Power Finance Corporation Dividend Update: March 12th Announcement

Table of Contents

Key Highlights of the Power Finance Corporation Dividend Announcement

The Power Finance Corporation's March 12th dividend announcement revealed several key details vital for shareholders. Here's a summary of the main points:

- Dividend per share declared: [Insert the actual dividend amount per share declared on March 12th].

- Total dividend payout: [Insert the total amount paid out as dividends].

- Record date for dividend eligibility: [Insert the record date – the date by which shareholders must own PFC shares to be eligible for the dividend].

- Payment date of the dividend: [Insert the date on which the dividend will be paid to eligible shareholders].

- Special considerations or adjustments: [If any special considerations or adjustments were mentioned in the announcement, detail them here. For example, tax implications or any specific conditions for receiving the dividend].

Impact of the PFC Dividend on Investors

The declared PFC dividend holds significant implications for existing shareholders. Let's analyze its impact:

-

Dividend Yield Calculation and Comparison: The dividend yield, calculated by dividing the annual dividend per share by the current market price, is [Calculate and insert the dividend yield]. This compares to [Insert previous year's dividend yield, if available] and [Mention industry benchmarks for comparison, if applicable]. A higher dividend yield generally signifies a more attractive return for investors seeking income from their investments.

-

Analysis of the Stock Price Reaction Post-Announcement: The market's reaction to the announcement is crucial. Typically, a well-received dividend announcement can lead to a positive stock price movement, reflecting investor confidence. [Analyze the actual stock price movement after the announcement, referencing data sources].

-

Assessment of Investor Sentiment: Investor sentiment following the announcement can be gauged through various market indicators, including trading volume and analyst reports. [Describe the observed investor sentiment – positive, negative, or neutral – based on market data and expert opinions].

-

Potential Long-Term Implications for Dividend Policy: The announced dividend provides insights into PFC's long-term dividend policy. Analyzing the consistency and growth pattern of previous dividends can help in projecting future dividend payouts. [Discuss the implications of the announced dividend for the future dividend policy of PFC].

Understanding Power Finance Corporation's Financial Performance

The PFC dividend announcement needs to be viewed within the context of the company's overall financial health. Analyzing key financial metrics provides valuable context:

-

Net Profit and Revenue Figures: PFC's recent financial results (quarterly or annual) are essential. [Insert the relevant net profit and revenue figures from the most recent financial reports]. Strong profitability is usually a prerequisite for consistent dividend payouts.

-

Cash Flow from Operations: A healthy cash flow from operations indicates the company's ability to generate cash from its core business activities. This is a key indicator of its capacity to sustain dividend payments. [Insert the relevant cash flow from operations data].

-

Debt-to-Equity Ratio: This metric highlights PFC's financial leverage. A lower debt-to-equity ratio usually suggests a more stable financial position, making sustainable dividend payments more likely. [Insert the debt-to-equity ratio from the recent reports].

-

Return on Equity (ROE): ROE measures how efficiently PFC uses its shareholders' investments to generate profits. A higher ROE generally signifies better profitability and can support higher dividend payouts. [Insert the ROE figure].

Future Outlook and Implications for PFC Investors

Based on the March 12th announcement and PFC's financial performance, what's the outlook for investors?

-

Projected Dividend Growth: Based on the current dividend and the company's projected financial performance, [mention any projections or estimations regarding future dividend growth].

-

Potential Risks and Opportunities Affecting Future Dividends: Several factors could influence PFC's future dividend payouts, including regulatory changes, competition, and economic conditions. [Discuss potential risks and opportunities affecting future dividends].

-

Analyst Predictions for PFC’s Stock Price: Market analysts provide insights into the anticipated stock price movement. [Summarize analyst predictions for PFC's stock price].

-

Recommendations for Investors (Buy, Hold, Sell): [Offer a recommendation based on the analysis, clearly stating the rationale behind the suggestion].

Conclusion

The Power Finance Corporation's March 12th dividend announcement provides crucial information for investors. Understanding the dividend amount, the impact on the stock price, and the implications for future payouts are key to making informed investment decisions. Analyzing PFC's financial performance alongside the dividend announcement allows for a comprehensive assessment of its investment potential.

Call to Action: Stay informed about future Power Finance Corporation dividend updates and other crucial financial news by regularly checking reputable financial news sources and the official PFC investor relations website. Thorough analysis of PFC's financial performance is essential for making sound investment decisions regarding your PFC shares.

Featured Posts

-

El Metodo Alberto Ardila Olivares Para Garantizar Goles

Apr 27, 2025

El Metodo Alberto Ardila Olivares Para Garantizar Goles

Apr 27, 2025 -

A Fifth Champions League Spot The Premier Leagues Future

Apr 27, 2025

A Fifth Champions League Spot The Premier Leagues Future

Apr 27, 2025 -

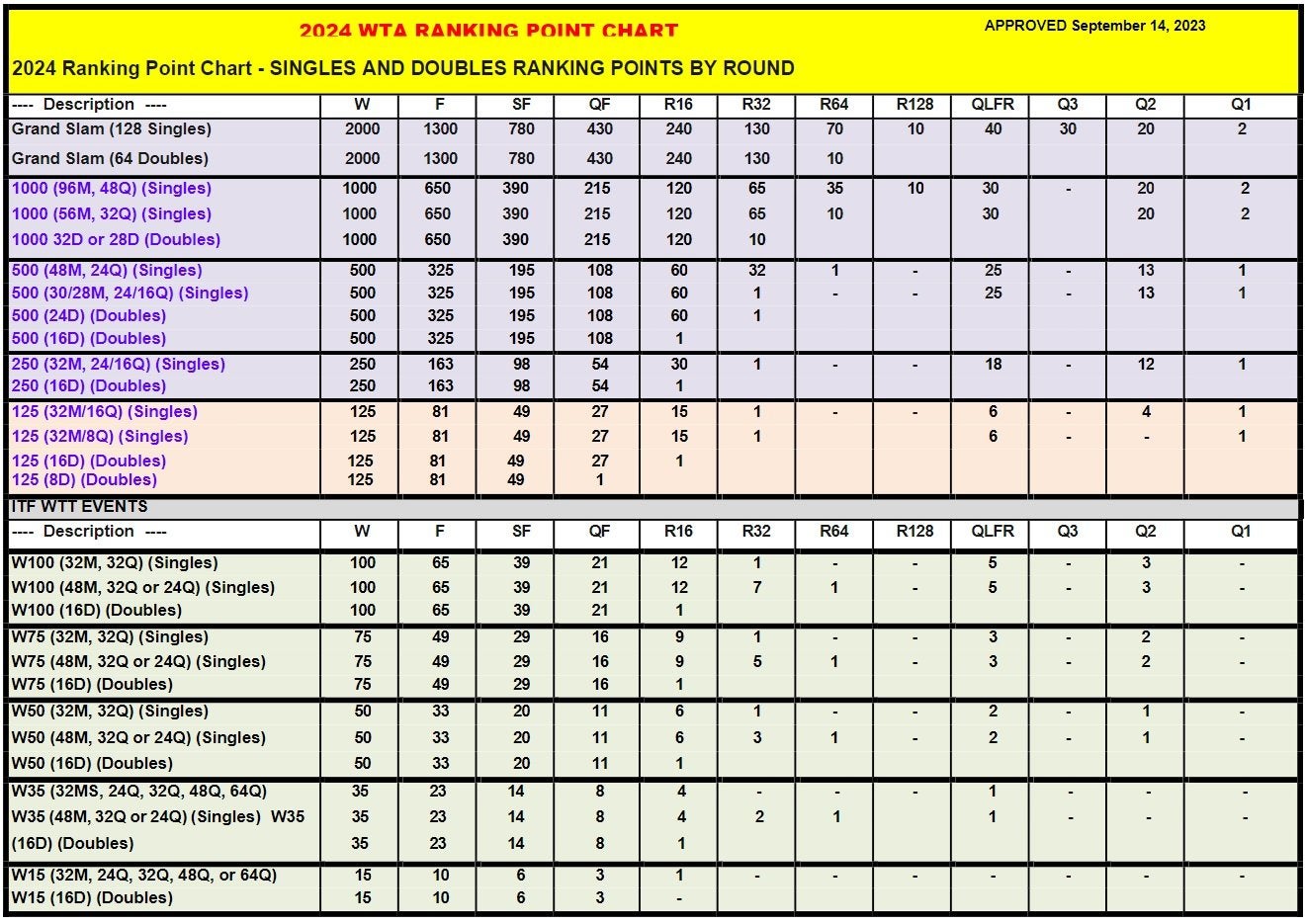

Wta Finals Austria And Singapore Set For Thrilling Showdowns

Apr 27, 2025

Wta Finals Austria And Singapore Set For Thrilling Showdowns

Apr 27, 2025 -

Subsystem Issue Forces Blue Origin To Cancel Rocket Launch

Apr 27, 2025

Subsystem Issue Forces Blue Origin To Cancel Rocket Launch

Apr 27, 2025 -

Real Life Sisters To Star In Werner Herzogs New Film Bucking Fastard

Apr 27, 2025

Real Life Sisters To Star In Werner Herzogs New Film Bucking Fastard

Apr 27, 2025

Latest Posts

-

75

Apr 28, 2025

75

Apr 28, 2025 -

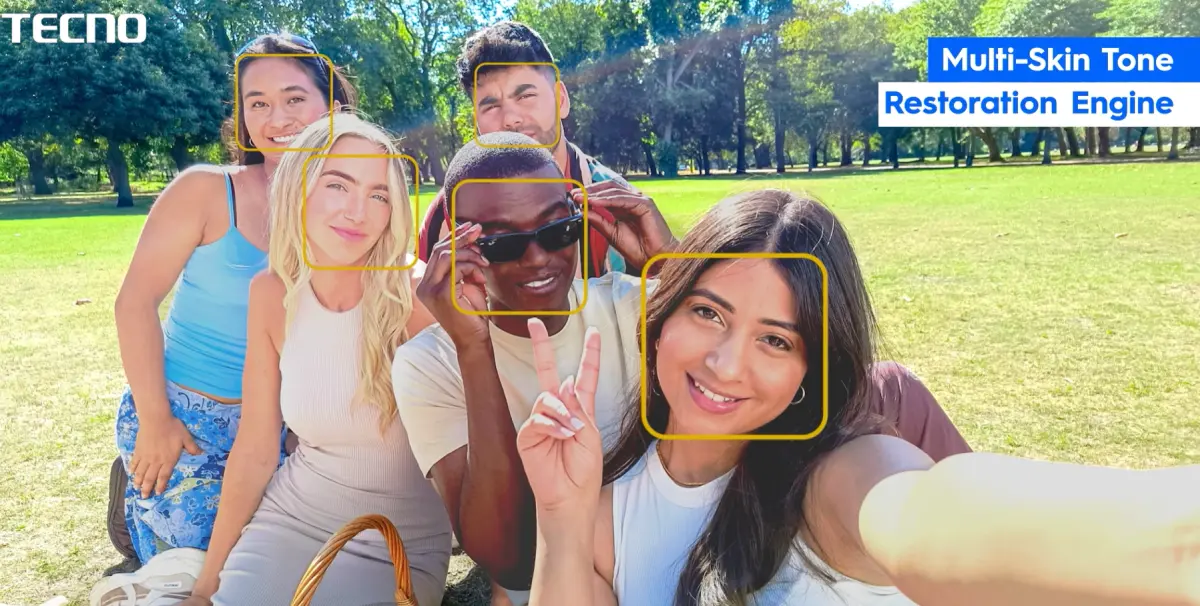

Universal Tone Tecno

Apr 28, 2025

Universal Tone Tecno

Apr 28, 2025 -

Tecno Universal Tone

Apr 28, 2025

Tecno Universal Tone

Apr 28, 2025 -

Boston Red Sox Lineup Modifications For Doubleheaders First Game

Apr 28, 2025

Boston Red Sox Lineup Modifications For Doubleheaders First Game

Apr 28, 2025 -

Red Sox Game 1 Lineup Coras Minor Adjustments

Apr 28, 2025

Red Sox Game 1 Lineup Coras Minor Adjustments

Apr 28, 2025