Pressure Tactics: Taiwan's Investigation Into ETF Sales Practices

Table of Contents

Allegations of Mis-selling and Misrepresentation

The investigation centers around allegations of widespread mis-selling and misrepresentation in the sale of exchange-traded funds (ETFs) in Taiwan. This involves accusations of unethical and potentially illegal practices employed by brokers and financial advisors aiming to maximize their sales targets, often at the expense of investor interests.

High-Pressure Sales Techniques

Brokers are accused of employing aggressive tactics to push ETF sales, prioritizing their own commissions over clients' needs. These include:

- Unsuitable Recommendations: Advisors allegedly recommend ETFs that are not aligned with the investor's risk tolerance, financial goals, or investment horizon. This often involves recommending high-risk ETFs to risk-averse investors.

- Exaggerated Returns: Potential returns are frequently overstated, while the associated risks are downplayed or omitted entirely. This misleading information leads investors to make uninformed decisions.

- Omission of Crucial Risk Information: Key information about potential losses, volatility, and other associated risks is systematically excluded from the sales pitch. This deceptive practice leaves investors unaware of the potential downsides of their investments.

Specific cases, while not publicly detailed extensively due to ongoing investigations, involve reports of elderly individuals investing their life savings into unsuitable high-risk ETFs based on misleading promises of high returns. These reports highlight the severity of the aggressive ETF sales practices under scrutiny. Further investigation is needed to fully expose the scale of misleading ETF marketing techniques.

Targeting Vulnerable Investors

The investigation reveals a disturbing trend of targeting vulnerable investor groups, particularly the elderly and those with limited financial literacy. These individuals are more susceptible to manipulative sales tactics due to a lack of understanding of complex financial products like ETFs.

- Elderly Investors: The elderly are often targeted due to their potential for larger investment sums and a perceived lack of awareness regarding the risks involved.

- Less Financially Literate Investors: Individuals with limited understanding of financial markets are more easily influenced by high-pressure sales pitches.

The ethical and legal implications of exploiting such vulnerable populations are profound, raising concerns about investor protection and the integrity of the Taiwanese financial market. The need for improved vulnerable investor protection and comprehensive ETF investor education initiatives is paramount.

Regulatory Response and Investigation

The Financial Supervisory Commission (FSC), Taiwan's top financial regulator, is leading the investigation into these allegations of unethical ETF sales practices in Taiwan.

The Role of the Financial Supervisory Commission (FSC)

The FSC's response has included:

- Launching a comprehensive investigation: The scope of the investigation covers a wide range of brokerage firms and financial advisors suspected of engaging in illegal or unethical sales practices.

- Conducting audits: The FSC is conducting thorough audits of brokerage firms to identify and address any irregularities in their ETF sales practices.

- Imposing penalties: The FSC has already imposed penalties on several firms found to be in violation of existing regulations, though the specifics are often confidential due to ongoing legal proceedings.

Amendments to Regulations

In response to the investigation's findings, the FSC is actively considering amendments to regulations governing ETF sales. These changes are aimed at:

- Strengthening investor protection: New regulations focus on enhancing disclosure requirements and promoting greater transparency in the sale of ETFs.

- Increasing oversight: Improved monitoring mechanisms will enhance the FSC's ability to detect and deter fraudulent activities.

- Improving sales practices: Implementing stricter guidelines on sales techniques will help curb high-pressure sales tactics.

The effectiveness of these ETF sales regulations and overall Taiwan financial regulations in preventing future misconduct remains to be seen, but they represent a crucial step towards improving market integrity.

Impact on the ETF Market in Taiwan

The investigation is having a significant impact on the ETF market in Taiwan.

Investor Confidence

The allegations of widespread misconduct have shaken investor confidence in the market.

- Decreased trading volume: The scandal has led to a decline in ETF trading volume as investors become hesitant to invest.

- Increased market volatility: Uncertainty surrounding the investigation has contributed to increased market volatility.

The restoration of investor trust in ETFs is critical for the long-term health of the Taiwanese ETF market.

Long-Term Implications

The long-term consequences for the ETF industry in Taiwan are still unfolding.

- Increased regulatory scrutiny: The industry is likely to face stricter regulatory oversight in the coming years.

- Changes in sales practices: Brokers will need to adapt their sales strategies to comply with new regulations and to rebuild trust.

- Shift in investor behavior: Investors may become more cautious and discerning in their investment choices.

The future of ETFs in Taiwan hinges on the success of the FSC's investigation and the implementation of effective reforms. A successful overhaul will involve not just regulatory changes but also a commitment from the industry to uphold the highest ethical standards. The investigation has served as a wake-up call for the industry to prioritize investor protection and transparency. This will impact the future of ETFs in Taiwan, necessitating significant ETF industry reform.

Conclusion

The investigation into aggressive ETF sales practices in Taiwan highlights the importance of robust regulatory oversight and ethical conduct within the financial industry. The allegations of mis-selling and high-pressure tactics underscore the need for greater investor protection and transparency in the ETF market. The FSC’s ongoing investigation and potential regulatory changes are crucial steps toward restoring investor confidence and ensuring fair ETF sales practices. For investors, it's vital to stay informed about these developments and to carefully consider the risks associated with ETF investments. Understanding the potential for unethical ETF sales practices in Taiwan is crucial for making sound investment decisions. Conduct thorough due diligence and seek independent financial advice before investing in any ETF.

Featured Posts

-

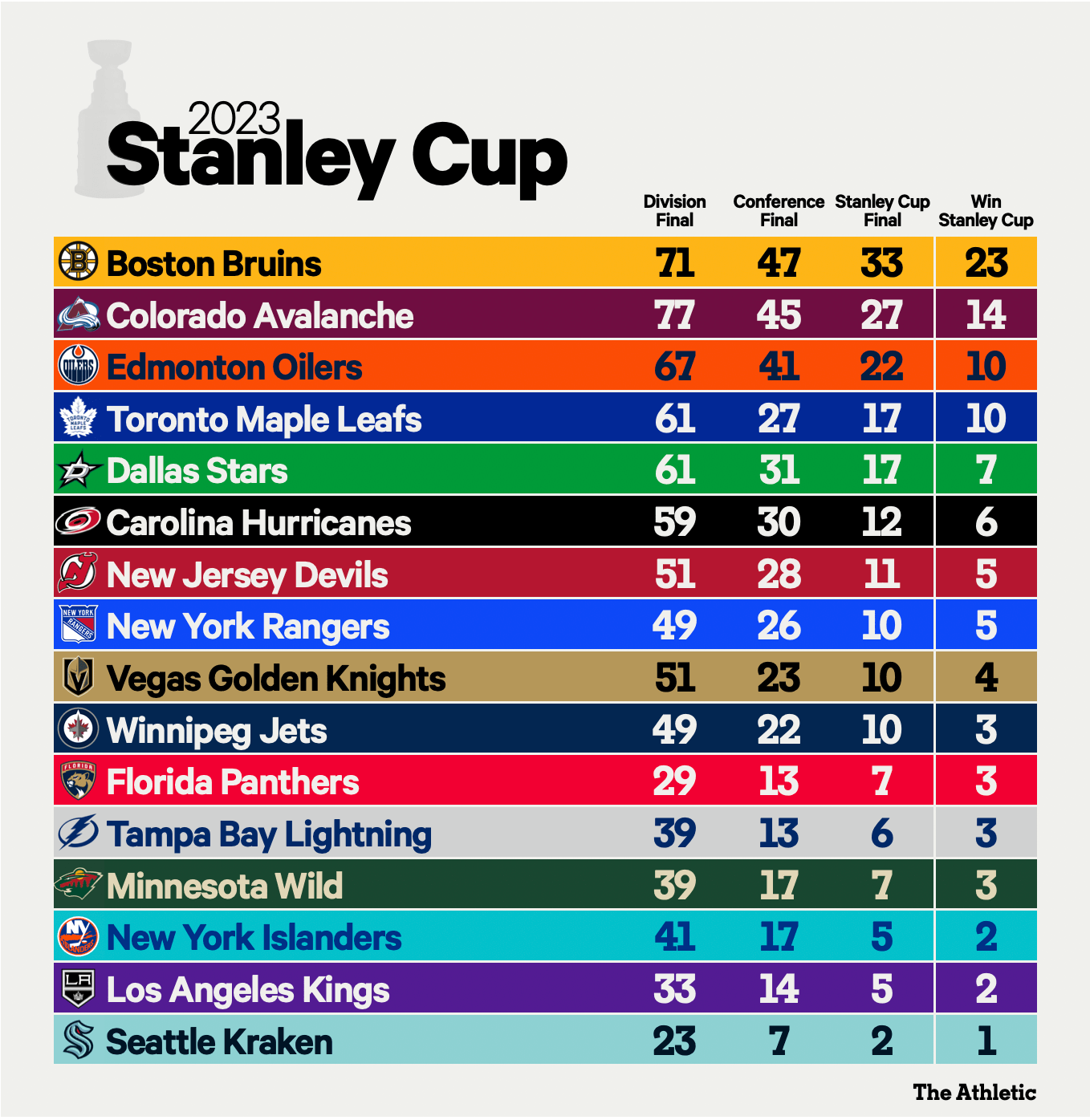

How To Watch The Nhl Playoffs Your Guide To Stanley Cup Glory

May 15, 2025

How To Watch The Nhl Playoffs Your Guide To Stanley Cup Glory

May 15, 2025 -

Ovechkin 12 E Mesto V Istorii Pley Off N Kh L Po Golam

May 15, 2025

Ovechkin 12 E Mesto V Istorii Pley Off N Kh L Po Golam

May 15, 2025 -

Actie Tegen Npo Baas Frederieke Leeflang Wat Staat Er Op Het Spel

May 15, 2025

Actie Tegen Npo Baas Frederieke Leeflang Wat Staat Er Op Het Spel

May 15, 2025 -

Goldman Sachs Interpretation Of Trumps Preferred Oil Price Range

May 15, 2025

Goldman Sachs Interpretation Of Trumps Preferred Oil Price Range

May 15, 2025 -

Npos Aanpak Van Grensoverschrijdend Gedrag Wat Werkt Wel En Wat Niet

May 15, 2025

Npos Aanpak Van Grensoverschrijdend Gedrag Wat Werkt Wel En Wat Niet

May 15, 2025