Point72's Departure: A Deep Dive Into The Closure Of An Emerging Markets Fund

Table of Contents

Understanding Point72's Emerging Markets Strategy

Point72's approach to emerging markets was characterized by a blend of long and short positions, focusing on a diversified portfolio across various sectors and geographies. While specific details about their exact allocation remain confidential, it is understood they concentrated investments in select, high-growth economies.

- Historical Performance: While precise figures are unavailable publicly, sources suggest Point72's emerging markets fund experienced periods of both strong returns and significant drawdowns, reflecting the inherent volatility of these markets. A detailed analysis of their Sharpe ratio and other performance metrics would offer a clearer picture but is currently unavailable publicly.

- Portfolio Composition: The fund's investments likely included a mix of equities, bonds, and potentially derivatives, aiming to capture diverse opportunities and mitigate risks. The exact weighting and specific holdings remained proprietary information.

- Investment Niche: Point72 likely focused on identifying undervalued companies with strong growth potential, employing fundamental analysis and rigorous due diligence to mitigate risks associated with emerging markets.

The Macroeconomic Factors Contributing to the Closure

The global macroeconomic environment played a significant role in Point72's decision. Several factors created a perfect storm of challenges for emerging market investors:

- Rising Interest Rates: The aggressive tightening of monetary policy by central banks worldwide increased borrowing costs, impacting growth in emerging economies that are often heavily reliant on foreign capital.

- Inflationary Pressures: Soaring inflation rates globally eroded purchasing power and added significant uncertainty to investment forecasts, making accurate valuation challenging in volatile emerging markets.

- Geopolitical Risks: The ongoing war in Ukraine, coupled with heightened geopolitical tensions in several regions, introduced significant uncertainty and risk aversion, making emerging markets less attractive.

- Currency Fluctuations: Sharp fluctuations in currency exchange rates in several emerging markets introduced additional volatility and increased the risk of significant losses.

Point72's Internal Decisions and Strategic Shifts

Beyond the macroeconomic environment, internal factors likely contributed to the closure. This might include:

- Strategic Re-allocation: Point72 may have decided to reallocate capital towards other areas perceived as offering higher returns or lower risk, such as developed markets or private equity.

- Performance Concerns: Underperformance relative to benchmarks or internal targets might have prompted a reassessment of the emerging markets strategy and a decision to exit the market.

- Risk Management: Point72’s famously stringent risk management procedures might have dictated a retreat due to an assessment of heightened systemic risk in emerging markets.

Implications for the Emerging Markets Investment Landscape

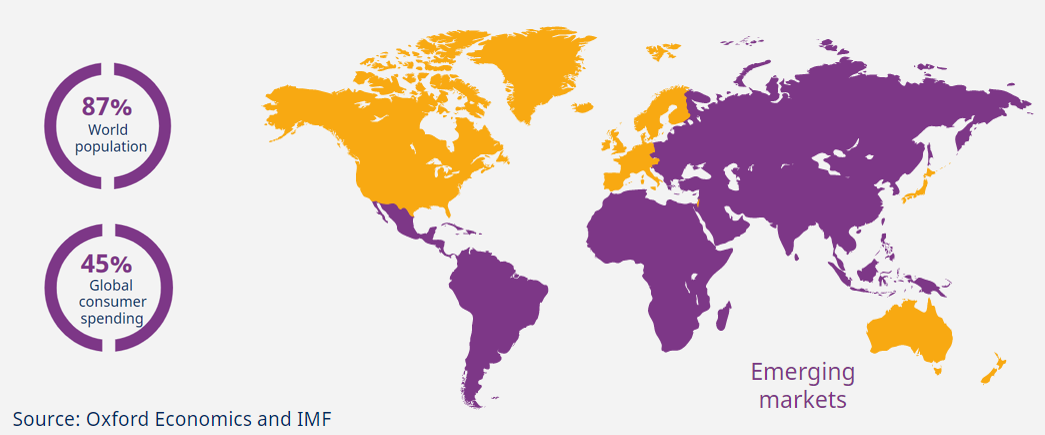

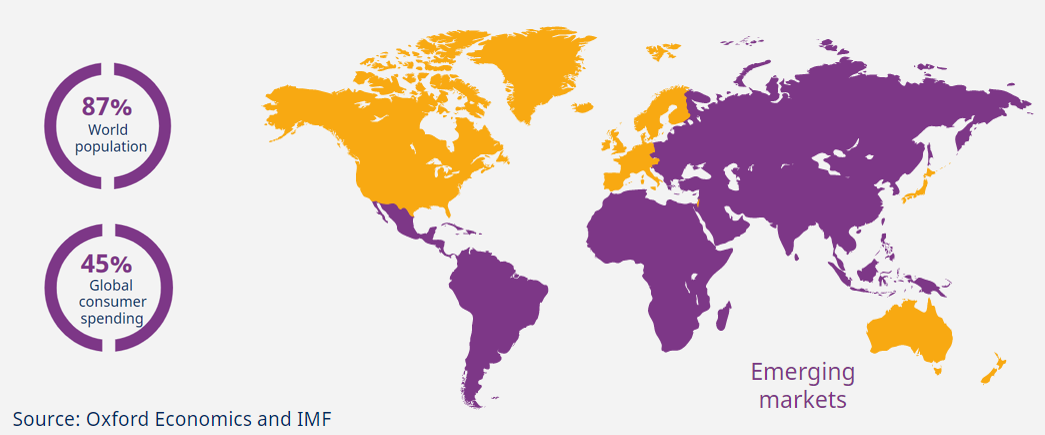

Point72's departure sends a clear message: investing in emerging markets is not without significant challenges. While opportunities for substantial returns exist, the inherent volatility demands careful consideration and risk management.

- Increased Caution: Other investors may become more cautious in their exposure to emerging markets, particularly those facing political or economic instability.

- Opportunities Remain: However, the pullback by some investors could create opportunities for those with a long-term horizon and a thorough understanding of specific market dynamics.

- Diversification Remains Crucial: The need for a diversified portfolio, including both developed and emerging markets, remains critical to mitigate risks and capitalize on opportunities.

Conclusion: The Fallout from Point72's Emerging Markets Fund Closure

The closure of Point72's emerging markets fund underscores the complex interplay between macroeconomic factors, internal strategic decisions, and the inherent volatility of emerging markets. Rising interest rates, inflation, geopolitical instability, and currency fluctuations all created significant headwinds. Simultaneously, internal factors at Point72, such as strategic reallocation or performance concerns, likely contributed to the final decision. The broader implication is a call for increased caution and diligent risk management in this dynamic sector. For investors, this highlights the need for further research into emerging markets investment strategies and possibly a reassessment of their portfolios. Consider professional advice to navigate the complexities of emerging markets investment and avoid repeating Point72's investment decisions. Ultimately, a nuanced understanding of the risks and opportunities within emerging markets is crucial for success.

Featured Posts

-

Anchor Brewing Companys 127 Year Run Comes To An End

Apr 26, 2025

Anchor Brewing Companys 127 Year Run Comes To An End

Apr 26, 2025 -

Clash Of Titans An American Battleground With The Worlds Richest

Apr 26, 2025

Clash Of Titans An American Battleground With The Worlds Richest

Apr 26, 2025 -

La Fires Landlords Accused Of Price Gouging Amid Crisis

Apr 26, 2025

La Fires Landlords Accused Of Price Gouging Amid Crisis

Apr 26, 2025 -

A Rural Schools Story 2700 Miles From Dc And The Impact Of Trumps Policies

Apr 26, 2025

A Rural Schools Story 2700 Miles From Dc And The Impact Of Trumps Policies

Apr 26, 2025 -

A Conservative Harvard Professors Plan To Save Harvard University

Apr 26, 2025

A Conservative Harvard Professors Plan To Save Harvard University

Apr 26, 2025