Principal Financial Group (PFG): What 13 Analysts Say About Its Future

Table of Contents

Principal Financial Group (PFG) is a global financial services company offering retirement, insurance, and investment products. It's a significant player in the financial market, and understanding analyst ratings is vital for investors considering PFG stock. Analyst opinions provide valuable insight into future performance and potential price movements, informing investment strategies.

Analyst Ratings and Price Targets for PFG Stock

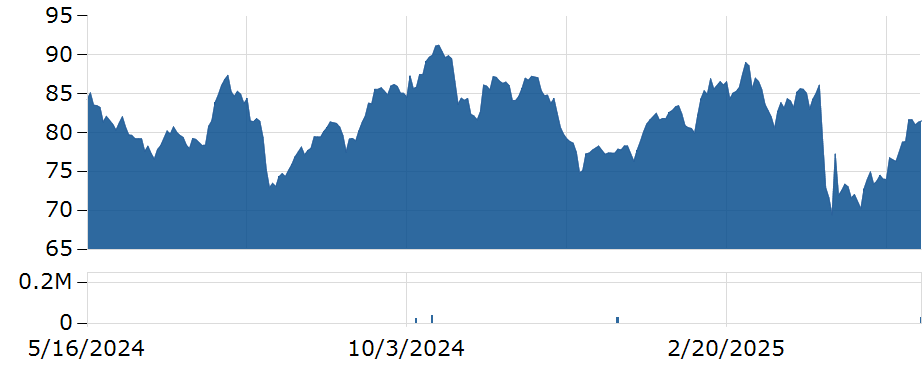

Thirteen analysts have issued ratings and price targets for PFG stock, revealing a range of opinions on its future performance. The average price target among these analysts is $78. However, individual targets vary significantly, highlighting the diversity of perspectives on PFG's prospects.

The highest price target sits at $95, reflecting an analyst's bullish outlook driven by projected strong growth in PFG's retirement planning sector. Conversely, the most conservative price target stands at $65, citing concerns over potential market volatility and its impact on PFG's investment portfolio.

Here's a summary of the analysts' predictions (Note: For brevity, analysts have been grouped by similar price targets):

- Group 1 (High Price Targets - $85-$95): Three analysts predict a price range of $85-$95, citing strong growth potential in PFG's retirement solutions and international expansion.

- Group 2 (Mid-Range Price Targets - $75-$80): Five analysts project a price range between $75 and $80, expressing confidence in PFG's financial stability and diversified revenue streams but acknowledging potential macroeconomic headwinds.

- Group 3 (Low Price Targets - $65-$70): Five analysts offer more conservative price targets ($65-$70), expressing caution regarding market volatility and potential regulatory changes affecting the financial services industry.

[Insert Bar Graph Here: X-axis: Analyst Groups; Y-axis: Price Target Range]

Key Factors Influencing Analyst Predictions for PFG

Analyst predictions for PFG are influenced by a complex interplay of macroeconomic and company-specific factors.

Macroeconomic Factors:

- Rising Interest Rates: Increasing interest rates impact PFG's investment portfolio returns and could potentially affect the profitability of certain products.

- Inflation: Inflation impacts PFG's operating costs and may squeeze profit margins if not managed effectively. The ability to pass increased costs to customers will be key.

- Economic Growth: Overall economic growth significantly influences consumer spending and demand for financial products, directly impacting PFG's revenue streams.

Company-Specific Factors:

- New Product Launches: Successful new product introductions can drive growth and improve market share.

- Acquisitions and Mergers: Strategic acquisitions can expand PFG's market reach and product offerings, but integration challenges must be considered.

- Management Changes: Changes in leadership can impact strategic direction and overall company performance.

- Competitive Landscape: Intense competition within the financial services industry necessitates continuous innovation and efficiency improvements.

PFG's Strengths and Weaknesses According to Analysts

Analysts generally agree on several key strengths and weaknesses for Principal Financial Group.

Strengths:

- Strong Brand Reputation: PFG benefits from a long-standing reputation for reliability and financial stability.

- Diversified Revenue Streams: PFG's diversified product portfolio reduces reliance on any single segment, mitigating risks.

- Robust Financial Position: Analysts highlight PFG’s solid financial foundation and capital reserves.

- Experienced Management Team: The leadership team's experience and expertise are seen as a key asset.

Weaknesses:

- Market Volatility Sensitivity: PFG’s investment portfolio is sensitive to market fluctuations, impacting profitability.

- Regulatory Scrutiny: The financial services sector faces increasing regulatory scrutiny, posing potential compliance challenges.

- Competition: Intense competition from other major players requires PFG to continuously innovate and improve efficiency.

Long-Term Outlook for Principal Financial Group (PFG)

The overall long-term outlook for PFG, based on analyst consensus, is cautiously optimistic. While acknowledging potential risks, analysts foresee moderate growth driven by several factors.

- Projected Growth Rate (3-5 years): Analysts project an average annual growth rate of around 5-7%, with variations depending on the macroeconomic environment.

- Key Drivers of Future Growth: Growth is expected to be driven by strategic initiatives in retirement planning, international expansion, and technological advancements.

- Potential Headwinds: Increased competition, regulatory changes, and unexpected economic downturns represent potential headwinds.

Investing in Principal Financial Group (PFG): A Summary of Analyst Predictions

This analysis of 13 analyst reports reveals a range of price targets for PFG stock, from a conservative $65 to an optimistic $95, with an average of $78. While individual analyst opinions differ, the overall sentiment leans towards cautious optimism, recognizing both PFG's strengths and the challenges presented by the current financial climate. The consensus highlights PFG's strong brand, diversified offerings, and financial stability as key positives, while also acknowledging the potential impact of market volatility and regulatory changes.

Disclaimer: This information is for educational purposes only and does not constitute financial advice.

Call to Action: Before making any investment decisions related to Principal Financial Group (PFG) stock, conduct your own thorough research, considering factors beyond analyst predictions. Consult a qualified financial advisor for personalized investment advice tailored to your risk tolerance and financial goals. Remember to carefully consider all aspects of PFG's performance and outlook before investing in its stock.

Featured Posts

-

Mike Breens Playful Jibes At Mikal Bridges Game Complaints

May 17, 2025

Mike Breens Playful Jibes At Mikal Bridges Game Complaints

May 17, 2025 -

Fortnite Icon Series Latest Skin Leaked

May 17, 2025

Fortnite Icon Series Latest Skin Leaked

May 17, 2025 -

Tracy Morgan A Roundup Of Recent News And Rumors

May 17, 2025

Tracy Morgan A Roundup Of Recent News And Rumors

May 17, 2025 -

Iga Svjontek I Njena Pobeda Vesti I Reakcije Nakon Meca

May 17, 2025

Iga Svjontek I Njena Pobeda Vesti I Reakcije Nakon Meca

May 17, 2025 -

Hl Alhb Ytjawz Farq Alsn Twm Krwz Wana Dy Armas Mthala

May 17, 2025

Hl Alhb Ytjawz Farq Alsn Twm Krwz Wana Dy Armas Mthala

May 17, 2025

Latest Posts

-

6 1 Billion Sale Boston Celtics Future Uncertain After Private Equity Acquisition

May 17, 2025

6 1 Billion Sale Boston Celtics Future Uncertain After Private Equity Acquisition

May 17, 2025 -

6 1 Billion Celtics Sale Impact On The Team And Its Fans

May 17, 2025

6 1 Billion Celtics Sale Impact On The Team And Its Fans

May 17, 2025 -

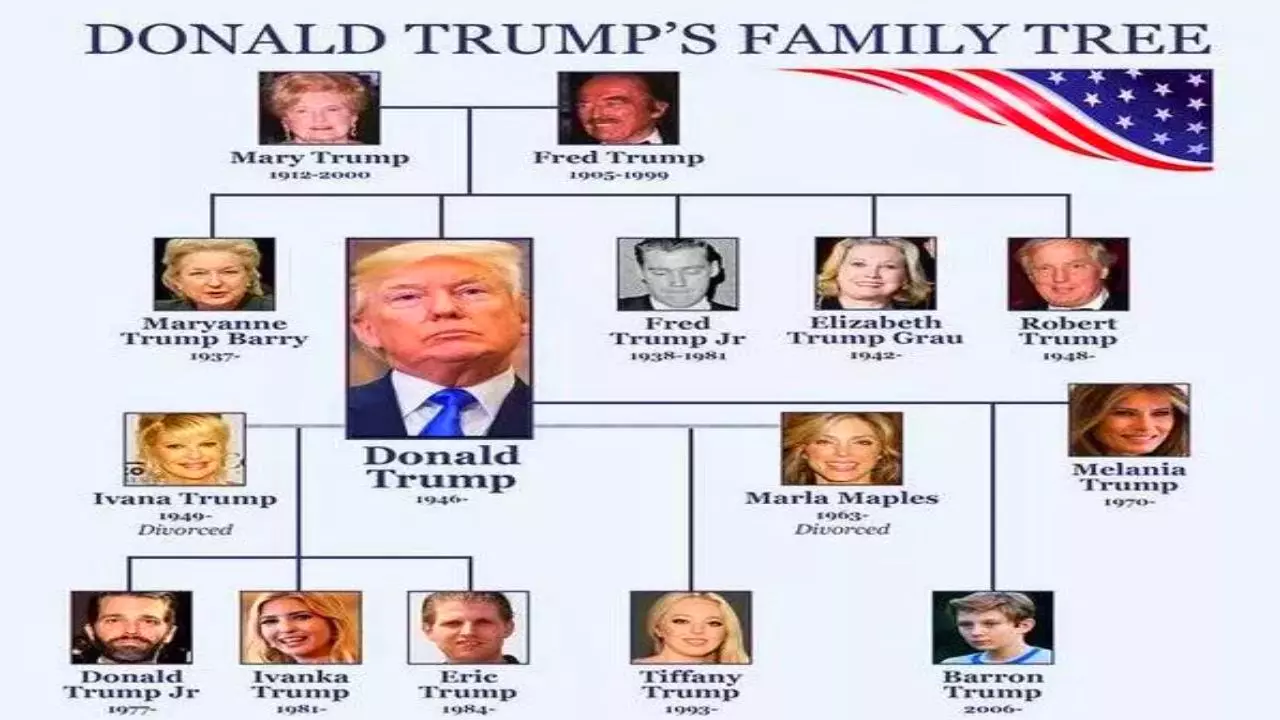

Understanding The Trump Family Key Figures And Their Connections

May 17, 2025

Understanding The Trump Family Key Figures And Their Connections

May 17, 2025 -

Celtics Vs Pistons Betting Odds And Prediction

May 17, 2025

Celtics Vs Pistons Betting Odds And Prediction

May 17, 2025 -

Donald Trumps Family Tree A Detailed Overview Of His Descendants And Ancestors

May 17, 2025

Donald Trumps Family Tree A Detailed Overview Of His Descendants And Ancestors

May 17, 2025