Private Credit Jobs: 5 Do's And Don'ts To Help You Succeed

Table of Contents

5 Do's to Secure Your Private Credit Job

Do #1: Network Strategically

Networking is paramount in the private credit world. Don't underestimate the power of personal connections in securing a coveted private credit career.

- Attend industry conferences and events: SuperReturn, PEI events, and smaller, niche conferences offer invaluable networking opportunities. These events allow you to meet professionals, learn about industry trends, and make connections that could lead to a job.

- Leverage LinkedIn: Optimize your LinkedIn profile with relevant keywords like "Private Credit Analyst," "Private Debt," and "Alternative Investments." Connect with professionals in private credit, engage with their posts, and participate in relevant groups.

- Informational interviews: Request informational interviews with people working in private credit. These conversations provide insights into the industry, specific firms, and potential job openings. They are also a great way to build relationships and make a positive impression.

- Join relevant professional organizations: Membership in organizations like the CFA Institute and ACA demonstrates your commitment to the profession and provides networking opportunities.

Do #2: Tailor Your Resume and Cover Letter

Your resume and cover letter are your first impression – make it count! A generic application will likely land in the "no" pile.

- Highlight relevant skills and experience: Showcase your proficiency in financial modeling, credit analysis, due diligence, and other skills relevant to private credit.

- Quantify your achievements: Instead of simply stating your responsibilities, quantify your accomplishments. For example, "Increased portfolio returns by 15%" is far more impactful than "Managed portfolio investments."

- Use keywords: Incorporate keywords from relevant job descriptions into your resume and cover letter. This helps applicant tracking systems (ATS) identify your application as a strong match.

- Tailor your application: Customize your resume and cover letter for each job application. Demonstrate that you understand the specific requirements and culture of each firm.

Do #3: Master the Interview Process

The interview is your chance to shine. Thorough preparation is crucial for success.

- Practice your behavioral interview responses (STAR method): Use the STAR method (Situation, Task, Action, Result) to structure your answers to behavioral questions, providing concrete examples of your skills and experience.

- Research the firm and the interviewers: Demonstrate your interest by thoroughly researching the firm's investment strategy, recent transactions, and the interviewers' backgrounds.

- Demonstrate your understanding: Showcase your knowledge of private credit principles, market trends, and relevant financial concepts.

- Prepare insightful questions: Asking thoughtful questions demonstrates your engagement and interest in the role and the firm.

- Show enthusiasm: Express your genuine interest in the role and the firm's culture.

Do #4: Showcase Your Financial Acumen

A strong understanding of finance is non-negotiable in private credit.

- Demonstrate proficiency in financial modeling and valuation techniques: Private credit roles often involve complex financial modeling, so showcasing your expertise is essential.

- Highlight experience with credit analysis, risk assessment, and portfolio management: These skills are central to private credit roles. Be prepared to discuss your experience in detail.

- Show understanding of different debt structures: Demonstrate your knowledge of various debt structures, including senior secured, subordinated, mezzanine, and distressed debt.

- Possess strong analytical and problem-solving skills: Private credit professionals must be able to analyze complex financial information and solve problems effectively.

Do #5: Develop Specialized Skills

Continuously enhancing your skillset is crucial for career advancement in this dynamic field.

- Pursue relevant certifications: Certifications such as the CFA (Chartered Financial Analyst) or CAIA (Chartered Alternative Investment Analyst) can significantly boost your credentials.

- Develop expertise in specific areas: Specializing in areas like distressed debt, real estate finance, or other niche sectors within private credit can make you a highly sought-after candidate.

- Enhance your technical skills: Become proficient in using tools like the Bloomberg Terminal and other relevant financial software.

- Continuously learn: Stay updated on industry trends, best practices, and regulatory changes through continuous learning and professional development.

5 Don'ts to Avoid in Your Private Credit Job Search

Don't #1: Neglect Networking

- Don't rely solely on online job boards.

- Don't underestimate the power of personal connections.

- Don't be afraid to reach out to people you don't know.

Don't #2: Submit Generic Applications

- Don't use a generic resume and cover letter for every application.

- Don't overlook the importance of tailoring your application to each specific job.

Don't #3: Underprepare for Interviews

- Don't go into an interview without researching the firm and the interviewers.

- Don't fail to practice your responses to common interview questions.

Don't #4: Lack Financial Knowledge

- Don't underestimate the importance of a strong understanding of finance and accounting.

- Don't avoid opportunities to enhance your financial modeling and analysis skills.

Don't #5: Ignore Professional Development

- Don't stop learning once you've entered the job market.

- Don't neglect opportunities for professional development and skill enhancement.

Conclusion

Securing a private credit job requires dedication, strategic planning, and a proactive approach. By following these do's and don'ts, you can significantly increase your chances of success. Remember to network effectively, tailor your applications, master the interview process, showcase your financial acumen, and continuously develop your skills. Start building your private credit career today! Begin your journey into the exciting world of private credit jobs and unlock your potential in this dynamic industry.

Featured Posts

-

Is A New Covid 19 Variant Fueling The Recent Case Increase

May 31, 2025

Is A New Covid 19 Variant Fueling The Recent Case Increase

May 31, 2025 -

Luxury Spring Hotel Bookings Save Up To 30

May 31, 2025

Luxury Spring Hotel Bookings Save Up To 30

May 31, 2025 -

New Pushback Car Dealers Reiterate Opposition To Electric Vehicle Requirements

May 31, 2025

New Pushback Car Dealers Reiterate Opposition To Electric Vehicle Requirements

May 31, 2025 -

Kostenlose Wohnungen In Deutschland Eine Stadt Sucht Neue Bewohner

May 31, 2025

Kostenlose Wohnungen In Deutschland Eine Stadt Sucht Neue Bewohner

May 31, 2025 -

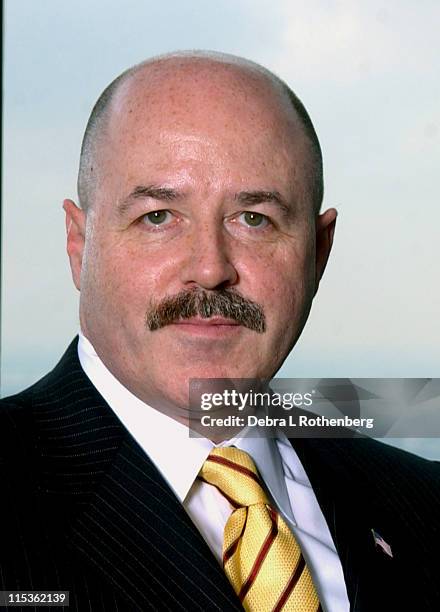

Death Of Bernard Kerik Remembering The 9 11 Nyc Police Commissioner

May 31, 2025

Death Of Bernard Kerik Remembering The 9 11 Nyc Police Commissioner

May 31, 2025