Palantir Technologies Stock: Buy Before May 5th? Wall Street's View

Table of Contents

Recent Palantir Technologies Stock Performance and Predictions

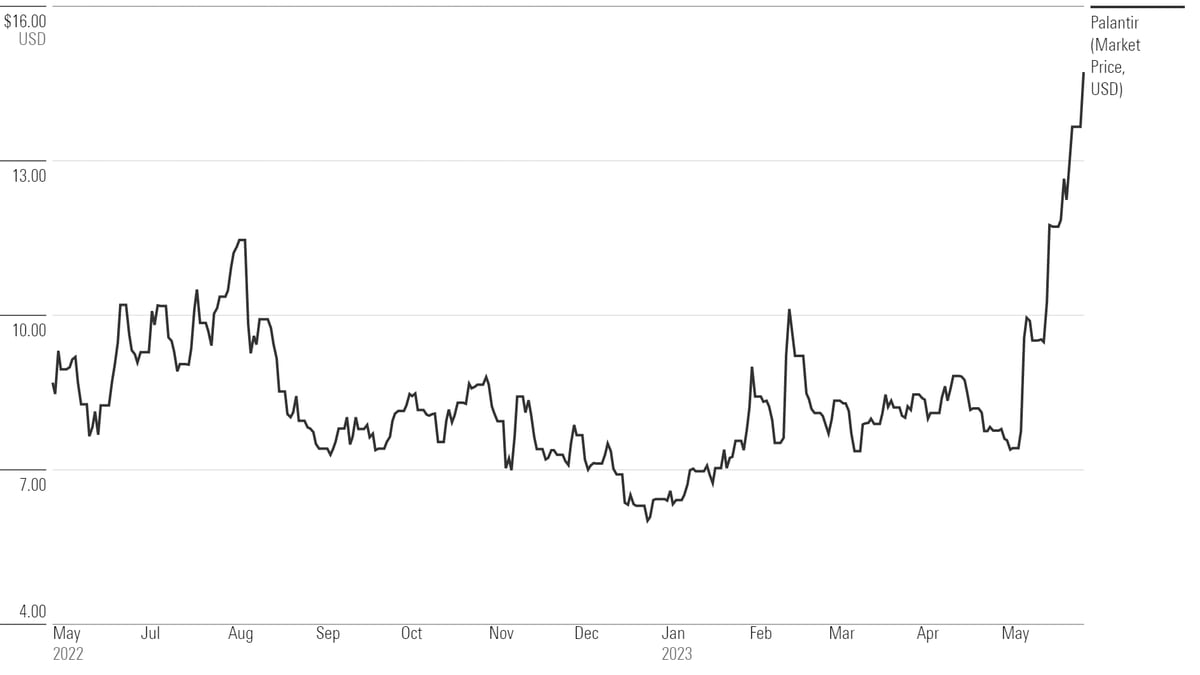

Palantir Technologies stock (PLTR) has experienced significant volatility in recent months. After a period of relative stability, the stock price has shown some fluctuation, reflecting the broader market sentiment towards technology stocks and the company's specific performance. [Insert relevant chart showing PLTR stock price movement over the past few months]. Recent news impacting the stock price includes [mention specific news, e.g., Q1 2024 earnings report, a significant contract win with a major government agency, or a new strategic partnership].

-

Analyze recent quarterly earnings and revenue growth: Palantir's recent earnings reports have shown [insert data on revenue growth, earnings per share, and other relevant financial metrics]. This performance [positive or negative] has influenced analyst predictions and investor sentiment.

-

Discuss the company's guidance for future performance: The company's guidance for [mention specific timeframe, e.g., the next quarter or fiscal year] indicates [summarize the company's outlook, including projected revenue growth and profitability]. This guidance is a key factor influencing current Palantir Technologies stock valuations.

-

Mention any significant changes in analyst ratings: Several analyst firms have recently adjusted their ratings on PLTR stock, reflecting changes in their outlook for the company. [mention examples, e.g., a downgrade from a "Buy" to a "Hold" rating or an upgrade from a "Hold" to a "Buy"].

Wall Street Analyst Ratings and Price Targets for Palantir Technologies Stock

The consensus view among Wall Street analysts on Palantir Technologies stock is currently [bullish, bearish, or neutral]. While opinions vary, the general sentiment reflects [explain the overall sentiment – e.g., cautious optimism due to strong growth potential but concerns about profitability].

| Analyst Firm | Rating | Price Target | Rationale |

|---|---|---|---|

| Goldman Sachs | Buy | $XX | Strong growth potential in government contracts |

| Morgan Stanley | Hold | $YY | Concerns about competition and profitability |

| JPMorgan Chase | Neutral | $ZZ | Waiting for further evidence of sustainable growth |

| Add more rows as needed |

-

List key analysts and their ratings (Buy, Sell, Hold): The table above provides a summary of key analyst ratings. These ratings should be considered alongside the analysts' individual rationale.

-

Present a range of price targets predicted by analysts: The price targets range from a low of $[lowest price target] to a high of $[highest price target], reflecting the diversity of opinion among analysts.

-

Explain the rationale behind different analyst opinions: The differences in analyst opinions often stem from differing assessments of Palantir's growth prospects, the intensity of competition in the big data analytics market, and the overall macroeconomic environment.

Key Factors Influencing Palantir Technologies Stock Price

Several factors influence the price of Palantir Technologies stock, both positive and negative.

-

Market sentiment towards tech stocks in general: The overall performance of the technology sector significantly impacts PLTR’s stock price. A positive market sentiment generally boosts tech stocks, while negative sentiment can lead to declines.

-

Competition in the big data and analytics market: Palantir faces intense competition from established players like Microsoft and Google Cloud, as well as numerous smaller, specialized firms. The company's ability to maintain its competitive advantage is crucial for its future success.

-

Palantir's growth prospects and potential for future innovation: Palantir’s success hinges on its ability to continue innovating and expanding its product offerings to meet evolving customer needs. The potential for new product launches and market penetration is a major factor influencing investor confidence.

-

Geopolitical factors and their potential impact: Palantir's significant government contracts make it susceptible to geopolitical events. Changes in government policies or international relations can impact its revenue streams and stock price.

-

Growth in government contracts vs. commercial sector performance: A significant portion of Palantir's revenue comes from government contracts. The balance between government and commercial sector performance is a key indicator of the company's long-term stability and growth.

-

The impact of increasing interest rates on technology valuations: Rising interest rates can negatively affect the valuations of growth stocks like Palantir, as investors may shift towards more conservative investments.

-

Potential risks associated with the company's operations: Risks include competition, dependence on large contracts, and the potential for cybersecurity breaches.

Understanding Palantir's Business Model and its Long-Term Potential

Palantir provides data integration and analysis platforms primarily to government and commercial clients. Its strength lies in its sophisticated software and expertise in handling large datasets. However, its high prices and complex implementation processes can be weaknesses.

-

Analyze the company's competitive advantages: Palantir's proprietary technology, strong relationships with government agencies, and deep expertise in data analytics are key competitive advantages.

-

Evaluate the sustainability of its revenue streams: The sustainability of Palantir's revenue streams depends on its ability to secure new contracts and expand into new markets.

-

Assess the potential for future product innovation and expansion: Palantir's future success relies on continuous innovation and expansion into new areas such as artificial intelligence and cloud-based solutions.

Conclusion

Wall Street's view on Palantir Technologies stock is mixed, with analysts offering a range of opinions and price targets. Key factors influencing the stock price include market sentiment, competition, Palantir's growth prospects, and geopolitical events. While the company shows promise, potential risks must be considered. Should you buy Palantir Technologies stock before May 5th? The decision depends on your individual risk tolerance and investment strategy. However, understanding Wall Street's view and the factors influencing the Palantir Technologies stock price is critical. Conduct further research and carefully consider your options before making any investment in PLTR stock. Remember to consult a financial advisor for personalized advice.

Featured Posts

-

U S China Trade Talks De Escalation Efforts This Week

May 09, 2025

U S China Trade Talks De Escalation Efforts This Week

May 09, 2025 -

Tech Billionaires 194 Billion Loss 100 Days Of Pain After Trump Inauguration Donation

May 09, 2025

Tech Billionaires 194 Billion Loss 100 Days Of Pain After Trump Inauguration Donation

May 09, 2025 -

Deutsche Bank Bolsters Defense Finance With Dedicated New Deals Team

May 09, 2025

Deutsche Bank Bolsters Defense Finance With Dedicated New Deals Team

May 09, 2025 -

Doohan Receives Warning From Alpine Team Boss F1 News

May 09, 2025

Doohan Receives Warning From Alpine Team Boss F1 News

May 09, 2025 -

Nhs Staff Illegal Access Of Nottingham Stabbing Victim Records

May 09, 2025

Nhs Staff Illegal Access Of Nottingham Stabbing Victim Records

May 09, 2025

Latest Posts

-

News From The Bangkok Post The Push For Better Transgender Rights

May 10, 2025

News From The Bangkok Post The Push For Better Transgender Rights

May 10, 2025 -

The Bangkok Post And The Ongoing Struggle For Transgender Equality

May 10, 2025

The Bangkok Post And The Ongoing Struggle For Transgender Equality

May 10, 2025 -

The Impact Of Trumps Executive Orders On The Transgender Community A Call For Stories

May 10, 2025

The Impact Of Trumps Executive Orders On The Transgender Community A Call For Stories

May 10, 2025 -

Examining Transgender Equality Issues Highlighted By The Bangkok Post

May 10, 2025

Examining Transgender Equality Issues Highlighted By The Bangkok Post

May 10, 2025 -

The Bangkok Post And The Fight For Transgender Equality In Thailand

May 10, 2025

The Bangkok Post And The Fight For Transgender Equality In Thailand

May 10, 2025