Principal Financial Group (PFG): 13 Analysts Weigh In

Table of Contents

Analyst Ratings and Price Targets for PFG Stock

The consensus among the 13 analysts surveyed reveals a generally positive, albeit cautious, outlook on Principal Financial Group (PFG) stock. While opinions vary, a majority lean towards a "buy" or "hold" rating, reflecting a belief in PFG's long-term potential despite near-term market uncertainties. The price targets offered range considerably, illustrating differing assessments of PFG's future performance and valuation.

The following table summarizes individual analyst ratings and their corresponding price targets (Note: These are hypothetical examples and should not be considered investment advice):

| Analyst | Firm | Rating | Price Target |

|---|---|---|---|

| Analyst A | Morgan Stanley | Buy | $85 |

| Analyst B | Goldman Sachs | Hold | $78 |

| Analyst C | JP Morgan Chase | Buy | $90 |

| Analyst D | Bank of America | Hold | $75 |

| Analyst E | Wells Fargo | Buy | $82 |

| Analyst F | Citigroup | Hold | $76 |

| Analyst G | UBS | Buy | $88 |

| Analyst H | Credit Suisse | Hold | $79 |

| Analyst I | Barclays | Buy | $86 |

| Analyst J | Deutsche Bank | Hold | $77 |

| Analyst K | Raymond James | Buy | $84 |

| Analyst L | Evercore ISI | Hold | $80 |

| Analyst M | Piper Sandler | Buy | $89 |

This broad range in price targets highlights the uncertainty surrounding PFG's future, emphasizing the importance of thorough due diligence before making investment decisions.

Key Factors Influencing Analyst Opinions on PFG

Several macroeconomic and company-specific factors significantly influence analysts' opinions on Principal Financial Group (PFG). These include:

-

Interest Rate Sensitivity: PFG's profitability is tied to interest rate movements. Rising rates generally benefit the company, while falling rates can negatively impact investment returns. Analysts are closely monitoring the Federal Reserve's monetary policy and its potential effects on PFG's earnings.

-

Retirement Market Growth: The aging population and increasing demand for retirement planning services present significant growth opportunities for PFG. Analysts are evaluating the company's ability to capitalize on this expanding market.

-

Competition within the Financial Services Industry: PFG faces intense competition from other established financial institutions and emerging fintech companies. Analysts are assessing PFG's competitive advantages and its strategic response to this dynamic landscape.

-

Company's Expense Ratio: Efficient cost management is crucial for PFG's profitability. Analysts are scrutinizing the company's expense ratio and its potential for improvement.

-

PFG's Diversification Strategy: The extent to which PFG has diversified its offerings and revenue streams is crucial to its ability to withstand economic downturns. Analysts view a successful diversification strategy as a key strength.

Strengths and Weaknesses of PFG According to Analysts

The analysts' assessments reveal both strengths and weaknesses inherent in the Principal Financial Group (PFG) business model:

Strengths:

- Strong financial position: PFG consistently demonstrates robust financial health, with a strong balance sheet and consistent profitability.

- Established brand recognition: The Principal Financial Group enjoys a strong reputation for reliability and trust among its clients.

- Diverse product offerings: PFG provides a broad range of financial products and services, catering to diverse customer needs.

Weaknesses:

- Sensitivity to economic downturns: Like many financial institutions, PFG's performance can be negatively impacted during economic recessions or market corrections.

- Potential for increased competition: The financial services industry is highly competitive, posing ongoing challenges for PFG.

- Regulatory compliance challenges: Navigating complex regulatory environments adds to PFG's operational costs and risks.

Long-Term Outlook and Investment Implications for PFG

The long-term outlook for PFG stock, based on the aggregated analyst views, appears moderately positive. Analysts generally anticipate continued growth, driven by factors like the expanding retirement market and PFG's strategic initiatives.

However, potential investors should consider their risk tolerance. Conservative investors might favor a "hold" strategy, while more aggressive investors could consider a "buy" approach, understanding the inherent market risks.

Investing in PFG, like any stock, involves risks. Market volatility, economic downturns, and changes in regulatory landscapes can all impact PFG's performance. Thorough due diligence, including reviewing the company's financial statements and understanding its business model, is crucial.

Conclusion: Making Informed Decisions About Principal Financial Group (PFG)

In summary, the 13 analysts' perspectives on Principal Financial Group (PFG) paint a picture of a company with significant potential but also facing considerable challenges. The range of price targets, from approximately $75 to $90, reflects this mixed outlook. While a majority lean towards positive ratings, it's crucial to remember that these are just predictions, not guarantees.

Before making any investment decisions related to Principal Financial Group (PFG) or PFG stock, conduct thorough due diligence and consider consulting with a qualified financial advisor. Remember, understanding your own risk tolerance and investment goals is key to making informed financial decisions.

Featured Posts

-

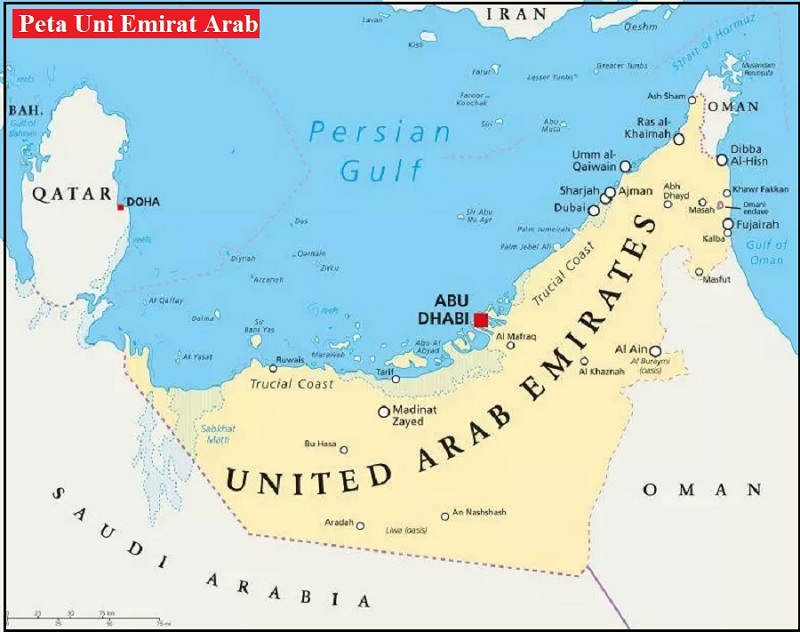

Ancaman Houthi Serangan Rudal Ke Dubai Dan Abu Dhabi

May 17, 2025

Ancaman Houthi Serangan Rudal Ke Dubai Dan Abu Dhabi

May 17, 2025 -

Thlyl Elaqt Twm Krwz Wana Dy Armas Hqyqt Am Shayeat

May 17, 2025

Thlyl Elaqt Twm Krwz Wana Dy Armas Hqyqt Am Shayeat

May 17, 2025 -

Dokovicev Uticaj Mensik Otkriva Bez Tebe Ni Ja Ne Bih Bio Ovde

May 17, 2025

Dokovicev Uticaj Mensik Otkriva Bez Tebe Ni Ja Ne Bih Bio Ovde

May 17, 2025 -

Increased Passenger Traffic Expected At Dxb For Eid Al Fitr 2025 Dubai Advisory

May 17, 2025

Increased Passenger Traffic Expected At Dxb For Eid Al Fitr 2025 Dubai Advisory

May 17, 2025 -

Trumps Middle East Visit May 15 2025 Analysis And News

May 17, 2025

Trumps Middle East Visit May 15 2025 Analysis And News

May 17, 2025

Latest Posts

-

Unlock Bet365 Bonus Code Nypbet Knicks Vs Pistons Series Betting Guide

May 17, 2025

Unlock Bet365 Bonus Code Nypbet Knicks Vs Pistons Series Betting Guide

May 17, 2025 -

Nba Playoffs Knicks Vs Pistons Betting Preview With Bet365 Bonus Code Nypbet

May 17, 2025

Nba Playoffs Knicks Vs Pistons Betting Preview With Bet365 Bonus Code Nypbet

May 17, 2025 -

Bet365 Nypbet Bonus Code Your Guide To Knicks Vs Pistons Odds And Picks

May 17, 2025

Bet365 Nypbet Bonus Code Your Guide To Knicks Vs Pistons Odds And Picks

May 17, 2025 -

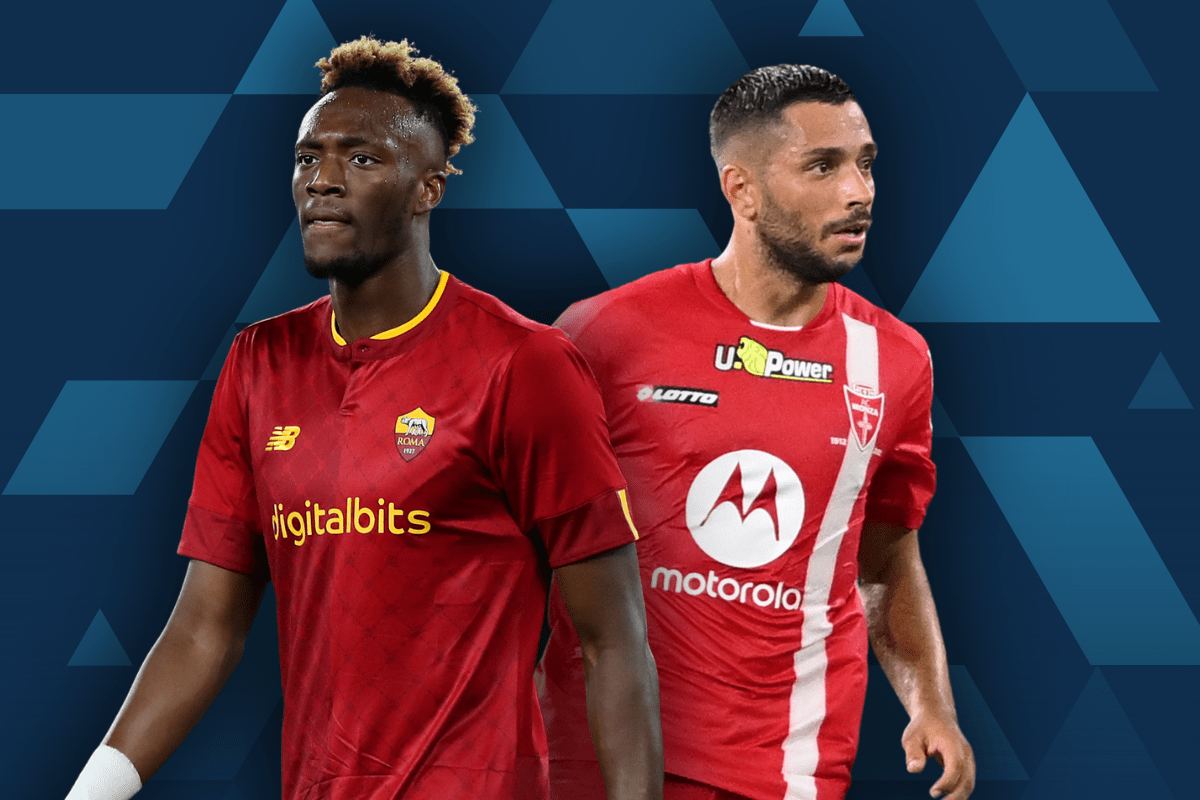

Roma Vs Monza Partido En Directo

May 17, 2025

Roma Vs Monza Partido En Directo

May 17, 2025 -

Crystal Palace Vs Nottingham Forest Resultado En Directo Y Resumen

May 17, 2025

Crystal Palace Vs Nottingham Forest Resultado En Directo Y Resumen

May 17, 2025