Palantir Stock: Time To Buy Before The Predicted 40% Jump In 2025?

Table of Contents

Palantir's Recent Performance and Growth Potential

Palantir Technologies, a prominent player in the big data analytics market, provides cutting-edge software platforms to government and commercial clients. Understanding Palantir's recent performance is crucial for evaluating its future potential.

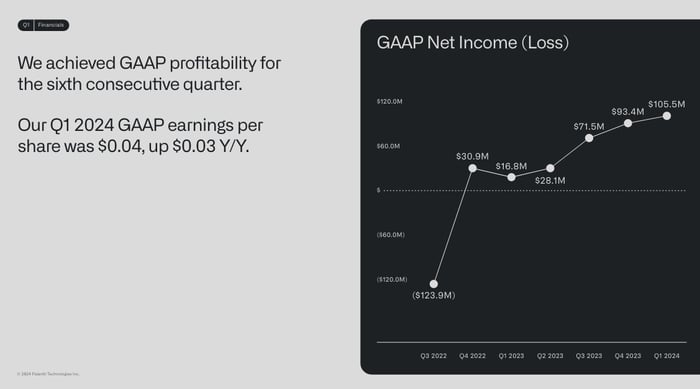

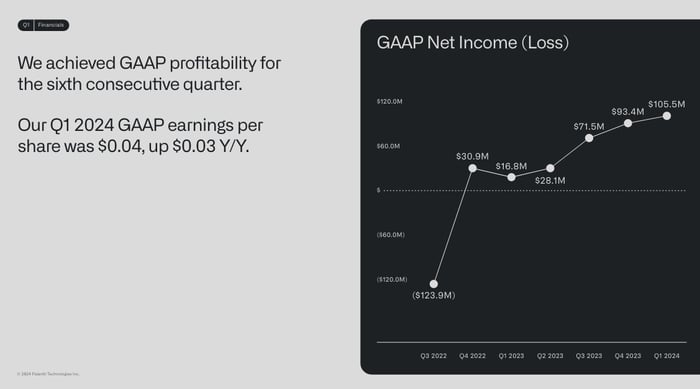

Financial Highlights:

Palantir has shown significant revenue growth in recent years, though profitability remains a key focus. Analyzing key financial metrics like revenue growth, operating margins, and earnings per share (EPS) is vital. While precise numbers fluctuate, consistent upward trends in revenue and a clear path towards profitability are positive indicators for Palantir stock. (Note: For a truly optimized article, include a visually appealing chart or graph here showcasing these key financial metrics over the past few years).

Key Partnerships and Contracts:

Palantir's strategic partnerships and lucrative government contracts are instrumental to its success. These contracts represent substantial and recurring revenue streams.

- US Government Agencies: Palantir has secured major contracts with various US government agencies, including the Department of Defense and the CIA. These partnerships showcase the company's crucial role in national security and intelligence gathering.

- Large Commercial Enterprises: Palantir is increasingly expanding its footprint in the commercial sector, securing contracts with prominent companies in healthcare, finance, and other industries. These partnerships demonstrate the versatility and applicability of Palantir's technology across diverse sectors. (Specific examples of major commercial partnerships should be named here).

Market Domination and Competitive Landscape:

Palantir possesses a competitive advantage due to its unique technology, proprietary data platforms, and strong relationships with key clients. However, the data analytics market is becoming increasingly crowded. Competition from established players and emerging startups necessitates ongoing innovation and strategic maneuvering to maintain Palantir's market dominance.

Factors Contributing to the Predicted 40% Jump in Palantir Stock

Several factors contribute to the optimistic forecast of a 40% increase in Palantir stock by 2025.

Increasing Government Spending on Data Analytics:

Government agencies worldwide are significantly increasing spending on advanced data analytics solutions. This trend is driven by the need for enhanced national security, improved public services, and better data-driven decision-making. Reports from reputable research firms projecting growth in this sector should be cited here.

Expanding Commercial Market Adoption:

Beyond the government sector, commercial clients are rapidly adopting Palantir's data analytics solutions. Across various industries, from healthcare to finance, companies are recognizing the value of Palantir's technology for streamlining operations, improving efficiency, and gaining a competitive edge.

Technological Advancements and Product Innovation:

Palantir’s commitment to research and development is a critical factor in its projected growth. Continuous innovation ensures the company remains at the forefront of the data analytics market.

- New Product Releases: (List specific examples of new product releases or significant updates to existing products).

- Technological Advancements: (Mention specific technological advancements, e.g., advancements in AI, machine learning capabilities, etc., that contribute to Palantir's competitive edge).

Risks and Challenges Facing Palantir Stock

Despite the positive outlook, several risks and challenges could impact Palantir stock.

Dependence on Government Contracts:

Palantir's significant reliance on government contracts exposes it to the risk of budget cuts, changes in government priorities, and potential political instability. This dependence necessitates diversification into the commercial sector.

Intense Competition:

The data analytics market is highly competitive. Established players and emerging startups pose a constant threat, requiring Palantir to maintain a strong innovative edge and effectively manage competition.

Valuation Concerns:

Concerns regarding Palantir's current stock valuation and the potential for overvaluation exist. A careful analysis of its market capitalization and future earnings projections is necessary.

Investment Strategies and Considerations

Before investing in Palantir stock, consider these factors.

Diversification:

It's crucial to diversify your investment portfolio to mitigate risks. Concentrating investments in a single stock, even one with high growth potential, can be risky.

Long-Term vs. Short-Term Investments:

Palantir stock is generally viewed as a long-term investment. While short-term gains are possible, a long-term perspective is more suitable for realizing the potential for significant returns.

Risk Tolerance:

Assess your personal risk tolerance before investing in Palantir stock. This high-growth stock carries inherent risks and might not be suitable for all investors.

Conclusion

The potential for a 40% jump in Palantir stock by 2025 is certainly enticing, driven by strong revenue growth, strategic partnerships, and increasing demand for data analytics solutions. However, significant risks, such as dependence on government contracts and intense competition, must be considered. While Palantir's innovative technology and market position offer compelling reasons for investment, thorough research and careful consideration of your risk tolerance are crucial before making any investment decisions. Conduct further due diligence and consult a financial advisor to determine if Palantir stock aligns with your investment strategy. Remember, this article is for informational purposes only and does not constitute financial advice.

Featured Posts

-

Improving Wheelchair Access On The Elizabeth Line A Practical Guide

May 10, 2025

Improving Wheelchair Access On The Elizabeth Line A Practical Guide

May 10, 2025 -

Indiana High School Athletic Association Bans Transgender Athletes Trumps Influence

May 10, 2025

Indiana High School Athletic Association Bans Transgender Athletes Trumps Influence

May 10, 2025 -

Focusing On The Bigger Picture The Attorney General And Fox News

May 10, 2025

Focusing On The Bigger Picture The Attorney General And Fox News

May 10, 2025 -

Us Sees Largest Fentanyl Seizure Ever Led By Pam Bondi

May 10, 2025

Us Sees Largest Fentanyl Seizure Ever Led By Pam Bondi

May 10, 2025 -

Disneys Profit Outlook Raised Parks And Streaming Drive Growth

May 10, 2025

Disneys Profit Outlook Raised Parks And Streaming Drive Growth

May 10, 2025