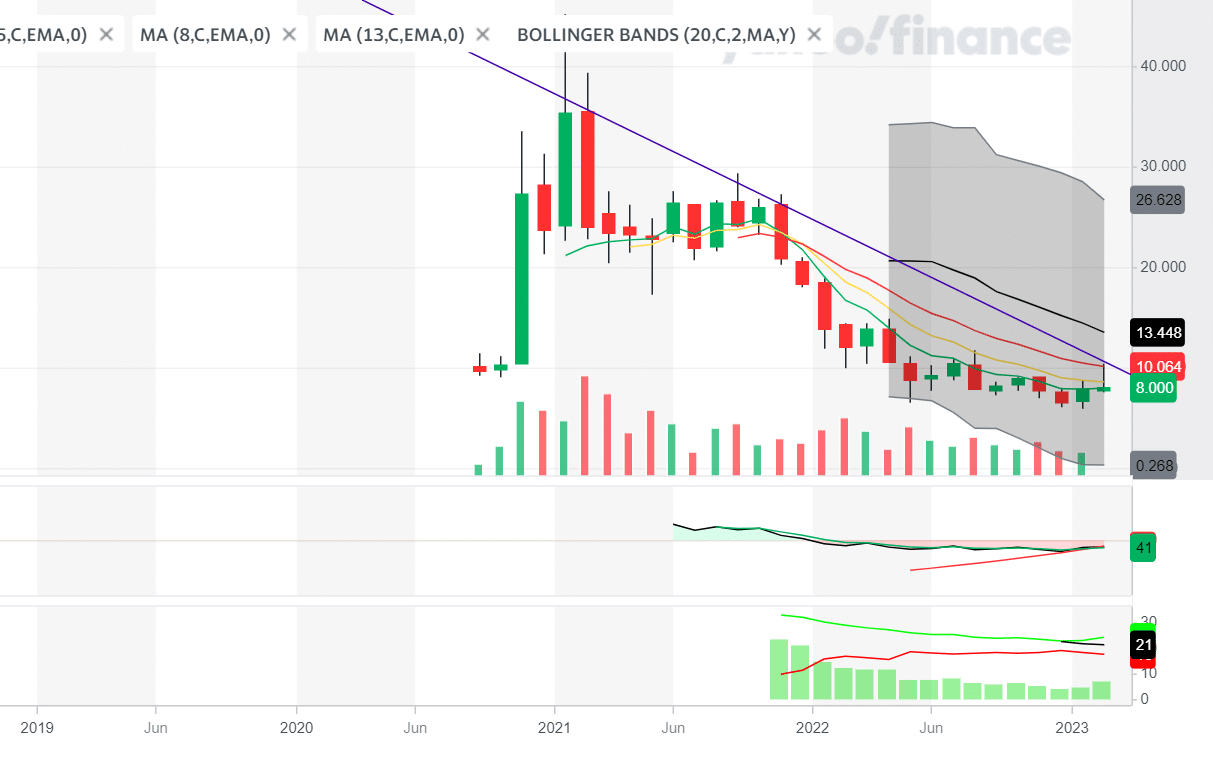

Palantir Revenue, PLTR Growth, and Profitability

Palantir's revenue growth has been a key focus for investors. Examining the year-over-year growth rates in both the government and commercial sectors is essential. We need to see if the growth is sustainable and if it's translating into improved profitability.

- Year-over-year revenue growth: Analyzing the percentage increase in revenue compared to the previous year reveals the company's growth trajectory. A consistent upward trend indicates strong performance.

- Operating margins: Operating margins highlight Palantir's efficiency in managing costs. Improving margins signify better profitability and a healthier financial position. Any significant changes in margins warrant close attention.

- Government contracts vs. Commercial contracts: The balance between government and commercial revenue streams is important. Diversification reduces reliance on any single sector, mitigating risk. Analyzing the growth of each sector provides insights into Palantir's market penetration.

Palantir Customers, Customer Acquisition, and Retention

Customer acquisition and retention are vital for long-term success. Palantir's ability to attract new clients and maintain existing relationships is a key indicator of its market strength.

- Key customer wins: Significant new client acquisitions demonstrate Palantir's ability to compete and expand its market reach. The size and importance of these clients should be considered.

- Contract renewals: A high rate of contract renewals points to strong customer satisfaction and a stable revenue stream. This signals the value Palantir provides to its clients.

- Churn rate: A low churn rate (percentage of customers who cancel their contracts) shows strong customer loyalty and a successful retention strategy. This is a critical factor to assess the long-term stability of the business.

Upcoming Catalysts and Growth Drivers

Several factors could significantly influence Palantir's future performance. We'll explore anticipated product launches and technological advancements, as well as the impact of government spending and geopolitical factors.

Palantir Foundry, AIP, New Product Launches, and Technological Advancements

Palantir continues to invest in research and development, leading to new product launches and technological advancements. These innovations could unlock new revenue streams and enhance the company's competitive edge.

- Palantir Foundry enhancements: Improvements to Palantir's flagship data integration and analytics platform, Foundry, could significantly boost its appeal to both government and commercial clients.

- Artificial Intelligence (AI) and AIP: The integration of AI and Palantir's Artificial Intelligence Platform (AIP) into its offerings will be key for future growth. Analyzing the market penetration and adoption rates of these AI capabilities will be crucial.

- New product launches: Any anticipated product launches should be analyzed for their potential market impact and revenue generation capabilities.

Government Contracts, Defense Spending, and Geopolitical Factors

Government spending on defense and intelligence significantly impacts Palantir's business. Geopolitical events can also influence contract awards and overall market dynamics.

- Increased defense spending: A rise in government spending on defense and intelligence creates opportunities for Palantir to secure more lucrative contracts.

- Government initiatives: Specific government programs and initiatives focused on data analytics and AI could directly benefit Palantir.

- Geopolitical risks: International relations and geopolitical instability can impact government spending priorities and influence contract negotiations.

Potential Risks and Challenges

Despite its potential, Palantir faces several challenges. We'll analyze the competitive landscape and the potential impact of macroeconomic factors.

Palantir Competitors, Market Competition, and Market Saturation

The data analytics and AI market is highly competitive. Understanding Palantir's competitive landscape and potential market saturation is crucial.

- Key competitors: Identifying key competitors and analyzing their market share, competitive advantages, and strategies is essential to assess Palantir's position in the market.

- Competitive advantages: Analyzing Palantir's unique strengths and competitive advantages (e.g., its strong government relationships, its proprietary technology) is necessary to determine its long-term viability.

- Market saturation: Assessing the potential for market saturation and the company’s ability to expand into new markets will determine its future growth potential.

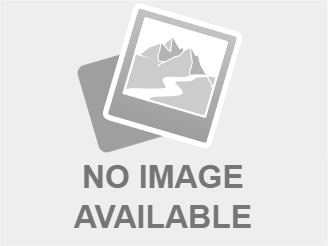

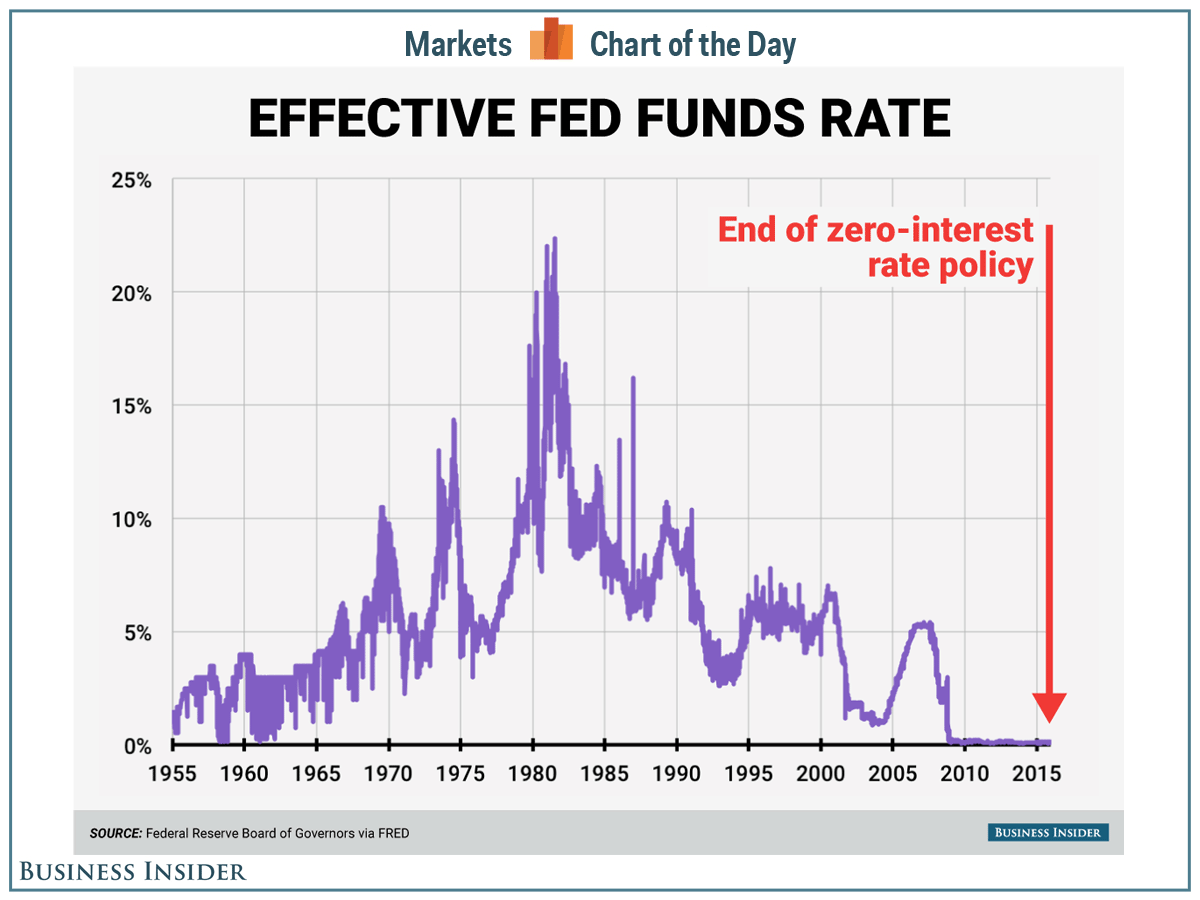

Economic Downturn, Inflation, Recession, and Macroeconomic Factors

Macroeconomic factors like inflation and potential economic downturns can significantly influence Palantir's business.

- Economic uncertainty: A recession or economic downturn could reduce spending by both government and commercial clients, impacting Palantir's revenue.

- Inflationary pressures: Rising inflation can increase costs, squeezing profit margins if not managed effectively.

- Market volatility: Economic uncertainty often leads to increased market volatility, affecting the PLTR stock price.

Conclusion

This pre-earnings analysis of Palantir stock provides a nuanced perspective on the factors likely to influence its performance. While potential catalysts like new product launches and increased government spending offer a bullish outlook, investors must also consider the risks associated with competition and macroeconomic uncertainty. By carefully weighing these factors, investors can make informed decisions regarding their investment in Palantir stock before the May 5th earnings announcement. Remember to conduct thorough due diligence and consider your own risk tolerance before making any investment decisions related to Palantir Technologies (PLTR). Stay informed on all Palantir stock news leading up to and after the earnings release for the most up-to-date information.

Featured Posts

-

Wynne Evans Seeks To Clear His Name With Fresh Evidence In Strictly Scandal

May 09, 2025

Wynne Evans Seeks To Clear His Name With Fresh Evidence In Strictly Scandal

May 09, 2025 -

Kuningas Charlesin Jaelkeen Britannian Kruununperimysjaerjestys Nyt

May 09, 2025

Kuningas Charlesin Jaelkeen Britannian Kruununperimysjaerjestys Nyt

May 09, 2025 -

Vstrecha Zelenskogo I Trampa V Vatikane Rezultaty Po Slovam Makrona

May 09, 2025

Vstrecha Zelenskogo I Trampa V Vatikane Rezultaty Po Slovam Makrona

May 09, 2025 -

Manchesters Stunning Castle To Host Major Music Festival With Olly Murs

May 09, 2025

Manchesters Stunning Castle To Host Major Music Festival With Olly Murs

May 09, 2025 -

Vegas Golden Nayts Pobeda Nad Minnesotoy V Overtayme Pley Off

May 09, 2025

Vegas Golden Nayts Pobeda Nad Minnesotoy V Overtayme Pley Off

May 09, 2025

Latest Posts

-

Toddler Choking On Tomato Dramatic Police Rescue Caught On Bodycam

May 10, 2025

Toddler Choking On Tomato Dramatic Police Rescue Caught On Bodycam

May 10, 2025 -

How The Fentanyl Crisis Influenced U S China Trade Discussions

May 10, 2025

How The Fentanyl Crisis Influenced U S China Trade Discussions

May 10, 2025 -

Federal Reserve Rate Policy An Explanation For The Delay In Cuts

May 10, 2025

Federal Reserve Rate Policy An Explanation For The Delay In Cuts

May 10, 2025 -

Chinese Exports In Crisis The Struggles Of Bubble Blasters And Similar Products

May 10, 2025

Chinese Exports In Crisis The Struggles Of Bubble Blasters And Similar Products

May 10, 2025 -

Les Miserables Cast May Boycott Trumps Kennedy Center Appearance

May 10, 2025

Les Miserables Cast May Boycott Trumps Kennedy Center Appearance

May 10, 2025