Post-Tariff Pause: Euronext Amsterdam Stocks Climb 8%

Table of Contents

The Impact of the Tariff Pause on Investor Sentiment

The pause in tariff increases has profoundly affected investor confidence, triggering a palpable shift from risk-averse to risk-on behavior. This change in market sentiment is directly linked to the decreased uncertainty surrounding future trade policies. The reduced threat of escalating tariffs has instilled renewed confidence in future economic growth, both domestically and internationally.

- Decreased uncertainty leading to increased investment: Investors, previously hesitant to commit capital, are now more willing to take on risk, leading to a surge in investment activity.

- Renewed confidence in future economic growth: The positive outlook fosters optimism and encourages long-term investments in Euronext Amsterdam stocks.

- Positive market outlook attracting both domestic and international investors: The improved market conditions are attracting a wider range of investors, increasing liquidity and competition.

- Improved trading volumes on Euronext Amsterdam: The increase in investor activity has resulted in significantly higher Euronext Amsterdam trading volumes, reflecting the renewed confidence in the market.

This positive shift in investor confidence and risk appetite is a key driver of the recent surge in stock prices. The improved market environment is vital for sustainable growth in the long term.

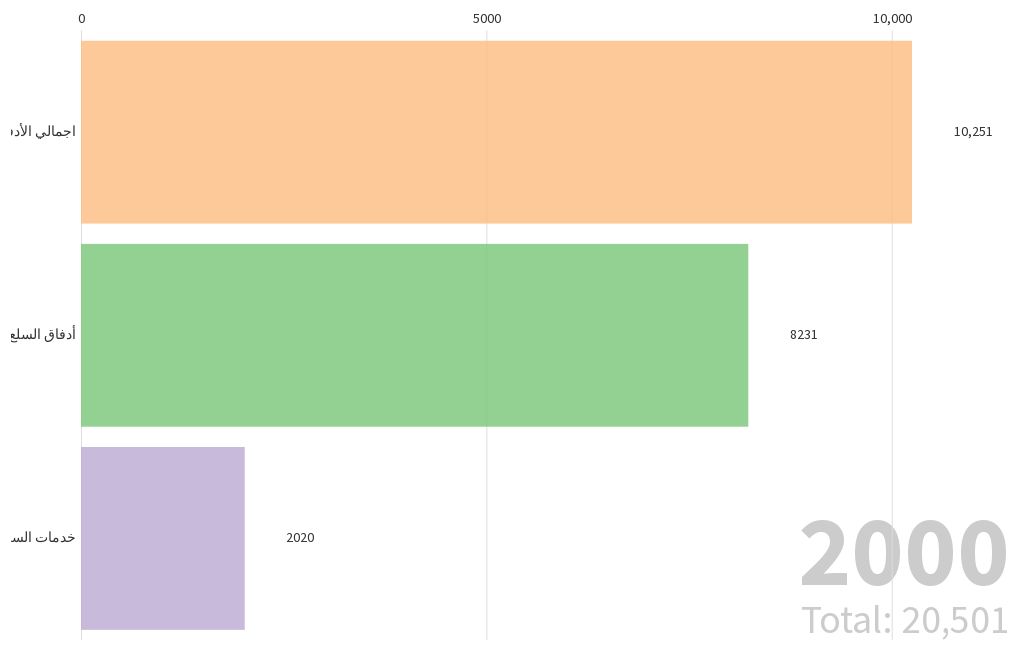

Sector-Specific Analysis of the 8% Surge in Euronext Amsterdam Stocks

The 8% surge in Euronext Amsterdam stocks wasn't uniform across all sectors. Some sectors experienced significantly stronger growth than others. This sector analysis reveals which areas benefited most from the tariff pause and the improved stock market performance.

- Technology sector gains due to reduced import costs: Companies heavily reliant on imported components saw a substantial boost, as reduced tariffs lowered their production costs and improved profit margins.

- Energy sector benefits from increased global demand: The global energy market experienced increased demand, leading to higher prices and stronger performance for energy companies listed on Euronext Amsterdam.

- Financial sector recovery driven by improved market stability: The reduced uncertainty surrounding trade policy stabilized the financial markets, positively impacting financial institutions and leading to improved investor confidence in this sector.

- Specific examples of companies with significant stock price increases: [Insert examples of specific companies with notable stock price increases, including ticker symbols for SEO purposes. For example: "ASML Holding (ASML.AS) saw a 12% increase, while ING Groep (INGA.AS) experienced a 9% rise."].

This varied performance highlights the importance of conducting thorough sector analysis before making investment decisions related to Euronext Amsterdam sectors.

Potential Future Implications for Euronext Amsterdam Stocks

While the current outlook for Euronext Amsterdam stocks is positive, future performance will depend on several factors, including the continuation of the tariff pause and the broader global economic environment.

- Impact of continued trade negotiations on investor sentiment: The ongoing trade negotiations could still introduce volatility. Any escalation of trade tensions could negatively impact investor confidence and lead to market corrections.

- Potential for further stock price increases depending on global economic conditions: Continued global economic growth and stable trade relations are crucial for sustaining the current positive trend in Euronext Amsterdam stocks.

- Risks associated with renewed trade tensions: A resurgence of protectionist policies could significantly undermine the gains achieved and negatively impact stock price prediction.

- Opportunities for long-term investment in Euronext Amsterdam stocks: Despite the inherent risks, the long-term outlook for many companies listed on Euronext Amsterdam remains favorable, offering attractive opportunities for long-term investment.

Understanding these factors is vital for developing a robust investment strategy for Euronext Amsterdam future performance.

Conclusion

The recent 8% surge in Euronext Amsterdam stocks demonstrates a strong positive reaction to the pause in tariff increases. Investor sentiment has significantly improved, leading to increased trading activity and strong performance across various sectors. While future uncertainty remains, the current future market outlook for Euronext Amsterdam stocks is optimistic.

Call to Action: Stay informed on the latest developments affecting Euronext Amsterdam stocks and capitalize on the opportunities presented by this dynamic market. Learn more about investing in Euronext Amsterdam stocks and discover how to optimize your portfolio for success in this evolving market landscape.

Featured Posts

-

Thames Waters Executive Bonus Payments A Critical Examination

May 24, 2025

Thames Waters Executive Bonus Payments A Critical Examination

May 24, 2025 -

Atfaq Washntn Wbkyn Altjary Ydem Artfae Mwshr Daks Alalmany Fwq 24 Alf Nqtt

May 24, 2025

Atfaq Washntn Wbkyn Altjary Ydem Artfae Mwshr Daks Alalmany Fwq 24 Alf Nqtt

May 24, 2025 -

Explore The 2025 Porsche Cayenne Interior And Exterior Photo Showcase

May 24, 2025

Explore The 2025 Porsche Cayenne Interior And Exterior Photo Showcase

May 24, 2025 -

How To Get Tickets For Bbc Radio 1s Big Weekend

May 24, 2025

How To Get Tickets For Bbc Radio 1s Big Weekend

May 24, 2025 -

Italian Citizenship New Law On Great Grandparent Claims

May 24, 2025

Italian Citizenship New Law On Great Grandparent Claims

May 24, 2025