Pension Law Reform In Colombia Faces Setback Due To Corruption Case

Table of Contents

The Corruption Case and its Implications

A major corruption scandal, currently under investigation by the Fiscalía General de la Nación (Colombia's Attorney General's Office), has cast a long shadow over the proposed pension law reform. Allegations of bribery and influence peddling involving several high-ranking officials and legislators have emerged, significantly delaying the legislative process. While the full extent of the scandal is still unfolding, initial reports suggest that millions of pesos may have been exchanged to influence the wording and passage of key aspects of the pension reform bill. This has created a climate of distrust and uncertainty, jeopardizing the entire reform effort.

- Key players implicated: While investigations are ongoing, several individuals, including a former senator and several legislative aides, have been publicly named in connection with the alleged scheme. Further details are expected as the investigation progresses.

- Alleged illegal activities: The alleged activities involve the exchange of significant sums of money in exchange for favorable amendments to the pension reform bill, including changes related to investment regulations and benefit distribution.

- Potential financial losses: The full financial impact of the alleged corruption is yet to be determined, but early estimates suggest significant losses to the public purse, potentially impacting the long-term sustainability of the pension system.

- Erosion of public trust: The scandal has severely damaged public trust in the government’s ability to manage the pension system effectively and implement necessary reforms. This distrust poses a substantial obstacle to future legislative efforts.

Current State of Colombia's Pension System

Colombia's pension system is a hybrid model consisting of both public and private components. The public system, administered by Colpensiones, is primarily defined benefit, while private pension funds (fondos privados) operate under a defined contribution model. While the system has provided retirement income for many Colombians, it faces significant challenges.

- Types of pension plans: Colombians can contribute to either the public Colpensiones system or a private AFP (Administradoras de Fondos de Pensiones). Each has its own structure and benefit calculation methodologies.

- Funding challenges: The aging population and decreasing birth rates are creating an unsustainable demographic imbalance, straining the public system and requiring significant adjustments to maintain solvency.

- Impact of aging population: The increasing number of retirees compared to the working-age population is putting immense pressure on the system's ability to meet its obligations.

- Coverage inequalities: Access to adequate pension coverage remains uneven, with significant disparities between urban and rural populations, and across different socioeconomic groups.

Proposed Changes in the Pension Law Reform

The now-stalled pension reform aimed to address the system’s weaknesses by introducing several key changes. These included adjustments to the retirement age, modifications to the formula for benefit calculations, and enhanced regulation of private pension funds.

- Main objectives: The reform sought to improve the financial sustainability of the pension system, enhance coverage, and increase the fairness of benefit distribution.

- Specific proposed changes: The proposed changes included gradual increases in the retirement age, adjustments to the replacement rate (the percentage of pre-retirement income received in pension benefits), and stricter regulations for private pension fund management.

- Anticipated effects: The reform aimed to reduce the financial burden on the public system while improving the long-term security of pensions for future generations.

- Potential consequences: While some saw the reform as necessary for the system's future, others expressed concerns about potential negative consequences for low-income workers and retirees.

The Path Forward for Pension Reform in Colombia

Rebuilding public trust and moving forward with pension reform requires a multi-pronged approach. The government must demonstrate a clear commitment to transparency and accountability.

- Improving transparency and accountability: Independent oversight of the pension system, strengthened anti-corruption measures, and public access to information are crucial steps.

- Strengthening regulatory frameworks: More robust regulations are needed to govern private pension funds, ensuring responsible investment practices and protecting contributors' assets.

- Public engagement and consultation: Meaningful dialogue with stakeholders, including retirees, workers, and experts, is essential to develop a reform that addresses the needs and concerns of all Colombians.

- Alternative strategies: Exploring alternative models for pension provision, such as strengthening social security programs, could be considered as complementary measures.

Conclusion

The corruption scandal surrounding Colombia's pension law reform represents a significant setback for the nation's efforts to secure the financial future of its citizens. The delay threatens to further destabilize an already fragile system and erode public trust in the government’s ability to address critical social issues. The need for comprehensive and transparent Pension Law Reform in Colombia remains urgent.

Understanding the complexities of the Pension Law Reform in Colombia and the impact of corruption is crucial. Staying informed about the ongoing investigations and future legislative developments is essential for all Colombians concerned about their retirement security. Continue to follow reputable news sources for updates on the future of pension reform in Colombia and advocate for transparent and accountable governance in the pension system.

Featured Posts

-

San Jose Earthquakes Fall To Columbus Crew 2 1

May 13, 2025

San Jose Earthquakes Fall To Columbus Crew 2 1

May 13, 2025 -

Natural Fiber Composites Market Global Forecast To 2029

May 13, 2025

Natural Fiber Composites Market Global Forecast To 2029

May 13, 2025 -

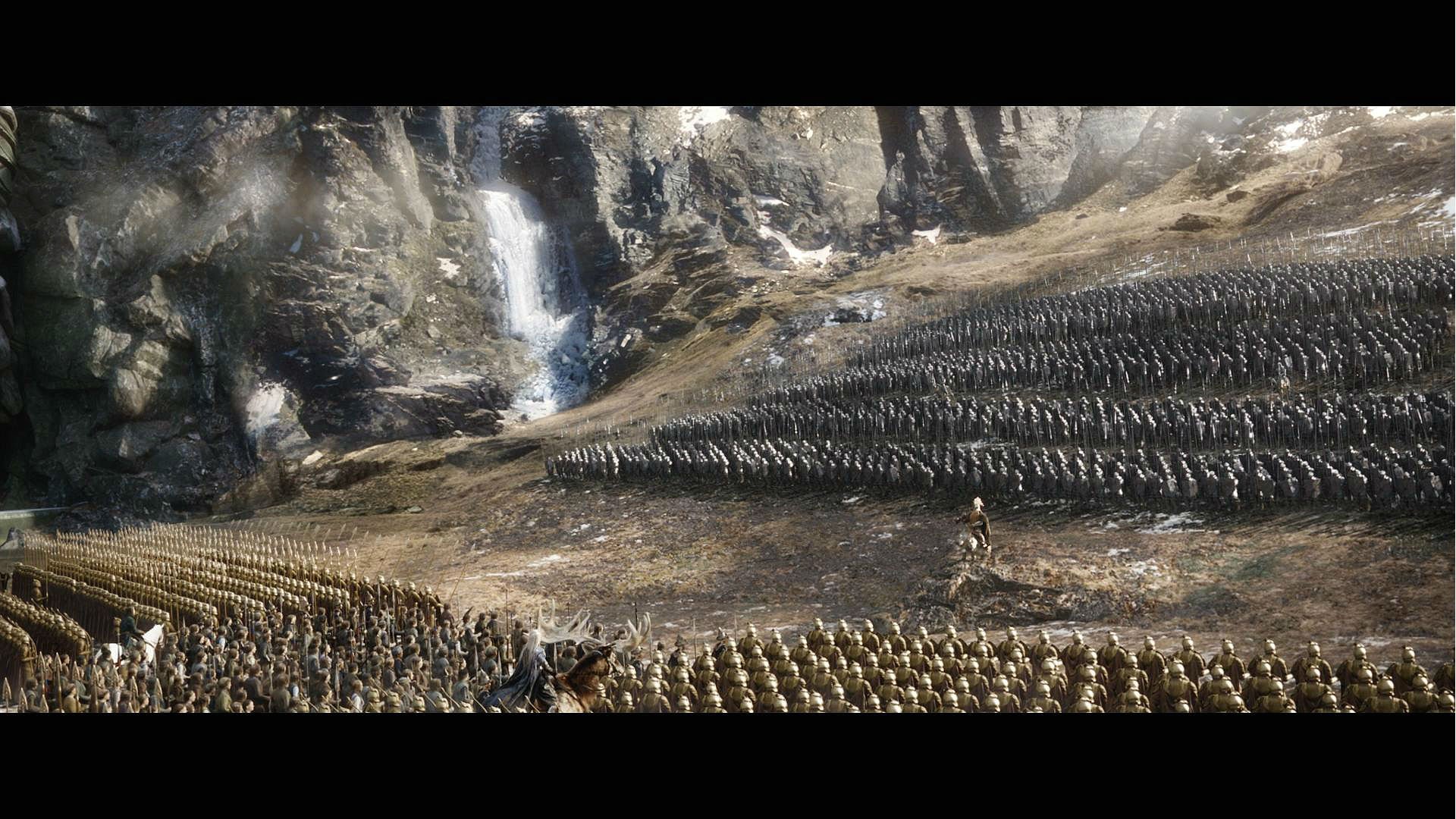

Exploring The Epic Confrontation The Hobbit The Battle Of The Five Armies

May 13, 2025

Exploring The Epic Confrontation The Hobbit The Battle Of The Five Armies

May 13, 2025 -

Atalanta Vs Venezia Prediksi Akurat Susunan Pemain Statistik Dan Head To Head

May 13, 2025

Atalanta Vs Venezia Prediksi Akurat Susunan Pemain Statistik Dan Head To Head

May 13, 2025 -

Ovechkins Historic Night 894 Goals Tying Gretzkys Record

May 13, 2025

Ovechkins Historic Night 894 Goals Tying Gretzkys Record

May 13, 2025