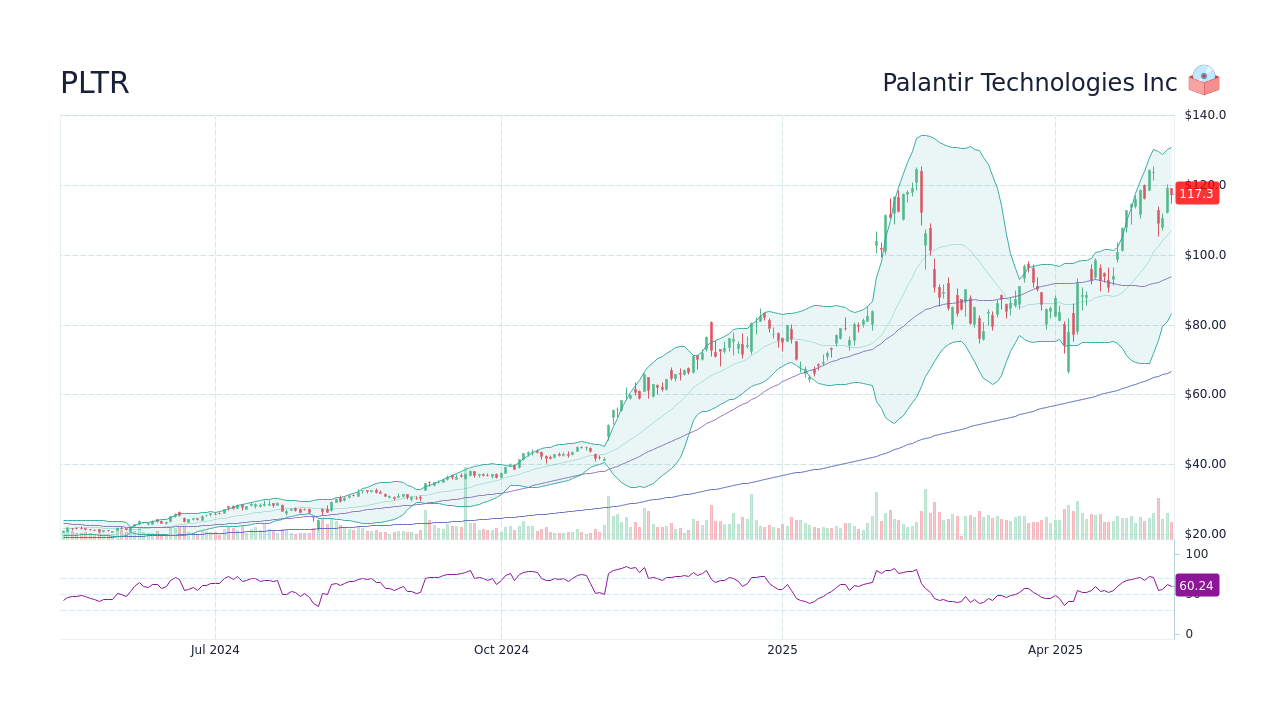

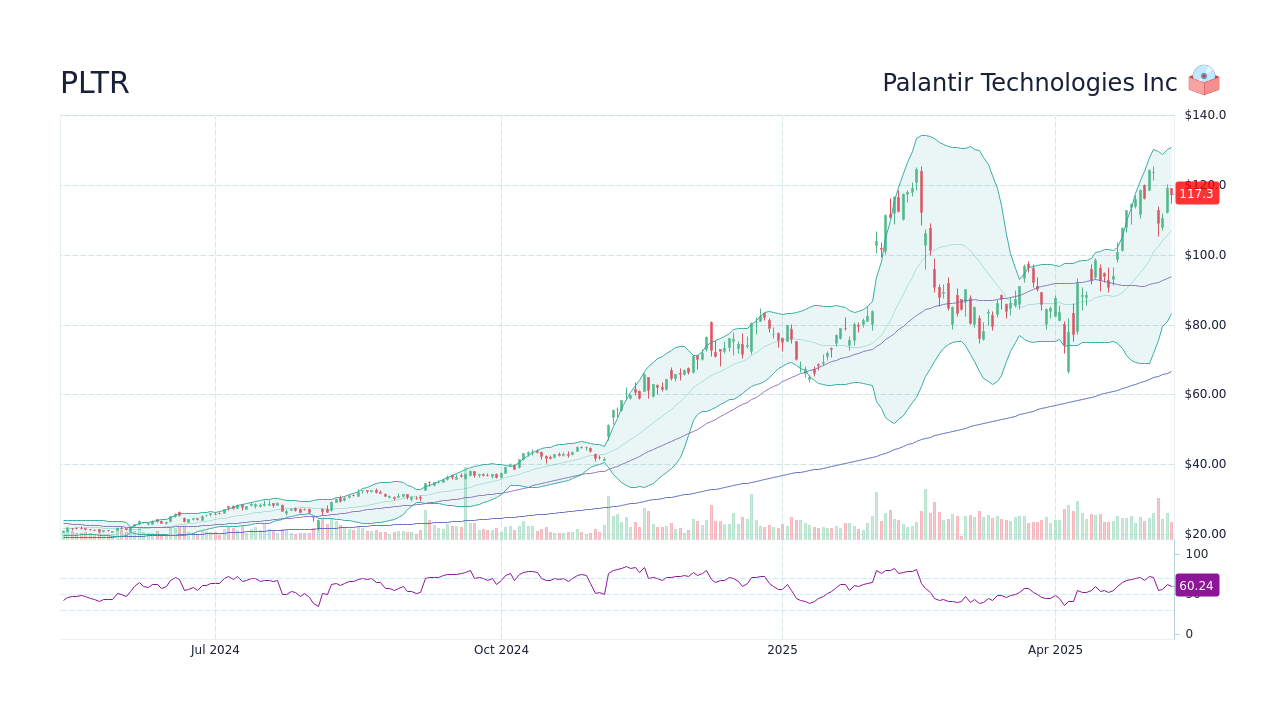

Palantir Stock Prediction: Before May 5th - What Wall Street Thinks

Table of Contents

Recent Palantir Financial Performance and Key Metrics

Analyzing Palantir's recent financial performance is critical for any Palantir stock prediction. We'll examine key metrics to understand the company's health and growth trajectory.

Revenue Growth and Profitability

Palantir's revenue growth and profitability are key indicators of its future potential. Recent quarterly earnings reports reveal important trends. Let's examine some key data points:

- Year-over-year revenue growth: (Insert most recent data from Palantir's financial reports. For example: "Q4 2023 showed a 25% year-over-year revenue increase.")

- Net income (or loss): (Insert most recent data. For example: "While still showing a net loss, the loss narrowed significantly compared to the same period last year.")

- Operating expenses: (Insert most recent data and comment on trends. For example: "Operating expenses increased, but at a slower rate than revenue growth, suggesting improved operational efficiency.")

- Key performance indicators (KPIs): (Include relevant KPIs like customer acquisition cost, average revenue per user, etc., with corresponding data. For example: "Average contract value increased by 15% year-over-year, indicating success in securing larger contracts.")

Significant contracts won or lost significantly impact the PLTR stock price. (Mention any recent notable contract wins or losses and their potential impact on revenue projections.)

Customer Acquisition and Retention

Palantir's ability to acquire and retain customers is fundamental to its long-term success. Key aspects to consider include:

- Number of new clients acquired: (Insert data and comment on trends. For example: "Palantir added X number of new clients in the last quarter, showing continued growth in their customer base.")

- Average contract value: (Insert data and context. For example: "The average contract value continues to rise, indicating increasing confidence from clients and larger-scale deployments of Palantir's solutions.")

- Customer retention rate: (Insert data and comment on its implications. For example: "A high customer retention rate of X% demonstrates the stickiness of Palantir's platform and the value it delivers to its clients.")

- Focus on specific industry segments: (Analyze Palantir's progress in key industries like government, healthcare, and finance. For example: "Their continued growth in the government sector remains a significant driver of revenue.")

Analyst Ratings and Price Targets for Palantir Stock

Understanding Wall Street's sentiment toward Palantir is crucial for predicting its stock price.

Consensus View from Wall Street

The consensus price target among leading financial analysts provides a useful benchmark:

- Average price target: (Insert the average price target from reputable financial sources. For example: "The average price target from leading analysts is $XX.")

- High and low price targets: (Insert the range of price targets. For example: "Price targets range from a low of $X to a high of $Y, reflecting a degree of uncertainty among analysts.")

- Number of buy, hold, and sell ratings: (Insert the breakdown of analyst ratings. For example: "The majority of analysts rate Palantir a 'hold,' indicating a cautious but not overwhelmingly negative outlook.")

- (Optional) Specific analyst names and firms: (If possible, include specific analyst opinions with proper attribution, emphasizing their rationale.)

Factors Influencing Analyst Predictions

Analysts base their predictions on several factors:

- Expected growth in government contracts: (Discuss the potential for future government contracts and their impact on revenue projections.)

- Competition from other data analytics firms: (Analyze the competitive landscape and Palantir's competitive advantages.)

- Impact of geopolitical events: (Discuss any geopolitical factors that might influence Palantir's business or stock price.)

- Potential for new product launches or acquisitions: (Analyze the potential impact of new product introductions or acquisitions on Palantir's growth.)

Market Conditions and Macroeconomic Factors Affecting PLTR Stock

Broader market conditions and macroeconomic trends significantly influence Palantir's stock price.

Overall Market Sentiment

The overall market sentiment plays a crucial role:

- Current state of the stock market indices (S&P 500, Nasdaq): (Analyze the current state of the major indices and their potential impact on Palantir's performance.)

- Interest rate environment: (Discuss the influence of interest rates on investor sentiment and investment decisions.)

- Inflation rates: (Analyze the effect of inflation on Palantir's costs and investor confidence.)

- Investor confidence: (Assess the overall level of investor confidence and its potential impact on the stock market.)

Sector-Specific Trends

Trends within the data analytics and software sectors are also important:

- Competition from similar companies: (Analyze the competitive landscape and Palantir's competitive positioning.)

- Technological advancements: (Discuss the impact of technological advancements on Palantir's products and services.)

- Regulatory changes impacting the sector: (Assess any regulatory changes that could affect Palantir's operations.)

Conclusion

Predicting Palantir stock price before May 5th requires careful consideration of its financial performance, analyst opinions, and macroeconomic factors. While analysts offer valuable insights, it's crucial to remember that these are merely predictions. Palantir's revenue growth, customer acquisition, and the broader market conditions will all play significant roles in determining the actual PLTR stock price. Remember to conduct thorough research and consider consulting a financial advisor before making any investment decisions related to Palantir stock or any other security. This article is for informational purposes only and does not constitute financial advice.

Featured Posts

-

Agression Violente A Dijon Trois Hommes Attaques Au Lac Kir

May 10, 2025

Agression Violente A Dijon Trois Hommes Attaques Au Lac Kir

May 10, 2025 -

Anchor Brewing Companys Closure A Legacy Ends

May 10, 2025

Anchor Brewing Companys Closure A Legacy Ends

May 10, 2025 -

Brobbeys Strength Could Decide Europa League Clash

May 10, 2025

Brobbeys Strength Could Decide Europa League Clash

May 10, 2025 -

Assessing Apples Position In The Ai Landscape

May 10, 2025

Assessing Apples Position In The Ai Landscape

May 10, 2025 -

Punjab Launches Technical Training Programme For Transgender Individuals

May 10, 2025

Punjab Launches Technical Training Programme For Transgender Individuals

May 10, 2025