Pounce Now: S&P 500 Downside Protection Strategies

Table of Contents

Understanding S&P 500 Downside Risk

Before diving into specific strategies, it's crucial to grasp the nature of S&P 500 downside risk.

Defining Market Volatility and its Impact

Market volatility refers to the rate and extent of fluctuations in market prices. The S&P 500, a widely followed index of 500 large-cap US stocks, is susceptible to periods of significant volatility. These fluctuations can lead to substantial losses in a short period.

- Examples of recent market volatility: The tech stock correction of 2022, the COVID-19 market crash of 2020, and various geopolitical events have all demonstrated the S&P 500's vulnerability to sudden drops.

- Consequences of significant drops: Significant drops can erode retirement savings, delay major life purchases, and create substantial financial stress.

- Importance of risk management: Proactive risk management is paramount to preserving capital and achieving long-term financial goals. Ignoring market volatility can lead to significant losses.

Identifying Your Risk Tolerance

Before implementing any S&P 500 downside protection strategy, honestly assessing your risk tolerance is crucial. This involves understanding your comfort level with potential losses and your investment timeline.

- Questions to ask yourself: How much risk am I willing to take? What is my investment timeframe? What is my financial situation and how much can I afford to lose? What is my emotional response to market downturns?

- Different investor profiles:

- Conservative: Prioritizes capital preservation over high returns; accepts lower potential gains to minimize risk.

- Moderate: Balances risk and return, seeking a mix of growth and stability.

- Aggressive: Willing to accept higher risk for potentially greater returns.

- Aligning strategy with risk tolerance: Your chosen S&P 500 downside protection strategy should directly correlate with your assessed risk tolerance. A conservative investor would employ different strategies than an aggressive investor.

S&P 500 Downside Protection Strategies

Several strategies can help mitigate S&P 500 downside risk. The best approach depends on your risk tolerance, investment goals, and understanding of the market.

Put Options

Put options are derivative contracts that grant the holder the right, but not the obligation, to sell a specified asset (in this case, an S&P 500 index fund or ETF) at a predetermined price (the strike price) before a certain date (the expiration date). Protective puts are a common strategy to hedge against potential losses.

- How to buy put options: Put options are purchased through brokerage accounts.

- Strike price selection: Choosing the right strike price is key. A lower strike price offers more protection but costs more.

- Expiration dates: Expiration dates determine the duration of the protection. Longer-term options provide more protection but are more expensive.

- Calculating potential profit/loss: Understanding the potential profit and loss associated with different strike prices and expiration dates is essential.

Inverse ETFs

Inverse exchange-traded funds (ETFs) aim to deliver the opposite performance of a particular index. For example, an inverse S&P 500 ETF would profit when the S&P 500 declines. These are suitable for short-term downside protection but carry significant risks.

- How inverse ETFs work: They use derivatives and leverage to achieve inverse performance.

- Risks associated with leveraged ETFs: Leverage magnifies both profits and losses. These ETFs are not suitable for long-term holding due to their compounding decay.

- Suitable timeframes for usage: Inverse ETFs are best used for short-term hedging during periods of expected market declines.

Hedged Mutual Funds and ETFs

Several mutual funds and ETFs employ strategies designed to minimize downside risk. These often involve hedging techniques or investments in less volatile assets.

- Examples of low-volatility funds: These funds focus on stocks with historically lower volatility.

- Strategies employed for downside protection: These can include hedging using options or other derivative instruments.

- Comparison with actively managed funds: Actively managed funds aim to outperform the market, while hedged funds prioritize risk mitigation.

Cash Allocation

Maintaining a cash reserve is a straightforward yet effective downside protection strategy. Cash offers liquidity and helps weather market downturns without forced selling.

- Advantages and disadvantages of holding cash: Advantages include liquidity and downside protection; disadvantages include low returns and opportunity cost.

- Determining appropriate cash allocation based on risk tolerance: Conservative investors might hold a larger cash allocation.

- Opportunity cost: Holding cash means foregoing potential investment gains in other asset classes.

Conclusion

Protecting your investments against S&P 500 downturns requires careful planning. We've explored several S&P 500 downside protection strategies: put options, inverse ETFs, hedged funds, and cash allocation. Remember that the optimal strategy depends heavily on your individual risk tolerance and investment goals. By diversifying your investments and understanding the various tools at your disposal, you can create a robust portfolio capable of weathering market fluctuations.

Start planning your S&P 500 downside protection strategy today! Don't wait for the market to dip – pounce now and secure your financial future. Remember to consult a financial advisor before making any investment decisions.

Featured Posts

-

Eurovision Song Contest 2025 Australian Broadcast Details And Live Streaming

Apr 30, 2025

Eurovision Song Contest 2025 Australian Broadcast Details And Live Streaming

Apr 30, 2025 -

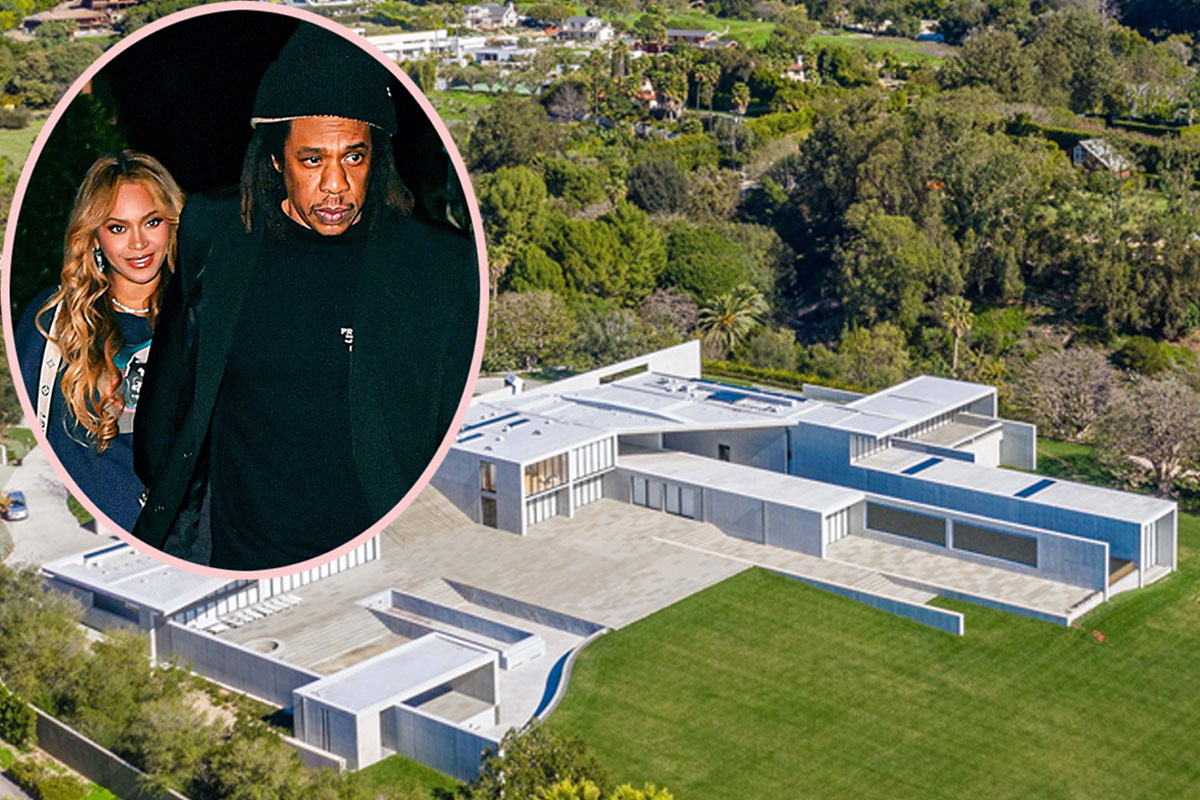

Beyonce And Jay Z A Cotswolds Move Trading California For Country Life

Apr 30, 2025

Beyonce And Jay Z A Cotswolds Move Trading California For Country Life

Apr 30, 2025 -

Post Election Silence Raises Concerns About Kamala Harris Leadership

Apr 30, 2025

Post Election Silence Raises Concerns About Kamala Harris Leadership

Apr 30, 2025 -

Khai Mac Giai Bong Da Thanh Nien Thanh Pho Hue Lan Thu Vii Thong Tin Chi Tiet Va Lich Thi Dau

Apr 30, 2025

Khai Mac Giai Bong Da Thanh Nien Thanh Pho Hue Lan Thu Vii Thong Tin Chi Tiet Va Lich Thi Dau

Apr 30, 2025 -

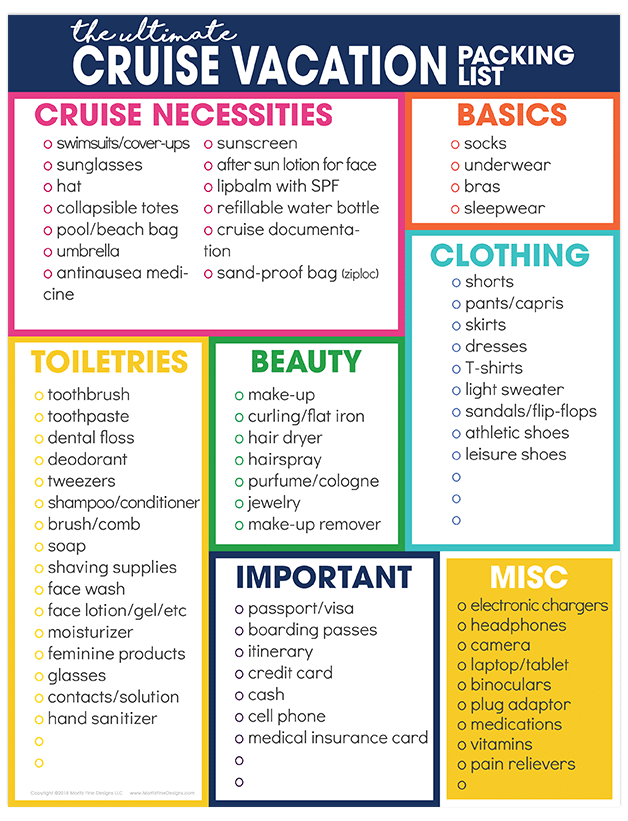

What Not To Pack For Your Cruise A Comprehensive Guide

Apr 30, 2025

What Not To Pack For Your Cruise A Comprehensive Guide

Apr 30, 2025