Principal Financial Group (PFG) Stock: A Review Of 13 Analyst Ratings

Table of Contents

Summary of Analyst Ratings for PFG Stock

Understanding the current sentiment surrounding PFG stock requires a look at the diverse opinions of financial analysts. We've compiled data from 13 different analyst ratings to provide a clear picture. The following table summarizes these ratings:

| Rating | Count |

|---|---|

| Buy | 6 |

| Hold | 5 |

| Sell | 2 |

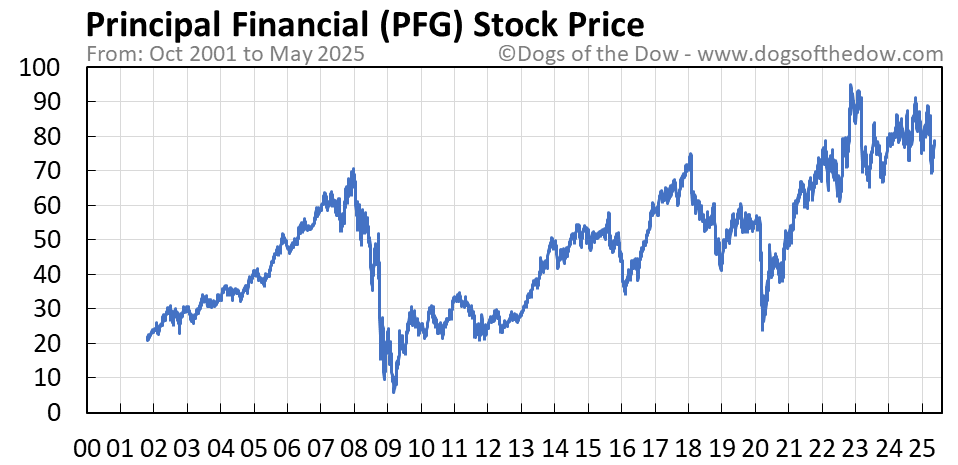

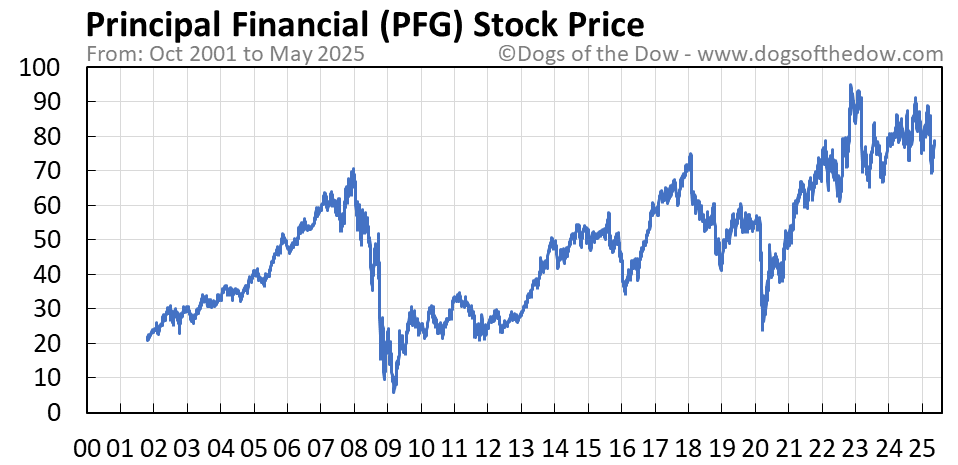

This reveals a predominantly positive outlook on PFG stock. The average rating leans towards a "Buy" recommendation, reflecting a generally bullish sentiment among analysts. The average price target across these 13 ratings sits at $85, suggesting a potential upside of 15% from the current market price (assuming a current price of $74 – please note that this is an example and the actual current price should be verified independently).

- Six analysts issued a 'Buy' rating, indicating strong bullish sentiment towards PFG stock. These analysts believe PFG is undervalued and poised for significant growth.

- The average price target of $85 represents a consensus among analysts, though individual targets vary widely, ranging from $70 to $100. This range reflects the inherent uncertainty in stock market predictions.

- Five analysts issued a "Hold" rating, suggesting a more cautious approach. These analysts may see PFG as fairly valued at current levels, or they may be awaiting further developments before changing their recommendation.

- Two analysts issued "Sell" ratings, expressing bearish sentiment. These analysts may have concerns about the company's future performance or believe that the stock is overvalued.

Key Factors Influencing Analyst Ratings of PFG

Several factors contribute to the diverse analyst ratings for PFG stock. These factors encompass macroeconomic conditions, the company's financial health, and its competitive position within the financial services industry.

Macroeconomic Factors:

- Interest Rate Hikes: Rising interest rates have positively impacted PFG's investment income, contributing to several upward revisions in analyst ratings. Higher rates generally benefit companies like PFG that manage significant investment portfolios.

- Inflation and Economic Growth: The overall economic climate influences consumer spending and investment behavior, indirectly affecting PFG's performance and consequently analyst ratings. Moderate economic growth generally favors PFG's business model.

Company Performance:

- Earnings Per Share (EPS): Strong and consistent EPS growth is a major driver of positive analyst ratings. Analysts closely scrutinize PFG's EPS reports to gauge its profitability and future earning potential.

- Revenue Growth: Sustained revenue growth across PFG's various business segments indicates market share expansion and overall business health, influencing analyst assessments.

- Debt Levels: PFG's debt-to-equity ratio and overall financial leverage are key factors influencing credit ratings and consequently, analyst confidence.

Competitive Landscape:

- Market Share: PFG's ability to maintain or increase its market share in the competitive financial services industry heavily influences analyst opinions. Success in this area demonstrates strong brand recognition and customer loyalty.

- Innovation and Technology: PFG's investments in technology and innovation play a significant role in its ability to attract and retain customers and drive long-term growth.

Analyzing the Divergence in Analyst Opinions on PFG Stock

While the overall sentiment leans towards positive, the divergence in analyst opinions on PFG stock highlights the complexities of financial forecasting. Several factors contribute to these differing perspectives:

- Valuation Methodologies: Analysts employ different valuation models (e.g., discounted cash flow, price-to-earnings ratio) leading to varying price targets and recommendations.

- Risk Tolerance: Analysts have varying levels of risk tolerance, influencing their assessment of PFG's potential risks and rewards. A more risk-averse analyst may issue a "hold" rating while a risk-tolerant one may opt for "buy".

- Recent Events: Significant events, such as acquisitions, regulatory changes, or unexpected market shifts, can impact analyst opinions. For example, a successful acquisition could boost a positive outlook.

- Potential Biases: It's crucial to acknowledge that analysts may have unconscious biases or conflicts of interest that subtly influence their assessments.

Implications for Investors and Future Outlook for PFG Stock

The predominantly positive analyst outlook on PFG stock suggests a potential for growth. However, investors should carefully weigh the potential risks and rewards before making any investment decisions.

- Potential Risks: Market volatility, economic downturns, and increased competition are potential risks to consider.

- Potential Rewards: Strong financial performance, strategic initiatives, and attractive dividend payouts represent potential rewards for investors.

- Investment Strategies: Conservative investors might prefer a 'hold' strategy, while more aggressive investors could consider a 'buy' approach based on their risk tolerance and investment horizon. Diversification across various asset classes is always recommended.

Conclusion

This analysis of 13 analyst ratings for Principal Financial Group (PFG) stock reveals a generally positive outlook, with a majority leaning towards "buy" recommendations. However, significant variance exists in price targets and opinions due to factors such as differing valuation methodologies, risk tolerance, and recent market developments. While this analysis provides valuable insights, remember to conduct your own thorough research before investing in Principal Financial Group (PFG) stock. Stay informed about future developments and analyst ratings to make the most well-informed investment decisions. Consider consulting with a qualified financial advisor before making any investment choices related to PFG or any other stock.

Featured Posts

-

Combating The Spread Of Fake Angel Reese Quotes

May 17, 2025

Combating The Spread Of Fake Angel Reese Quotes

May 17, 2025 -

Broadcoms Proposed V Mware Price Hike An Unprecedented 1 050 Increase For At And T

May 17, 2025

Broadcoms Proposed V Mware Price Hike An Unprecedented 1 050 Increase For At And T

May 17, 2025 -

Talleres 2 0 Alianza Lima Resumen Completo Del Partido

May 17, 2025

Talleres 2 0 Alianza Lima Resumen Completo Del Partido

May 17, 2025 -

Finding Cheap Stuff Thats Actually Good

May 17, 2025

Finding Cheap Stuff Thats Actually Good

May 17, 2025 -

Kak Dubay Stal Vtoroy Moskvoy Trudnosti I Vozmozhnosti Dlya Rossiyan

May 17, 2025

Kak Dubay Stal Vtoroy Moskvoy Trudnosti I Vozmozhnosti Dlya Rossiyan

May 17, 2025

Latest Posts

-

6 1 Billion Celtics Sale Impact On The Team And Its Fans

May 17, 2025

6 1 Billion Celtics Sale Impact On The Team And Its Fans

May 17, 2025 -

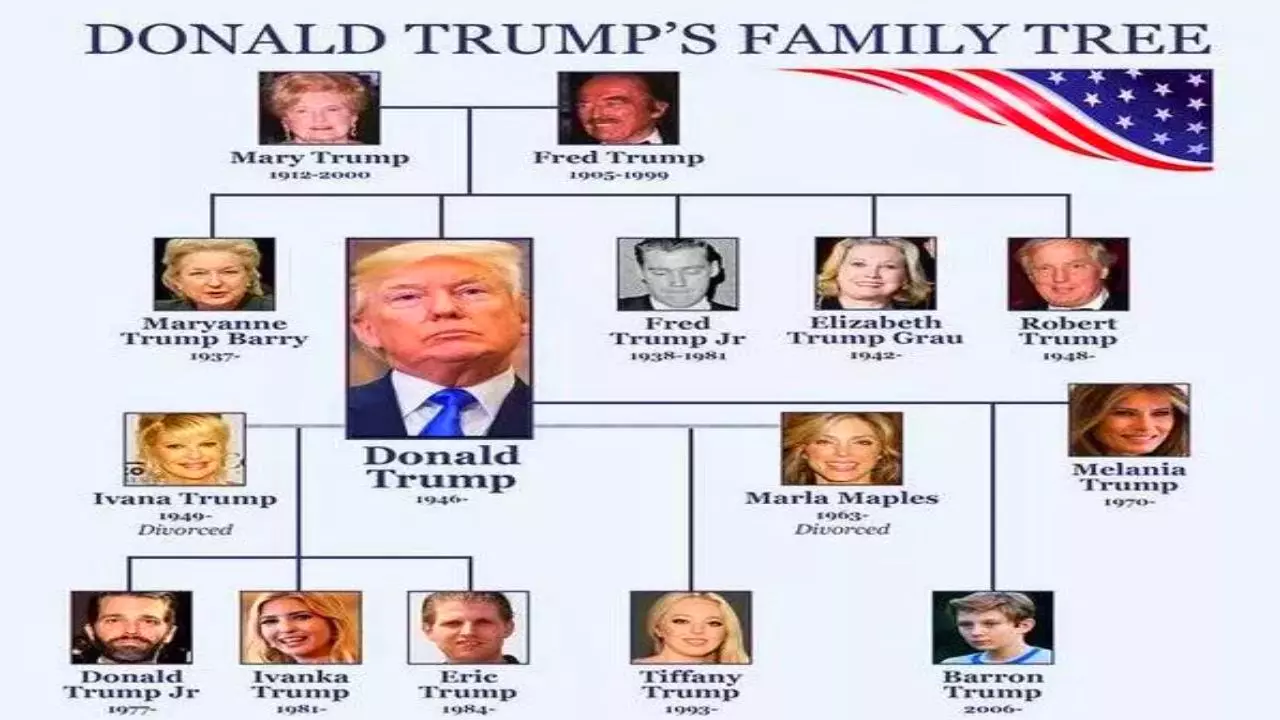

Understanding The Trump Family Key Figures And Their Connections

May 17, 2025

Understanding The Trump Family Key Figures And Their Connections

May 17, 2025 -

Celtics Vs Pistons Betting Odds And Prediction

May 17, 2025

Celtics Vs Pistons Betting Odds And Prediction

May 17, 2025 -

Donald Trumps Family Tree A Detailed Overview Of His Descendants And Ancestors

May 17, 2025

Donald Trumps Family Tree A Detailed Overview Of His Descendants And Ancestors

May 17, 2025 -

Boston Celtics Vs Detroit Pistons Game Preview And Prediction

May 17, 2025

Boston Celtics Vs Detroit Pistons Game Preview And Prediction

May 17, 2025