Palantir Technologies Stock: Investment Potential And Future Outlook

Table of Contents

Palantir Technologies is a data analytics company specializing in providing sophisticated software platforms – Gotham and Foundry – to government and commercial clients worldwide. These platforms empower organizations to integrate and analyze massive datasets, uncovering valuable insights and driving better decision-making. This article aims to analyze the factors influencing Palantir Technologies stock, helping you assess its investment viability.

Palantir's Business Model and Competitive Advantage

H3: Government Contracts and Revenue Streams

Palantir's success hinges significantly on its substantial government contracts. These contracts, secured with both US and international agencies, provide a stable revenue stream and a strong foundation for growth. "Palantir government contracts" contribute a considerable portion of the company's overall revenue.

- Examples of government clients: CIA, US Army, various international defense and intelligence agencies.

- Types of contracts: Primarily long-term contracts ensuring consistent revenue streams, with some short-term projects supplementing this base.

- Revenue projections based on government contracts: While specific figures are subject to change and vary based on contract renewals and new awards, government contracts represent a significant and relatively predictable component of Palantir's revenue forecasts. Analyzing government spending on data analytics offers insight into potential future contract opportunities.

H3: Commercial Market Expansion and Growth Potential

Beyond its government clientele, Palantir's expansion into the commercial sector offers substantial growth potential. The company is actively pursuing partnerships across diverse industries, capitalizing on the increasing demand for advanced data analytics. The term "Palantir commercial clients" is rapidly expanding to include numerous organizations seeking to leverage Palantir's technology for improved efficiency and decision-making.

- Examples of successful commercial partnerships: Partnerships with leading financial institutions, healthcare providers, and manufacturing companies demonstrate Palantir's ability to adapt its platform across diverse sectors.

- Industry verticals targeted: Palantir is actively targeting sectors like finance, healthcare, aerospace, and manufacturing, reflecting the broad applicability of its data analytics solutions.

- Potential for future growth in the commercial sector: The vast and rapidly growing data analytics market size presents significant opportunities for Palantir to increase its commercial revenue streams.

H3: Technological Innovation and Future-Proofing

Palantir's ongoing investment in research and development (R&D) is crucial for maintaining its competitive edge. The company continually adapts to evolving technological landscapes, integrating cutting-edge technologies into its platforms. The terms "Palantir Foundry" and "Palantir Gotham" represent the core of its technological prowess. The incorporation of AI in data analytics further enhances the power and adaptability of its offerings.

- Key technologies used by Palantir: Artificial intelligence (AI), machine learning (ML), and advanced data visualization are integral to Palantir's platforms.

- Planned future product developments: Palantir is actively exploring new applications of its technology and developing new features to further enhance its platform's capabilities.

- Examples of successful technological innovations: Continuous improvements in the user interface, enhanced data integration capabilities, and the integration of new analytical tools demonstrate Palantir's commitment to innovation.

Financial Performance and Valuation

H3: Revenue Growth and Profitability

Analyzing Palantir's financial statements reveals a complex picture. While revenue growth has been significant, profitability remains a key focus area. Examining metrics such as revenue figures, profit margins, and key financial ratios (like P/E ratio and debt-to-equity ratio) is essential for assessing financial health.

- Revenue figures for the past few years: Examining historical revenue trends provides insight into growth rates and potential future performance.

- Profit margins: Tracking profit margins helps determine the company's efficiency and its ability to translate revenue into profit.

- Key financial ratios: Analyzing ratios such as the P/E ratio and debt-to-equity ratio helps assess Palantir's valuation relative to its industry peers and its overall financial risk profile. "Palantir earnings" reports provide valuable data for this assessment.

H3: Valuation and Investment Metrics

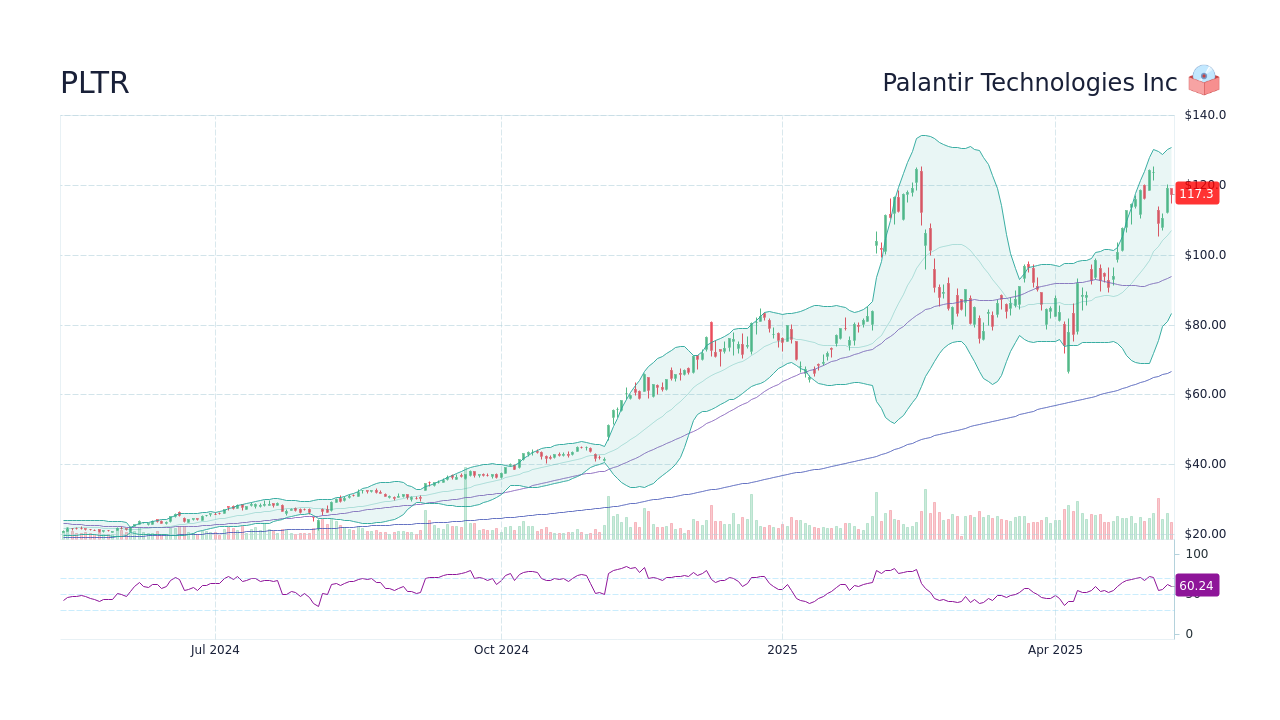

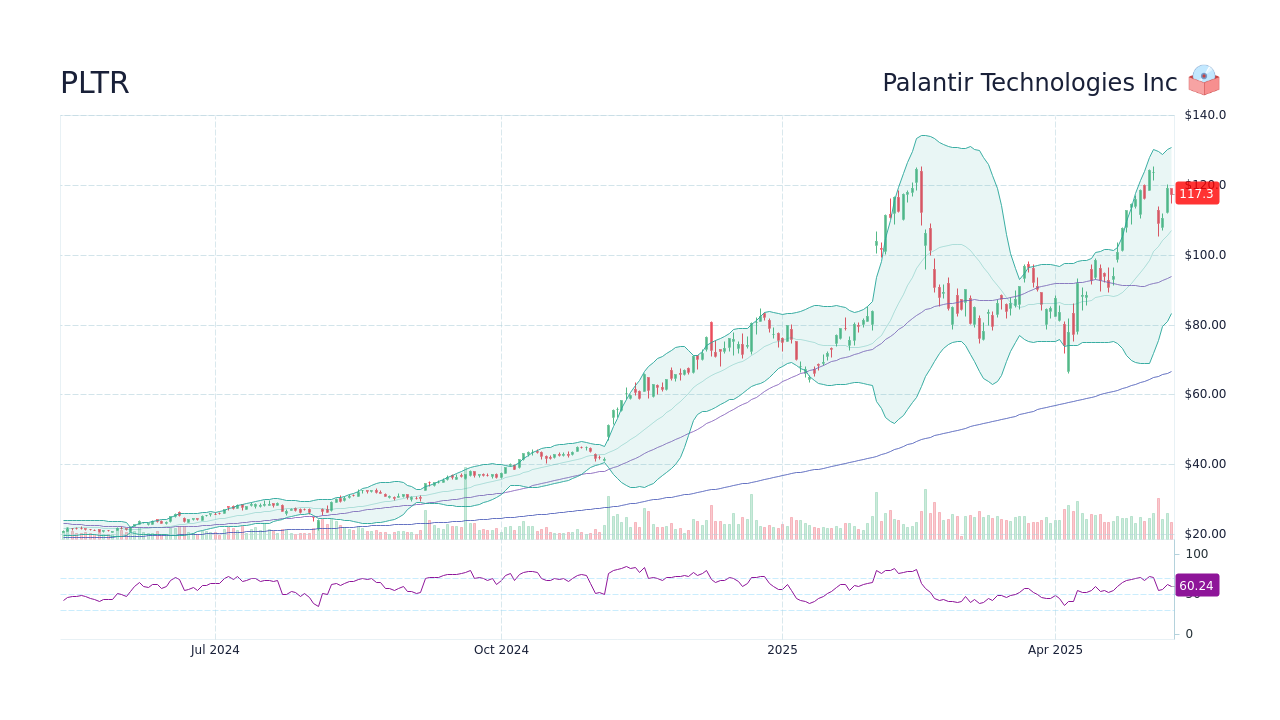

Determining the "Palantir stock price" and its valuation requires a detailed analysis comparing Palantir with its competitors. Metrics like the price-to-sales ratio and various valuation models help estimate potential upside or downside.

- Comparison with similar companies: Comparing Palantir's valuation multiples to those of its competitors in the data analytics space provides context for its current valuation.

- Price-to-sales ratio: This ratio helps assess the company's valuation relative to its revenue generation.

- Potential upside/downside based on various valuation models: Different valuation models can provide a range of possible future stock prices, highlighting both the potential rewards and risks.

Risks and Challenges

H3: Dependence on Government Contracts

A significant risk for Palantir is its dependence on government contracts. "Palantir government contract risk" includes potential budget cuts or changes in government policy that could negatively impact revenue.

- Potential impacts of reduced government spending: Reduced government funding could lead to decreased contract awards and potentially impact revenue growth.

- Diversification strategies to mitigate this risk: Palantir's expansion into the commercial sector is a key strategy to lessen its reliance on government contracts.

H3: Competition and Market Saturation

The data analytics market is competitive, with several established players. "Palantir competitors" include companies offering similar data analytics solutions.

- Key competitors: Identifying and analyzing the strengths and weaknesses of competitors provides a clearer picture of Palantir's market position.

- Competitive advantages and disadvantages: Palantir's advanced technology and strong government relationships represent key advantages, but the potential for market saturation remains a risk.

- Strategies to maintain a competitive edge: Continuous innovation, strategic partnerships, and expansion into new markets are critical for maintaining a competitive advantage.

H3: Geopolitical Risks

Geopolitical events can significantly impact Palantir's business and stock price. "Palantir geopolitical risk" includes factors such as international conflicts and changes in global political landscapes.

- Examples of geopolitical risks: International sanctions, trade wars, and political instability in regions where Palantir operates can impact revenue and profitability.

- Strategies to mitigate geopolitical risks: Diversifying its client base and operations across different regions is crucial for mitigating geopolitical risk.

Conclusion

Palantir Technologies stock presents a complex investment proposition. While the company boasts strong technology, significant government contracts, and expanding commercial operations, its dependence on government contracts and the competitive data analytics market pose substantial risks. Analyzing "Palantir financial statements" and "Palantir stock valuation" are crucial for understanding its financial health and future potential. Thorough research is essential before making any investment decisions. Remember to consult reliable financial news sites and analyst reports to inform your strategy. Invest responsibly and make informed choices about Palantir Technologies Stock.

Featured Posts

-

Unexpected Reunion In High Potential Finale Abc Series Actors Return After 7 Years

May 10, 2025

Unexpected Reunion In High Potential Finale Abc Series Actors Return After 7 Years

May 10, 2025 -

Uk Set To Implement Stricter Immigration Policies English Fluency A Key Factor

May 10, 2025

Uk Set To Implement Stricter Immigration Policies English Fluency A Key Factor

May 10, 2025 -

Why The Federal Reserve Remains Hesitant To Lower Interest Rates

May 10, 2025

Why The Federal Reserve Remains Hesitant To Lower Interest Rates

May 10, 2025 -

French Minister Proposes European Nuclear Shield Collaboration

May 10, 2025

French Minister Proposes European Nuclear Shield Collaboration

May 10, 2025 -

Punjab Launches Technical Training Programme For Transgender Individuals

May 10, 2025

Punjab Launches Technical Training Programme For Transgender Individuals

May 10, 2025