Personal Loan Rates: Compare & Find The Best Deal Today

Table of Contents

Understanding Personal Loan Interest Rates

Understanding personal loan interest rates is crucial to securing the best deal. The Annual Percentage Rate (APR) represents the yearly cost of borrowing, including interest and any fees. A lower APR means you'll pay less overall. Personal loans typically offer either fixed or variable interest rates.

- Fixed Interest Rates: These remain consistent throughout the loan term, providing predictable monthly payments. This offers stability and allows for better budgeting.

- Variable Interest Rates: These fluctuate based on market conditions. While they might start lower, they can increase over time, leading to unpredictable payments.

Several factors significantly impact your personal loan interest rate:

- Credit Score: Your credit history is a primary determinant. A higher credit score (good credit) typically translates to lower interest rates.

- Loan Amount: Larger loan amounts often come with higher interest rates.

- Loan Term: Shorter loan terms usually mean higher monthly payments but lower overall interest paid because you're paying off the loan principal quicker. Longer terms result in lower monthly payments but higher total interest.

- Debt-to-Income Ratio: Lenders assess your income against your existing debts. A lower debt-to-income ratio strengthens your application.

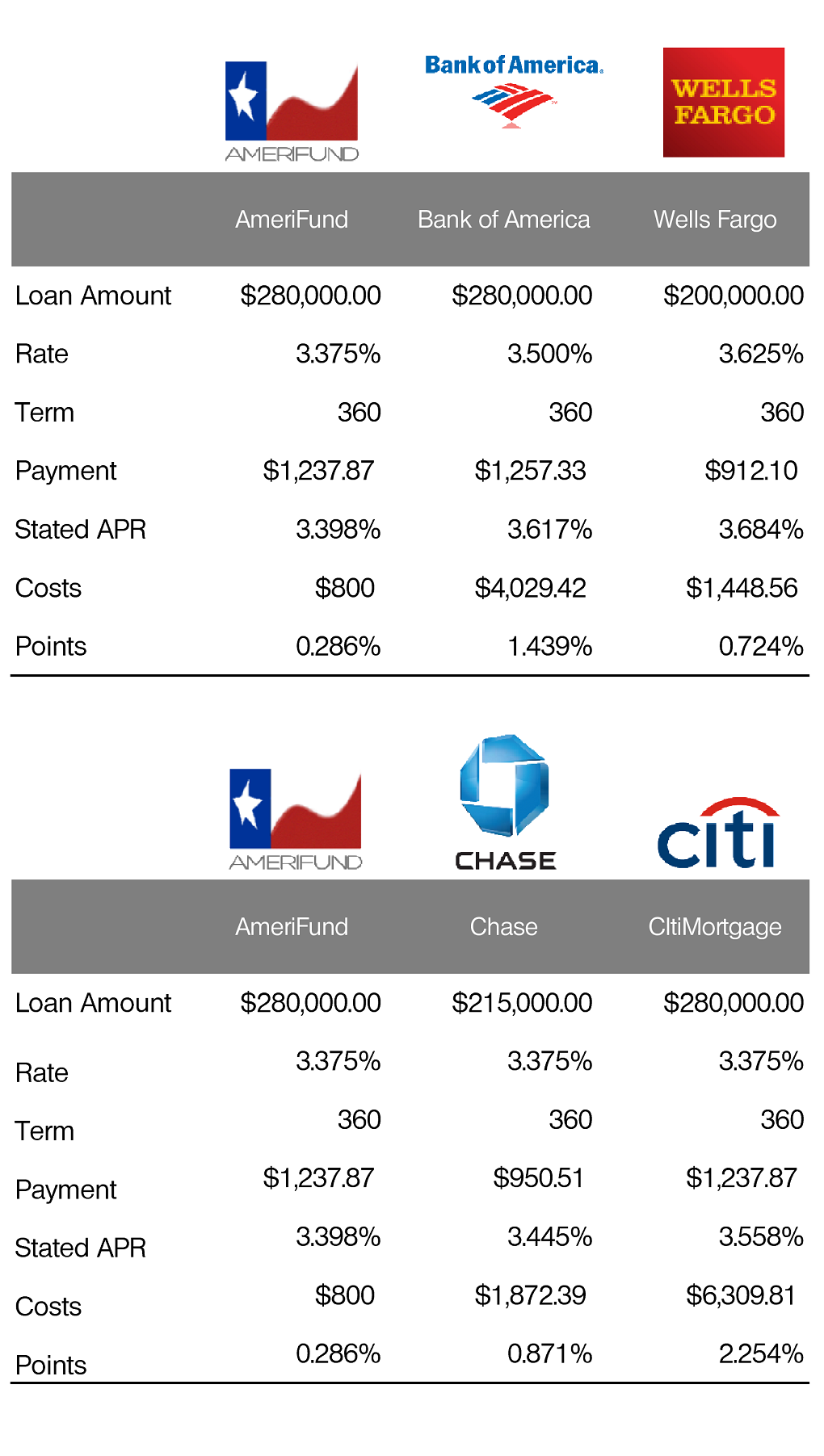

Comparing Personal Loan Offers from Different Lenders

Comparing offers from multiple lenders—banks, credit unions, and online lenders—is paramount to securing the best personal loan rates. Don't settle for the first offer you receive.

- Use Online Comparison Tools: Several websites provide tools to compare personal loan rates from various lenders simultaneously. These tools save you considerable time and effort.

- Read the Fine Print: Carefully review all loan documents for hidden fees, prepayment penalties, and other charges that can significantly impact the overall cost.

When comparing offers, pay close attention to:

- APR: The most important factor, indicating the true cost of borrowing.

- Loan Terms: Compare repayment periods to find a plan that fits your budget.

- Fees: Be aware of origination fees, late payment fees, and other potential charges.

- Lender Reputation: Check online reviews and ratings to gauge the lender's trustworthiness and customer service quality.

Improving Your Chances of Getting a Lower Personal Loan Rate

Taking steps to improve your creditworthiness before applying can significantly improve your chances of securing a lower personal loan rate.

- Improve Your Credit Score: Paying bills on time, keeping credit utilization low (the amount of credit you use compared to your total credit limit), and maintaining a long credit history are key to improving your credit score.

- Consider a Co-signer: A co-signer with good credit can strengthen your application, especially if your credit history is limited or imperfect.

- Shop Around: Comparing offers from multiple lenders ensures you get the most competitive rates.

Before applying:

- Check your credit report: Look for errors and dispute them if found.

- Pay down existing debts: Lowering your debt-to-income ratio improves your chances of approval.

- Build positive credit history: Consistently making on-time payments demonstrates responsible credit management.

- Secured Loan: If your credit is poor, a secured loan (backed by collateral) may be an option, although it carries the risk of losing the collateral if you default.

Choosing the Right Personal Loan for Your Needs

Different types of personal loans exist, each with its own features and requirements.

- Unsecured Loans: These don't require collateral, making them easier to obtain but often carrying higher interest rates.

- Secured Loans: These require collateral (like a car or savings account), reducing the lender's risk and potentially resulting in lower interest rates.

- Peer-to-Peer Loans: These are offered through online platforms connecting borrowers with individual lenders.

Choose a loan amount and repayment term that you can comfortably afford.

- Purpose of the loan: Borrow only what you need for your specific purpose.

- Repayment plan: Create a realistic budget to ensure timely repayments.

- Avoid overborrowing: Don't borrow more than you can comfortably repay.

- Factor in monthly expenses: Carefully consider your monthly expenses when determining loan affordability.

Conclusion: Find the Best Personal Loan Rate Today

Securing a favorable personal loan rate involves understanding interest rates, comparing offers from multiple lenders, and improving your creditworthiness. Remember to carefully compare APRs, loan terms, and fees before committing to a loan. Responsible borrowing and budgeting are essential to successful loan repayment.

Don't settle for a high personal loan rate! Start comparing personal loan rates today and find the best deal for your financial needs. Use online comparison tools or contact lenders directly to begin your search for the perfect personal loan. [Link to comparison website 1] [Link to comparison website 2] [Link to reputable lender]

Featured Posts

-

Futbol Efsanesi Ronaldo Nun Emeklilik Zamani Geldi Mi Hasselbaink In Analizi

May 28, 2025

Futbol Efsanesi Ronaldo Nun Emeklilik Zamani Geldi Mi Hasselbaink In Analizi

May 28, 2025 -

Man Utd News 50m Stars House Sale Hints At Departure

May 28, 2025

Man Utd News 50m Stars House Sale Hints At Departure

May 28, 2025 -

Pirates Announce Paul Skenes As Opening Day Pitcher

May 28, 2025

Pirates Announce Paul Skenes As Opening Day Pitcher

May 28, 2025 -

Kanye Wests Post Bianca Censori Life A Look At Recent Developments

May 28, 2025

Kanye Wests Post Bianca Censori Life A Look At Recent Developments

May 28, 2025 -

Wes Anderson And The Phoenician A Venetian Palazzo Aesthetic

May 28, 2025

Wes Anderson And The Phoenician A Venetian Palazzo Aesthetic

May 28, 2025

Latest Posts

-

Understanding Primera Natural Bladder Control Solutions For Women

May 30, 2025

Understanding Primera Natural Bladder Control Solutions For Women

May 30, 2025 -

Kyriaki 16 3 Ti Na Deite Stin Tileorasi

May 30, 2025

Kyriaki 16 3 Ti Na Deite Stin Tileorasi

May 30, 2025 -

Effective Natural Remedies For Womens Bladder Control Primera

May 30, 2025

Effective Natural Remedies For Womens Bladder Control Primera

May 30, 2025 -

Plires Programma Kyriakis 16 Martioy

May 30, 2025

Plires Programma Kyriakis 16 Martioy

May 30, 2025 -

Addressing Bladder Issues Naturally Primera For Women

May 30, 2025

Addressing Bladder Issues Naturally Primera For Women

May 30, 2025