Podcast: Riding The Wave Of Low Inflation

Table of Contents

Understanding the Mechanics of Low Inflation

Low inflation, generally defined as a sustained rate of price increase below 2%, signifies a slow but steady increase in the general price level of goods and services in an economy. This seemingly benign condition has profound implications for economic growth. While some mild inflation is generally considered healthy for a growing economy, persistently low inflation can signal underlying economic weaknesses.

Several factors contribute to the current low-inflation environment:

- Decreased demand for goods and services: A slowdown in economic activity often leads to reduced consumer spending, dampening inflationary pressures. This can be a result of various factors, including uncertainty about the future or shifts in consumer preferences.

- Increased productivity and efficiency: Technological advancements and improvements in manufacturing processes have led to increased productivity, resulting in lower production costs and potentially lower prices for consumers. This increase in efficiency can combat inflationary pressures.

- Global economic slowdown: Global economic events, such as trade wars or recessions in major economies, can significantly impact global demand and contribute to low inflation. The interconnected nature of the global economy means that events in one region can ripple across the world, influencing inflation rates everywhere.

- Government policies impacting inflation: Monetary and fiscal policies implemented by governments, such as interest rate adjustments by central banks or government spending programs, can influence inflation rates significantly. For example, low interest rates can stimulate borrowing and spending, potentially leading to higher inflation, while restrictive fiscal policies can curb inflation.

Low Inflation's Impact on Investment Strategies

Low inflation significantly alters the landscape of investment strategies. Investors need to adapt their portfolios to account for the unique challenges and opportunities presented by this economic condition.

- Lower returns on fixed-income investments: In a low-inflation environment, returns on bonds and other fixed-income securities tend to be lower, as interest rates are often kept low to stimulate economic activity. This necessitates a search for alternative investments with higher yield potential, despite added risk.

- Potential for increased stock market volatility: While low inflation can initially boost stock market performance, unexpected shifts in inflation rates can lead to increased volatility. Investors need to be prepared for potential market fluctuations.

- The importance of diversification in a low-inflation climate: Diversifying your investment portfolio across different asset classes becomes even more critical in a low-inflation environment to mitigate risk and potentially enhance returns. This might involve exploring international markets, alternative investments, or inflation-protected securities.

- Strategies for inflation-protected investments: Investors may consider inflation-protected securities, such as Treasury Inflation-Protected Securities (TIPS), to safeguard their investments against the erosion of purchasing power, even in a low inflation setting. These investments adjust their value based on inflation rates, offering a hedge against unexpected price increases.

The Impact of Low Inflation on Consumers and Businesses

Low inflation affects both consumers and businesses in significant ways. Understanding these impacts is crucial for making sound financial decisions.

- Increased consumer purchasing power: Low inflation means that consumers' money buys more goods and services, leading to increased purchasing power. This can stimulate consumer spending and economic activity. However, it can also lead to decreased investment in higher-risk assets by consumers.

- Reduced borrowing costs for businesses: Low inflation often translates to lower interest rates, making it cheaper for businesses to borrow money for investments and expansion. This can fuel economic growth and job creation. However, it also means that lending institutions make less revenue.

- Potential for deflationary pressures: Persistent low inflation can lead to deflation, a sustained decrease in the general price level. Deflation can be harmful to an economy, as consumers postpone purchases in anticipation of further price drops, leading to decreased demand and economic slowdown.

- Challenges for businesses with pricing strategies: Businesses might struggle to maintain profit margins in a low-inflation environment, as they may face pressure to keep prices low to compete. This can lead to reduced profits and potentially hinder investment.

Predicting the Future: Low Inflation Trends and Forecasts

Predicting future inflation trends is a complex undertaking, subject to numerous variables and uncertainties. While economists offer various forecasts, it's crucial to approach them with caution.

- Analysis of leading economic indicators: Economists closely monitor leading economic indicators, such as consumer spending, industrial production, and employment data, to gauge future inflation trends. These indicators often provide insights into the direction of inflation, but are not perfect predictors.

- Potential for future inflation spikes: Even in a low-inflation environment, unexpected events, such as supply chain disruptions or geopolitical instability, can trigger sudden inflation spikes. This makes it essential for individuals and businesses to remain vigilant and adapt their strategies accordingly.

- The role of central bank policies in managing inflation: Central banks play a critical role in managing inflation through monetary policy. Their actions, such as adjusting interest rates or implementing quantitative easing programs, can significantly influence inflation rates. However, their effectiveness is not always guaranteed.

- Long-term outlook for low inflation: The long-term outlook for low inflation varies depending on the economic model used and the assumptions made. Some economists predict a prolonged period of low inflation, while others foresee potential inflationary pressures in the future.

Riding the Wave of Low Inflation – Key Takeaways and Next Steps

Understanding low inflation and its implications is vital for navigating the current economic landscape. This article highlighted the mechanics of low inflation, its effects on investments, consumers, and businesses, and offered insights into future trends. It's crucial to diversify investments, carefully analyze consumer spending, and adapt business strategies according to prevailing economic conditions.

To stay informed about the latest low inflation trends and refine your financial strategies, subscribe to our podcast and explore our related resources on [website address]. Mastering low inflation is key to financial success.

Featured Posts

-

Podcast Production Revolutionized Ais Role In Processing Repetitive Documents

May 27, 2025

Podcast Production Revolutionized Ais Role In Processing Repetitive Documents

May 27, 2025 -

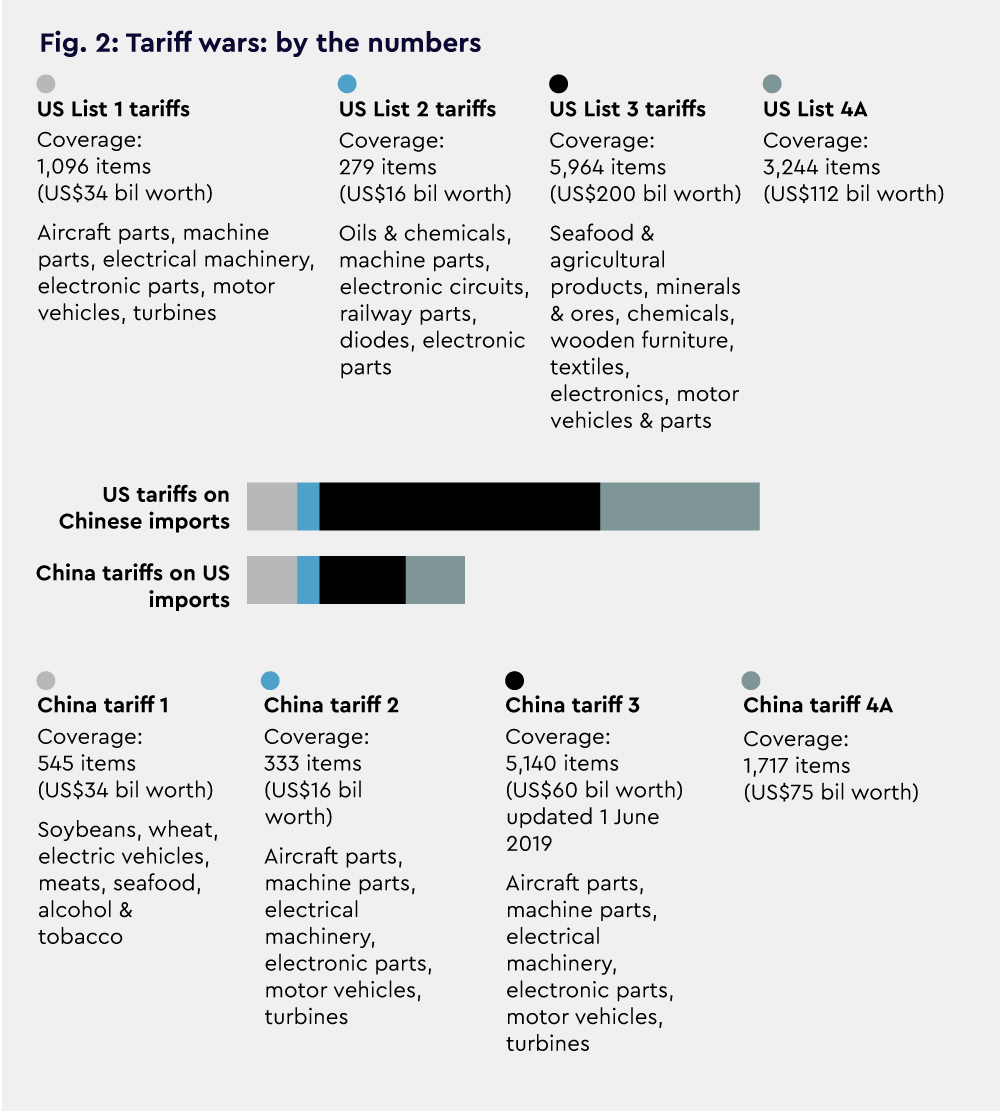

Us China Trade Tensions Key Impacts On The Asia Summit

May 27, 2025

Us China Trade Tensions Key Impacts On The Asia Summit

May 27, 2025 -

Tonights Tracker Season 2 Episode 19 Premiere Time And Melissa Roxburgh

May 27, 2025

Tonights Tracker Season 2 Episode 19 Premiere Time And Melissa Roxburgh

May 27, 2025 -

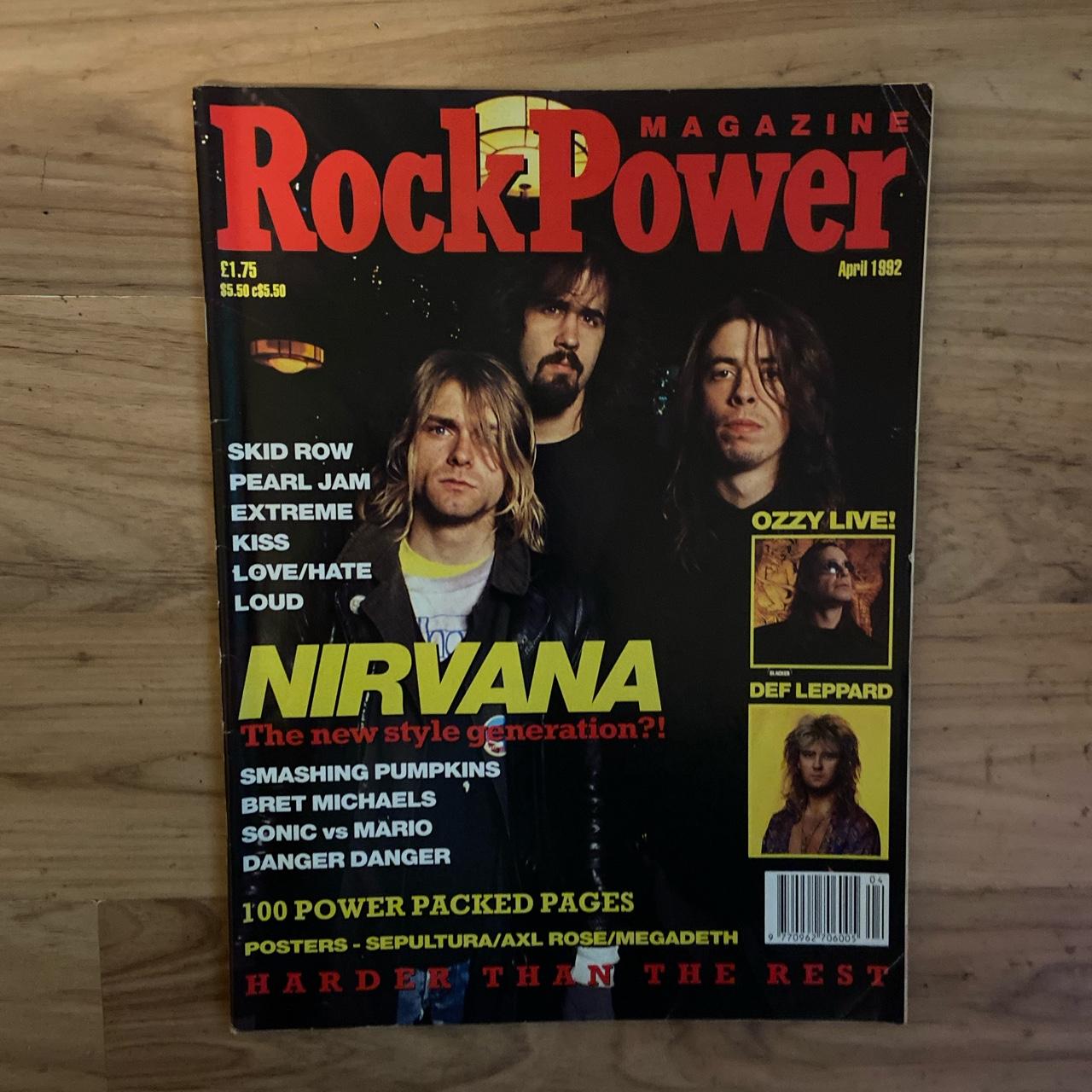

1990s Rock Legends Unexpected Comments On His Ex Wifes Maga Pop Stardom

May 27, 2025

1990s Rock Legends Unexpected Comments On His Ex Wifes Maga Pop Stardom

May 27, 2025 -

Lost Wolves Of Yellowstone Documentary Official Trailer

May 27, 2025

Lost Wolves Of Yellowstone Documentary Official Trailer

May 27, 2025