Palantir Stock Prediction: Should You Buy Before May 5th?

Table of Contents

Palantir Technologies (PLTR) has been a volatile stock, captivating investors and sparking intense debate. With May 5th approaching, many are questioning whether now is the right time to invest. This analysis delves into key factors influencing PLTR's price, aiming to provide insights for your investment decision before this date. We'll explore Palantir's recent performance, future growth prospects, inherent risks, and offer a considered prediction for Palantir stock.

Palantir's Recent Performance and Q1 2024 Earnings

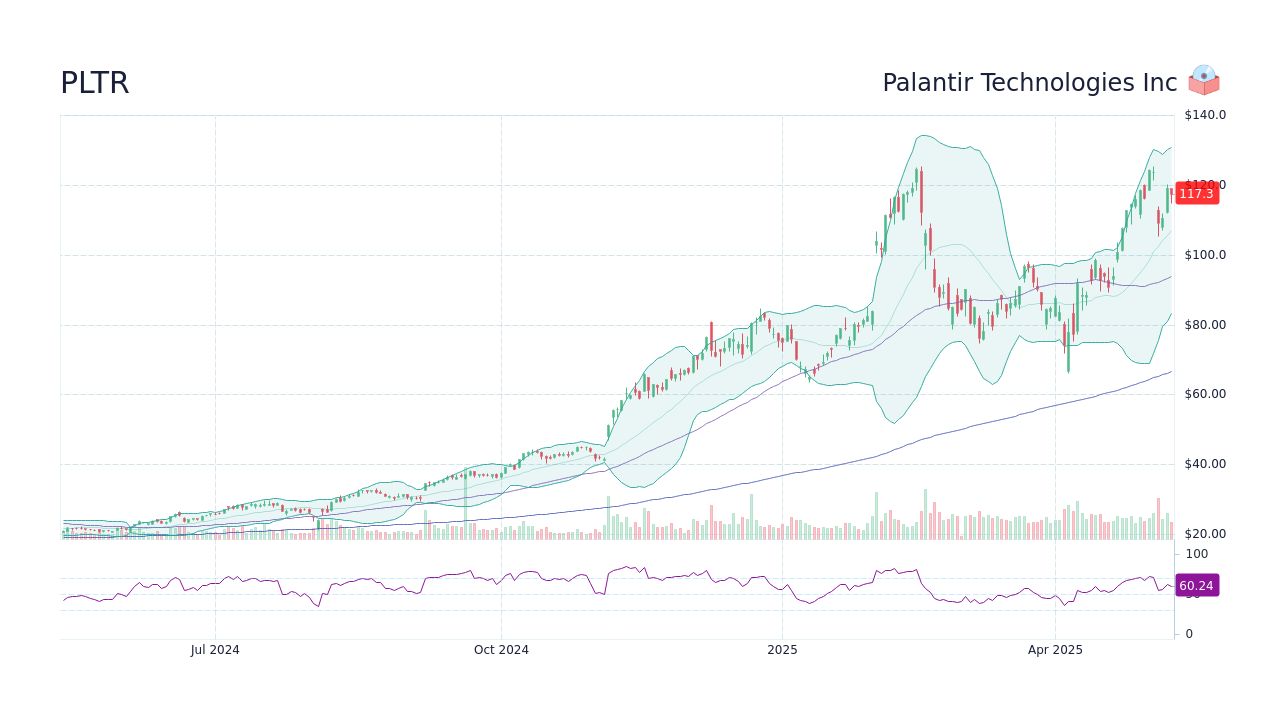

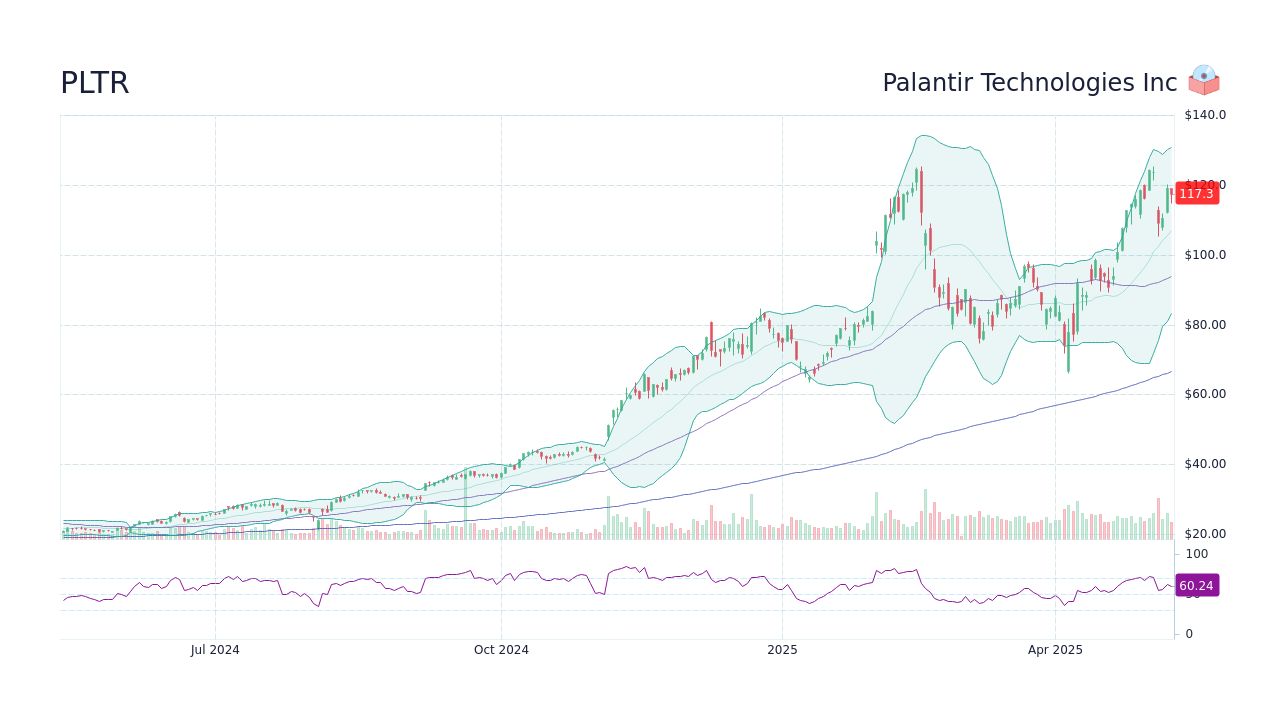

Analyzing Palantir's recent stock performance is crucial for predicting future movements. The stock price has experienced considerable fluctuations, reflecting the inherent volatility of the tech sector and investor sentiment surrounding the company's performance. (Insert chart/graph showing PLTR stock price movement in recent months here).

The company's Q1 2024 earnings report provides valuable insights. While specific numbers will need to be updated when the report is released, we anticipate close examination of key metrics:

- Key financial metrics from the Q1 report: Revenue growth, net income, earnings per share (EPS), operating margins, and free cash flow will be critically examined. Strong growth in these areas will signal positive investor sentiment.

- Comparison to analyst expectations: Beating or missing analyst expectations will significantly influence the stock price. A substantial positive surprise could lead to a price surge, while a negative surprise might trigger a decline.

- Impact of recent market trends on Palantir's performance: Broader market trends, including interest rate changes, inflation, and geopolitical events, will have a ripple effect on PLTR's stock price.

- Significant partnerships or contract wins: Any new major partnerships or contract wins, especially with large government agencies or Fortune 500 companies, would be considered positive indicators for future growth.

Future Growth Prospects and Market Predictions for Palantir

Palantir's long-term growth hinges on its core business: providing data analytics and AI-driven solutions to government and commercial clients. The potential for future growth is substantial, driven by several key factors:

- Key drivers of future growth: The increasing adoption of artificial intelligence (AI) across various sectors, coupled with rising government spending on national security and intelligence, presents significant opportunities.

- Market share projections: Analysts' projections regarding Palantir's market share within the data analytics and AI sectors will be a key factor influencing stock price predictions. Any significant gains in market share would reflect positively on the stock.

- Potential risks and challenges: Competition from established tech giants and emerging startups, as well as potential regulatory hurdles, present challenges to Palantir's growth trajectory.

- Analyst predictions and price targets: Consolidating predictions from reputable market analysts provides a valuable perspective. Their price targets offer a range of potential outcomes, which should be considered alongside other factors. (Include a summary of key analyst predictions here).

Risks and Considerations Before Investing in Palantir Stock

Before investing in Palantir, understanding the inherent risks is crucial. The company's stock is known for its volatility, which can result in significant price swings in short periods.

- High volatility of PLTR stock: This volatility makes it a higher-risk investment, potentially leading to substantial gains or losses. Investors with a higher risk tolerance are better suited to this stock.

- Competition from other data analytics companies: The competitive landscape is crowded, with both established and emerging players vying for market share. Palantir needs to maintain its innovative edge and secure substantial contracts to remain competitive.

- Dependence on large government contracts: A significant portion of Palantir's revenue comes from government contracts. Changes in government policy or spending could significantly impact the company's financial performance.

- Potential for regulatory changes: Regulatory changes affecting data privacy and security could pose significant challenges to Palantir's operations.

Technical Analysis of Palantir Stock (Optional)

(This section would include analysis of technical indicators such as moving averages, support/resistance levels, and chart patterns. However, it's crucial to state clearly that technical analysis is not a guarantee of future performance and should be used cautiously in conjunction with fundamental analysis.)

Conclusion

Our analysis of Palantir Technologies suggests a complex picture. While the company boasts strong growth potential driven by AI adoption and government contracts, the inherent volatility and competitive pressures present significant risks. The Q1 2024 earnings report will be a critical factor in shaping the near-term outlook. Based on the current information, we [insert your recommendation - buy, hold, or sell]. Remember, this is not financial advice. Before making any investment decisions, conduct thorough due diligence and consider your personal risk tolerance. Make an informed decision about your Palantir stock investment and learn more about Palantir's stock forecast to refine your Palantir investment strategy before May 5th.

Featured Posts

-

Musks Space X Holdings Outpace Tesla A 43 Billion Increase

May 10, 2025

Musks Space X Holdings Outpace Tesla A 43 Billion Increase

May 10, 2025 -

Review St Albert Dinner Theatres Hilarious New Production

May 10, 2025

Review St Albert Dinner Theatres Hilarious New Production

May 10, 2025 -

Us Militarys Arctic Ambitions Examining The Proposed Transfer Of Greenland To Northern Command

May 10, 2025

Us Militarys Arctic Ambitions Examining The Proposed Transfer Of Greenland To Northern Command

May 10, 2025 -

Trumps Threat Tariffs On Commercial Aircraft And Engines

May 10, 2025

Trumps Threat Tariffs On Commercial Aircraft And Engines

May 10, 2025 -

Toddler Choking On Tomato Dramatic Police Rescue Caught On Bodycam

May 10, 2025

Toddler Choking On Tomato Dramatic Police Rescue Caught On Bodycam

May 10, 2025