Posthaste: Trouble Brewing In The Global Bond Market

Table of Contents

Rising Interest Rates and their Impact on the Global Bond Market

The Mechanics of Rising Rates

Rising interest rates have a direct and inverse impact on bond prices. When interest rates rise, newly issued bonds offer higher yields, making existing bonds with lower coupon rates less attractive. This results in a decrease in the market price of those existing bonds to compensate for the lower yield. Understanding concepts like the yield curve, duration risk, and reinvestment risk is crucial for navigating this environment. The yield curve illustrates the relationship between bond yields and their maturities, showing how rates differ across short-term, medium-term, and long-term bonds. Duration risk measures a bond's sensitivity to interest rate changes; longer-duration bonds are more susceptible to price fluctuations. Reinvestment risk refers to the uncertainty surrounding the reinvestment of coupon payments at potentially lower future rates.

-

Impact on Different Bond Types: Rising rates disproportionately affect longer-term bonds and those with lower coupon payments. Government bonds, typically considered less risky, are also impacted, though often less severely than corporate bonds, which carry higher default risk.

-

Implications for Bondholders: Bondholders face potential capital losses as bond prices decline in response to rising rates. This risk is amplified for investors holding bonds with longer durations.

-

Challenges for Fixed-Income Investors: Fixed-income investors face the challenge of adjusting their portfolios to mitigate interest rate risk. Strategies like laddering (investing in bonds with staggered maturities) can help reduce this risk.

Inflation's Persistent Grip on the Global Bond Market

Inflation's Erosive Effect on Bond Yields

High inflation erodes the real return of bonds. When inflation outpaces the yield on a bond, investors actually lose purchasing power. This is because the future value of the bond's principal and interest payments is diminished by inflation.

-

Inflation Expectations and Bond Yields: Market participants' expectations about future inflation significantly influence bond yields. Higher inflation expectations lead to higher demanded yields to compensate for the anticipated erosion of purchasing power.

-

Central Bank Policy and its Impact: Central banks employ monetary policy tools, such as raising interest rates, to combat inflation. While this can help curb inflation, it also impacts bond markets by increasing yields and potentially reducing bond prices.

-

Stagflationary Risks: The potential for stagflation (a combination of slow economic growth and high inflation) poses a significant threat to bond markets. Stagflation makes it difficult for central banks to effectively manage both inflation and economic growth, creating further uncertainty for bond investors.

Geopolitical Uncertainty and its Ripple Effect on the Global Bond Market

Global Conflicts and their Impact

Geopolitical instability, including wars, trade tensions, and political upheavals, increases risk aversion among investors. This often leads to a flight to safety, pushing investors towards government bonds perceived as safer havens.

-

Flight to Safety and Government Bond Yields: The increased demand for government bonds during times of geopolitical uncertainty drives down their yields, creating a temporary safe haven effect.

-

Impact on Emerging Market Bonds: Emerging market bonds are particularly vulnerable to geopolitical shocks, as investor sentiment can shift rapidly, leading to significant price volatility.

-

Increased Market Volatility and Uncertainty: Geopolitical events create significant uncertainty and volatility in the global bond market, making it challenging to predict future price movements.

Navigating the Current Challenges in the Global Bond Market

Strategies for Investors

Managing risk and potentially profiting in a volatile bond market requires careful planning and strategic decision-making.

-

Diversification Strategies: Diversifying across different bond types (e.g., government, corporate, municipal), maturities, and geographies can help mitigate risk.

-

Active vs. Passive Bond Fund Management: Active bond fund managers aim to outperform benchmarks by making strategic decisions about which bonds to hold, while passive funds aim to track a specific index. The best approach depends on individual investor risk tolerance and goals.

-

Alternative Fixed-Income Investments: Investors can consider alternative fixed-income investments, such as inflation-protected securities (TIPS) or high-yield corporate bonds, to manage inflation risk or seek higher returns, but these also come with higher risk.

Conclusion

The global bond market is facing a confluence of challenges: rising interest rates, persistent inflation, and geopolitical uncertainty. These factors are creating significant volatility and risk for investors. Understanding the mechanics of rising rates, the erosive effects of inflation, and the impact of geopolitical risks is crucial for making informed investment decisions. Key takeaways include the need for diversification, careful consideration of interest rate risk and inflation risk, and the potential for higher yields to compensate for increased risk.

Understanding the intricacies of the global bond market is crucial in these turbulent times. Stay informed and consider consulting a financial advisor to navigate the complexities of global bond market investing.

Featured Posts

-

Valerie Rodriguez Erazo Nueva Secretaria Del Daco

May 23, 2025

Valerie Rodriguez Erazo Nueva Secretaria Del Daco

May 23, 2025 -

Dylan Dreyer And Brian Fichera Their Relationship Journey

May 23, 2025

Dylan Dreyer And Brian Fichera Their Relationship Journey

May 23, 2025 -

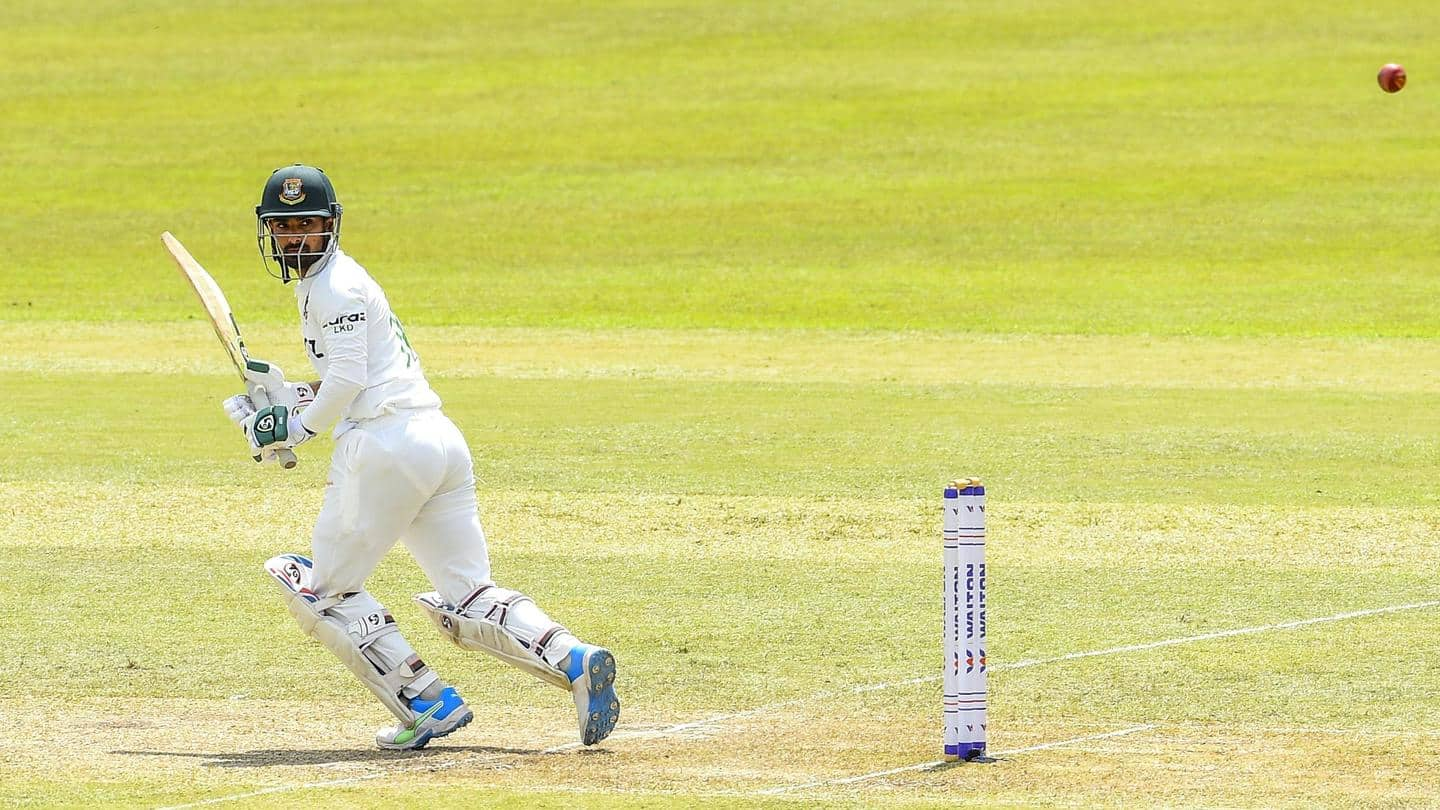

Bangladeshs Fightback Key Moments From The First Test Against Zimbabwe

May 23, 2025

Bangladeshs Fightback Key Moments From The First Test Against Zimbabwe

May 23, 2025 -

Jasprit Bumrah Holds Top Spot In Latest Icc Test Bowling Rankings

May 23, 2025

Jasprit Bumrah Holds Top Spot In Latest Icc Test Bowling Rankings

May 23, 2025 -

Arsenal Defender Earns Ten Hags Respect After Real Madrid Match

May 23, 2025

Arsenal Defender Earns Ten Hags Respect After Real Madrid Match

May 23, 2025