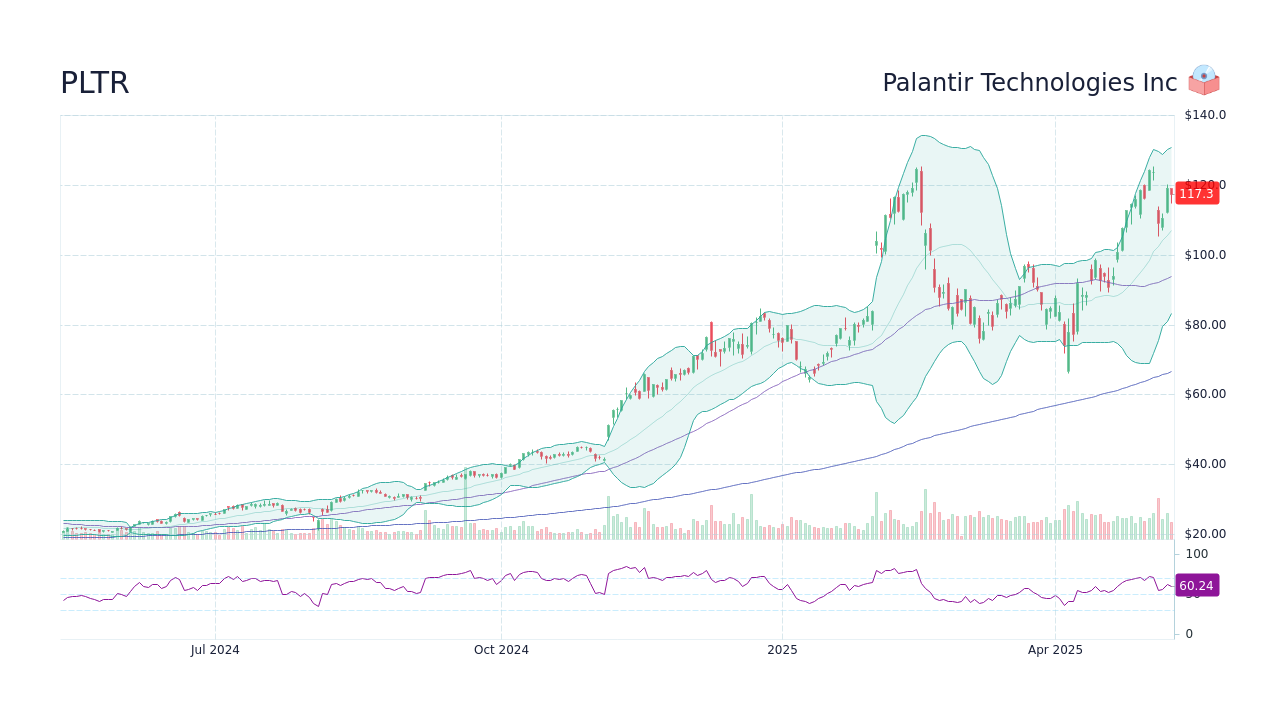

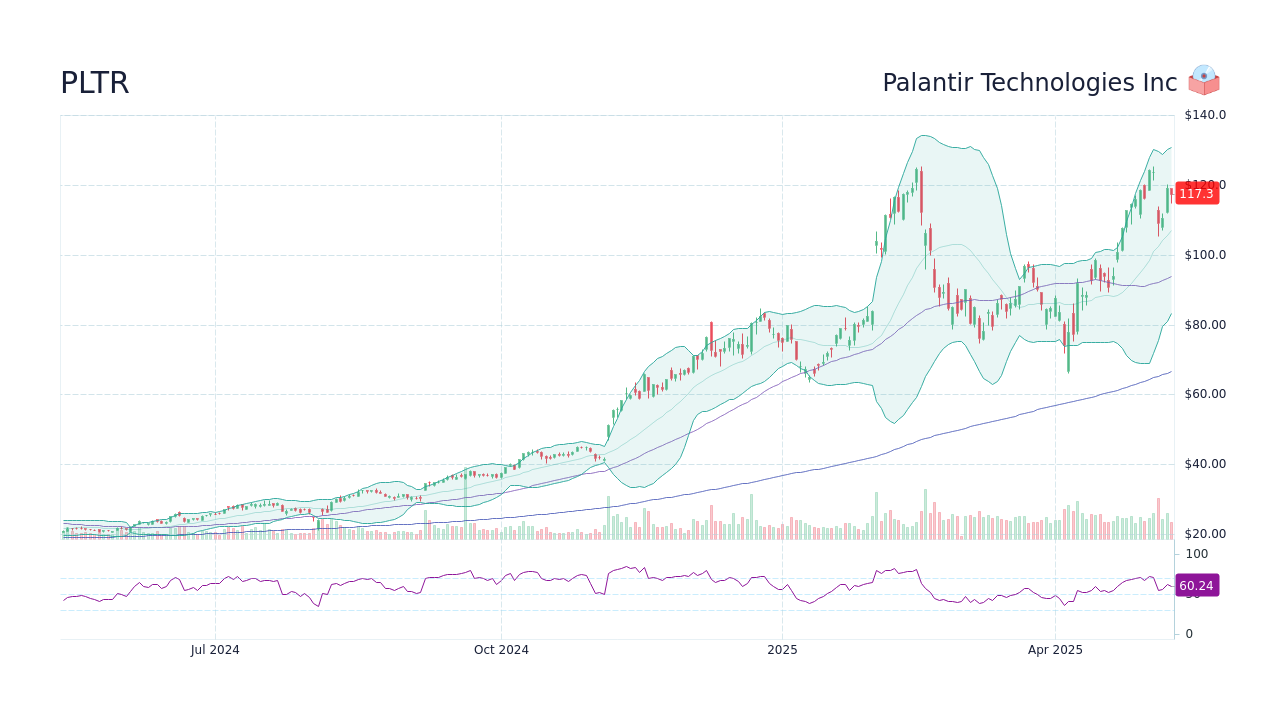

Palantir Technologies Stock: Buy Before May 5th? Wall Street's Outlook

Table of Contents

Recent Palantir Technologies Financial Performance and Growth Prospects

Q4 2022 Earnings Report Analysis

Palantir's Q4 2022 earnings report offered a mixed bag for investors. While the company exceeded expectations on revenue, exceeding the projected $500 million, its net income fell slightly short of analyst predictions. Let's analyze the key metrics:

- Revenue: Showed strong year-over-year growth, indicating sustained demand for Palantir's data analytics platform. This positive trend suggests a healthy trajectory for PLTR stock.

- Earnings: While positive, the earnings per share (EPS) were slightly lower than anticipated. This discrepancy warrants further investigation into the underlying factors influencing profitability.

- Growth Rates: The company demonstrated continued growth in its government and commercial sectors, showcasing the platform's versatility across various applications. However, investors should analyze the sustainability of these growth rates in the long term.

- Comparison to Analyst Expectations: While revenue beat expectations, the shortfall in EPS led to a mixed reaction from analysts, emphasizing the need for a cautious approach to PLTR stock investment.

Positive Aspects: Strong revenue growth, expansion into new markets. Negative Aspects: Slightly missed earnings expectations, potential headwinds from a slowing economy.

Long-Term Growth Potential

Palantir's long-term growth potential hinges on several factors:

- Market Position: Palantir holds a strong position in the burgeoning big data analytics market, particularly within the government and defense sectors. Its Foundry platform provides a competitive edge.

- New Markets and Technologies: The company is actively expanding into new markets and integrating cutting-edge technologies like artificial intelligence (AI) and machine learning (ML) into its offerings. This diversification strengthens its future prospects.

- Potential Risks: Competition from established tech giants and the potential impact of economic slowdowns represent significant risks to Palantir's growth. Government contract dependence also presents volatility.

Growth Drivers: Expanding market share, technological innovation, strategic partnerships. Potential Challenges: Intense competition, economic uncertainty, reliance on government contracts.

Wall Street's Sentiment and Analyst Ratings for Palantir Stock

Current Analyst Ratings and Price Targets

Analyst ratings for Palantir stock are currently mixed, reflecting the uncertainty surrounding the company's future performance.

- Buy, Hold, and Sell Recommendations: A range of recommendations exists, with some analysts maintaining a "buy" rating citing long-term growth potential, while others recommend "hold" or "sell" due to short-term concerns.

- Average Price Target: The average price target among analysts provides a benchmark for potential returns, offering investors a sense of potential upside or downside.

- Key Analysts and Reasoning: Understanding the rationale behind individual analyst ratings is crucial. Different analysts might focus on different aspects of the business, leading to varying perspectives on PLTR stock's future.

Consensus Among Analysts: A generally cautious outlook prevails, with a wide spread of opinions making it challenging to determine a clear consensus.

Impact of Recent News and Events on Palantir Stock

Recent news and events have significantly impacted investor sentiment towards Palantir stock.

- New Contracts and Partnerships: Securing large government contracts or forging strategic partnerships generally boosts investor confidence and drives up the stock price.

- Geopolitical Events and Macroeconomic Factors: Global instability or economic downturns can negatively impact investor sentiment, leading to decreased demand for PLTR stock.

- Market Sentiment Towards the Tech Sector: The overall performance of the technology sector significantly influences investor appetite for Palantir stock, often leading to correlated movements.

Significant News Events: Keep an eye on press releases from Palantir, news articles focusing on government contracts, and overall market analysis to understand the latest developments affecting PLTR stock.

Key Factors to Consider Before Investing in Palantir Technologies Stock Before May 5th

Risk Assessment

Investing in Palantir stock carries inherent risks:

- High Valuation: Palantir's stock price might be considered high relative to its current earnings, making it vulnerable to price corrections.

- Dependence on Government Contracts: A significant portion of Palantir's revenue comes from government contracts, making it susceptible to changes in government spending or policy.

- Competition: The big data analytics market is highly competitive, with established players constantly vying for market share.

Mitigation Strategies: Diversification of your investment portfolio, adopting a long-term investment horizon, and thorough due diligence before investing can help mitigate some of these risks.

Investment Timeline and Strategy

The decision to invest in Palantir stock before May 5th depends on your investment timeline and strategy:

- Short-Term Trading: High volatility makes short-term trading risky. You need to be comfortable with potential significant price swings.

- Long-Term Holding: A long-term strategy aligns with Palantir's growth potential, allowing you to ride out short-term market fluctuations.

Investment Approaches: Thoroughly research your preferred approach, considering your risk tolerance and financial goals. Set realistic expectations for potential returns, recognizing that investing always involves risk.

Conclusion

This analysis of Palantir Technologies stock, considering Wall Street's outlook and the upcoming May 5th deadline, reveals a complex picture. While Palantir exhibits strong growth potential in the expanding big data analytics sector, investors must carefully weigh potential risks against projected gains. The consensus among analysts is varied, highlighting the need for thorough due diligence before committing capital.

Call to Action: Ultimately, the decision of whether or not to buy Palantir Technologies stock before May 5th rests with you. However, armed with this analysis of recent financial performance, Wall Street sentiment, and key risk factors, you are better equipped to make an informed investment decision regarding Palantir stock. Remember to conduct your own thorough research before investing in any stock. Consider consulting a financial advisor for personalized guidance on investing in PLTR or other similar growth stocks.

Featured Posts

-

Identifying Emerging Business Centers A Comprehensive Map

May 10, 2025

Identifying Emerging Business Centers A Comprehensive Map

May 10, 2025 -

Brobbeys Strength Could Decide Europa League Clash

May 10, 2025

Brobbeys Strength Could Decide Europa League Clash

May 10, 2025 -

Nhl Predictions Oilers Vs Sharks Betting Analysis And Odds

May 10, 2025

Nhl Predictions Oilers Vs Sharks Betting Analysis And Odds

May 10, 2025 -

Attorney General Uses Fake Fentanyl To Illustrate Opioid Crisis Severity

May 10, 2025

Attorney General Uses Fake Fentanyl To Illustrate Opioid Crisis Severity

May 10, 2025 -

Analyzing Palantir Stock A Pre May 5th Investment Decision

May 10, 2025

Analyzing Palantir Stock A Pre May 5th Investment Decision

May 10, 2025