Palantir Stock: Is It Too Late To Buy In 2024?

Table of Contents

Palantir Technologies (PLTR) stock has been a rollercoaster ride, experiencing significant volatility in recent years. Its unique position in the big data analytics market, serving both government and commercial clients, has attracted considerable attention, but also raised questions about its long-term potential. Is 2024 the year to jump on the Palantir bandwagon, or has the opportunity already passed? This article will analyze Palantir's current financial performance, market position, and inherent risks to help you determine if investing in Palantir stock is still a viable option. We'll explore relevant keywords such as Palantir stock, Palantir Technologies, PLTR stock, big data analytics, government contracts, investment, stock market, and 2024 stock predictions to provide a comprehensive overview.

Palantir's Current Financial Performance and Future Projections

H3: Revenue Growth and Profitability:

Palantir's recent financial reports paint a mixed picture. While the company has demonstrated consistent revenue growth, profitability remains a key area of focus. Let's examine some key figures:

-

Revenue Growth: [Insert specific revenue figures from recent quarters/years with source citation, e.g., "Q3 2023 revenue increased by X% compared to Q3 2022, reaching $Y billion (Source: Palantir's Q3 2023 Earnings Report)."] This growth is primarily driven by increased demand for its data analytics platforms from both government and commercial sectors.

-

Profitability Margins: [Insert data on operating margin and net income with source citation. Analyze trends, e.g., "Operating margin improved from Z% in 2022 to A% in 2023 (Source: Palantir's annual reports), indicating progress towards profitability."]

-

Significant Contracts: [Mention any notable contract wins or losses, specifying their impact on revenue projections. E.g., "The recent award of a large contract with [Client Name] is expected to contribute significantly to revenue growth in 2024."]

H3: Key Performance Indicators (KPIs):

Analyzing key performance indicators provides valuable insights into Palantir's operational efficiency and future growth prospects.

-

Customer Acquisition: [Discuss trends in customer acquisition, mentioning growth rates and strategies employed. E.g., "Customer acquisition costs have remained relatively stable, suggesting efficiency in sales and marketing efforts."]

-

Customer Churn: [Analyze customer retention rates. A low churn rate indicates strong customer satisfaction and loyalty. E.g., "Low customer churn rates suggest high customer satisfaction and the effectiveness of Palantir's platform."]

-

Average Revenue Per User (ARPU): [Analyze trends in ARPU. An increasing ARPU suggests successful upselling and cross-selling of Palantir's services. E.g., "ARPU has steadily increased, indicating success in upselling and expansion within existing customer accounts."]

Market Analysis and Competitive Landscape

H3: Industry Trends:

The big data analytics market is experiencing robust growth, fueled by increasing data volumes, the rise of artificial intelligence (AI), and the growing need for data-driven decision-making across various industries. Palantir is well-positioned to capitalize on this growth, but faces stiff competition.

-

AI and Machine Learning: [Discuss how Palantir is integrating AI and machine learning into its offerings to enhance its competitive edge. Highlight any successful implementations.]

-

Key Competitors: [Identify and discuss major competitors, such as [Competitor 1], [Competitor 2], analyzing their market share and competitive strengths.]

H3: Geopolitical Factors:

Palantir's significant reliance on government contracts, particularly with the US government, makes its performance susceptible to geopolitical events and policy changes.

-

Government Spending: [Analyze the impact of government spending on defense and intelligence on Palantir's revenue. Discuss potential budget cuts or shifts in priorities.]

-

International Relations: [Discuss the impact of international relations and global instability on Palantir's international business opportunities.]

H3: Analyst Ratings and Price Targets:

Analyst opinions on Palantir stock are varied. [Summarize a range of analyst ratings and price targets, citing sources. Be sure to include both bullish and bearish perspectives to provide a balanced view.]

Risks and Potential Downsides of Investing in Palantir Stock

H3: Valuation Concerns:

Palantir's stock valuation is a key concern for investors. [Analyze the P/E ratio and other valuation metrics, comparing them to competitors. Discuss whether the stock is overvalued or undervalued.]

H3: Dependence on Government Contracts:

Palantir's significant reliance on government contracts poses a substantial risk. Loss of major contracts or budget cuts could severely impact its revenue and profitability.

H3: Competition and Market Saturation:

The big data analytics market is becoming increasingly competitive. The potential for market saturation and the emergence of new technologies pose challenges to Palantir's continued growth.

Conclusion: Is Palantir Stock a Buy, Sell, or Hold in 2024?

Based on our analysis, investing in Palantir stock presents both opportunities and risks. While Palantir demonstrates strong revenue growth and is positioned in a rapidly expanding market, its profitability, reliance on government contracts, and valuation concerns require careful consideration. The current competitive landscape and potential for market saturation also need to be factored into the equation.

Our recommendation is a Hold. While the long-term potential is there, the current uncertainties warrant a cautious approach. Before making any investment decisions, conduct thorough due diligence and consider your own risk tolerance.

Start your own research on Palantir stock today and determine if it's the right investment for your portfolio. Remember, this analysis is for informational purposes only and not financial advice. Always consult a financial advisor before making any investment decisions. The future of Palantir stock, and the broader market, remains uncertain. Careful consideration of all factors is crucial before investing in Palantir stock or any other security.

Featured Posts

-

Technical Glitch Grounds Blue Origin Rocket Launch Abort Announced

May 10, 2025

Technical Glitch Grounds Blue Origin Rocket Launch Abort Announced

May 10, 2025 -

Don De Cheveux A Dijon Pour La Bonne Cause

May 10, 2025

Don De Cheveux A Dijon Pour La Bonne Cause

May 10, 2025 -

Dakota Johnson Apuesta Por Hereu La Marca Catalana Que Conquista A Las Celebrities

May 10, 2025

Dakota Johnson Apuesta Por Hereu La Marca Catalana Que Conquista A Las Celebrities

May 10, 2025 -

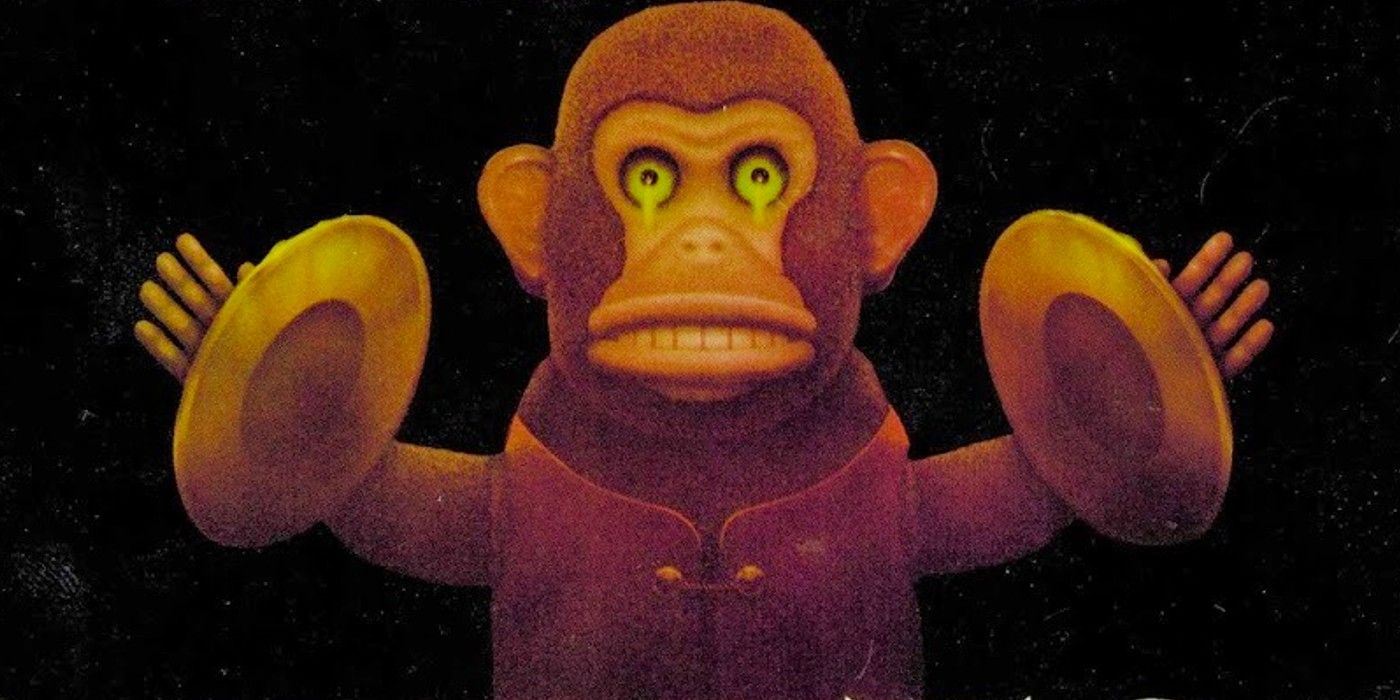

The Potential Of The Monkey Will It Make 2025 A Top Year For Stephen King Films

May 10, 2025

The Potential Of The Monkey Will It Make 2025 A Top Year For Stephen King Films

May 10, 2025 -

Aocs Fiery Response To Trump Coverage On Fox News

May 10, 2025

Aocs Fiery Response To Trump Coverage On Fox News

May 10, 2025