Principal Financial Group Stock: In-Depth Analysis From 13 Analysts

Table of Contents

Current Financial Performance of Principal Financial Group Stock (PFG)

Analyzing Principal Financial Group's recent financial performance is crucial for understanding its current health and potential for future growth. Key metrics like PFG earnings, revenue, and the PFG stock price provide valuable insights.

-

Analysis of recent quarterly earnings reports and revenue streams: Reviewing recent quarterly reports reveals trends in PFG's core business segments, including retirement services, asset management, and insurance products. Examining revenue growth across these segments helps identify areas of strength and weakness. For example, strong growth in annuity sales could indicate positive momentum in the retirement planning sector.

-

Examination of key financial ratios (e.g., P/E ratio, dividend yield): The price-to-earnings (P/E) ratio provides insight into the market's valuation of PFG relative to its earnings. A low P/E ratio might suggest the stock is undervalued, while a high P/E ratio could imply it's overvalued. Furthermore, the dividend yield is a critical indicator for income-oriented investors, showcasing the return on investment based on dividends paid out.

-

Comparison of PFG's performance against competitors in the financial services industry: Benchmarking PFG's performance against its competitors, such as MetLife or Prudential Financial, provides valuable context. This comparative analysis highlights PFG's relative strengths and weaknesses within the broader financial services landscape. Analyzing growth rates, profitability margins, and market share provides a comprehensive perspective.

-

Discussion of any recent announcements or news impacting PFG's financial health: Recent news and announcements – including mergers, acquisitions, regulatory changes, or changes in leadership – can significantly impact PFG's financial health and stock price. This section will cover any material events that influence the overall financial performance.

Analyst Ratings and Price Targets for Principal Financial Group Stock

Understanding the consensus view of financial analysts is vital when assessing investment opportunities. This section summarizes the opinions of 13 leading analysts regarding Principal Financial Group stock.

-

Summary of buy, sell, and hold ratings from the 13 analysts: This section will present a consolidated view of the 13 analysts' recommendations, categorizing them into buy, sell, and hold ratings. This provides a clear picture of the overall sentiment towards PFG stock.

-

Average price target and range of price targets: The average price target reflects the analysts' collective forecast for the future PFG stock price. The range of price targets indicates the level of uncertainty surrounding these projections. A wide range suggests considerable disagreement among analysts.

-

Reasons behind varying analyst opinions: Different analysts may have varying opinions due to differing methodologies, risk assessments, and forecasts for future market conditions. Understanding the rationale behind these discrepancies is essential for a thorough evaluation.

-

Discussion of any significant changes in analyst sentiment over time: Tracking changes in analyst sentiment over time offers valuable insights into evolving market perceptions and the trajectory of PFG stock.

Key Growth Drivers and Risks for Principal Financial Group

Identifying potential growth drivers and risks associated with PFG stock is critical for informed investment decisions.

-

Identification of key growth opportunities in Principal Financial Group's business segments (e.g., annuities, retirement products, asset management): PFG operates in several segments. Examining the growth potential within each segment, considering market trends and competitive dynamics, is crucial. Growth in the retirement market, driven by an aging population, may present significant opportunities.

-

Assessment of potential risks, including market volatility, regulatory changes, and competitive pressures: Investing in PFG comes with risks. Market volatility can significantly impact stock prices. Furthermore, regulatory changes and intense competition in the financial services industry also represent considerable risks.

-

Discussion of the company's strategic initiatives and their potential impact on future growth: Analyzing PFG's strategic initiatives – such as new product launches, market expansion, or technological investments – provides insight into its future growth trajectory.

Long-Term Investment Outlook for Principal Financial Group Stock

This section provides a perspective on the long-term investment potential of PFG stock.

-

Assessment of PFG’s long-term growth potential based on analyst forecasts: Combining the analysts' price targets and growth projections with an evaluation of the company's strategic direction allows for a clearer long-term outlook.

-

Discussion of the suitability of PFG stock for different investor profiles (e.g., long-term investors, dividend investors): PFG stock might be suitable for various investors. Long-term investors may benefit from potential capital appreciation, while dividend investors might appreciate the consistent dividend payouts.

-

Evaluation of PFG's competitive advantages and sustainable business model: A strong competitive advantage and a sustainable business model are critical for long-term success. Analyzing PFG's strengths and weaknesses in this context is essential.

Conclusion

This analysis synthesized the opinions of 13 leading analysts on Principal Financial Group stock (PFG), examining its current financial performance, growth prospects, and potential risks. The diverse viewpoints provide a comprehensive picture, enabling investors to make informed decisions aligned with their investment goals.

Call to Action: Are you ready to make informed investment decisions regarding Principal Financial Group stock? Conduct thorough research, consider your own risk tolerance, and consult with a qualified financial advisor before making any investment decisions. Learn more about PFG and other investment opportunities through further research. Remember to always consider your individual financial situation and risk tolerance before investing in any stock, including Principal Financial Group stock (PFG).

Featured Posts

-

Warner Bros Pictures At Cinema Con 2025 A Complete Overview

May 17, 2025

Warner Bros Pictures At Cinema Con 2025 A Complete Overview

May 17, 2025 -

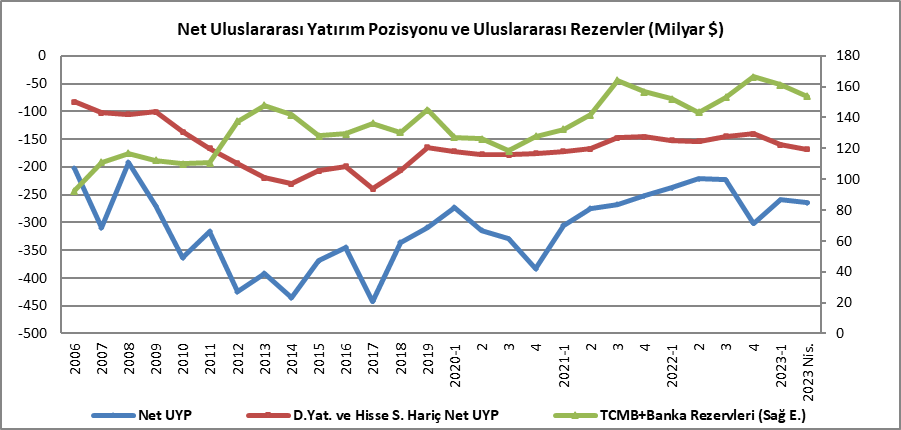

Tuerkiye Nin Subat Ayi Uluslararasi Yatirim Pozisyonu Oenemli Noktalar Ve Sonuclari

May 17, 2025

Tuerkiye Nin Subat Ayi Uluslararasi Yatirim Pozisyonu Oenemli Noktalar Ve Sonuclari

May 17, 2025 -

Tony Bennett His Career Collaborations And Impact

May 17, 2025

Tony Bennett His Career Collaborations And Impact

May 17, 2025 -

Mariners Giants Injury Update Assessing Lineups For April 4 6 Games

May 17, 2025

Mariners Giants Injury Update Assessing Lineups For April 4 6 Games

May 17, 2025 -

Mariners First Inning Explosion Leads To 14 0 Victory Over Marlins

May 17, 2025

Mariners First Inning Explosion Leads To 14 0 Victory Over Marlins

May 17, 2025

Latest Posts

-

Lawrence O Donnell Trumps Humiliating Live Tv Moment

May 17, 2025

Lawrence O Donnell Trumps Humiliating Live Tv Moment

May 17, 2025 -

Indian Wells 2024 Chien Thang Vang Doi Cua Tai Nang Tre Nga 17 Tuoi

May 17, 2025

Indian Wells 2024 Chien Thang Vang Doi Cua Tai Nang Tre Nga 17 Tuoi

May 17, 2025 -

Iga Svjontek Najnovije Vesti O Pobedi Nad Ukrajinkom

May 17, 2025

Iga Svjontek Najnovije Vesti O Pobedi Nad Ukrajinkom

May 17, 2025 -

Thang Loi Lich Su Kieu Nu 17 Tuoi Xu Bach Duong Tai Indian Wells

May 17, 2025

Thang Loi Lich Su Kieu Nu 17 Tuoi Xu Bach Duong Tai Indian Wells

May 17, 2025 -

Svjontek Vs Ukrajinska Teniserka Rezultati I Analiza Meca

May 17, 2025

Svjontek Vs Ukrajinska Teniserka Rezultati I Analiza Meca

May 17, 2025