PBOC Daily Yuan Support Below Estimates: A First In 2024

Table of Contents

H2: Understanding the PBOC's Daily Yuan Fixing Mechanism

The PBOC's daily fixing mechanism plays a crucial role in managing the Yuan's value against other major currencies, primarily the US dollar. This daily reference rate, set each morning, acts as a benchmark for the currency throughout the trading day. The PBOC's intervention in the foreign exchange market influences the Yuan's exchange rate, and this intervention is a key element of China's monetary policy. While the PBOC considers market forces, its decision is also influenced by various factors including:

- The mechanics of the daily fixing: The PBOC considers a range of factors, including the previous day's closing rate, the movement of other major currencies, and overall market sentiment. A complex algorithm, not fully disclosed to the public, combines these data points to arrive at the daily fixing.

- The historical role of the PBOC: The PBOC has historically played a significant role in managing the Yuan's value, often intervening to prevent sharp fluctuations. This intervention has involved buying or selling Yuan in the foreign exchange market to influence the exchange rate.

- Implications of a weaker Yuan: A weaker Yuan, resulting from lower daily support, can boost Chinese exports by making them cheaper for international buyers. However, it also increases the cost of imports, potentially fueling inflation. This delicate balance is a constant consideration for the PBOC.

H2: Analyzing the Discrepancy: Why was the Support Below Estimates?

The lower-than-expected Yuan support raises several important questions. Several factors could be at play:

- External factors: The strengthening US dollar, driven by aggressive monetary policy from the Federal Reserve, puts downward pressure on many global currencies, including the Yuan. Global economic uncertainties and geopolitical tensions further complicate the situation.

- Internal economic pressures: China's economic growth has slowed recently, impacting investor confidence and potentially leading to capital outflows. Weakening economic indicators, like lower-than-expected industrial production and retail sales, may have influenced the PBOC's decision.

- US monetary policy impact: The US Federal Reserve’s interest rate hikes have made US dollar-denominated assets more attractive, potentially encouraging capital flight from China and putting pressure on the Yuan.

H2: Market Reactions and Implications for Investors

The PBOC's move immediately impacted the foreign exchange market, causing volatility in the Yuan's value. The implications for investors and businesses are significant:

- Short-term and long-term effects: The short-term impact is likely to be increased volatility in the currency market. Long-term effects depend on the future course of the Chinese economy and the PBOC's response. A sustained weakening of the Yuan could have significant consequences for global trade.

- Impact on Chinese exports and imports: A weaker Yuan makes Chinese exports cheaper, potentially benefiting exporters. However, it makes imports more expensive, increasing inflationary pressures and potentially impacting consumer spending.

- Investor strategy adaptation: Investors need to carefully reassess their risk profiles and diversify their portfolios, considering the increased uncertainty surrounding the Yuan. Hedging strategies may become increasingly crucial for those with Yuan-denominated assets.

H3: Potential Future Scenarios for the Yuan

Predicting the future value of the Yuan is challenging, but considering the current economic climate and the PBOC’s potential actions, several scenarios are possible. A continued weakening is plausible if economic headwinds persist. However, the PBOC may intervene more aggressively to stabilize the Yuan if the depreciation becomes too rapid. The ongoing situation necessitates close monitoring of economic indicators and PBOC policy announcements for a clearer outlook.

3. Conclusion:

The PBOC's decision to set daily Yuan support below estimates represents a notable shift, marking a significant departure from the trends observed earlier in 2024. The underlying causes are likely multifaceted, involving a combination of external factors like the strengthening US dollar and internal economic pressures in China. The market reacted with increased volatility, highlighting the importance of closely monitoring the situation. To navigate this uncertainty, it's vital to monitor the PBOC's daily Yuan support, stay updated on the RMB exchange rate, and track the Yuan's performance against other major currencies. By staying informed, investors and businesses can better adapt their strategies and manage the risks associated with fluctuations in the Chinese currency.

Featured Posts

-

Knicks Narrow Escape A Look At The Overtime Loss

May 16, 2025

Knicks Narrow Escape A Look At The Overtime Loss

May 16, 2025 -

Adakar Tam Krwz Awr Ayk Mdah Ka Hyran Kn Waqeh Jwtwn Pr Pawn

May 16, 2025

Adakar Tam Krwz Awr Ayk Mdah Ka Hyran Kn Waqeh Jwtwn Pr Pawn

May 16, 2025 -

Chinas Role In The Fentanyl Epidemic A Former Us Envoys Assessment

May 16, 2025

Chinas Role In The Fentanyl Epidemic A Former Us Envoys Assessment

May 16, 2025 -

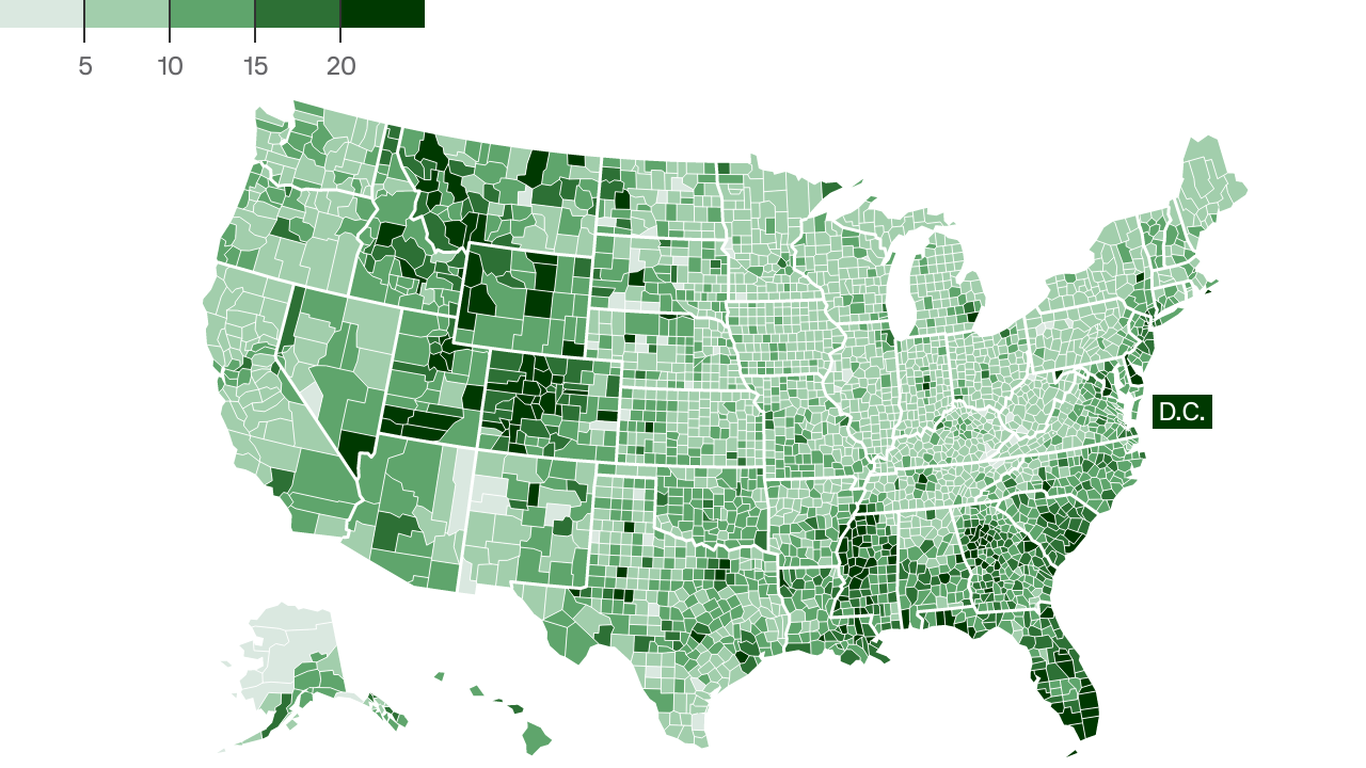

Mapping The Rise Of New Business Hotspots Across The Nation

May 16, 2025

Mapping The Rise Of New Business Hotspots Across The Nation

May 16, 2025 -

Albanese And Duttons Election Strategies Strengths And Weaknesses

May 16, 2025

Albanese And Duttons Election Strategies Strengths And Weaknesses

May 16, 2025