Palantir Stock: Should You Invest Before May 5th? Analysis And Predictions

Table of Contents

Palantir Technologies (PLTR) has been a volatile stock, captivating investors with its ambitious data analytics platform and government contracts. With its upcoming earnings report scheduled for May 5th, many are questioning the wisdom of investing in Palantir stock before this potentially market-moving event. This in-depth analysis will explore the key factors influencing Palantir's stock price, providing insights to help you make a well-informed investment decision.

Palantir's Recent Performance and Upcoming Earnings Report (May 5th):

Palantir's stock price has experienced significant fluctuations in recent months, reflecting the broader tech market volatility and investor sentiment towards the company. Market sentiment has been mixed, with some analysts expressing optimism about Palantir's growth potential, while others remain cautious about its profitability and dependence on government contracts. Recent news, including new contract wins and strategic partnerships, has also played a role in shaping the stock's trajectory.

- Price Fluctuations: Over the past quarter, Palantir's stock price has seen a [Insert Percentage]% change, with highs at [Insert Price] and lows at [Insert Price]. These fluctuations highlight the inherent volatility associated with investing in Palantir.

- Analyst Ratings: Analyst ratings for Palantir have been diverse, ranging from [Insert Example Ratings] reflecting the differing perspectives on the company's future prospects.

- Earnings Expectations (May 5th): The market anticipates [Insert Expected Revenue/Earnings]. A beat or miss on these expectations could significantly impact the stock price, leading to either a surge or a drop. Positive surprises regarding revenue growth in the commercial sector could boost investor confidence. The impact of the earnings report will largely depend on the company's guidance for future quarters and its overall narrative around growth and profitability.

Fundamental Analysis of Palantir's Business:

Palantir operates on a unique business model, offering its sophisticated data analytics platform to both government agencies and commercial clients. While government contracts have historically been a major source of revenue, the company is increasingly focusing on expanding its commercial footprint. This diversification strategy aims to reduce reliance on government spending cycles and unlock new avenues for growth.

- Key Financial Metrics: Palantir's revenue has shown [Insert Growth Percentage]% growth in recent quarters, although profitability remains a key area of focus. Key metrics include revenue of [Insert Revenue Figure], profit margins of [Insert Margin Percentage], and a debt-to-equity ratio of [Insert Ratio]. Analyzing these figures is crucial to understanding the company's financial health.

- Growth Prospects: Significant growth opportunities exist in the rapidly expanding data analytics market. Palantir's strength lies in its ability to handle complex data sets and provide actionable insights to clients across various sectors, including healthcare, finance, and manufacturing.

- Competitive Landscape: Palantir competes with established players such as [Mention Key Competitors] in the data analytics space. The company's competitive advantage lies in its proprietary technology, strong customer relationships, and focus on high-value, complex projects. Maintaining this edge is crucial for sustained growth.

- Strategic Partnerships and Contracts: Palantir has secured several key partnerships and contracts recently. These collaborations provide access to new markets and reinforce the company's position in the industry.

Technical Analysis of Palantir Stock:

A technical analysis of Palantir's stock chart reveals [Insert Key Observations]. Identifying potential support and resistance levels is crucial for gauging potential price movements.

- Technical Indicators: Analyzing indicators like moving averages (e.g., 50-day and 200-day), Relative Strength Index (RSI), and volume can provide valuable insights into potential price trends. [Insert Specific Indicator Readings and Interpretations].

- Chart Patterns: Identifying chart patterns such as head and shoulders, double tops, or bottoms can help predict future price movements. [Insert Specific Pattern Observations and Interpretations, if applicable].

- Potential Price Targets: Based on the technical analysis, potential price targets could range from [Insert Low Price Target] to [Insert High Price Target], depending on the market's reaction to the upcoming earnings report and broader market trends. [Include chart if possible].

Risk Assessment for Investing in Palantir:

Investing in Palantir stock involves significant risk. The company's stock price is highly volatile, making it susceptible to sharp price swings.

- Specific Risks:

- High Volatility: Palantir's stock price is known for its volatility.

- Competition: Intense competition from established players in the data analytics market.

- Regulatory Risks: Changes in government regulations could impact government contracts.

- Dependence on Government Contracts: A significant portion of Palantir's revenue stems from government contracts, making it vulnerable to changes in government spending.

- Risk Mitigation Strategies: Diversifying your investment portfolio and using stop-loss orders can help mitigate some of the risks associated with investing in Palantir. A long-term investment approach can help weather short-term volatility.

Conclusion:

Palantir's stock price is influenced by a complex interplay of factors, including its upcoming earnings report on May 5th, its fundamental business performance, and technical market indicators. While the company possesses significant growth potential in the data analytics market, investing in Palantir involves inherent risks due to its volatility and dependence on government contracts. The May 5th earnings report is a crucial event that could significantly impact the stock price.

Investment Recommendation: Before making any investment decision regarding Palantir stock, careful consideration of its strengths, weaknesses, and the associated risks is paramount. Weigh the potential rewards against the inherent volatility before committing capital.

Call to Action: Conduct your due diligence and determine if Palantir stock aligns with your investment strategy before May 5th. Remember that this analysis is for informational purposes only and does not constitute financial advice. Always consult with a qualified financial advisor before making any investment decisions.

Featured Posts

-

Su That Ve Loi Khai Bao Mau Bao Hanh Tre O Tien Giang

May 09, 2025

Su That Ve Loi Khai Bao Mau Bao Hanh Tre O Tien Giang

May 09, 2025 -

Draisaitls Lower Body Injury Timeline And Impact On Edmonton Oilers Playoff Run

May 09, 2025

Draisaitls Lower Body Injury Timeline And Impact On Edmonton Oilers Playoff Run

May 09, 2025 -

Anchorage Opens New Candle Studio Alaska Airlines Lounge Korean Bbq And Eye Tooth Restaurant

May 09, 2025

Anchorage Opens New Candle Studio Alaska Airlines Lounge Korean Bbq And Eye Tooth Restaurant

May 09, 2025 -

The Kilmar Abrego Garcia Case A Microcosm Of Us Immigration Challenges

May 09, 2025

The Kilmar Abrego Garcia Case A Microcosm Of Us Immigration Challenges

May 09, 2025 -

Injured Leon Draisaitl Oilers Opt For Caution Against Jets

May 09, 2025

Injured Leon Draisaitl Oilers Opt For Caution Against Jets

May 09, 2025

Latest Posts

-

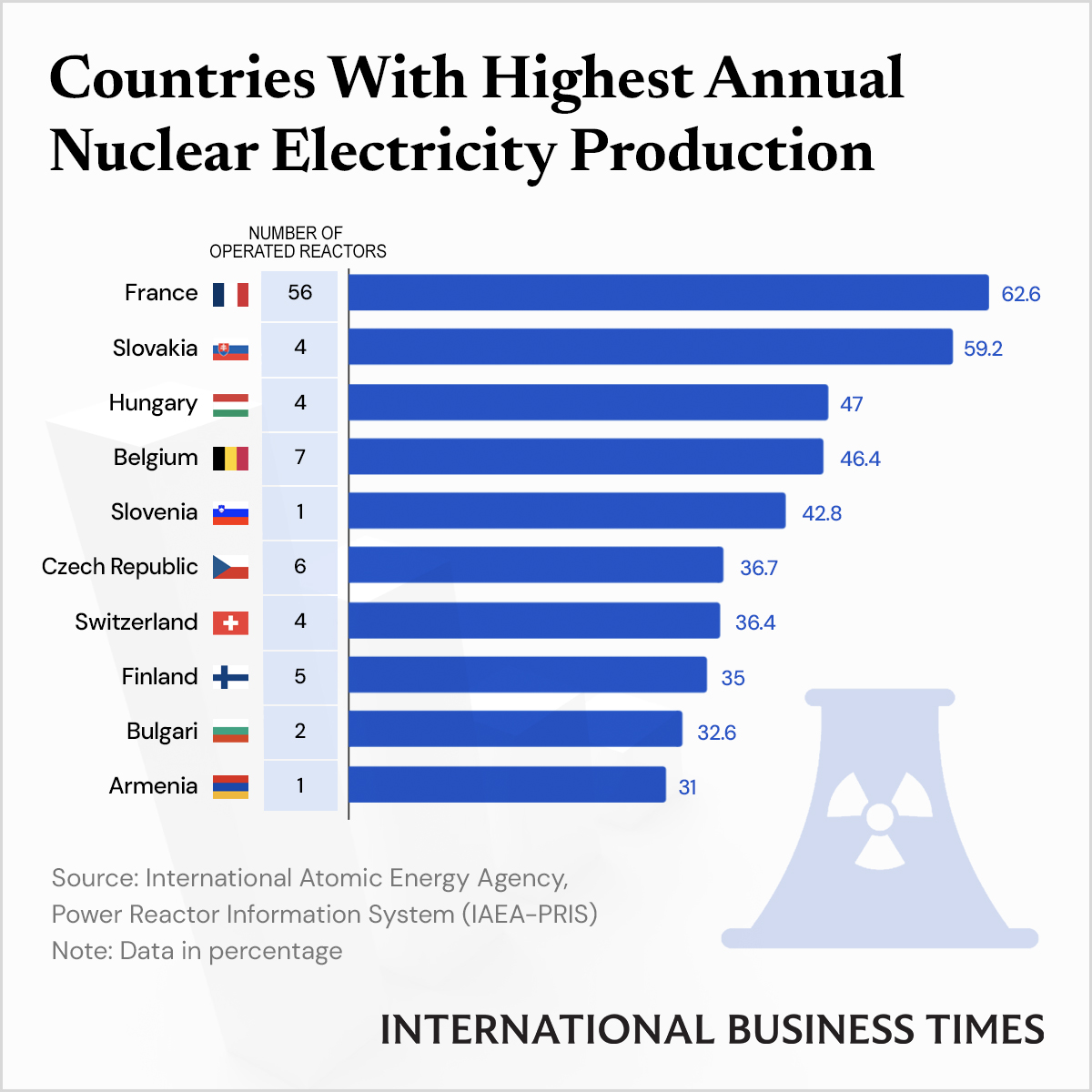

Frances Nuclear Shield A Proposal For Shared European Security

May 09, 2025

Frances Nuclear Shield A Proposal For Shared European Security

May 09, 2025 -

French Minister Calls For Stronger Eu Response To Us Tariffs

May 09, 2025

French Minister Calls For Stronger Eu Response To Us Tariffs

May 09, 2025 -

French Minister Highlights Importance Of Shared Nuclear Defense In Europe

May 09, 2025

French Minister Highlights Importance Of Shared Nuclear Defense In Europe

May 09, 2025 -

Europe Minister Advocates For Joint Nuclear Deterrence

May 09, 2025

Europe Minister Advocates For Joint Nuclear Deterrence

May 09, 2025 -

Frances Europe Minister Promotes Shared Nuclear Shield

May 09, 2025

Frances Europe Minister Promotes Shared Nuclear Shield

May 09, 2025