Posthaste: Risks And Implications Of The World's Largest Bond Market's Instability

Table of Contents

Rising Interest Rates and their Impact on Bond Prices

Inverse Relationship Explained

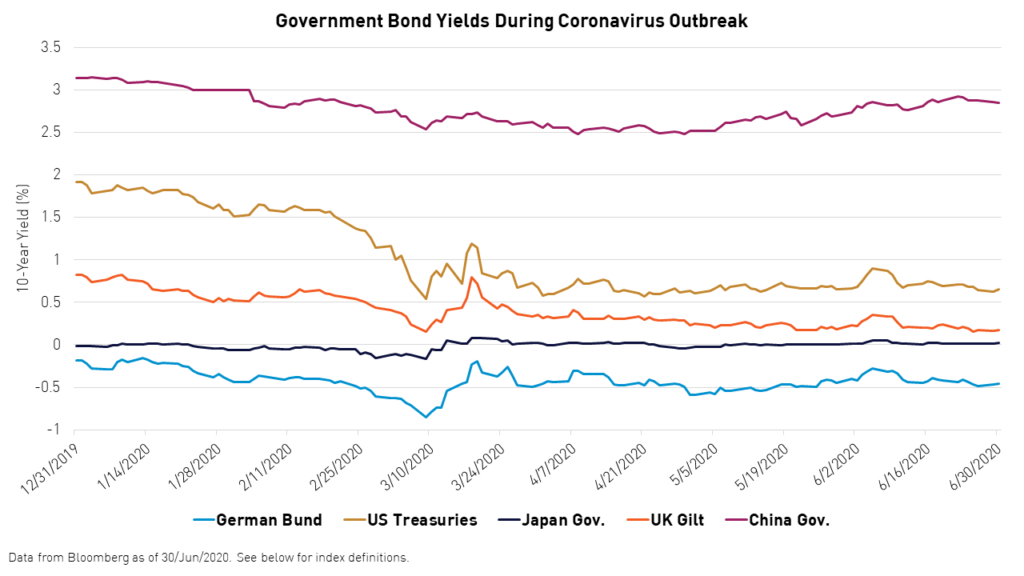

The bond market operates on a fundamental inverse relationship between interest rates and bond prices. This means that when interest rates rise, bond prices generally fall, and vice versa. This relationship stems from the fact that newly issued bonds offer higher yields, making existing bonds with lower coupon rates less attractive to investors.

- How rising interest rates make existing bonds less attractive: As interest rates climb, newly issued bonds offer higher returns, making older bonds with lower coupon payments less appealing. Investors will demand lower prices for the older bonds to compensate for their lower yield.

- Impact on bond yields and returns: Rising interest rates directly increase the yield on new bonds, but simultaneously decrease the value of existing bonds. This can lead to capital losses for bondholders if they need to sell their bonds before maturity.

- Potential for capital losses in a rising rate environment: Bondholders face the risk of substantial capital losses if they sell their bonds before maturity in a rising interest rate environment. The longer the maturity of the bond, the greater the potential loss.

- Examples of recent interest rate hikes and their effects: The recent series of interest rate hikes by the Federal Reserve have demonstrably impacted the US Treasury market, leading to a decline in bond prices and increased yields on newly issued bonds. This directly reflects the inverse relationship between interest rates and bond prices. The US Treasury yield curve, a graphical representation of these yields, has steepened significantly, reflecting investor expectations of future rate hikes.

Inflation's Role in Bond Market Volatility

Inflation and Purchasing Power

High inflation significantly erodes the purchasing power of fixed-income investments like bonds. Inflation reduces the real value of future interest payments and the principal repayment at maturity.

- Impact of unexpected inflation surges on bond valuations: Unexpected inflation surges negatively impact bond valuations because they reduce the real return an investor receives. Investors demand higher yields to compensate for the erosion of purchasing power.

- Relationship between inflation expectations and bond yields: Market participants' expectations of future inflation are directly reflected in bond yields. Higher inflation expectations lead to higher demanded yields.

- Central bank actions to combat inflation and their effect on the bond market: Central banks often raise interest rates to combat inflation. This action, while aiming to curb inflation, can lead to increased bond market volatility and decreased bond prices in the short term.

- Inflation-indexed bonds as a hedge against inflation: Inflation-indexed bonds (like TIPS in the US) offer a partial hedge against inflation because their principal and interest payments adjust with inflation. These bonds are an alternative strategy for investors concerned about inflation risk.

Geopolitical Risks and their Influence on Bond Market Sentiment

Global Uncertainty and Safe-Haven Demand

Geopolitical events significantly influence investor sentiment and the demand for US Treasury bonds, often considered a safe-haven asset. During times of uncertainty, investors flock to these bonds, driving up their prices and lowering yields.

- Impact of geopolitical tensions on bond yields: Geopolitical tensions often lead to a flight to safety, increasing demand for US Treasury bonds, thereby driving down yields.

- Flight-to-safety phenomenon and its effect on bond prices: The flight-to-safety phenomenon is a key driver of bond market dynamics during periods of global uncertainty. Investors seek the perceived safety and liquidity of US Treasury bonds, pushing prices higher.

- Examples of geopolitical events influencing the bond market: The ongoing war in Ukraine, trade tensions between major economies, and political instability in various regions have all had notable impacts on the bond market.

- Role of international capital flows in bond market dynamics: International capital flows play a crucial role in determining bond market prices and yields. Capital flight from unstable regions can drive significant inflows into US Treasury bonds.

Systemic Risks and Contagion Effects

Domino Effect and Financial Stability

Instability in the world's largest bond market can trigger wider systemic risks and contagion effects throughout the global financial system. The interconnectedness of financial markets means that a crisis in one area can quickly spread.

- Interconnectedness of financial markets: Financial markets are highly interconnected; a shock in one market can quickly propagate to others, creating a domino effect.

- Impact of a bond market crisis on other asset classes: A bond market crisis can significantly impact other asset classes, including stocks, real estate, and commodities, leading to widespread market declines.

- Role of financial regulation in mitigating systemic risks: Robust financial regulation plays a vital role in mitigating systemic risk by ensuring the stability of financial institutions and markets.

- Potential impact on economic growth and financial stability: Instability in the world's largest bond market can negatively impact economic growth and overall financial stability, potentially leading to recessions or financial crises.

Conclusion

Instability in the world's largest bond market presents significant risks and implications for investors, policymakers, and the global economy. Rising interest rates, inflation, geopolitical uncertainties, and the potential for systemic risk all contribute to this volatility. Understanding the interplay of these factors is crucial for effective risk management. Staying informed about fluctuations in the world's largest bond market is crucial for navigating these uncertain times. Understanding the risks associated with bond market instability allows for more informed investment decisions and better risk management strategies. Diversifying your investment portfolio and employing strategies to mitigate interest rate risk and inflation risk are key to navigating the complexities of the global bond market.

Featured Posts

-

Sheinelle Jones A Look At Her Health Journey And Return To The Today Show

May 23, 2025

Sheinelle Jones A Look At Her Health Journey And Return To The Today Show

May 23, 2025 -

Dylan Dreyer And Brian Fichera New Social Media Post Generates Buzz

May 23, 2025

Dylan Dreyer And Brian Fichera New Social Media Post Generates Buzz

May 23, 2025 -

Low Gas Prices Forecast For Memorial Day Weekend Travel

May 23, 2025

Low Gas Prices Forecast For Memorial Day Weekend Travel

May 23, 2025 -

Sunday May 11 Nyt Mini Crossword Clues And Solutions Explained

May 23, 2025

Sunday May 11 Nyt Mini Crossword Clues And Solutions Explained

May 23, 2025 -

Kermit The Frog To Deliver 2025 University Of Maryland Commencement Address

May 23, 2025

Kermit The Frog To Deliver 2025 University Of Maryland Commencement Address

May 23, 2025