Personal Loan Interest Rates: Your Guide To Finding The Best Deal

Table of Contents

Factors Affecting Personal Loan Interest Rates

Several crucial factors determine the personal loan interest rates you'll receive. Understanding these factors empowers you to improve your chances of securing a favorable rate.

Credit Score: The Foundation of Your Rate

Your credit score is arguably the most significant factor influencing your personal loan interest rates. Lenders use your credit score to assess your creditworthiness – essentially, how likely you are to repay the loan.

- High credit score = lower rates: A higher credit score demonstrates a history of responsible borrowing, making you a lower-risk borrower. Lenders are more willing to offer you lower APRs (Annual Percentage Rates).

- Ways to improve credit score: Paying bills on time, keeping credit utilization low (the amount of credit you use compared to your total available credit), and avoiding new credit applications are key steps to improving your score.

- Checking your credit report: Regularly review your credit report from agencies like Equifax, Experian, and TransUnion to identify and address any errors that could negatively impact your score. A credit score above 750 typically qualifies you for the lowest personal loan interest rates.

Debt-to-Income Ratio (DTI): A Measure of Your Financial Health

Your debt-to-income ratio (DTI) measures the percentage of your monthly income that goes towards debt payments. Lenders use this to evaluate your ability to manage additional debt.

- Definition of DTI: DTI is calculated by dividing your total monthly debt payments by your gross monthly income.

- How lenders use DTI: A high DTI indicates that a larger portion of your income is already committed to debt, making you appear riskier to lenders. This often results in higher interest rates or loan denials.

- Strategies to lower DTI: Reducing existing debt, increasing your income, or both, can improve your DTI and improve your chances of getting a better interest rate. For example, if you consolidate high-interest debts, you may lower your monthly payments and your DTI.

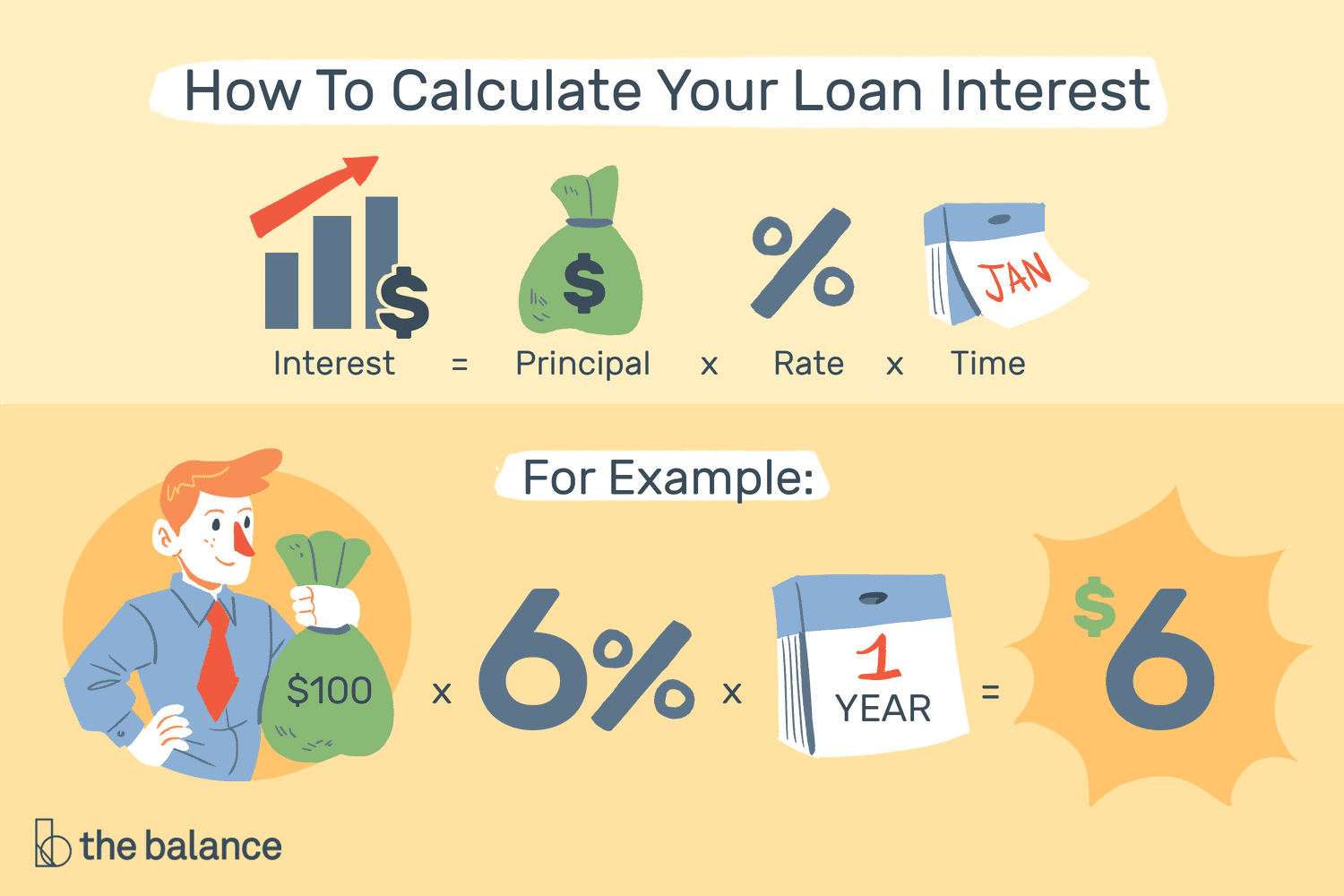

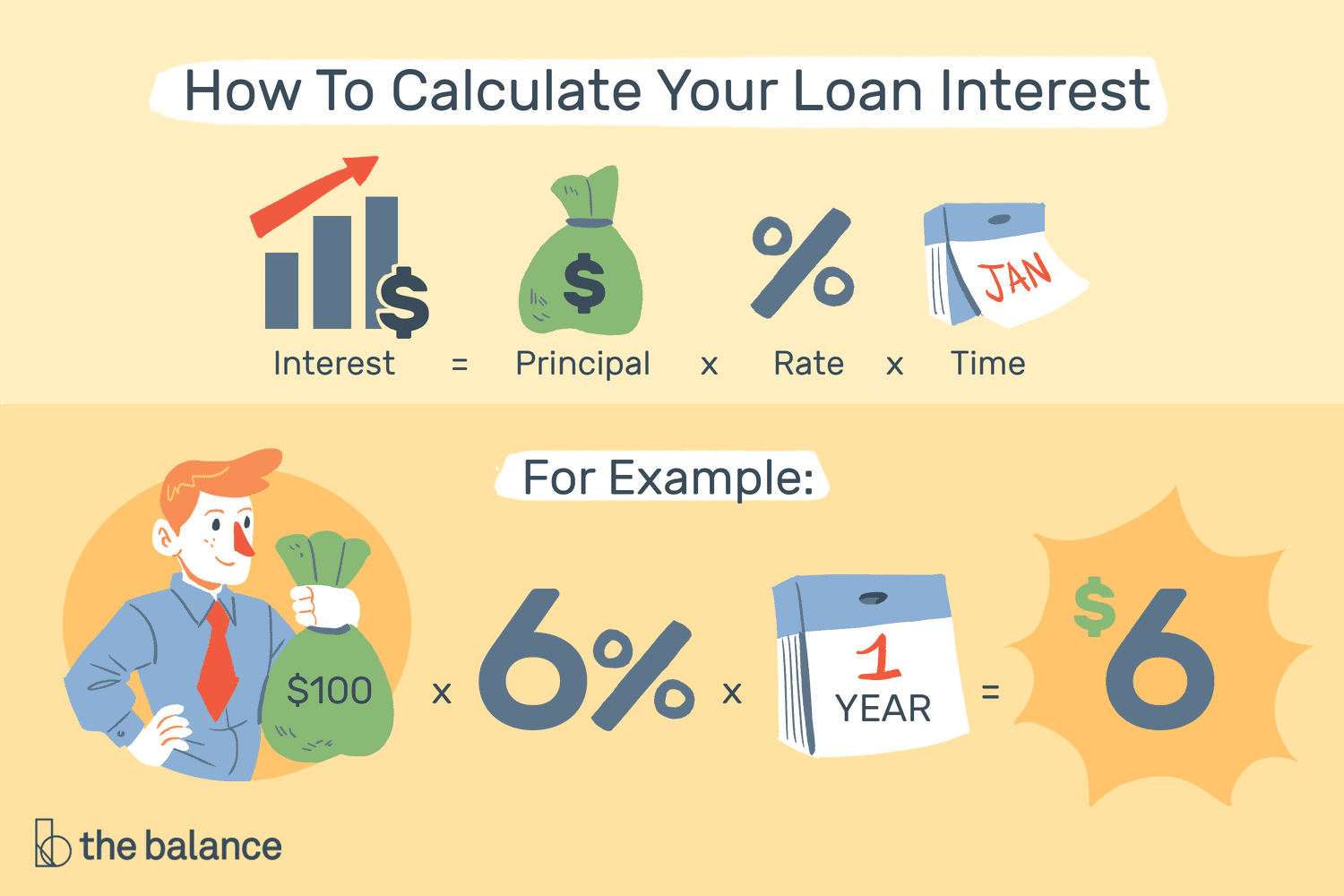

Loan Amount and Term: Balancing Payments and Interest

The amount you borrow and the loan term (the length of time you have to repay the loan) also impact your interest rate.

- Longer loan terms = higher total interest: While monthly payments are lower with longer terms, you'll end up paying significantly more in interest over the life of the loan.

- Shorter loan terms = higher monthly payments: Shorter loan terms mean higher monthly payments but considerably less interest paid overall. A shorter loan term can also positively influence your credit score by reducing your credit utilization quicker.

- Larger loan amounts might attract slightly higher rates due to the increased risk for the lender. Carefully consider the trade-off between a manageable monthly payment and minimizing total interest.

Lender Type: Exploring Different Options

Different lenders – banks, credit unions, and online lenders – offer varying personal loan interest rates and terms.

- Banks vs. credit unions: Banks often have broader eligibility requirements but might offer less personalized service or slightly higher rates compared to credit unions. Credit unions often cater to their members with potentially lower rates and fees.

- Online lenders vs. traditional lenders: Online lenders often provide a more streamlined application process and may offer competitive rates, but it's crucial to research their reputation and check for hidden fees.

- Comparison of fees and services: Compare not only interest rates but also origination fees, late payment fees, and other associated costs before making a decision.

How to Find the Best Personal Loan Interest Rates

Finding the best personal loan interest rates requires proactive effort and smart comparison shopping.

Shop Around and Compare: The Power of Comparison

Don't settle for the first offer you receive. Compare offers from multiple lenders to secure the most favorable terms.

- Use online comparison tools: Several reputable websites allow you to compare personal loan offers from various lenders simultaneously, streamlining the process.

- Check interest rates and fees carefully: Don't just focus on the interest rate; carefully examine all fees associated with the loan. Compare the Annual Percentage Rate (APR), which includes interest and fees, for a truly accurate comparison.

- Read the fine print: Thoroughly review all loan documents before signing to understand the terms and conditions fully.

Pre-qualify for Loans: A Credit-Score-Friendly Strategy

Pre-qualifying for loans lets you check your eligibility and see potential interest rates without impacting your credit score (only a soft credit inquiry is performed).

- Understanding pre-qualification: Pre-qualification gives you a preliminary idea of the rates you qualify for, allowing you to compare offers more effectively.

- Finding lenders who offer pre-qualification: Many lenders offer pre-qualification options on their websites.

- Comparing offers after pre-qualification: Once you have several pre-qualification offers, you can focus your time on applying for the loans with the best terms.

Negotiate with Lenders: Improving Your Chances

Don't be afraid to negotiate with lenders for a better interest rate. A strong financial standing provides leverage.

- Strong credit history as leverage: Your excellent credit score is your strongest negotiating tool.

- Offering a larger down payment: A larger down payment can reduce the lender's risk and potentially lead to a lower interest rate.

- Comparing competing offers: Having multiple competing offers in hand gives you a stronger position to negotiate.

Avoiding Personal Loan Scams: Protecting Yourself

Be wary of predatory lending practices. Knowing the red flags helps you avoid scams.

Red Flags to Watch Out For: Identifying Potential Scams

Beware of these warning signs:

- Unusually low interest rates: Offers that seem too good to be true often are.

- High upfront fees: Legitimate lenders rarely charge exorbitant upfront fees.

- Aggressive sales tactics: High-pressure sales tactics should raise suspicion.

- Lack of transparency: Avoid lenders who are unclear about their fees, terms, and conditions.

Resources for Safe Lending: Finding Reputable Lenders

For safe lending, consider these resources:

- Reputable online lenders: Research and choose lenders with positive reviews and transparent practices.

- Credit unions: Credit unions often offer competitive rates and personalized service to their members.

- Banks: Established banks generally have a robust reputation, although their rates may not always be the lowest.

- Financial advisors: A financial advisor can provide guidance on choosing a suitable loan and lender.

Conclusion

Securing the best personal loan interest rates requires understanding the factors that influence them, comparing offers from multiple lenders, and avoiding potential scams. Your credit score plays a pivotal role, so maintaining a healthy credit history is crucial. By shopping around, pre-qualifying for loans, and negotiating effectively, you can significantly reduce your borrowing costs. Don't settle for a high interest rate! Use this guide to find the best personal loan interest rates and save money on your next loan.

Featured Posts

-

The End Of Rent Control A Threat To Tenant Living Conditions

May 28, 2025

The End Of Rent Control A Threat To Tenant Living Conditions

May 28, 2025 -

Amorims Shock Plan Selling A Man Utd Star Against Ratcliffes Will

May 28, 2025

Amorims Shock Plan Selling A Man Utd Star Against Ratcliffes Will

May 28, 2025 -

Irjen Daniel Pimpin Sertijab 7 Perwira Menengah Polda Bali Detail Dan Pesan Khususnya

May 28, 2025

Irjen Daniel Pimpin Sertijab 7 Perwira Menengah Polda Bali Detail Dan Pesan Khususnya

May 28, 2025 -

Man City And Napoli Vie For Serie A Midfielder Former Man Utd Player

May 28, 2025

Man City And Napoli Vie For Serie A Midfielder Former Man Utd Player

May 28, 2025 -

Bert Natters De Nadagen Van De Nazis In Een Krachtige Moeilijke Roman

May 28, 2025

Bert Natters De Nadagen Van De Nazis In Een Krachtige Moeilijke Roman

May 28, 2025