Post-Correction Rally: Chinese Stocks Climb Amidst US Trade Discussions And Economic Figures

Table of Contents

Easing Trade Tensions Fueling the Rally

Positive signals from US-China trade talks have contributed significantly to investor optimism, boosting confidence in the Chinese market and fueling this post-correction rally. The thawing of relations, however tentative, has injected a much-needed dose of stability into an otherwise uncertain landscape.

- Recent statements from both sides indicating progress in negotiations: While a comprehensive trade deal remains elusive, recent statements from both the US and Chinese governments suggest a willingness to find common ground, potentially leading to a phased trade agreement. This de-escalation of trade war rhetoric has significantly calmed investor anxieties.

- Potential for a phased trade deal easing concerns about further tariffs: The possibility of a phased approach allows both sides to achieve incremental wins, reducing the immediate threat of further tariffs and boosting investor confidence. This phased approach is key to understanding the current Chinese stock rally.

- Increased foreign investment flowing back into the Chinese market: As confidence returns, foreign investors are increasingly viewing the Chinese market as less risky, leading to a renewed inflow of capital that further propels the post-correction rally.

- Impact on specific sectors (technology, manufacturing) showing signs of recovery: Sectors heavily impacted by the trade war, such as technology and manufacturing, are showing early signs of recovery, benefiting from the easing tensions and contributing significantly to the overall market rebound. This sector-specific improvement is a hallmark of the current Chinese market rebound.

Stronger-Than-Expected Economic Data

Better-than-anticipated economic indicators have played a crucial role in the post-correction rally, signaling underlying strength in the Chinese economy and reinforcing the strength of the Chinese stock market rally. This positive data has countered some of the negative narratives surrounding the Chinese economy.

- Positive growth in key economic sectors (retail sales, industrial production): Recent data reveals encouraging growth in key sectors, indicating resilience and a potential for sustained economic expansion. This positive economic growth underpins the market’s recent strength.

- Government stimulus measures boosting economic activity: The Chinese government has implemented various stimulus measures to boost economic activity, further contributing to the positive economic indicators and the resulting market rally.

- Analysis of recent inflation figures and their impact on market sentiment: While inflation remains a concern, recent figures have been relatively manageable, easing fears of runaway inflation and supporting positive market sentiment.

- Comparison of current economic data with previous quarters and predictions: The current economic performance surpasses many previous predictions, demonstrating a stronger-than-expected recovery and fueling the post-correction rally in Chinese stocks.

Government Intervention and Market Support

The Chinese government's proactive measures to stabilize the market have contributed significantly to the rally's momentum. These interventions have played a crucial role in bolstering investor confidence and influencing the current Chinese market rebound.

- Details of government policies designed to support the stock market: The government has implemented a range of policies aimed at supporting the stock market, including measures to increase liquidity and encourage investment.

- Impact of regulatory changes on investor confidence: Changes in regulations have aimed to improve transparency and investor protection, boosting confidence and attracting further investment.

- Analysis of the effectiveness of these interventions: The government's interventions have demonstrably helped to stabilize the market and contribute to the current rally.

- Discussion on potential future government initiatives: The continued commitment of the Chinese government to support economic growth suggests further supportive policies may be implemented, supporting the continuation of this post-correction rally.

Sector-Specific Performance

Different sectors within the Chinese stock market have exhibited varying degrees of recovery following the correction. Understanding this sector-specific performance is critical to navigating the post-correction rally.

- Analysis of the performance of key sectors (e.g., technology, financials, real estate): The technology sector, for example, has shown particularly strong growth, while others have experienced more moderate rebounds.

- Identifying leading and lagging sectors within the rally: Identifying these leading and lagging sectors provides valuable insights into market dynamics and potential investment opportunities.

- Reasons for sector-specific performance variations: Factors such as government policies, global demand, and industry-specific challenges contribute to the varying performance of different sectors.

- Investment opportunities highlighted by sector-specific performance: Understanding these variations can help investors identify potentially lucrative investment opportunities within the Chinese stock market.

Conclusion

The post-correction rally in Chinese stocks is a complex phenomenon driven by a confluence of factors, including easing trade tensions, improved economic indicators, and supportive government policies. While the future remains uncertain, the recent surge suggests a degree of resilience within the Chinese market. The Chinese market rebound offers both challenges and opportunities.

Call to Action: Understanding the nuances of this post-correction rally is crucial for investors navigating the Chinese stock market. Stay informed on the latest developments in US-China trade relations and economic data to make well-informed decisions regarding your investments in this dynamic market. Further research into specific sectors experiencing the strongest post-correction rally can yield substantial investment opportunities. Continue to monitor this Chinese stock rally and the post-correction rally for optimal investment strategies.

Featured Posts

-

Buducnost Svetoveho Pohara 2028 Vplyv Nhl A Otazka Ucasti Ruska

May 07, 2025

Buducnost Svetoveho Pohara 2028 Vplyv Nhl A Otazka Ucasti Ruska

May 07, 2025 -

Anthony Edwards Faces Backlash Amidst Baby Mama Controversy

May 07, 2025

Anthony Edwards Faces Backlash Amidst Baby Mama Controversy

May 07, 2025 -

Rihannas Show Stopping Engagement Ring And Red Heels Combo

May 07, 2025

Rihannas Show Stopping Engagement Ring And Red Heels Combo

May 07, 2025 -

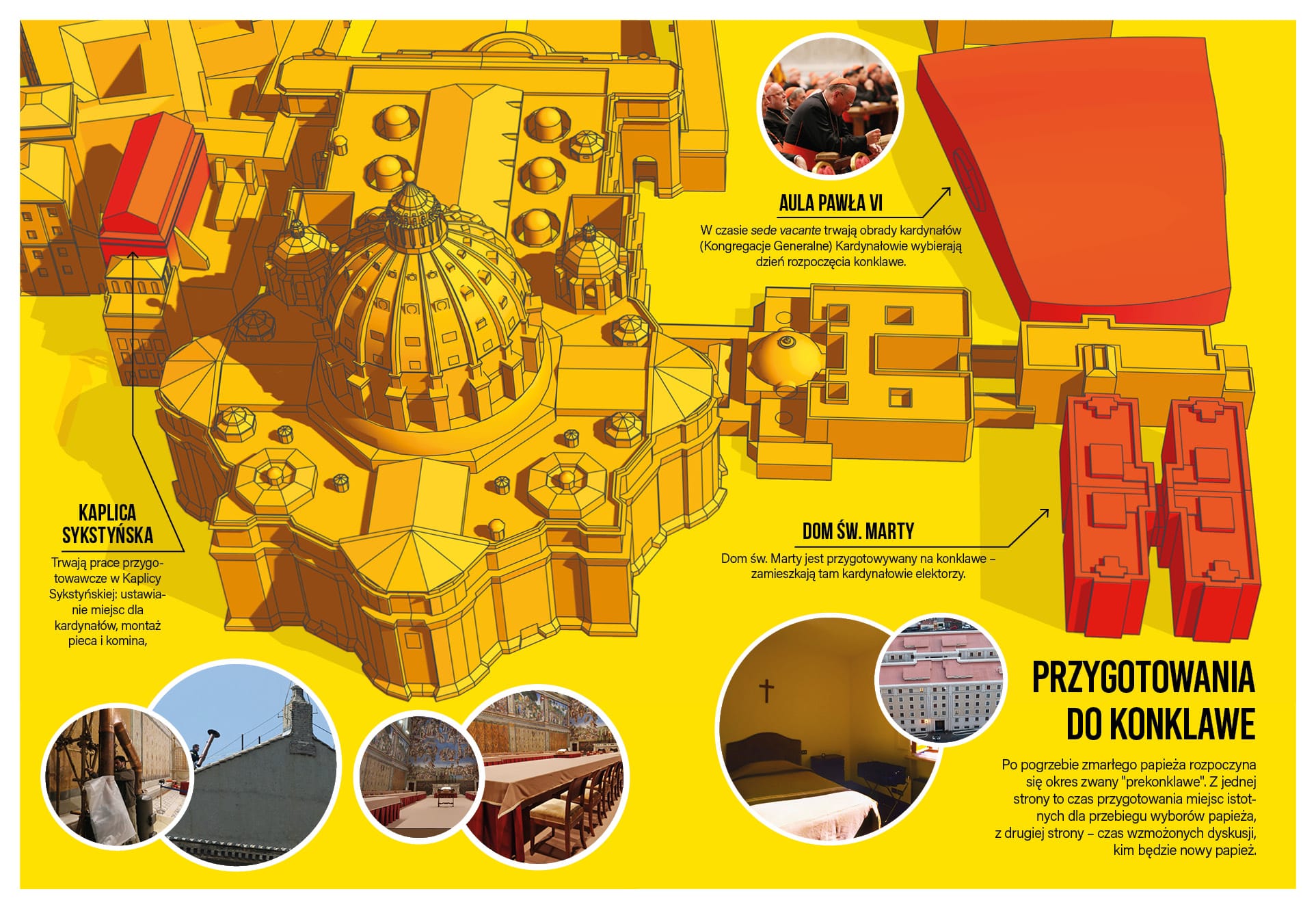

Ks Sliwinski Prezentuje Konklawe Tajemnice Wyborow Papieskich Warszawa

May 07, 2025

Ks Sliwinski Prezentuje Konklawe Tajemnice Wyborow Papieskich Warszawa

May 07, 2025 -

Could Xrp Reach 5 By 2025 A Realistic Analysis

May 07, 2025

Could Xrp Reach 5 By 2025 A Realistic Analysis

May 07, 2025