Planning For The Future In A Low-Inflation Environment: A Podcast

Table of Contents

We'll explore practical tips and discuss specific strategies for investing, retirement planning, and budgeting in a low-inflation world. Our podcast delves into specific topics like optimizing your investment portfolio for low-return environments, maximizing Social Security benefits, and developing a robust emergency fund. This article will give you a preview of the key takeaways.

A low-inflation environment, often characterized by a low inflation rate (generally below 2%) and sometimes even deflationary pressures, significantly impacts personal finance. Low inflation typically leads to low interest rates, making traditional savings accounts less attractive and requiring a more strategic approach to investment and retirement planning.

This article aims to provide you with actionable strategies for effective financial planning in a low-inflation environment, empowering you to build a secure financial future regardless of economic headwinds.

Investing Strategies in a Low-Inflation Environment

Diversification is Key

In a low-inflation environment, where returns on traditional investments may be muted, portfolio diversification is more critical than ever. Spreading your investments across various asset classes mitigates risk and improves the potential for growth.

- Stocks: Offer potential for higher returns but carry higher risk. Consider diversifying across different sectors and market caps.

- Bonds: Provide stability and income but offer lower returns in a low-interest-rate environment. Explore a mix of government, corporate, and municipal bonds.

- Real Estate: Can offer inflation hedge and rental income, but requires significant capital and carries inherent risks.

- Commodities: Like gold, can act as an inflation hedge, but are volatile and require specialized knowledge.

Effective asset allocation is crucial. Your risk tolerance and time horizon should guide your allocation across these asset classes. Professional advice from a financial advisor can help you create a risk management strategy tailored to your specific needs and the low-return environment.

Exploring Alternative Investments

While traditional investments remain important, exploring alternative investments can offer diversification and potentially higher returns in a low-inflation world. However, these investments often carry higher risks.

- Private Equity: Investing in privately held companies offers potential high growth but with limited liquidity.

- REITs (Real Estate Investment Trusts): Offer exposure to real estate without direct ownership, providing income and potential capital appreciation.

- Hedge Funds: Employ complex investment strategies; access is often restricted to accredited investors, and high fees and risks are involved.

It is vital to understand the potential benefits and drawbacks of each alternative investment before allocating funds, especially given the complexities of a low-yield environment. Professional guidance is strongly recommended.

The Role of Inflation-Protected Securities

TIPS (Treasury Inflation-Protected Securities) and other inflation-linked bonds are designed to protect against inflation risk. Their principal adjusts with inflation, ensuring your investment maintains its purchasing power.

- How TIPS Work: The principal of a TIPS is adjusted based on changes in the Consumer Price Index (CPI).

- Advantages: Provides a hedge against inflation, offering a relatively stable return even if inflation rises.

- Disadvantages: Returns may lag behind other investments in periods of low inflation.

Diversifying your bond portfolio with inflation-protected securities can offer a critical layer of protection in a low-inflation (or potentially inflationary) environment.

Retirement Planning in a Low-Inflation World

Adjusting Retirement Goals

Low inflation necessitates adjustments to retirement planning. Lower interest rates and slower economic growth mean you might need to save more to reach your desired retirement income.

- Increased Savings: Low returns require a higher savings rate to accumulate the necessary funds.

- Longer Time Horizon: Consider working longer to compensate for potentially lower returns on investments.

- Longevity Risk: Plan for a longer retirement life expectancy, requiring even greater savings.

Accurate projections of your retirement needs, accounting for the low-yield environment, are essential.

Maximizing Social Security Benefits

Social Security benefits represent a crucial element of retirement income for many. Understanding claiming strategies is essential to maximize your benefits.

- Delayed Retirement: Delaying your retirement claim can significantly increase your monthly benefits.

- Spousal Benefits: Explore spousal benefits to maximize household income.

Careful consideration of claiming strategies, relative to your life expectancy and the low inflation environment, is vital for optimizing your retirement income.

Considering Annuities

Annuities provide a guaranteed income stream throughout retirement, offering financial security in a low-inflation environment.

- Fixed Annuities: Offer a fixed rate of return, providing predictable income.

- Variable Annuities: Offer a potentially higher return but with greater risk.

The choice between different types of annuities depends on your risk tolerance, income needs, and financial goals within the context of a low-inflation climate.

Saving and Budgeting Strategies for Low Inflation

The Importance of Debt Management

Low interest rates offer an opportunity for strategic debt management. Prioritize paying off high-interest debt first to minimize long-term interest payments.

- Debt Consolidation: Consolidate high-interest debt into a lower-interest loan to save money.

- Budgeting: Develop a realistic budget to track expenses and accelerate debt repayment.

Leveraging low interest rates for debt reduction is a key strategy in building financial stability.

Emergency Funds and Financial Cushion

Building a substantial emergency fund is paramount in any economic climate, but especially crucial during periods of low inflation and potential economic uncertainty.

- Three-to-Six Months' Expenses: Aim to save three to six months' worth of living expenses in a readily accessible account.

- Unexpected Expenses: The emergency fund acts as a buffer against job loss, medical emergencies, or other unforeseen expenses.

A robust emergency fund provides financial security and peace of mind, essential for navigating uncertain times.

Conclusion: Mastering Financial Planning in a Low-Inflation Economy

Successfully navigating financial planning in a low-inflation environment requires a proactive and adaptable approach. Diversifying your investment portfolio, carefully planning for retirement, and establishing effective budgeting strategies are all essential steps. The podcast provides detailed strategies to address the unique challenges of a low-inflation economy.

Remember the importance of diversification across asset classes, the need to adjust retirement goals to account for lower returns, and the crucial role of debt management and emergency funds. By implementing these strategies, you can build a secure financial future regardless of the prevailing economic climate.

Listen to our podcast, "[Podcast Name]", available on [Podcast Platform Link] and [Website Link], to gain a deeper understanding of financial planning in a low-inflation environment and learn more about the strategies discussed here. Subscribe to stay updated on future episodes covering related topics and further enhancing your financial knowledge.

Featured Posts

-

See Whos Starring In The Dubbo Championship Wrestling Musical

May 27, 2025

See Whos Starring In The Dubbo Championship Wrestling Musical

May 27, 2025 -

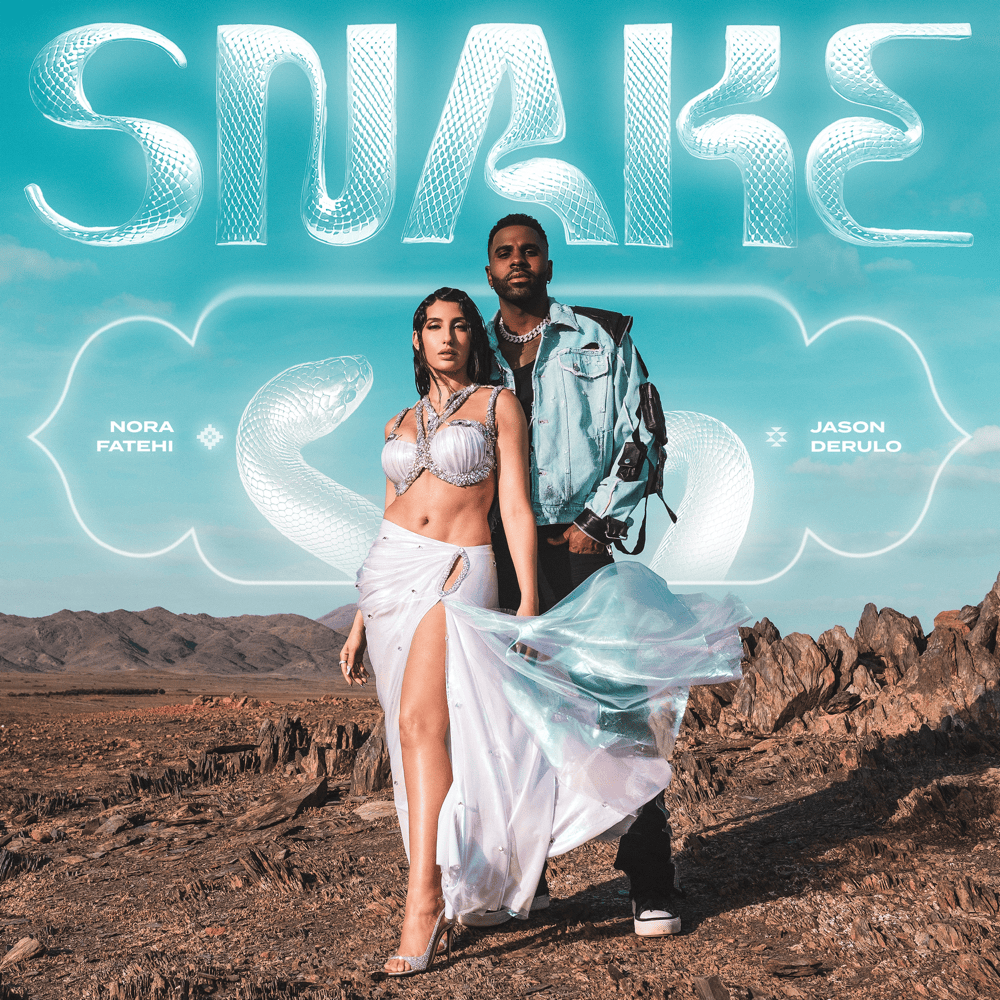

Snake By Nora Fatehi And Jason Derulo Number One On Uk British Asian Charts

May 27, 2025

Snake By Nora Fatehi And Jason Derulo Number One On Uk British Asian Charts

May 27, 2025 -

Two Women Rescued From Drowning By Dylan Efron In Miami

May 27, 2025

Two Women Rescued From Drowning By Dylan Efron In Miami

May 27, 2025 -

Eisvoli Liston Se Katoikia Sti Xalkidiki Leptomereies Gia Tin Egklimatiki Energeia

May 27, 2025

Eisvoli Liston Se Katoikia Sti Xalkidiki Leptomereies Gia Tin Egklimatiki Energeia

May 27, 2025 -

Dates Et Stades Des Matchs Berkane Constantine Coupe De La Caf

May 27, 2025

Dates Et Stades Des Matchs Berkane Constantine Coupe De La Caf

May 27, 2025